June Non Farm Payrolls Day | XAUUSD Analysis: The Golden Barricades at $1907/1926

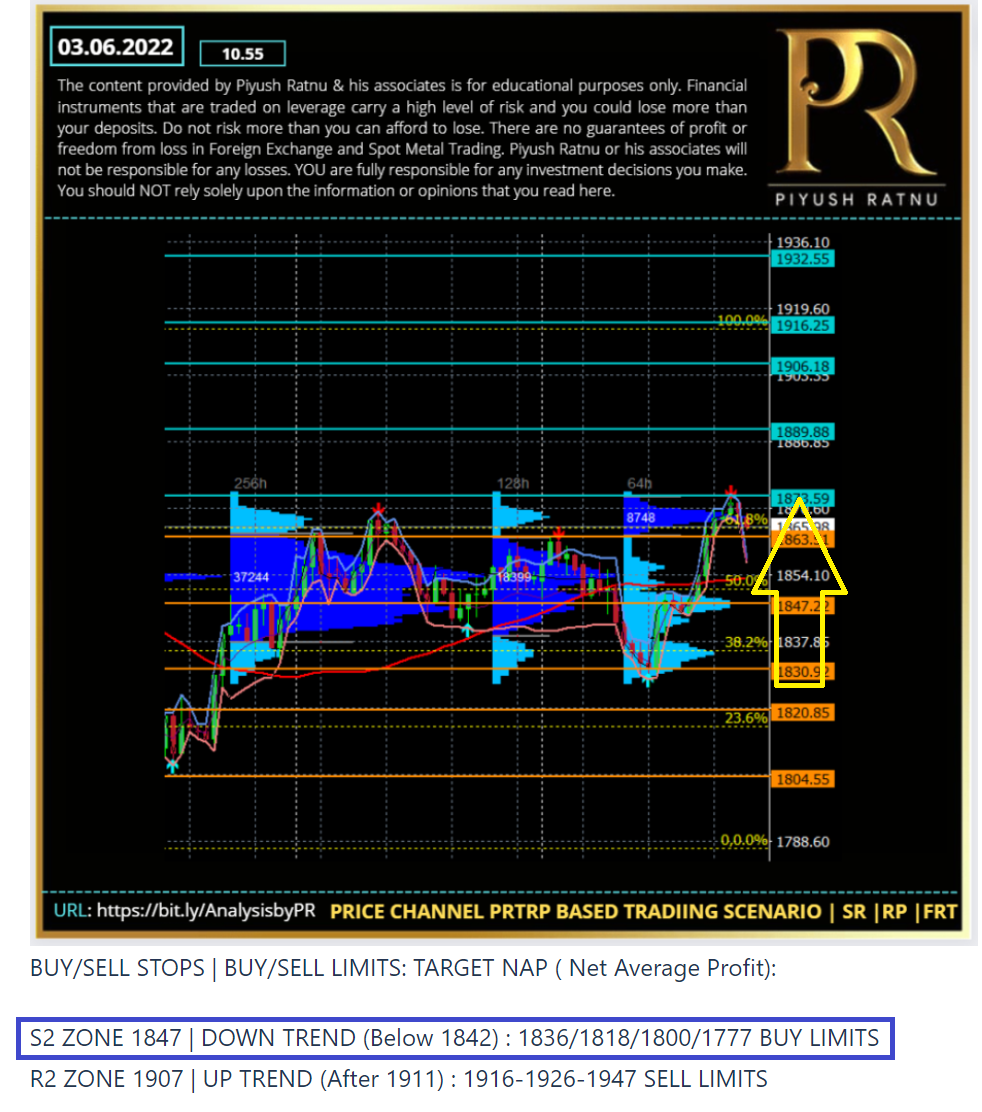

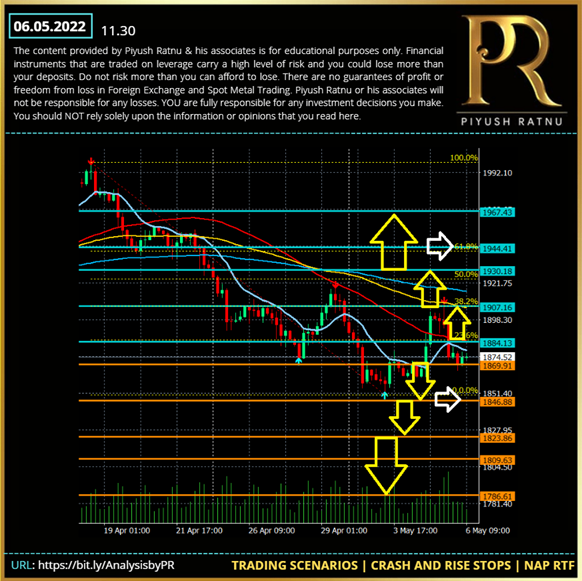

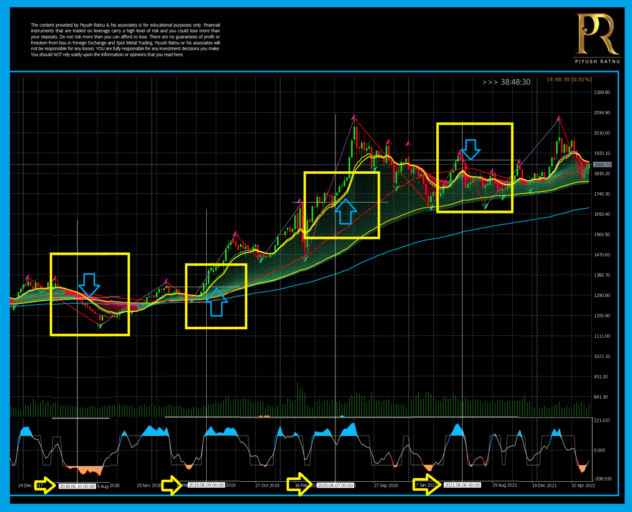

Spot Gold (XAUUSD) price is back to $1866 zone, where it was on 06 May, 2022 on NFP Day. In my analysis published last month, this is what I had mentioned: Non Farm Payrolls Day May 2022: Spot Gold Analysis: XAUUSD: $1866/1836 or $1907/1926? Result: Gold touched the mark of 1907 and then crashed till $1787 mark in less than 10 days. BUY/SELL STOPS | BUY/SELL LIMITS: TARGET NAP ( Net Average Profit):

S2 ZONE 1846 | DOWN TREND (Below 1840) : 1836/1818/1800/1777 stops

R2 ZONE 1907 | UP TREND (After 1909) : 1916-1926-1947 stops

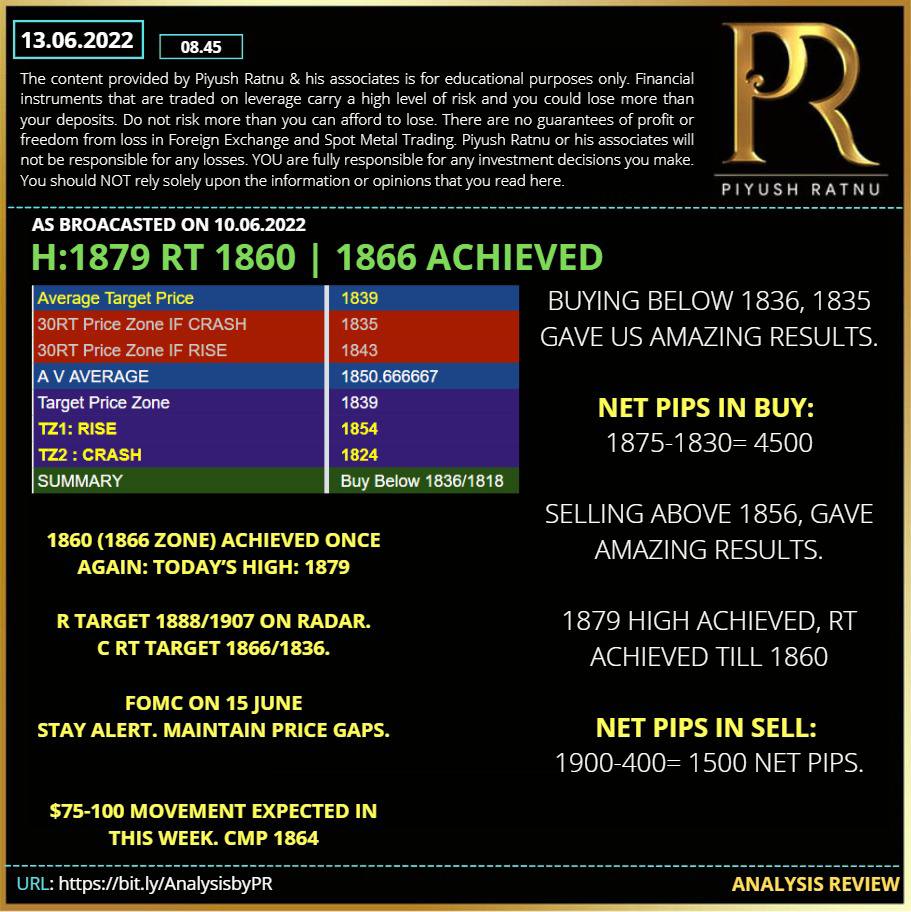

Analysis 06.05.2022 Review: 1909 was well achieved, hence sell limits hit at 1909 gave handsome profits at 1836. 1836/1818/1800 buy limits hit on 11 May – 16 May, 2022, and today GOLD is at 1866, proving accuracy of our analysis once again.

Following the key levels mentioned in my analysis dated 06.05.2022: buying Gold at following price zones in last one month gave good returns:

($) 1836, 1818, 1808, 1790 and made an exit in net average profit of all trades

Selling Gold at following price zones in last three days proved a wise idea:

($) 1855, 1866 and made an exit in net average profit of all trades

FUNDAMENTAL ANALYSIS | CMP $1866 | 03.06.2022

Thursday’s strong advance in XAUUSD was on the back of rising open interest and opens the door to further gains in the very near term. Against that, the precious metal faces a tough resistance around the $1,866 level per ounce troy. Gold traders are facing barricades at around $1,866.00 amid cautious trading added with risk-on mood sentiments over the US NFP. The DXY has slipped below 101.70 on positive market sentiment. The ADP Research Institute has reported addition of 128k jobs in the labour market, significantly lower than the estimates of 300k. It is worth noting that the US labour market is at its peak levels and employment generation may get slower amid less scope for growth. Therefore, investors should brace for a slower job growth rate. As per the market consensus, the US NFP is seen at 325k. The gold price is performing well against the greenback as investors are expecting that the actual NFP figure won’t even justify the consensus. A lower than expected job addition will fetch significant offers to the US dollar index (DXY). Currently, the DXY is oscillating below 101.70, and more downside looks possible considering the strength of the bears on the counter.

The greenback changed course on Thursday and gave up all of its Wednesday gains and more. Easing government bond yields and tepid US employment-related figures put pressure on the American currency, later weighed by the positive tone of Wall Street. However, it is always wise to stay cautious, as they say: Don’t always believe in what they show you, be cautious, implement money management and be ready for a reversal which may come as a surprise resulting in heavy drawdown.

US 10 Year yields stand at 2.915, USDJPY at 129.94, XAUXAG ratio at 83.50 and Dollar Index at 101.737 at the time of writing.

How to trade Spot Gold XAUUSD on NFP data today?

Bearish Scenario: Gold Stops: $1836/1818/1777, once again?

If the bearish momentum extends, gold price could fall further towards 1836 (after 1842) with 1818/1777 as final destination, if Gold crash halts at 1836 or 1818 zone a reversal can be expected with a RT 23.6 on M5 and M15 30% RT before/in next 12 trading days.

Bullish Scenario: Gold Stops: $1907/1926/1947?

If the Bullish momentum pushes Gold price across $1888 barrier, $1907 and $1926 can be the next target for Gold, opening way to $1947.

Heading into the NFP showdown today, gold price is under a price trap of 1836-1866 zone, as investors are less hesitant to place fresh bets due to ongoing saga of risk-on mood. The US NFP will emerge as the main market driver for gold price today.

A break above $1907 after M1 M5 23.6 retracement format, might result in price trap of $1926-$1947 on a longer run and a further bullish trend might help GOLD bulls to achieve $1947-1966 zone. However a crash below $1842 might open gates for $1836 (after S2), $1818/1777 zone before retracement is achieved at 23.6 M5, M15/M30 in next 12 days.

TRADING STRATEGY:

Observe price at US OPENING SS1 and then US SS2

Observe S2-S3/S4 zone and R2-R3 zone for reversals/retracement, Target NAP

Do not enter between the S/R zones or in pivot zone

Observe: FIB 23.6% on M5 and M15 TF for NAP target price

after 30/60/90/120 minutes of NFP

Crash scenario:

S2 -6/9 RT NAP

S3 -3/6 RT NAP

S4 -6 RT NAP

Rise scenario:

R2+6/9 RT NAP

R3+3/6 RT NAP

R4+6 RT NAP

Implement RM till 30 after 15/30 min. and price gap 12/18/24 after NFP

Implement GR/SM after $25/40 price movement from CMP at NFP data

Golden Ratio based money management should not be used at least till $24 price movement in any direction, if SM needs to be ignored.

Kindly observe the crucial limits/stops levels mentioned by me in this analysis in addition to possible crash and rise zones highlighted in

Today, I will prefer to BUY session/daily lows below Support zone (-3/6/9 pattern) S3 and S4, and I will prefer to SELL above Resistance zones 2 and 3 with a target of NET average profit, if fundamentals support and favour the same.

Movement of 25/40 or 60 dollars on Gold price is not something unexpected nowadays, and a surprise on Monday during early trading hours can not be ruled out too, so closing all positions today in net average profit is always the best trading strategy for every trader who wants to safeguard his principle. I expect A pattern in next 12 days.

BUY/SELL STOPS | BUY/SELL LIMITS: TARGET NAP ( Net Average Profit):

S2 ZONE 1847 | DOWN TREND (Below 1842) : 1836/1818/1800/1777 BUY LIMITS

R2 ZONE 1907 | UP TREND (After 1911) : 1916-1926-1947 SELL LIMITS

It is always wise to first PLAN THE TRADE, and then TRADE THE PLAN! Hence, it is suggested to first observe the crash or rise with specific zones and levels in mind on the basis of various fundamental and technical parameters mentioned above, before entering a trade in a specific direction with a target of net average profit in a specific set of trades.

WARNING: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The author will not be held responsible for information that is found at the end of links posted on this page. The author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. The author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author is not a registered investment advisor and nothing in this article is intended to be investment advice. All performance information reflects past performance and is presented on a total return basis. Past performance is no guarantee of future results. Current performance may differ from the performance shown.

RISK WARNING | DISCLAIMER

Information on this Channel/Page contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Information or opinions provided by us should not be used for investment advice and do not constitute an offer to sell or solicitation of an offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. When making a decision about your investments, you should seek the advice of a professional financial adviser.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

The analysis and trading suggestions published by Piyush Ratnu does not warrant or guarantee the accuracy, timeliness or completeness to its service or information contained therein. Piyush Ratnu does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading on their own risk and Piyush Ratnu shall not be responsible under any circumstances for the consequences of such activities. Piyush Ratnu and its affiliates, in no event, be liable to users or any third parties for any consequential damages or losses in any direct or indirect manner, however arising, including but not limited to damages caused by negligence or Force Majeure whether such damages were foreseen or unforeseen.

The capital value of units in the fund can fluctuate and the price of units can go down as well as up and is not guaranteed. You should not buy a warrant unless you are prepared to sustain a total loss of the money you have invested plus any commission or other transaction charges. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals. The high degree of leverage can work against you as well as for you hence implement risk management and money management strictly to safeguard your investment. Do not risk more than .10% of your principle amount in a single trade set.

Before deciding to invest in foreign exchange or other markets you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some, or all, of your initial investment. Therefore, you should not invest money that you cannot afford to lose. In some cases, it is possible to lose more than your initial investment as it is not always possible to exit a market at the price you intend upon doing so. There are also risks associated with utilizing an Internet-based trade execution software application including, but not limited to, the failure of hardware and software. You should be aware of all the risks associated with investing in foreign exchange, indices and commodities and seek advice from an independent financial advisor if you have any doubts.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu or his associates will not accept any liability for any loss or damage, including but without limitation to, any financial, emotional loss, which may arise directly or indirectly due to your decision. If you do not agree to the above terms, conditions and disclaimer YOU MUST leave this group with immediate effect and YOU MUST not act as per the information provided in this document.

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

Analysis Review: RESULT