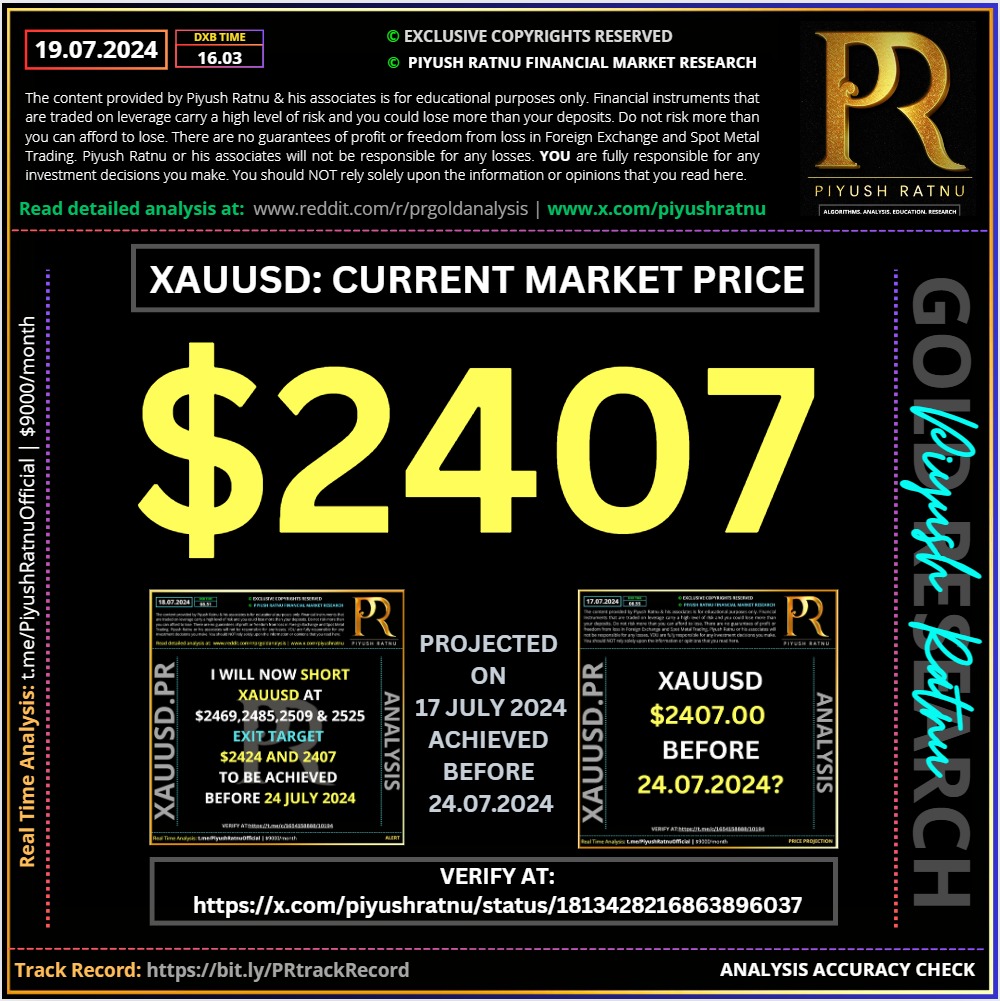

XAUUSD is trading at $2406.30 currently.

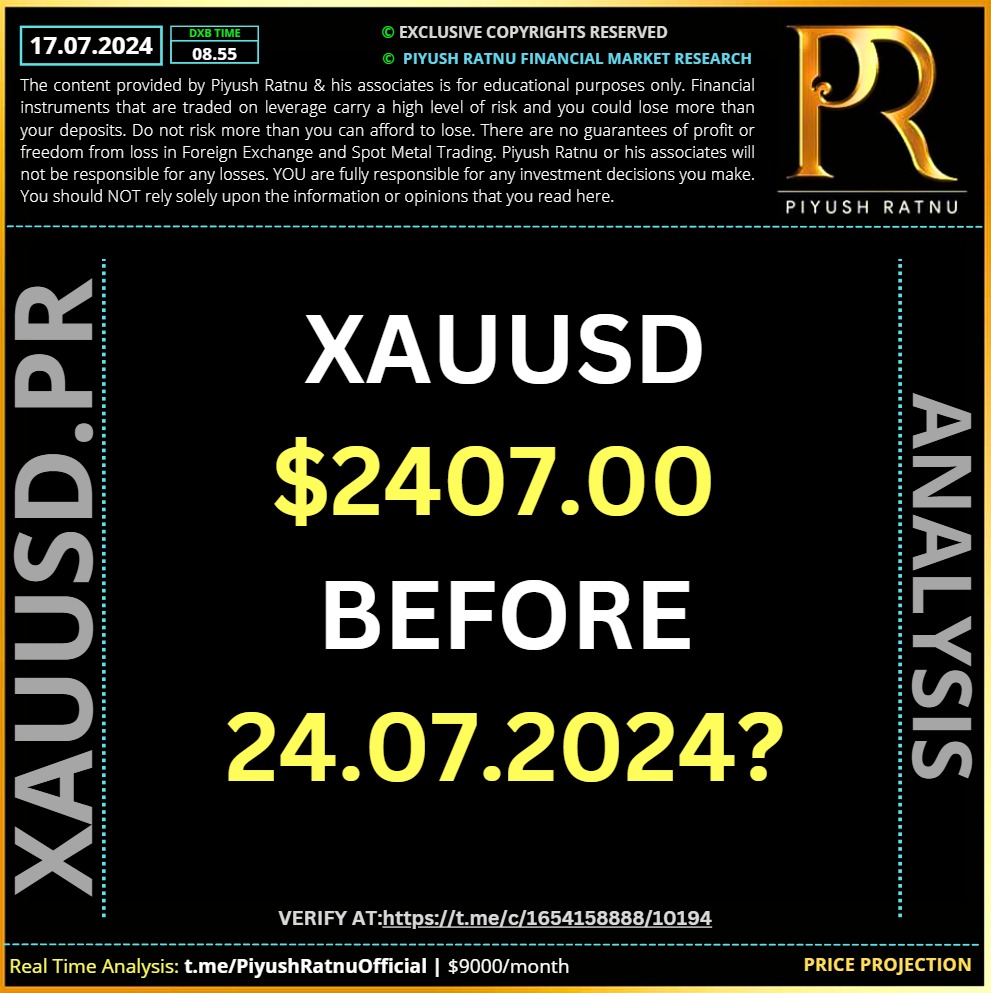

We projected a crash before 24 July 2024 till $2424/2407 in advance, verify at: https://x.com/piyushratnu/status/1813428216863896037/photo/1

One of the major reasons XAUUSD crashed, which nobody is mentioning is:

- https://www.barrons.com/articles/stock-market-today-dow-nasdaq-0ad19ded

- https://www.reuters.com/technology/traders-london-singapore-struggle-cyber-outage-disrupts-business-2024-07-19/

Gold price (XAU/USD) maintains its offered tone through the Asian session on Friday and is currently placed near a multi-day low, around the $2,425 region. The US Dollar (USD) builds on the previous day’s solid recovery from a four-month low and turns out to be a key factor dragging the commodity lower for the third successive day. Apart from this, some profit-taking, especially after the recent rally of over 6.5% since the beginning of this month, further contributes to the decline, though the downside seems limited.

Investors now seem convinced that the Federal Reserve (Fed) will start lowering borrowing costs in September and have been pricing in the possibility of two more rate cuts by year end. This keeps the US Treasury bond yields on the defensive and should cap the USD. Apart from this, the risk-off mood could lend support to the safe-haven Gold price. Furthermore, geopolitical tensions and central bank demand should help limit any meaningful depreciating move for the non-yielding yellow metal.

Crucial Price Zones Ahead:

🔻BZ $2407/2385/2369/2332

🔺SZ $2469/2485/2500/2525

Tendencies in the markets

Equities weak, USD stronger, cryptos sideways, oil correcting, Gold bearish, Silver down, JPY sideways.

US President Biden gets under further pressure as the election campaign continues. The 81-year-old has been diagnosed with COVID-19 and needs to take a break from public appearances. Negative headlines also followed from Nancy Pelosi, the former Democratic speaker of the House, stating that he should step down from a potential re-election. Former President Trump had delivered a speech in Milwaukee during the Republican National Convention. Meanwhile the Dollar is gearing up steam. Further pressure might cause the correction in stock markets to extend: Microsoft has seemingly reported issues with an outage of a computer system.

The strength of the Dollar continues and most currency pairs offer a potential turnaround pattern towards the end of this week. Also equities remain negative with in particular the Dow Jones having pared most of last week’s previous gains. Tech stocks remain hit the most and the current news surrounding Microsoft might further weigh negatively on the situation. The strength of the Dollar also caused Gold to weaken.