Why Spot Gold Price is rising? How to trade XAUUSD Spot Gold accurately in 2024?

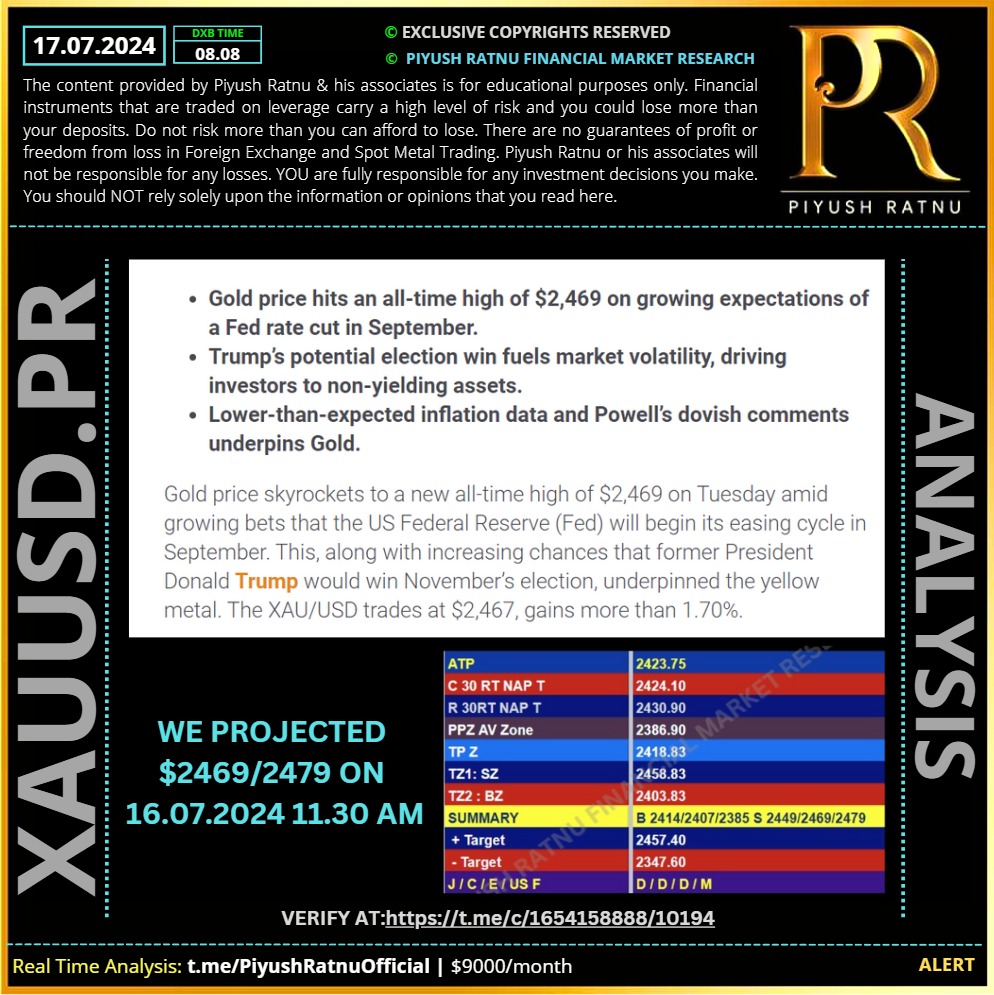

Gold price (XAU/USD) scales higher for the third straight day – also marking the sixth day of a positive move in the previous seven – and hits a fresh record peak, around the $2,482-2,483 region during the Asian session on Wednesday.

The current market pricing indicates over a 90% chance that the Federal Reserve (Fed) will cut interest RATES in September. This, in turn, keeps the US Treasury bond yields depressed near a multi-month trough and is seen as a key factor driving flows towards the non-yielding yellow metal.

That said, a modest US Dollar (USD) uptick holds back bullish traders from placing fresh bets around the Gold price amid slightly overbought Relative Strength Index (RSI) on the daily chart. Apart from this, the prevalent risk-on environment – as depicted by an extension of the uptrend across the global equity markets – contribute to capping gains for the safe-haven precious metal.

Nevertheless, the aforementioned fundamental backdrop suggests that the path of least resistance for the XAUUSD remains to the upside.

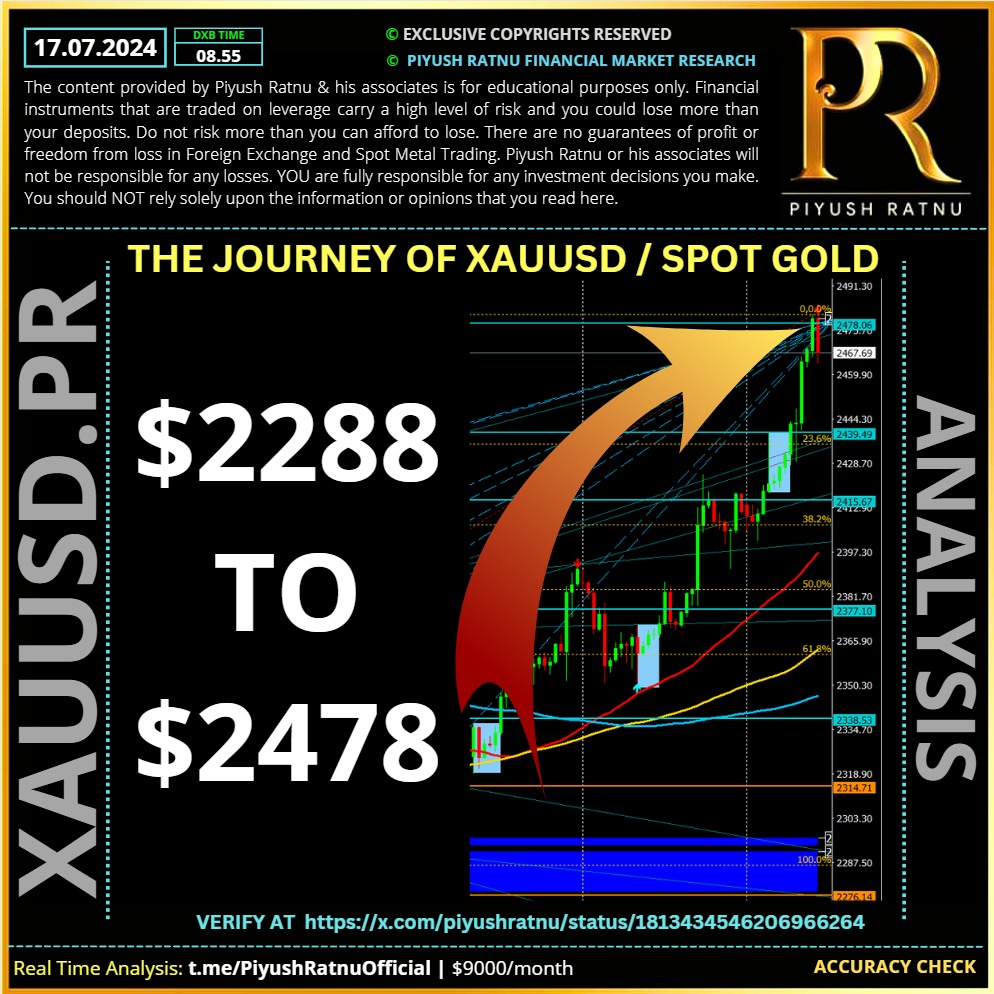

Journey of Gold: $2288-2323-2342-2369-2385-2407-2424-2442-2469-2479: all target projected by us in advance in sequence in our daily analysis LIVE feed on Telegram and on X.com | x.com/piyushratnu

$2479: https://x.com/piyushratnu/status/1813428125952360939

$2477: https://x.com/piyushratnu/status/1813214451245465846/photo/1

$2469: https://x.com/piyushratnu/status/1812143332920885428/photo/1

$2442: https://x.com/piyushratnu/status/1811638164856988075

$2424: https://x.com/piyushratnu/status/1811437013117358228

$2407: https://x.com/piyushratnu/status/1811379158741647763/photo/1

$2350-2385: https://x.com/piyushratnu/status/1809215950975082691

$2369: https://x.com/piyushratnu/status/1808501669631561873

$2369: https://x.com/piyushratnu/status/1808506007460421904/photo/1

$2323: https://x.com/piyushratnu/status/1806298827227324779

$2288: https://x.com/piyushratnu/status/1806298827227324779

The key price driving factors are as follows:

- Weaker-than-expected US Consumer Price Index (CPI) data sponsored Gold’s leg-up above $2,400, as the odds for Fed rate cuts increased, as reflected by falling US Treasury bond yields.

- US Retail Sales in June were flat at 0% MoM, as expected. Core sales expanded by 0.4% MoM, above the projected 0.1%.

- June Export and Import Prices both decreased, with Export prices dropping -0.5% MoM, below the forecast of -0.1%. Import prices rose compared to May’s -0.2% decline, coming in at 0%, beneath the estimated 0.2% increase.

- Meanwhile, the US Dollar Index (DXY), which tracks the Greenback against a basket of six currencies, is up by a minimal 0.02% at 104.27.

- December 2024 fed funds rate futures contract implies that the Fed will ease policy by 53 basis points (bps) toward the end of the year, up from 50 last Friday.

- Bullion prices retreated slightly due to the People’s Bank of China (PBoC) decision to halt gold purchases in June, as it did in May. By the end of June, China held 72.80 million troy ounces of the precious metal.

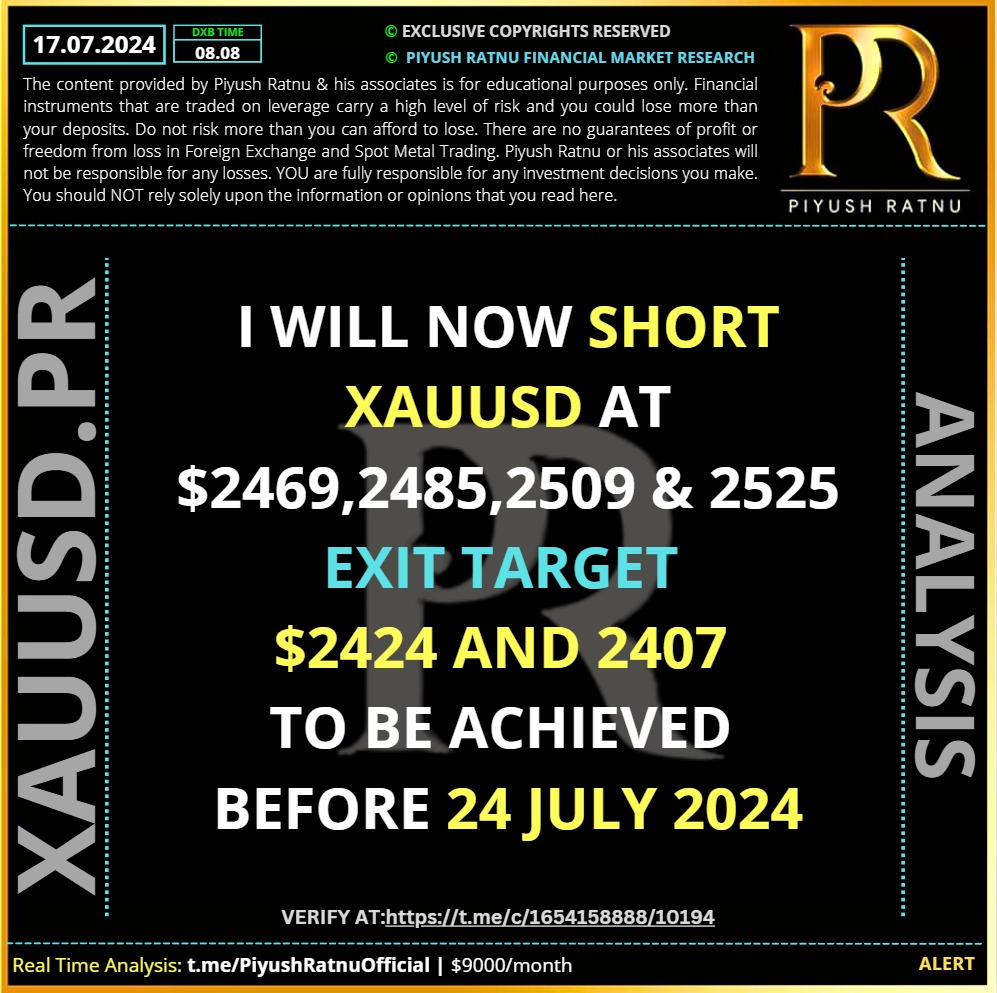

I will NOW SHORT XAUUSD at $2469,2485,2509 and 2525 Exit Target $2424 and 2407 to be achieved before 24 July 2024