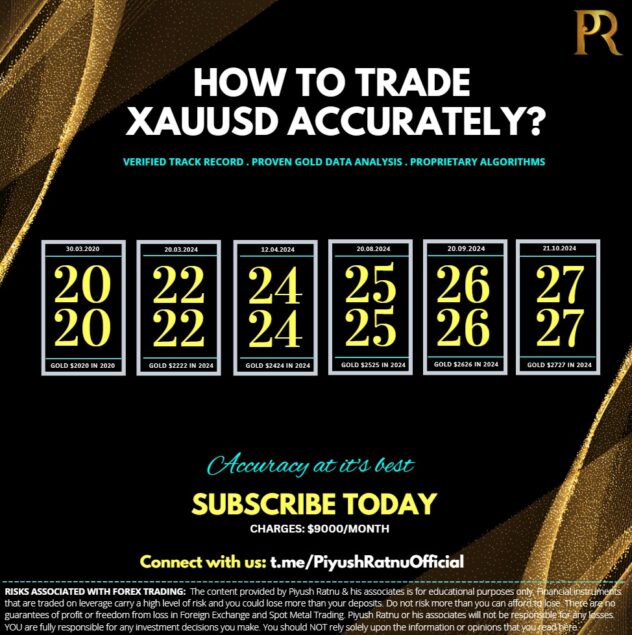

Piyush Ratnu is a prominent figure in the realm of gold market analysis, particularly focusing on the XAU/USD currency pair. His recent analyses have highlighted significant fluctuations in gold prices, notably a drop from the $2787-$2647 range, which he had predicted. Ratnu’s approach combines both technical and fundamental analysis, allowing him to provide insights into market movements influenced by economic indicators, geopolitical tensions, and central bank policies. For instance, recent data indicating robust economic growth in the U.S. has tempered expectations for interest rate cuts, which in turn has affected gold prices.

His forecasts suggest that traders should be cautious, especially with upcoming reports like the Nonfarm Payrolls (NFP) that could sway market sentiment. Ratnu emphasizes the importance of understanding key price zones for trading strategies, advising to buy on dips and sell at resistance levels. His track record boasts a high accuracy rate, making him a trusted source for traders looking to navigate the complexities of the gold market. Check Track Record: 2021-2024.

What are the key factors influencing gold prices according to Piyush Ratnu?

What are the key factors influencing gold prices according to Piyush Ratnu?

According to Piyush Ratnu, several key factors influence gold prices:

- Economic Indicators: Reports such as GDP growth, inflation rates, and employment figures can heavily impact gold prices. Strong economic performance typically leads to lower gold prices, while weak data can boost gold as a safe-haven asset.

- Central Bank Policies: Actions and statements from central banks, particularly the Federal Reserve in the U.S., regarding interest rates and monetary policy are crucial. Lower interest rates often make gold more attractive, while increases can dampen its appeal.

- Geopolitical Tensions: Global uncertainties, such as conflicts or political instability, tend to drive investors towards gold as a safe haven, leading to price increases.

- Market Sentiment: Investors’ perceptions and market trends can create volatility, impacting demand for gold. For example, shifts in investment trends toward equities or cryptocurrencies can affect gold’s attractiveness.

- Supply and Demand Dynamics: The physical demand for gold (jewelry, industrial use) and changes in supply (mining output, recycling rates) also play significant roles in determining prices.

- Currency Fluctuations: The strength of the U.S. dollar inversely affects gold prices; a weaker dollar typically makes gold cheaper for foreign investors, increasing demand and driving prices up.

By monitoring these factors closely, traders can make more informed decisions regarding gold investments.

How does Piyush Ratnu incorporate economic data into his gold analysis?

Piyush Ratnu incorporates economic data into his gold analysis by closely monitoring key indicators that can influence gold prices. Here’s how he typically does it:

- Interest Rates: Ratnu examines central bank policies, particularly those of the Federal Reserve. Changes in interest rates have a direct impact on gold prices, as lower rates tend to increase gold’s appeal as a non-yielding asset.

- Economic Growth Indicators: He evaluates data related to GDP growth, employment rates, and manufacturing indexes. Strong economic growth often leads to higher interest rates and a stronger dollar, which can put downward pressure on gold prices, while weak data might lead to higher gold demand as a safe haven.

- Inflation Data: Ratnu utilizes inflation metrics, such as the Consumer Price Index (CPI), to gauge how inflation expectations can affect investor behavior toward gold. Rising inflation usually boosts gold’s appeal as a hedge.

- Geopolitical Events: He considers geopolitical tensions and crises, which can drive investors toward gold for safety. Economic data from different regions can also provide context for these events.

- Market Sentiment: Ratnu integrates economic data with market sentiment indicators, such as the Commitment of Traders (COT) report, to assess how traders are positioned and how that might impact future price movements.

By synthesizing these elements, Ratnu develops a comprehensive view of the factors influencing gold prices, which helps traders make informed decisions in the market.

What trading strategies does Piyush Ratnu recommend for gold traders?

Piyush Ratnu recommends several trading strategies for gold traders, focusing on a mix of technical analysis and market sentiment. Here are some key strategies he often emphasizes:

- Support and Resistance Levels: Ratnu advises traders to identify key support and resistance zones on gold charts. This allows traders to make informed decisions about entry and exit points, aiming to buy at support levels and sell at resistance.

- Trend Analysis: He highlights the importance of recognizing the prevailing trend in the gold market. Traders are encouraged to align their trades with the trend direction, whether it’s bullish or bearish, to increase the likelihood of successful trades.

- Market Sentiment: Understanding market sentiment is crucial. Ratnu suggests keeping an eye on economic indicators, geopolitical events, and central bank policies, as these factors can significantly influence gold prices. Traders should be prepared to react to news that could affect market sentiment.

- Risk Management: He emphasizes the necessity of implementing solid risk management strategies. This includes setting stop-loss orders to protect against significant losses and only risking a small percentage of capital on any single trade.

- Using Technical Indicators: Ratnu encourages the use of technical indicators, such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence), to generate buy and sell signals based on historical price movements.

- Long-term vs. Short-term Trading: Depending on individual trading styles, he suggests both day trading strategies and long-term investment strategies. Day traders should focus on quick gains based on smaller price movements, while long-term investors may look for broader trends and accumulate gold over time.

- Staying Informed: Staying updated with market news, economic reports, and technical analysis is crucial for making timely trading decisions. Ratnu often shares insights and updates to help traders adapt to changing market conditions.

By employing these strategies, traders can enhance their chances of success in the gold market while managing risk effectively.

How has Piyush Ratnu’s analysis performed historically in predicting gold price movements?

Piyush Ratnu’s analysis has historically shown a strong track record in predicting gold price movements. He is known for his keen insights and ability to identify significant price levels, trends, and market sentiment. His analyses often incorporate both technical and fundamental factors, allowing him to provide well-rounded forecasts.

Traders and investors who follow his recommendations have noted a high accuracy rate, particularly in identifying key support and resistance levels. For example, Ratnu has successfully predicted major price drops and recoveries in the gold market, which has helped traders make informed decisions.

However, like any market analyst, his predictions are subject to the inherent volatility and unpredictability of financial markets. While his past performance has been commendable, it is essential for traders to conduct their own research and consider various factors when trading in gold or any other asset.

Overall, Piyush Ratnu’s insights are generally respected in the trading community for their depth and accuracy, contributing positively to traders’ strategies.

Trade with Confidence with Piyush Ratnu Gold Market Research

Subscribe one of the most accurate analysis in the industry: Spot Gold Analysis by Piyush Ratnu powered by 90+ technical and fundamental parameters with a verified and audited track record.

Current Trading Profit Status: 112%

Highest Drawdown Faced YTD: 8%

Highest profit/month booked: 42%

Highest loss/month booked: 5%

Check Trading Performance at:

https://www.myfxbook.com/members/PiyushRatnu

Core Focus: XAUUSD | Spot Gold

Platform: MT4 MT5

Trading Mode: Manual + Algorithm | Automated: both available

Auto-Copy Trading: Available | Plug and Play Solution

Live Trading Feed Available | Real Time Analysis Available

Connect for an appointment at T.ME/PIYUSHRATNUOFFICIAL