- Prosecutors accuse three former JPMorgan Chase & Co employees of “ripping off” the precious metals futures market with fake orders

- Spoofing—or the placement of sell and buy orders one never intends to honor—has been illegal since the Dodd-Frank Act of 2010

- While regulators’ actions might be assuring, spoofing may still exist at some point

JPM’s former global precious metals desk head Michael Nowak, precious metals trader Gregg Smith, and salesperson Jeffrey Ruffo are in the dock.

Nowak, once the most powerful person on the gold market, made hundreds of millions of dollars in profit for JPM, trading everything from silver to palladium over a decade. Now, the court is told he and two of his former colleagues generated thousands of spoofing trades, which prosecutors say were used for years to generate illicit gains for his employer and its top clients.

It is the most aggressive criminal trial to date that targets spoofing and has been exposing the inner workings of a prestigious bank that has long dominated the market for gold. The government says Nowak’s business operated as a criminal enterprise, manipulating prices from 2008 to 2016 by placing thousands of trade orders without the intention of ever executing them. The three men are among the most prominent players yet to face prison for price manipulation if convicted. Nowak, also a board member of the body that runs the London gold market, faces 15 counts, including commodities fraud, conspiracy to engage in racketeering and price manipulation, and spoofing. Trader Gregg Smith faces 13 counts, while Jeffrey Ruffo, a salesman, faces two counts. A fourth defendant, trader Christopher Jordan, is scheduled to be tried separately on Nov 28. All have pleaded not guilty. The trial of the former JPM employees comes after years of a US government investigation on price manipulation in precious metals that saw JPM pay $920 million to settle spoofing claims two years ago. With $330 billion of notional value in precious metals derivatives contracts at the end of March, the New York-based bank accounts for 67% of the positions put through US banks. Data show that it holds three times as much as the next-biggest player, Citigroup (NYSE:C).

Separately, chat logs introduced as evidence by prosecutors at last year’s spoofing trial of former Merrill Lynch traders show one of them, Edward Bases, bragging about how easy it was to manipulate prices.

This sort of testimony—that the trade structurally is built for this kind of deception—could keep new retail investors away, said Phillip Streible, precious metals strategist at Blueline Futures. He added:

“I really believed the exchanges and regulatory bodies had really put controls in place, all ready to flag these types of instances of spoofing. But really, that doesn’t seem to be the case. I represent a retail commodity futures broker, generally the little guy, the account that’s worth $25,000 to $1 million. I don’t want to see large operations exploit the little guy. I don’t think spoofing would go away after this, although I’d like to think the exchange, the FCMs (Futures Commodity Merchants), and others are doing a great job of being able to find these repetitive patterns and hold those that do harm accountable.”

However, Streible also stressed that some of his clients had been unnerved by the sheer scale of deceit in precious metals unearthed by the revelations in court.

To make his point, he shared an anecdote: “I had some firm requesting information on precious metals positions after an article I wrote, and I reached out to the person and said, ‘Silver’s at a low price; would you like to be actively involved on the futures side?’ And the guy goes, ‘No, the silver market is rigged.’ […] So that guy will potentially never be a client. And he could have been. It really hurts us from a marketing standpoint. We won’t be able to convert them into retail clients for precious metals, no matter how hard we try.”

The ongoing trial of three former JPMorgan Chase & Co (NYSE:JPM) employees charged with making fake orders has been dividing the precious metals trading community.

One end believes that legal action couldn’t have come a day sooner, as the authorities are finally acting in a sign that they won’t tolerate such fraud anymore—regardless of who you are. The other end of the community argues that the prosecution has come at least two decades late, as demand for action in an almost daily (allegedly) manipulated trade marks a lost opportunity to set things right at the right time. The vulnerability of precious metals futures to rigging has been laid open, and those who fear getting caught in it someday might never get in.

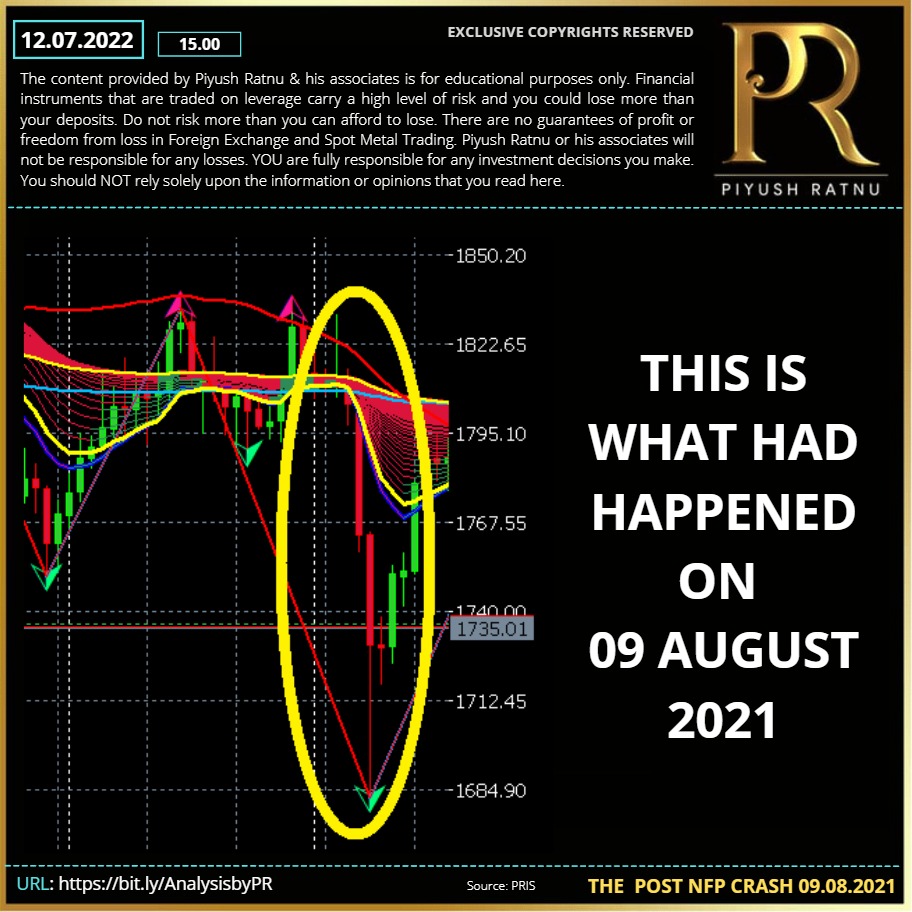

Of particular note was an incident on Aug 9, 2021, when COMEX gold trading during Asian markets ahead of its New York open dropped some 4% within a span of 15 minutes to below $1,700 an ounce, in what was termed as a ‘flash crash’.

The World Gold Council explained it as a freak occurrence: “When there is generally less liquidity in global markets across all assets.” Avoiding any mention of manipulation, the council added that: “[The lightning drop] likely initiated some stop-loss orders that were probably situated around the $1,700 level, and this created a snowball effect, causing additional selling.” However, to traders who were long gold and lost big by dumping their positions that day, unsurprisingly, it looked and felt like another act of spoofing.

Above article source and copyright: Investing.com