Introduction: Piyush Ratnu Gold Market Research

Piyush Ratnu’s Gold Market Research has gained recognition for its accuracy and reliability, particularly in the realm of spot gold trading. His analysis is powered by over 90 technical and fundamental parameters, which contribute to a verified and audited track record from 2022 to 2024. As of the latest reports, Ratnu’s trading performance boasts a current profit status of 116%, with a maximum drawdown of only 8%. This indicates a robust risk management strategy alongside profitable trading.

The highest monthly profit recorded was 42%, while the highest loss was limited to 5%, showcasing a disciplined approach to trading. Ratnu’s core focus is on XAUUSD, the spot gold market, and he offers both manual and algorithmic trading modes, catering to a diverse range of traders. His services include auto-copy trading and real-time analysis, making it accessible for both novice and experienced traders. The combination of a strong analytical foundation and practical trading solutions positions Piyush Ratnu as a trusted figure in the gold market, appealing to those looking to trade with confidence.

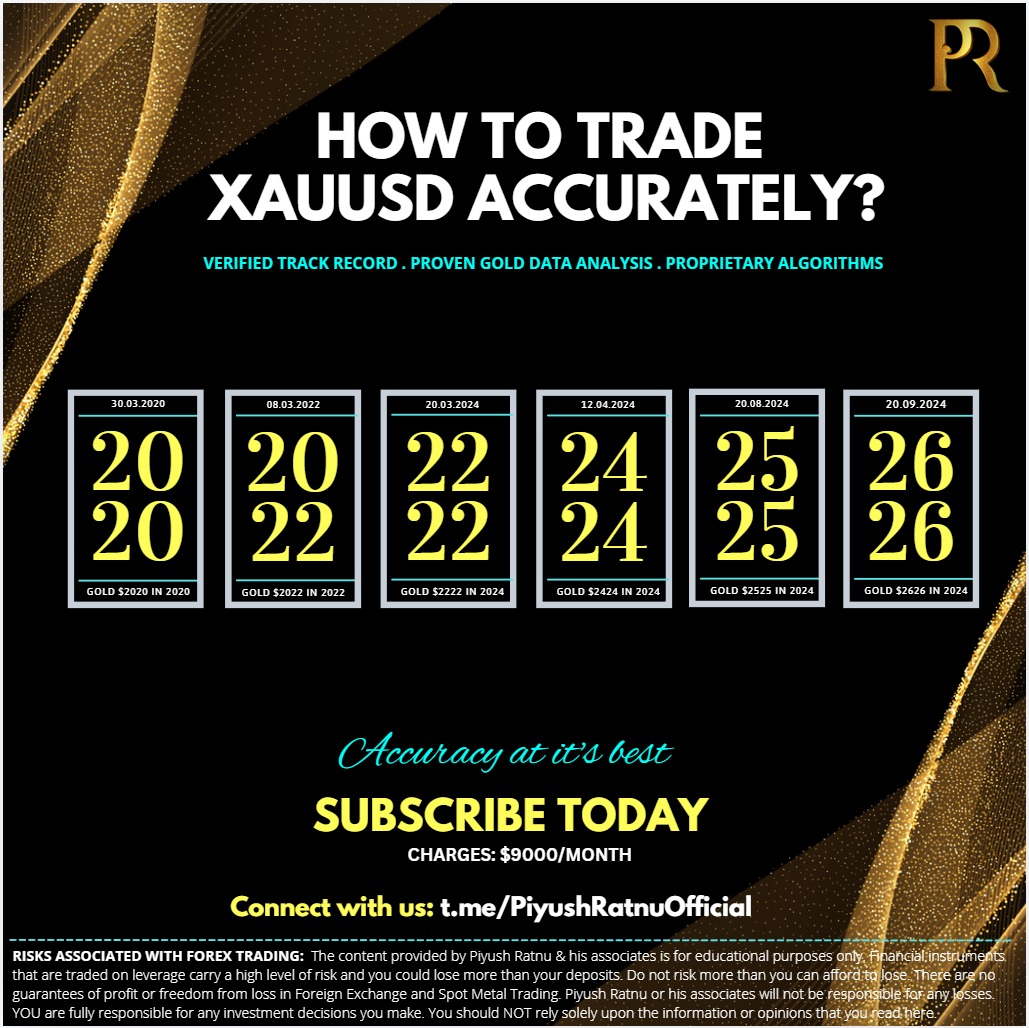

Piyush Ratnu Gold Market Research Analysis Review Most Accurate XAUUSD Analysis Price Forecast

Few of the methods used by Piyush Ratnu Gold Market Research:

Piyush Ratnu employs a variety of methodologies in his gold market analysis, combining both technical and fundamental approaches to provide a comprehensive view of the market. Here are some key methodologies he typically uses:

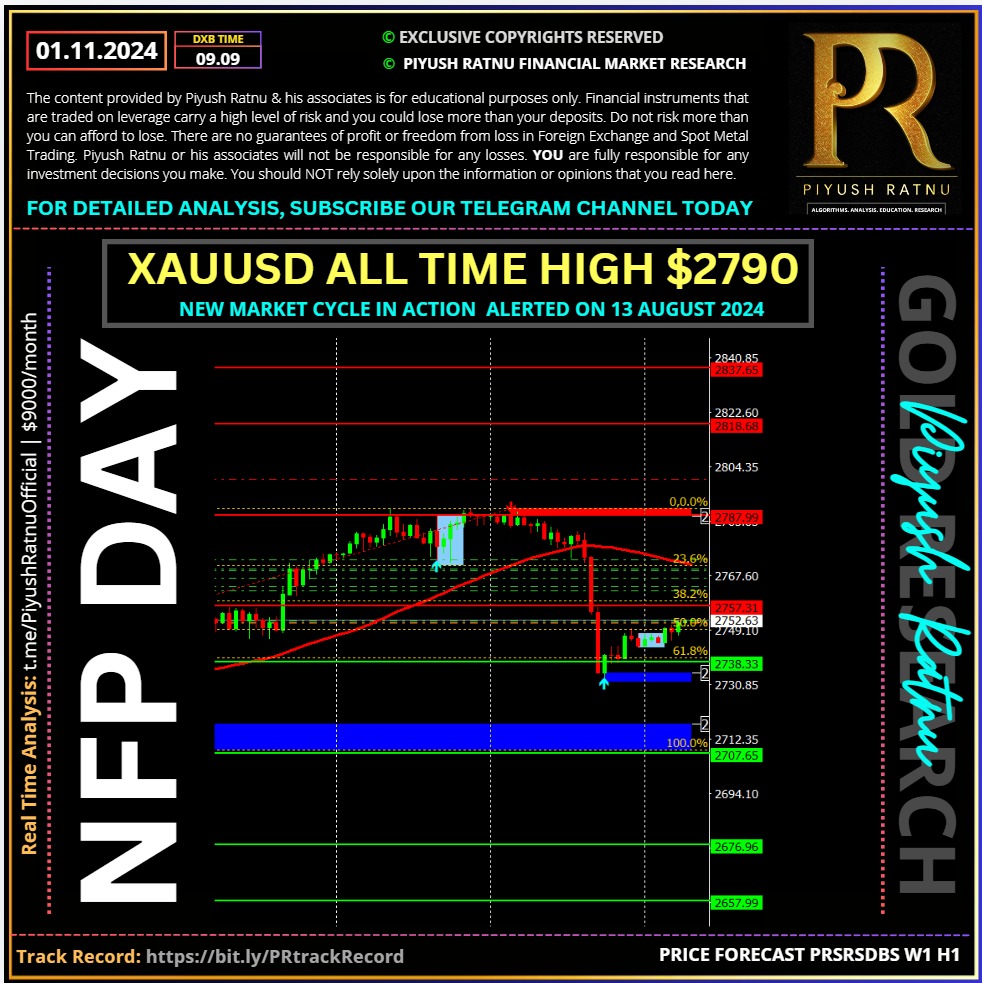

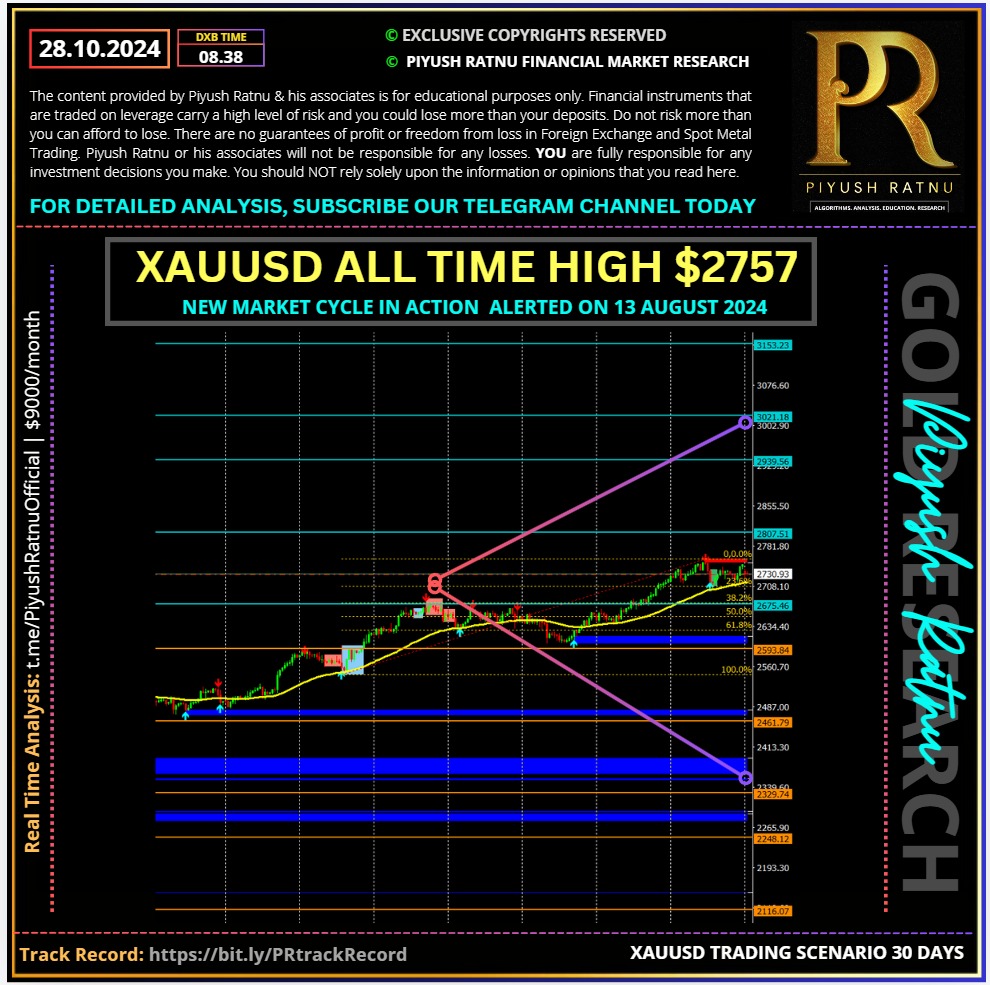

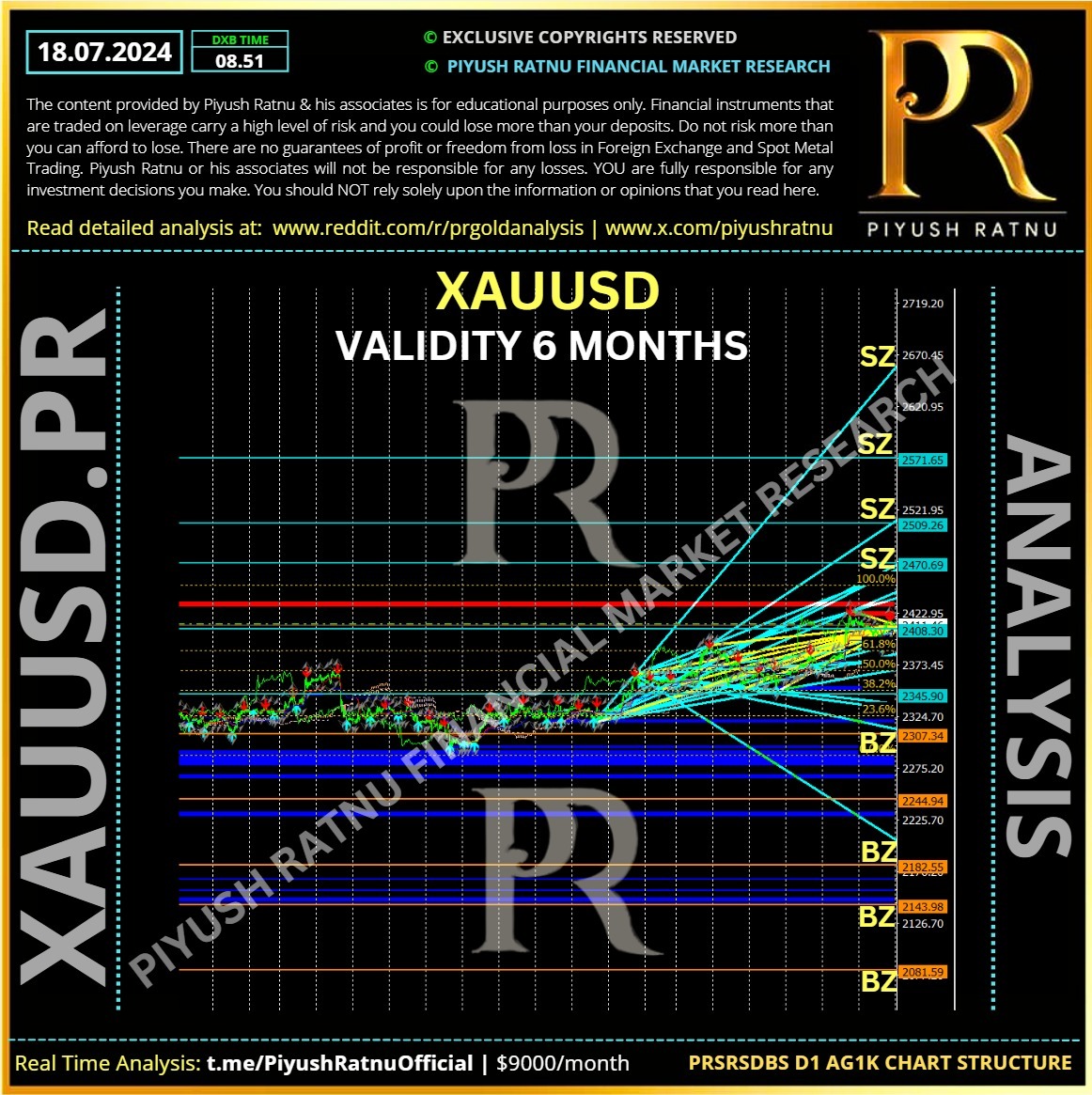

- Technical Analysis: Ratnu uses over 90 technical indicators and chart patterns to analyze price movements. This includes trend analysis, support and resistance levels, moving averages, and momentum indicators.

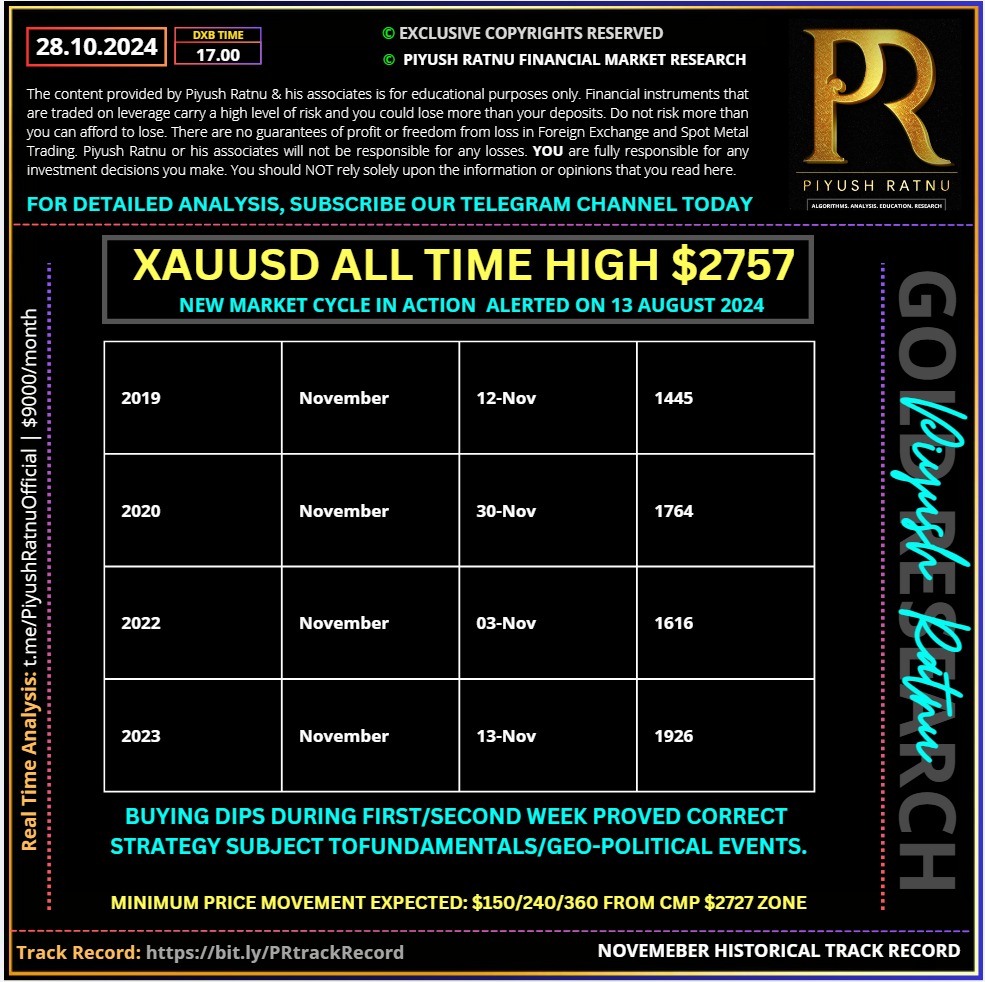

- Fundamental Analysis: He evaluates economic indicators, news events, and geopolitical factors that can influence gold prices. This includes monitoring interest rates, inflation rates, and central bank policies.

- Algorithmic Trading: Ratnu employs algorithmic trading strategies that automate certain aspects of trading based on predefined criteria. This methodology helps in executing trades quickly and efficiently.

- Sentiment Analysis: He assesses market sentiment by analyzing trader positioning, sentiment surveys, and market news. Understanding the overall mood of the market can provide insights into potential price movements.

- Risk Management: Ratnu implements robust risk management techniques to protect against significant losses. This includes setting stop-loss levels, position sizing, and diversifying trades.

- Backtesting: By backtesting strategies against historical data, Ratnu assesses the viability and effectiveness of his approaches before applying them in real-time trading.

- Real-time Data Analysis: Ratnu utilizes real-time market data and analytics to make informed trading decisions, ensuring that his analysis reflects current market conditions.

- Education and Insight Sharing: He often shares insights and educational content, helping traders understand market dynamics and learn the methodologies he employs.

These methodologies enable Piyush Ratnu to provide accurate and reliable analysis in the gold market, catering to both novice and experienced traders.

Piyush Ratnu Gold Market Research’s Trading Performance

Piyush Ratnu’s trading performance can be compared to industry standards by looking at key metrics such as return on investment (ROI), drawdown, and consistency.

- Return on Investment (ROI): Ratnu’s current profit status of 116% is significantly higher than the industry average for professional traders, which typically ranges from 10% to 30% annually, depending on market conditions and trading strategies.

- Drawdown: A maximum drawdown of 8% is considered excellent in the trading world. Many investors and funds experience drawdowns of 20% or more, particularly during volatile market periods. This indicates that Ratnu employs effective risk management techniques.

- Consistency: Ratnu’s ability to achieve a monthly profit of up to 42%, with a maximum loss of only 5%, illustrates a high level of consistency and discipline in his trading approach. In comparison, many traders struggle to maintain such consistency, often experiencing significant fluctuations in performance.

Overall, Ratnu’s performance appears to exceed many industry standards, particularly in terms of ROI and managing drawdown, making him a notable figure in the gold trading market. His use of over 90 technical and fundamental parameters reinforces his analytical approach and likely contributes to these favorable outcomes.

Key Features of Piyush Ratnu’s Trading Tools

Piyush Ratnu Gold Market Research offers several key features designed to enhance the trading experience for users, particularly in the gold market. Here are some of the main features:

- Comprehensive Analysis Tools: The platform provides access to over 90 technical and fundamental parameters, enabling users to conduct in-depth market analysis.

- Auto-Copy Trading: This feature allows traders to automatically copy the trades of experienced traders, making it easier for beginners to participate in the market with reduced risk.

- Manual and Algorithmic Trading Modes: Users can choose between manual trading, where they make trading decisions themselves, and algorithmic trading, which employs automated strategies to execute trades.

- Real-Time Updates: The platform offers real-time analysis and market updates, allowing traders to stay informed about market movements and making timely decisions.

- Risk Management Tools: With a focus on maintaining a low drawdown (maximum drawdown of 8%), the platform emphasizes strong risk management strategies to protect traders’ investments.

- Performance Tracking: Users can track their trading performance, which includes metrics like profit percentage, maximum loss, and monthly performance to assess the effectiveness of their strategies.

- Educational Resources: The platform may provide educational materials, webinars, or tutorials to help traders improve their skills and understanding of the gold market.

- User-Friendly Interface: The platform is designed to be accessible and easy to navigate for traders of all experience levels.

These features, combined with a commitment to accuracy and reliability in market research, make Piyush Ratnu’s trading platform a valuable resource for those interested in trading gold.

Major risks involved in Gold Trading

Trading in the gold market, like any investment, carries inherent risks. Here are some of the primary risks associated with this market:

- Market Volatility: The price of gold can fluctuate widely due to macroeconomic factors, geopolitical events, supply and demand dynamics, and market sentiment. These price swings can lead to significant gains or losses in a short period.

- Leverage Risk: Many traders use leverage to amplify their positions, which can magnify both gains and losses. While leverage can enhance profits, it can also lead to rapid losses that exceed the initial investment.

- Currency Risk: Gold is typically traded in US dollars. Therefore, fluctuations in currency exchange rates can affect gold prices and, subsequently, trading outcomes for investors using other currencies.

- Interest Rate Risk: Changes in interest rates can impact gold prices. Generally, higher interest rates increase the opportunity cost of holding non-yielding assets like gold, while lower rates can support gold prices.

- Economic and Geopolitical Risk: Economic downturns, inflation, political instability, or global conflicts can influence gold prices. While gold is often viewed as a safe-haven asset, its value is still affected by broader economic conditions.

- Liquidity Risk: Depending on the trading platform or market conditions, there may be times when it’s difficult to buy or sell gold at desired prices, leading to potential slippage or losses.

- Regulatory Risk: Changes in regulations or taxes on gold trading can impact the market and trading profits. Traders must stay informed about legal frameworks that could affect their investments.

- Psychological Risks: Emotional decision-making can adversely affect trading performance. Fear and greed can lead traders to make impulsive decisions, deviating from their trading strategies.

- Counterparty Risk: When trading through brokers or exchanges, there is a risk that the other party may default on their obligations. It’s essential to choose reputable and regulated platforms.

- Storage and Insurance Risks: For those who invest in physical gold, there are risks associated with storage, theft, and loss. Insurance costs can also add to the overall expense of holding physical gold.

To mitigate these risks, traders should employ sound risk management strategies, stay informed about market conditions, and have a clear trading plan that includes entry and exit strategies.

Trade with Confidence with Piyush Ratnu Gold Market Research

Subscribe one of the most accurate analysis in the industry: Spot Gold Analysis by Piyush Ratnu powered by 90+ technical and fundamental parameters with a verified and audited track record.

Current Trading Profit Status: 112%

Highest Drawdown Faced YTD: 8%

Highest profit/month booked: 42%

Highest loss/month booked: 5%

Check Trading Performance at:

https://www.myfxbook.com/members/PiyushRatnu

Core Focus: #XAUUSD | Spot #Gold

Platform: MT4 MT5

Trading Mode: Manual + Algorithm | Automated: both available

Auto-Copy Trading: Available | Plug and Play Solution

Live Trading Feed Available | Real Time Analysis Available

Connect for an appointment at T.ME/PIYUSHRATNUOFFICIAL

Piyush Ratnu Gold Market Research Analysis Review Most Accurate XAUUSD Analysis Price Forecast