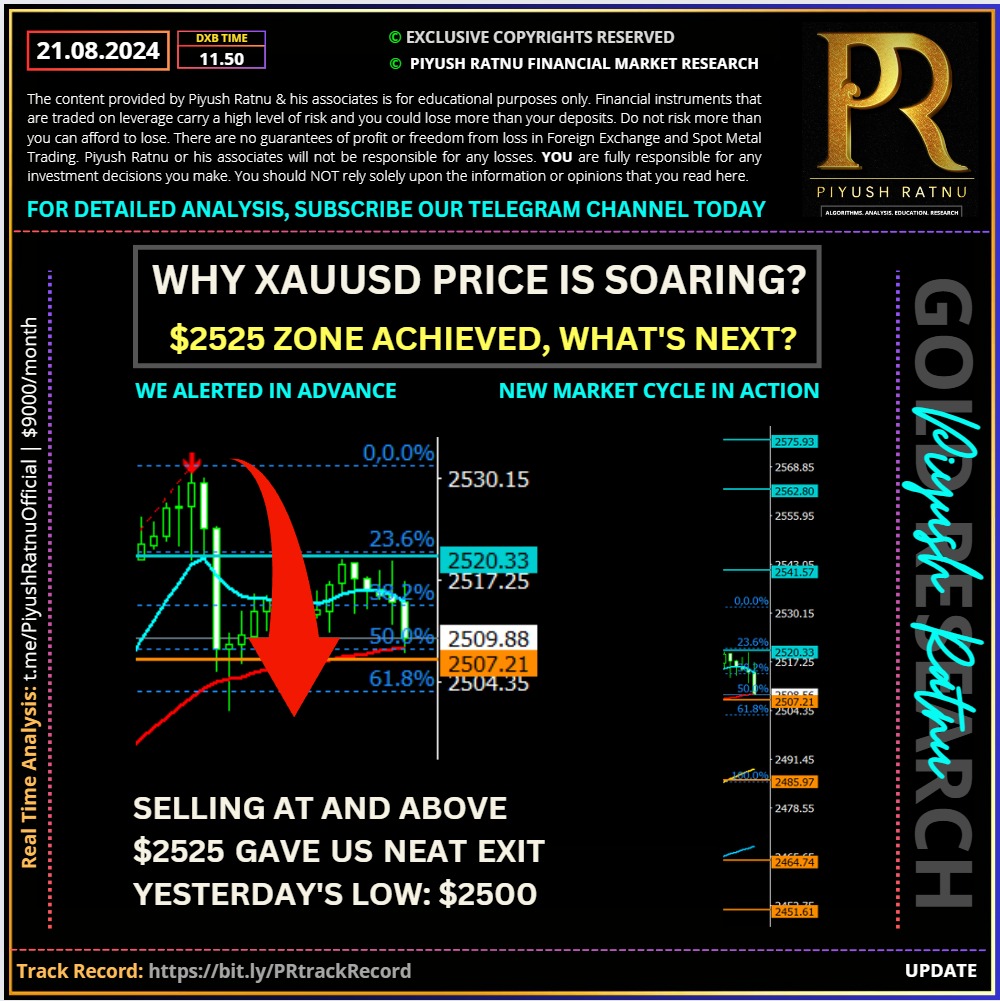

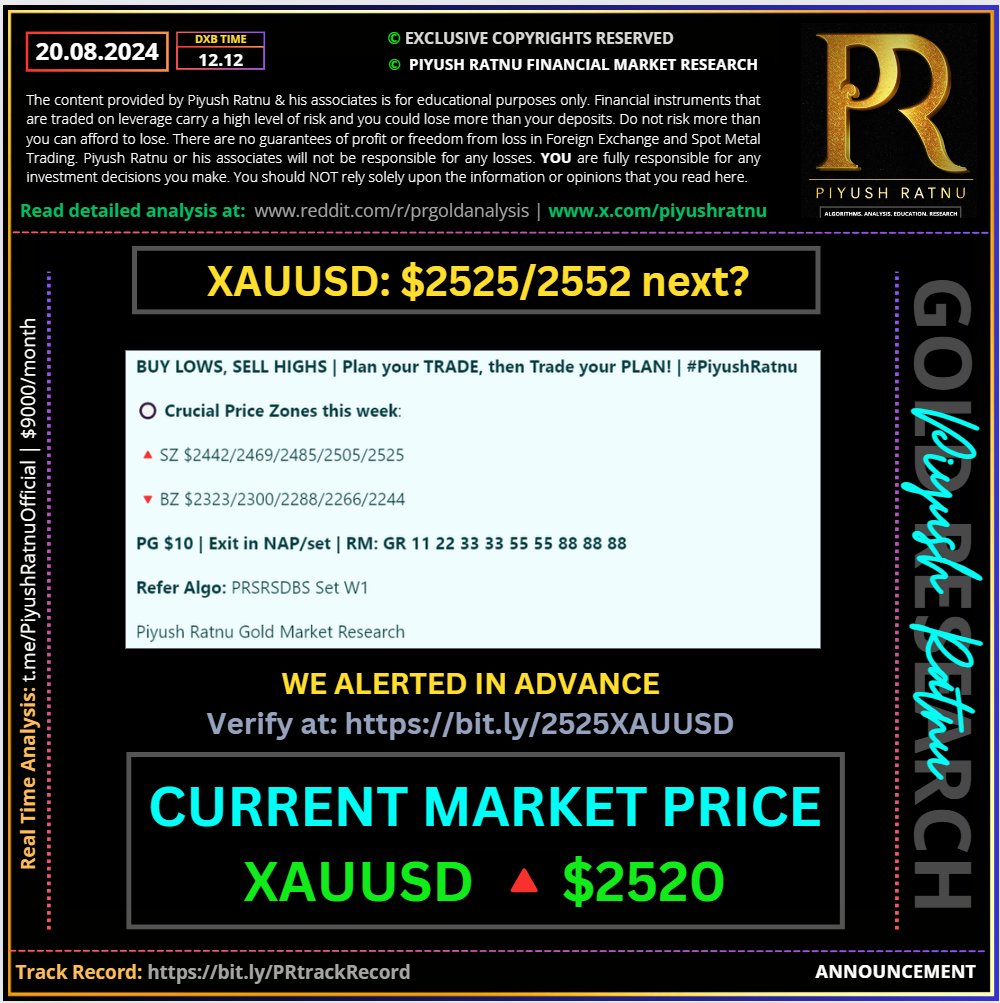

As alerted by us: NEW GOLD CYCLES on the way from 15 August 2024 onwards:

Why XAUUSD Spot GOLD price is rising?

Analysis by Piyush Ratnu

Gold (XAU/USD) trades up to a new all-time high in the $2,520s on Tuesday on the back of news of solid demand from China, a weakening US Dollar (in which the precious metal is mostly priced), and continued geopolitical risks stemming from the Middle East, where peace talks are at risk of running aground.

Gold at new high after news of Chinese demand

Gold continues rallying on Tuesday on the back of increased safe-haven demand from China. The People’s Bank of China (PBoC) issued new Gold import quotas to banks which “triggered speculation of a renewed wave of demand,” according to broker SP Angel. Safe-haven demand for Gold in China rose after Chinese 10-year Government Bond yields fell to record lows last week and, as a result, “Chinese buyers are seeking alternative safe-haven protection, with Gold an obvious candidate,” added the broker.

New gold import quotas for Chinese banks could foreshadow another surge in Chinese demand.

Demand for gold was white-hot in China last spring, helping drive global prices to record highs. Chinese demand slowed in recent months due to high prices, but there are signs another Chinese gold buying spree could be on the horizon.

The People’s Bank of China has given several commercial banks new gold import quotas in anticipation of revived demand despite high prices.

Sources told Reuters that the Chinese central bank granted the new quotas this month after a two-month pause due to slower physical demand caused by record-high prices.

China ranks as the world’s biggest consumer of gold.

(-) DXY = (+) XAUUSD

Gold is gaining a further lift as the US Dollar pushes to a new low eight-month low on Tuesday. The US Dollar Index (DXY) fell to 101.76 in early trade – a positive for Gold since the two assets share a high degree of negative correlation.

Geo-political tensions = (+) XAUUSD

Gold may be seeing safe-haven demand after an attempt to reach a peace agreement in the Middle East, spearheaded by US Secretary of State Antony Blinken, stalled with Israel ready to agree but Hamas not because it wants the agreement to include a permanent and not a temporary ceasefire as laid out in the current deal. Hamas further ratcheted up tensions by owning up to a recent suicide bomb attack in Tel Aviv. An Iranian all-out attack against Israel also remains an overhead risk factor. Middle East peace talks have hit an impasse, further increasing geopolitical risk.

Jackson Hole Symposium

Jackson Hole Symposium

This week’s focus will be on the Jackson Hole Symposium, hosting policymakers from around the globe. The event will take place over the weekend, with Federal Reserve (Fed) Chairman Jerome Powell speaking on Friday.

🟢Gold price battles $2,525 as buyers gather pace amid souring risk sentiment.

🟢The US Dollar struggles with US Treasury bond yields on dovish Fed expectations.

🟢The focus remains on Wednesday’s FOMC Minutes and Fed Chair Jerome Powell’s speech on Friday.

🟢Upcoming FOMC meeting minutes and Fed Chair Powell’s speech are critical for insights into future monetary policy.

🟢The uncertainty around the Fed’s next moves maintains gold prices near record highs.

Markets are currently fully pricing in a 25 basis points (bps) rate cut by the Fed next month, with the odds of a 50 bps move off the table. The further upside in Gold price could be also capped because of the pricing out of a bigger rate reduction for September.

Ahead of the key Fed events, Gold price will continue to remain at the mercy of risk trends and speeches from Fed policymakers. Fresh developments surrounding the Iran-Israel conflict could also play a pivotal role in the Gold price action.

Trading gold during a geopolitical crisis is a strategic move, as gold is traditionally viewed as a safe-haven asset that tends to appreciate when uncertainty rises. During such times, investors often flock to gold, driving prices higher as they seek stability amidst market volatility. It’s crucial to monitor geopolitical developments closely, as news events can trigger rapid price movements. It is equally important to manage risk by setting appropriate stop-loss levels and avoiding over-leveraging. Given the uncertainty in the market regarding the interest rate decision, the gold market could react strongly ahead of the Fed’s announcement. 🟢Therefore, it’s essential to manage trades carefully.

PG 25 | RT 25 | GR 11 22 33 55 | DD 5

🟢Refer PRSRSDBS MN set Algorithm

🟢 Expected Price Movement: $200-240

Trading Scenarios by Piyush Ratnu Gold Market Research:

#XAUUSD #Gold #Forex #Trading #War #Iran #Israel #IsraelIranWar