The outcome of the US elections could have a large impact on Gold prices. If there is a Democratic Victory (partial or full) the impact on Gold prices would be limited. In case of a universal tariff under a Trump presidency, we would likely see lower Gold prices, while over the longer-term these moves would likely be reversed, ABN AMRO’s FX strategist Georgette Boele note.

Will Gold prices to fall if Republicans win?

The evolution of the Gold market from merely a safe haven and jewellery market to a market where investment decisions play a more crucial role is important. Indeed, since the introduction of Gold ETFs (March 2003) Gold has developed more into a speculative asset and behaved less as a safe haven asset. As a result, developments in the US Dollar, monetary policy and real yields have become dominant drivers over time.

A Republican Victory brings more complicated dynamics. In the scenario of a full tariff implementation, we expect in the first years of the of the presidential term inflation to increase, the Fed to hike and the USD to rally because monetary policy divergence and weakness elsewhere.

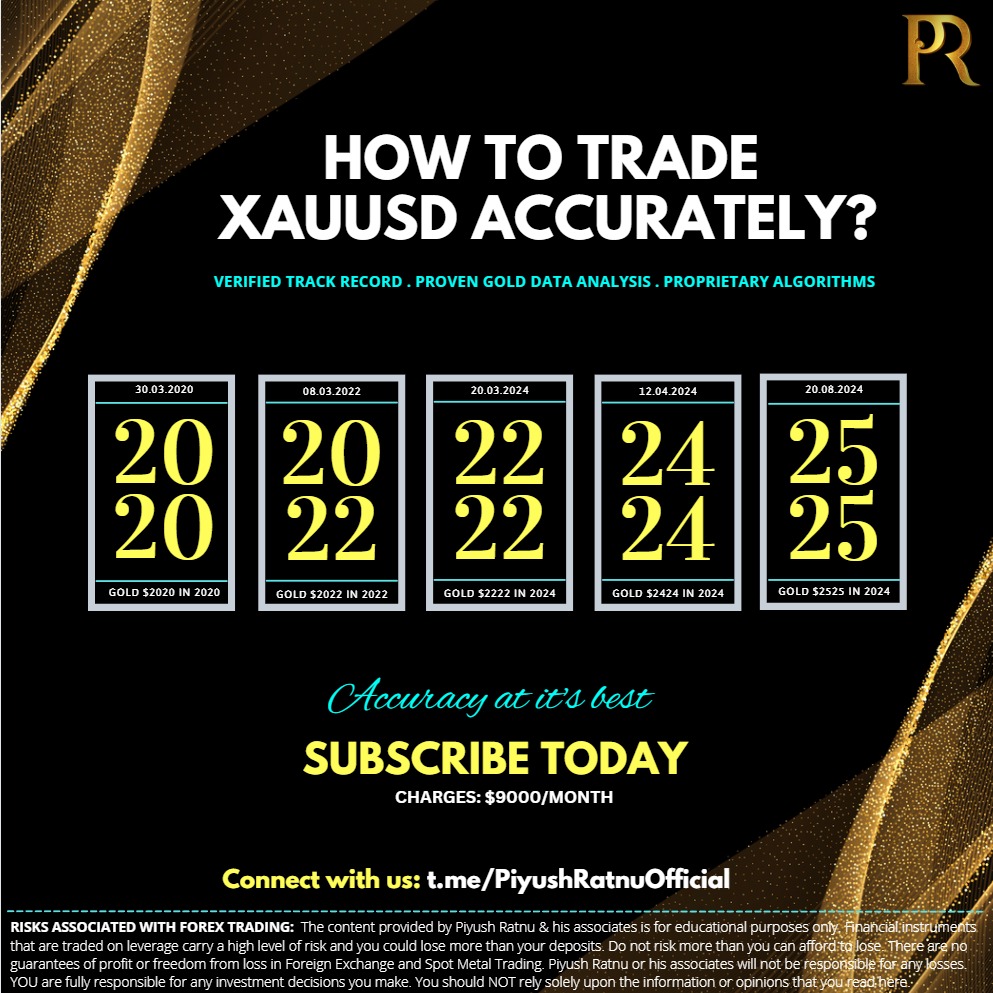

As a result, Gold prices will suffer, and Gold prices could decline towards $2,266/2244/2222/2185/2145 per ounce in sequence marking the same as a perfect BUY entry. Later we expect the USD to weaken, US-China conflict, geo-political tensions and real rates to come down. This will give room for Gold prices to rally again and move beyond the highs set earlier in 2024: $2525/2626/2727.

If there is a Democratic Victory (partial or full) we think the Gold prices could be very modestly supported because we expect a modest decline in or a neutral USD and some lower real yields. We expect Gold prices to stay around $2,400/2500 per ounce.