NFP September 2024:

XAUUSD: 🔺$2569/2585 or 🔻2385/2369?

Following a quiet start to the week, Gold (XAU/USD) briefly dipped below $2,500 on a broad US Dollar (USD) recovery. Although the precious metal struggled to gather bullish momentum, it managed to stabilize above $2,500 ahead of next week’s key macroeconomic data releases from the US.

After ending the previous week on a bullish note on Federal Reserve (Fed) Chairman Jerome Powell’s dovish remarks at the Jackson Hole Economic Symposium, Gold registered small gains on Monday and Tuesday. In the absence of fundamental drivers, however, the yellow metal’s upside remained limited.

**🟢Financial markets in the US will remain closed in observance of the Labor Day holiday on Monday. **

On Tuesday, the ISM Manufacturing Purchasing Managers Index (PMI) for August will be featured in the US economic docket. Investors expect the headline PMI to edge higher to 47.8 from 46.8 in July. A reading above 50, which would suggest that the business activity in the manufacturing sector recovered back into the expansion territory, could provide a boost to the USD with the immediate reaction and weigh on XAU/USD.

On Thursday, the ADP Employment Change and the ISM Services PMI data from the US will be looked upon for fresh impetus. The market reaction to these data is likely to be straightforward and short-lasting, with positive surprises supporting the USD and negative prints hurting the currency, ahead of Friday’s highly-anticipated August jobs report.

On Friday, Nonfarm Payrolls (NFP) in the US are forecast to rise by 163,000 in August following July’s disappointing 114,000 increase. The Unemployment Rate is expected to tick down to 4.2% from 4.3% and the monthly wage inflation, as measured by the change in the Average Hourly Earnings, is seen rising 0.3%.

Fed policymakers made it clear following the July policy meeting that they are shifting their focus to the labor market on growing signs of worsening conditions. Hence, even a small divergence from the market consensus in the NFP reading could 🔻🔺trigger a big reaction in Gold.

**🔻A better-than-forecast print could cause investors to refrain from pricing in an aggressive Fed policy loosening and fuel a strong rebound in the USD, weighing on Gold. **

According to the CME FedWatch Tool, markets currently see a nearly 70% probability of the Fed lowering the policy rate by a total of at least 100 basis points by year-end.

🔺On the other hand, a second straight weak NFP print could open the door for another leg lower in the US Treasury bond yields and the USD, allowing XAU/USD to push higher heading into the weekend.

According to Bloomberg, Gold ETF holdings rose by 15 tonnes last week to the highest level in six months. Speculative interest is particularly strong. The net long position of speculative investors rose to around 193,000 contracts in the week to August 20th, at the same time as Gold hit an all-time high, its highest level in almost four and a half years.

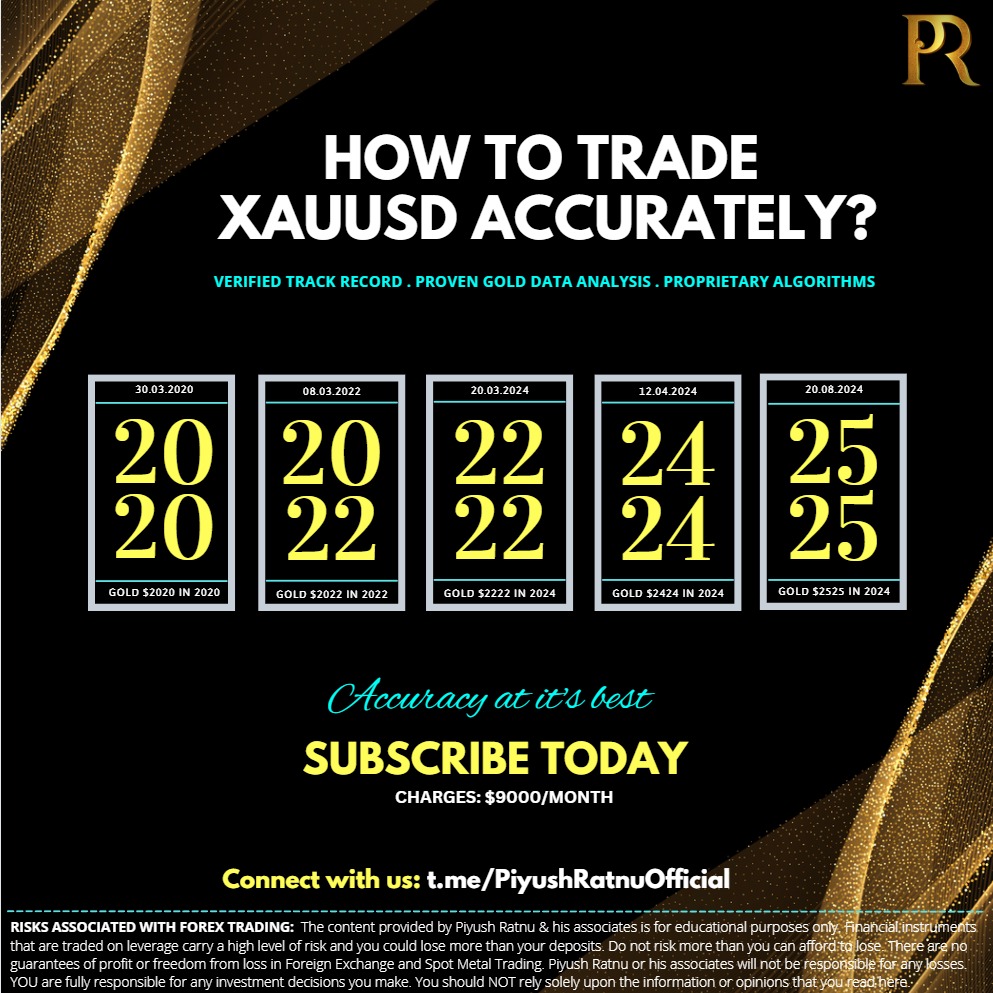

🟢It will be wise to note the past 5 years pattern indicated by us in our analysis dated 30 August 2024.🟢 | XAUUSD: $2585 or $2385?

Most Accurate Gold Market Analysis by Piyush Ratnu:

Subscribe our Telegram Channel at t.me/piyushratnuofficial for LIVE analysis, trading entry/exit zones, buying and selling zones as per economics and 133+ technical and fundamental parameters.