Will XAUUSD Spot Gold hit Stop Loss of TD Securities $2675? Latest Gold XAUUSD Price Prediction | Most Accurate Forex XAUUSD Spot Gold Analysis

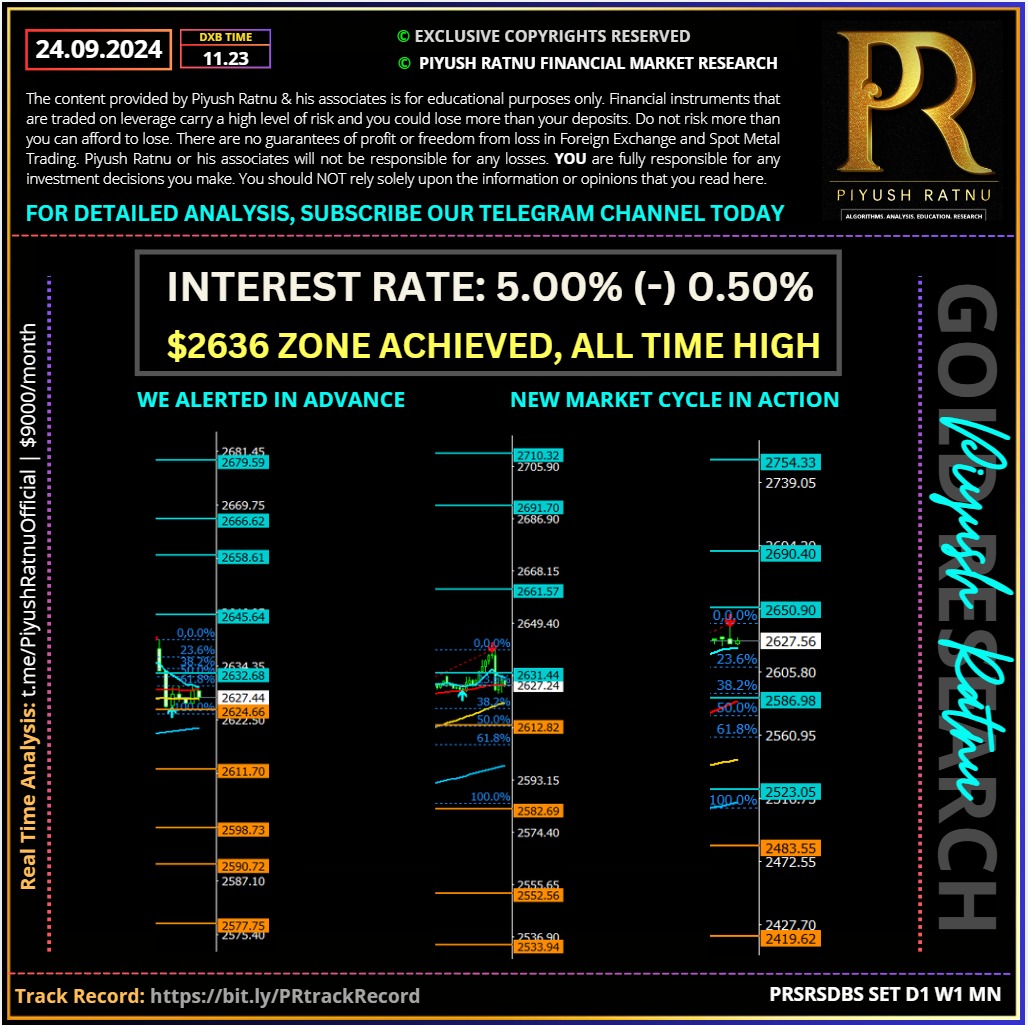

Current Status: CMP: $2626, retraced from the high $2640

Gold price (XAU/USD) retreats after touching a fresh all-time peak, around the $2,640 area on Tuesday and slides to the lower end of its daily range heading into the European session. An uptick in the US Treasury bond yields helps revive the US Dollar (USD) demand, which, in turn, prompts some profit-taking around the commodity amid slightly overbought conditions on the daily chart.

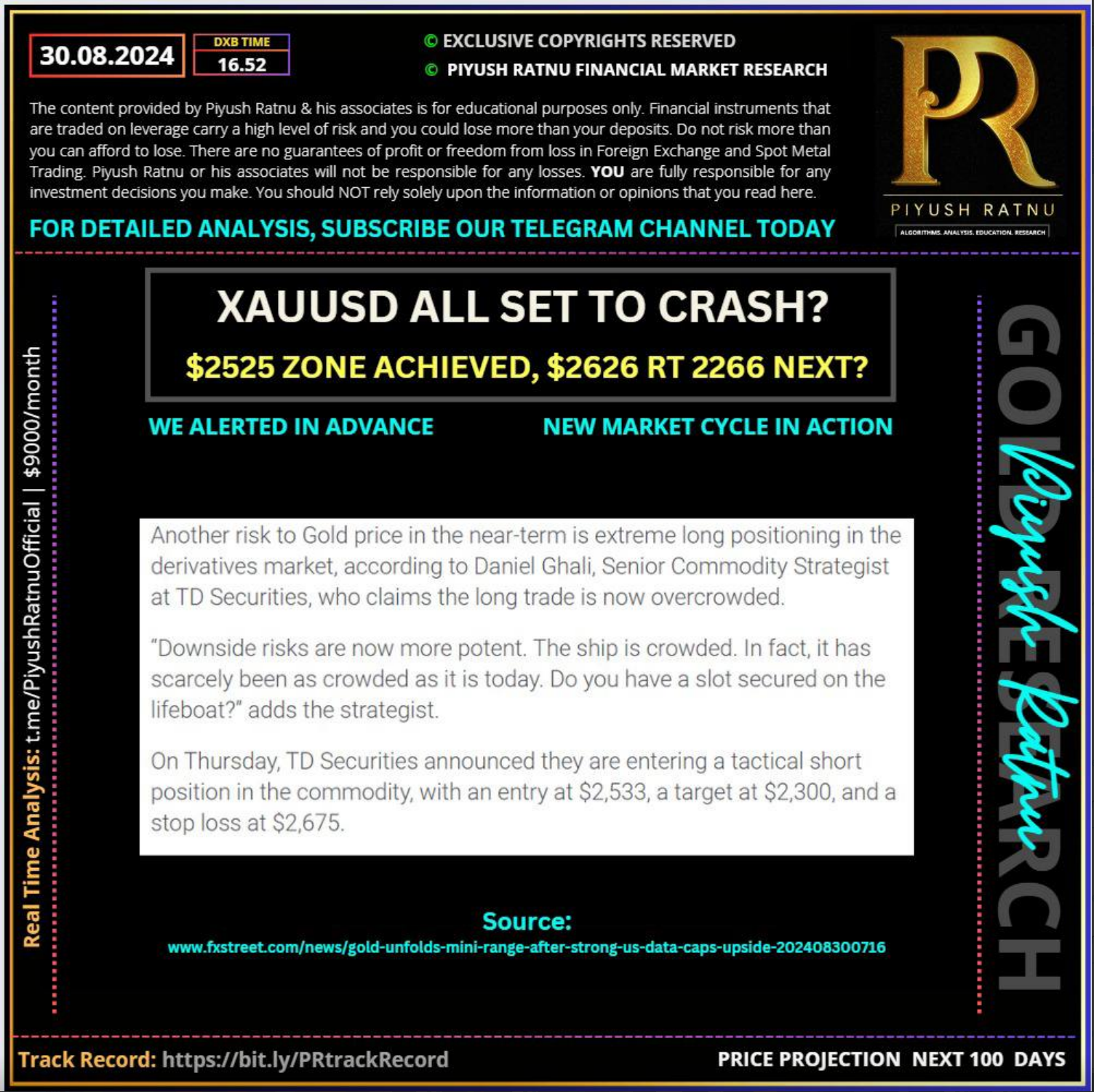

Humble reminder: As alerted on 30 August and as published by TD Securities:

Verify here: https://marketnews.com/gold-td-securities-initiate-tactical-short-in-gold

TD Securities: SHORT Positions activated at $2533 with STOP LOSS $2675.

As per our algorithms: XAUUSD was set to rise from $2525 to $2569/2585/2609/2626/26366: next target $2669: a correction might happen at CMP or after $2669/2685 zone.

Hence I will be NOW on SHORT positions MORE rather than LONG Positions.

Hence I will be NOW on SHORT positions MORE rather than LONG Positions.

I will take BUY positions only below $2569/2542

I will take SELL positions after $2646/2669/2685 and will exit in $5 profit in each set.

#XAUUSD #Gold #Forex #Trading #PiyushRatnu

Factors supporting XAUUSD / Spot Gold price:

Factors supporting XAUUSD / Spot Gold price:

Despite a modest recovery staged by the US Dollar and overbought conditions on the daily chart, Gold price holds its position close to the all-time high, as buyers refuse to give up on the back of the latest FED commentaries, in addition increased hopes of Chinese stimulus coming through and escalating Middle East geopolitical tensions are supporting Spot GOLD XAUUSD Price..

CHINA: PBOC | RRR deduction by 50 bps | hopes of Chinese stimulus

At the highly-anticipated press conference, People’s Bank of China (PBOC) Governor Pan Gongsheng announced a series of measures to boost the economic recovery, including plans to cut the reserve requirement ratio (RRR) by 50 basis points (bps). Increased expectations that these stimulus measures would stimulate the economy keep the pullback restricted in Gold price. China is the world’s top GOLD consumer.

Geo-Political Tensions | Lebanon | Israel | Hezbollah

Bloomberg reported that Israel intensified its airstrikes in southern Lebanon, killing about 500 people while injuring 1000. This was the deadliest attack since the 2006 Israel-Hezbollah war. This follows the weekend’s exchange of missiles by both Israel and Hezbollah, as the Middle-East strife seems to translate into a wider regional conflict. Gold price tends to benefit from geopolitical tensions due to its traditional safe-haven status.

Statements by Fed Officials:

Fed policymakers continued to advocate the need for more rate cuts amid looming downside risks to the labor market, as inflation continues to move closer to the bank’s 2.0% target. Amongst the Fed officials who spoke on Monday, Chicago Fed President Austan Goolsbee was the most dovish, noting that “many more rate cuts are likely needed over the next year, rates need to come down significantly.”

The focus now remains on Fed Governor Michelle Bowman’s speech and the US Conference Board (CB) Consumer Confidence data for fresh trading incentives in Gold price, as Middle East escalation will be also closely eyed.

SUMMARY: KEY POINTS:

- Bets that the Federal Reserve will further lower borrowing costs by 125 basis points in 2024 after last week’s jumbo 50 bps rate cut pushed the non-yielding Gold price to a fresh record high on Monday.

- According to the CME Group’s FedWatch Tool, investors are now pricing in another oversized rate cut at the November policy meeting, which caps a modest US Dollar recovery from the YTD low.

- Minneapolis Fed President Neel Kashkari noted on Monday that the balance of risks had shifted away from high inflation to a further weakening of the labor market, warranting a lower interest rate.

- Adding to this, Atlanta Fed President Raphael Bostic said that the recent data show convincingly that the US is on a sustainable path to price stability and that risks to the labour market have increased.

- Chicago Fed President Austan Goolsbee said that the labor market deterioration typically happens quickly and that keeping rates high does not make sense when you want things to stay where they are.

- On the data front, a survey compiled by S&P Global showed that business activity in the Eurozone unexpectedly contracted sharply, while business activity in the US was steady in September.

- Additional details of the flash US PMI showed that average prices charged for goods and services rose at the fastest pace in six months, pointing to an acceleration in inflation in the coming months.

- This comes on top of the hypothesis that rate cuts implemented to stimulate the economy occasionally lead to rising prices and could benefit the commodity’s status as a hedge against inflation.

- Israeli airstrikes on Monday against what it said are Hezbollah weapons sites in southern and eastern Lebanon killed nearly 500 people, raising the risk of a wider conflict in the Middle East.

- This, along with the US political uncertainty and a bleak global economic outlook, suggests that the path of least resistance for the safe-haven precious metal remains to the upside.

- That said, a surprise rate cut by the People’s Bank of China (PBOC) on Monday, along with a stopgap spending bill to fund the US government through December 20, cap gains for the XAU/USD.

- Traders might also opt to move to the sidelines ahead of the release of the US Personal Consumption Expenditures (PCE) Price Index on Friday amid overbought conditions on the daily chart.

Trade with Confidence with Piyush Ratnu Gold Market Research

Trade with Confidence with Piyush Ratnu Gold Market Research

Subscribe one of the most accurate analysis in the industry: Spot Gold Analysis by Piyush Ratnu powered by 90+ technical and fundamental parameters with a verified and audited track record.

Current Trading Profit Status: 109%

Highest Drawdown Faced YTD: 8%

Highest profit/month booked: 42%

Highest loss/month booked: 5%

Core Focus: #XAUUSD | Spot #Gold

Platform: MT4 MT5

Trading Mode: Manual + Algorithm | Automated: both available

Auto-Copy Trading: Available | Plug and Play Solution

Live Trading Feed Available | Real Time Analysis Available

Verify Trading Performance at: https://bit.ly/PRinvestizo

#PiyushRatnu #prdxb #prgoldanalysis #gold #XAUUSD #forex

Connect for an appointment at T.ME/PIYUSHRATNUOFFICIAL