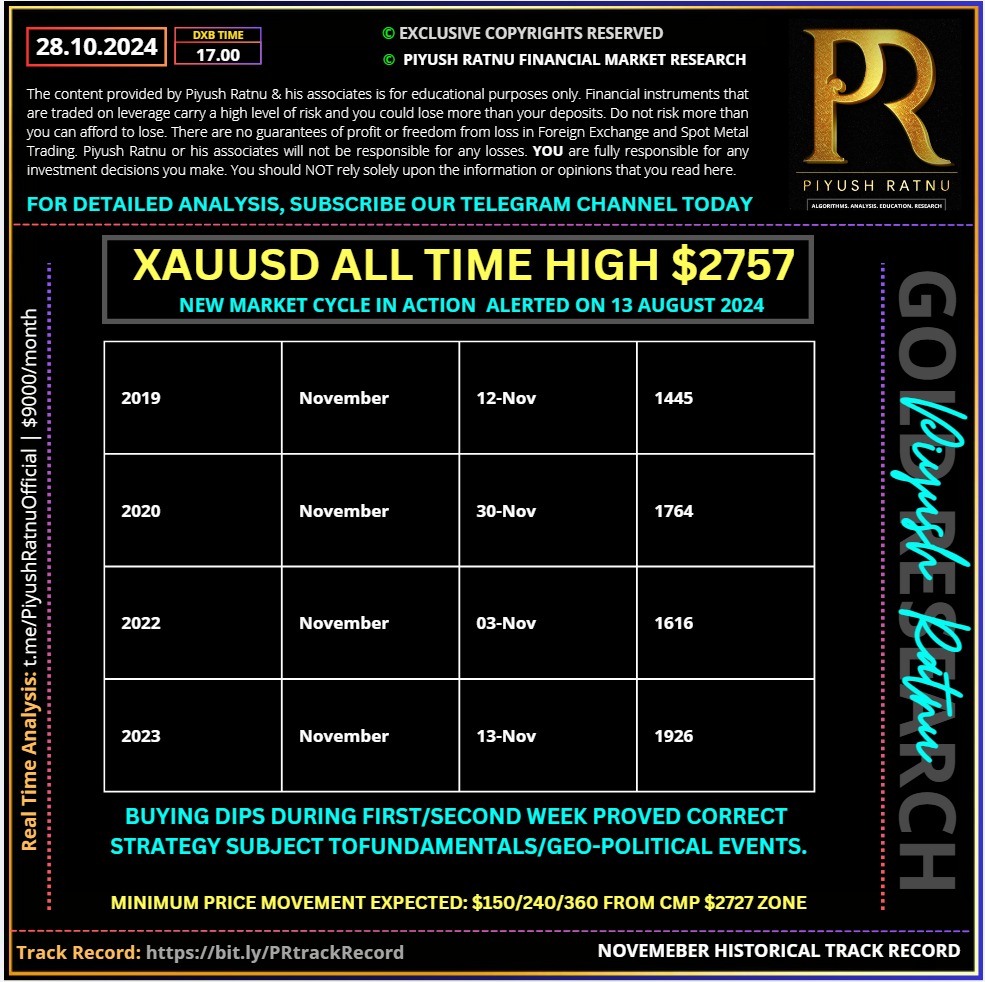

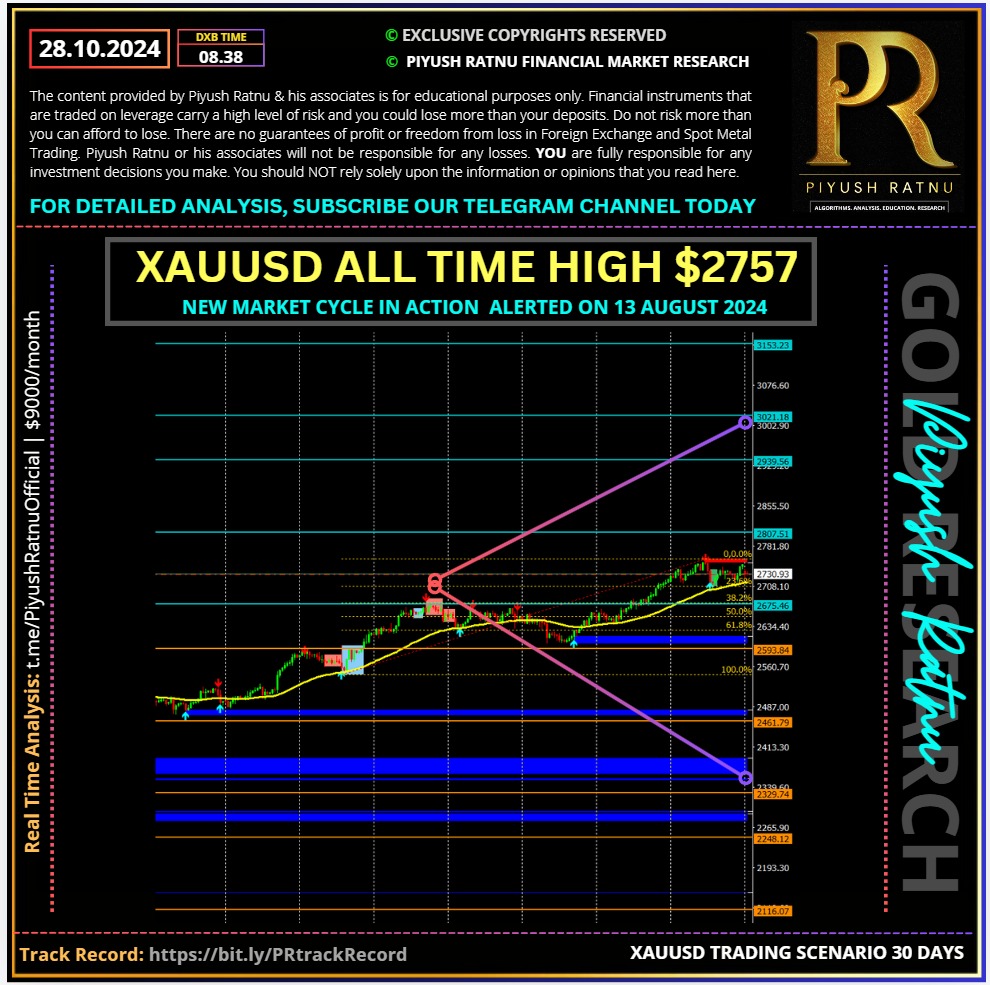

XAUUSD: $2828/2929/3030/3131 or $2626/2525/2424/2323 in next 90/120 Trading days?

Gold price has lost its two-day recovery momentum, trading near $2727 zone. Gold buyers did find acceptance above the $2,740 static resistance on Friday but the further upside appears elusive on resurgent US Dollar (USD) demand.

Japan Elections:

The coalition led by Japan’s ruling Liberal Democratic Party (LDP) has lost its majority in parliament, its worst result in over a decade. Impact USDJPY +1000P at MO | Yen (-) USD (+)

The USD resumes the recent uptrend, drawing safe-haven demand amid further escalation in the Middle East tensions and uncertainty around the November 5 US presidential election.

Israel attacked Iran with a series of airstrikes early Saturday, saying it was targeting military sites in retaliation for the barrage of ballistic missiles the latter fired upon Israel on October 1, 2024. Israel limits strikes to military targets. The strike avoided oil, nuclear and civilian infrastructure, in line with a request from US President Joe Biden’s administration.

Markets are wagering a less aggressive easing cycle by the US Federal Reserve (Fed) on US economic resilience, which keeps the sentiment around the Greenback underpinned at the expense of the Gold price.

The downside of the Gold price remains capped due to renewed expectations of more stimulus measures from China. China’s Vice Minister of Finance Liao Min said earlier that the country will step up countercyclical adjustments of its macro policies to bolster economic recovery in the fourth quarter.

China is the world’s biggest Gold consumer and hence, hopes of an increase in physical demand for Gold on stimulus optimism favors buyers.

Further, the festive season of DIWALI🪔 in India– the world’s no.2 yellow metal market – could also lend support to the bright metal.

🟢Current Status: Buy Dips XAUUSD

Equities sideways, USD weaker in proportion to past track record, cryptos sideways, oil weaker, metals weaker, JPY weaker (hence supporting +USDJPY)

Important US macro releases this week – the Advance Q3 GDP report, the Personal Consumption Expenditures (PCE) Price Index and the closely-watched Nonfarm Payrolls (NFP) report. This, in turn, warrants caution before placing aggressive bearish bets around the XAU/USD.

KEY Factors impacting XAUUSD Spot GOLD and USD co-relations:

- The US Dollar added to its recent strong gains registered over the past four weeks and climbed to its highest level since July 30 amid bets for a less aggressive policy easing by the Federal Reserve.

- According to the CME Group’s FedWatch Tool, the markets have nearly fully priced in the possibility of a regular 25 basis points rate cut by the US central bank at its November policy meeting.

- The latest poll indicates a tight race between Vice President Kamala Harris and the Republican nominee Donald Trump amid deficit-spending concerns after the November 5 US presidential election.

- Moreover, the US macro releases on Friday added to a string of recent upbeat data and suggested that the economy remains on strong footing, validating market bets for smaller Fed rate cuts.

- The US Census Bureau reported that Durable Goods Orders in the US declined by 0.8% in September, lower than the 1% fall expected, while new orders excluding transportation increased by 0.4%.

- Adding to this, the University of Michigan’s Consumer Sentiment Index reached a six-month high of 70.5 in October, better than both the preliminary result and the previous month’s reading.

- The yield on the benchmark 10-year US government bond stands firm near a three-month high touched last week, which is seen benefiting the USD and weighing on the non-yielding precious metal.

- Iran on Saturday indicated that it would not retaliate against Israeli strikes on military targets across its territory if a deal is reached for a ceasefire agreement in the Gaza Strip and Lebanon.

- China’s Vice Minister of Finance, Liao Min, said on Monday that the country will step up countercyclical adjustments of its macro policies to bolster economic recovery in the fourth quarter.

🟢 Crucial Price Zones this week: Refer our Telegram Channel.

Trade with Confidence with Piyush Ratnu Gold Market Research

Trade with Confidence with Piyush Ratnu Gold Market Research

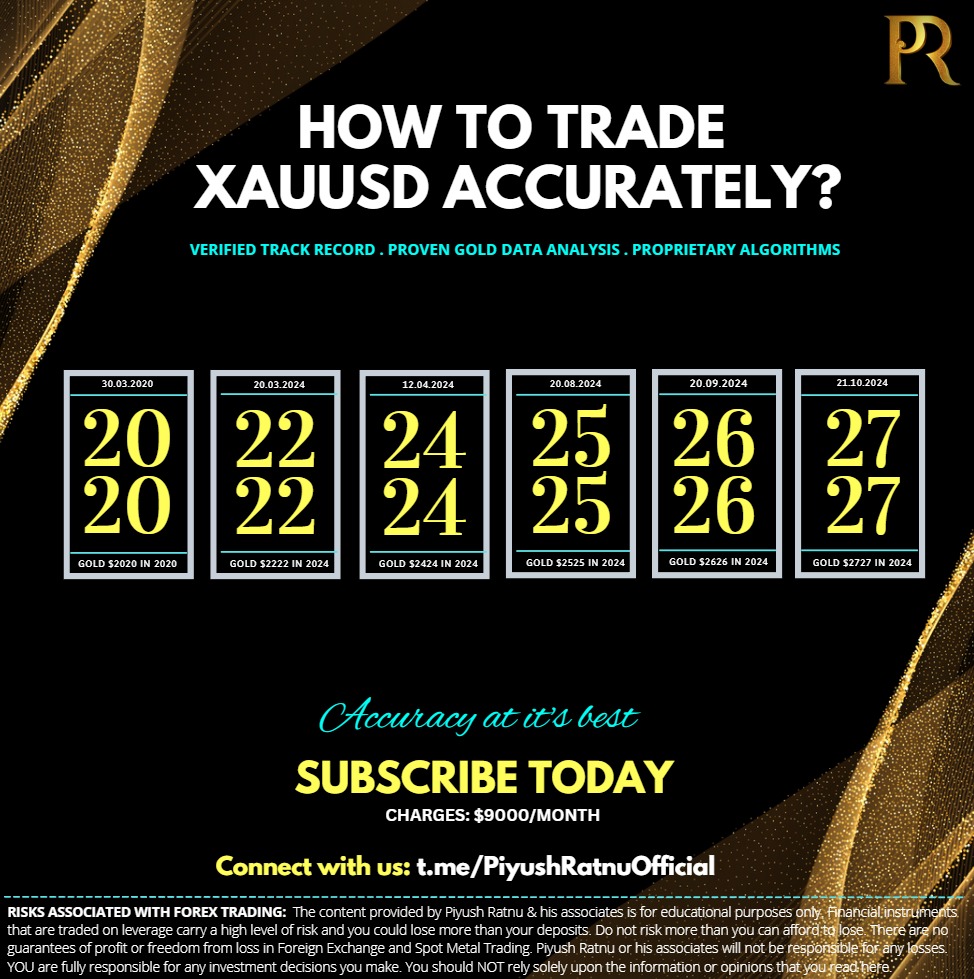

Subscribe one of the most accurate analysis in the industry: Spot Gold Analysis by Piyush Ratnu powered by 90+ technical and fundamental parameters with a verified and audited track record.

Current Trading Profit Status: 112%

Highest Drawdown Faced YTD: 8%

Highest profit/month booked: 42%

Highest loss/month booked: 5%

Check Trading Performance at:

https://www.myfxbook.com/members/PiyushRatnu

Connect at t.me/PiyushRatnuOfficial on Telegram