XAU/USD, or Gold against the US Dollar, is a widely traded currency pair that reflects the price of gold in terms of US dollars. Gold has historically been considered a safe-haven asset, particularly during times of economic uncertainty or inflation.

As of the latest data, the price of XAU/USD is approximately 2,736.45 USD, showing a slight decrease of 0.27%. This fluctuation in price can be attributed to various factors including changes in interest rates, geopolitical tensions, and shifts in market sentiment. Traders often analyze technical indicators and historical data to forecast future movements in the price of gold.

For instance, recent trends indicate a strong bullish sentiment over the past year, with gold prices rising by over 37%. Investors typically use XAU/USD not only for speculative trading but also as a hedge against inflation and currency devaluation. The demand for gold can also be influenced by central bank policies, as many central banks hold gold reserves as part of their monetary policy. Overall, XAU/USD remains a critical indicator of economic health and investor confidence in the financial markets. Most accurate XAUUSD Gold Analysis Traders Price forecast by Piyush Ratnu.

HISTORICAL TRENDS

Historical trends of gold prices against the US dollar (XAU/USD) have shown significant fluctuations over the years, influenced by various economic, political, and social factors. Here are some key points highlighting major trends:

- Long-Term Uptrend: Over the long term, gold has typically been in a general uptrend, particularly since the early 2000s. This rise has been largely driven by increased demand for gold as a safe-haven asset during periods of economic uncertainty, high inflation, and geopolitical tensions.

- 2008 Financial Crisis: During the global financial crisis in 2008, gold prices surged as investors sought safety. From around $800 per ounce in late 2007, gold climbed to over $1,900 per ounce by late 2011, marking a significant increase as markets experienced volatility.

- Post-Crisis Period: After peaking in 2011, gold prices experienced corrections and fluctuations, with prices falling to around $1,050 per ounce in late 2015. The Federal Reserve’s monetary policy, including interest rate hikes, contributed to this decline.

- COVID-19 Pandemic: In 2020, gold prices reached a new all-time high, exceeding $2,070 per ounce, due to widespread economic uncertainty, massive fiscal stimulus measures, and low interest rates amid the COVID-19 pandemic. This surge reflected heightened demand for gold as a hedge against market instability.

- Recent Trends: In the years following the peak in 2020, gold prices have continued to show volatility, influenced by changes in monetary policy, inflation rates, and global economic recovery efforts. As of late 2023, gold prices have experienced fluctuations between $1,800 and $2,000 per ounce.

- Seasonal Trends: Historically, certain times of the year, like the wedding seasons in India and increased jewelry purchases during the holiday season, can lead to seasonal increases in demand for gold, thereby affecting its price.

- Inflation Hedge: Throughout history, gold has been viewed as a hedge against inflation. In times of rising inflation, many investors turn to gold to preserve value, further influencing its price.

Overall, the trends in XAU/USD demonstrate gold’s role as a financial safe haven and its reaction to global economic events. Traders and investors continually monitor these trends to inform their investment strategies. Most accurate XAUUSD Gold Analysis Traders Price forecast.

Impact of GEO-POLITICAL EVENTS on XAUUSD / Spot Gold Price

Geopolitical events can significantly impact the price of XAU/USD (gold against the US dollar) for several reasons:

- Safe-Haven Demand: During times of geopolitical tension, such as conflicts, wars, or political instability, investors often seek safety for their assets. Gold is traditionally viewed as a safe-haven asset, leading to increased demand and a rise in its price when geopolitical events trigger uncertainty.

- Inflation and Economic Stability: Geopolitical events can lead to economic disruptions that may cause inflation or recessionary fears. When investors anticipate higher inflation or economic instability, they may turn to gold as a hedge, which in turn drives up its price.

- US Dollar Strength: The relationship between gold and the US dollar is typically inverse. Geopolitical tensions can lead to fluctuations in the dollar’s value. If geopolitical issues weaken the dollar, gold priced in dollars becomes cheaper for holders of other currencies, increasing demand and driving up the price of XAU/USD.

- Central Bank Policy: Geopolitical events can influence the monetary policies of central banks. For example, if tensions lead a central bank to adopt a more accommodative monetary policy (like lowering interest rates), it might weaken the dollar and boost gold prices.

- Market Sentiment: Geopolitical events can shift market sentiment quickly. Positive resolutions may lead to a sell-off in gold as investors move back into riskier assets, while persistent tensions or negative developments can sustain upward pressure on gold prices.

- Supply Chain Disruptions: In certain geopolitical situations, gold mining operations may be affected, particularly in regions where conflicts or tensions are prevalent. Disrupted supply can affect gold availability and lead to price increases.

In summary, geopolitical events can create an environment of uncertainty that drives investors to seek the relative safety of gold, thereby impacting the price of XAU/USD significantly.

TECHNICAL INDICATORS

When trading XAU/USD (Gold vs. US Dollar), various technical indicators can help traders make informed decisions. Here are some of the most effective technical indicators for trading this asset:

- Moving Averages (MA):

-

- Simple Moving Average (SMA): Helps identify the general trend by smoothing out price data over a specific period (e.g., 50-day or 200-day SMA). Crossovers between short-term and long-term SMAs can signal potential buy or sell opportunities.

- Exponential Moving Average (EMA): Places more weight on recent prices and reacts more quickly to price changes. Commonly used EMAs are the 20-day and 50-day.

- Relative Strength Index (RSI):

-

- A momentum oscillator that ranges from 0 to 100, indicating overbought or oversold conditions. An RSI above 70 may signal overbought conditions, while an RSI below 30 may indicate oversold conditions.

- MACD (Moving Average Convergence Divergence):

-

- A trend-following momentum indicator that shows the relationship between two moving averages of an asset’s price. Traders look for MACD line crossovers and divergences from price trends to identify potential entry and exit points.

- Bollinger Bands:

-

- Bollinger Bands consist of a middle band (SMA) and two outer bands (standard deviation lines). They help identify volatility and potential reversal points. Prices touching the upper band may suggest overbought conditions, while prices touching the lower band may indicate oversold conditions.

- Stochastic Oscillator:

-

- A momentum indicator that compares a particular closing price of gold to a range of prices over a specific period. Values above 80 indicate overbought conditions, while values below 20 indicate oversold conditions.

- Fibonacci Retracement Levels:

-

- These levels are useful for identifying potential support and resistance levels. Traders often use Fibonacci retracement levels to spot potential reversal points in the price action following trends.

- Volume:

-

- Analysing trading volume can provide insight into the strength of a price move. Increasing volume during a price increase suggests strong buying interest, while decreasing volume during a price increase may suggest a weakening trend.

- Average True Range (ATR):

-

- Measures market volatility. Knowing the ATR can help traders set stop-loss orders and manage risk more effectively.

While no single indicator guarantees success, using a combination of these indicators and validating their signals with price action and chart patterns can help you make more informed trading decisions for XAU/USD. Always consider risk management and perform due diligence before entering trades.

IMPACT OF CENTRAL BANK POLICIES

Central bank policies can significantly influence gold prices through several mechanisms:

- Interest Rates: Central banks, such as the Federal Reserve in the U.S., set interest rates that directly affect the cost of borrowing and the yield on savings. When interest rates are low, the opportunity cost of holding gold (which does not earn interest) decreases, making gold more attractive as an investment. Conversely, when interest rates rise, gold may become less appealing compared to interest-bearing assets.

- Monetary Policy and Inflation: Central banks use monetary policy tools to control inflation. If a central bank increases the money supply (e.g., through quantitative easing), this can lead to inflation fears. Gold is often viewed as a hedge against inflation, so when central banks adopt policies that could lead to inflation, demand for gold may rise, pushing prices up.

- Currency Value: Central bank actions can also influence the strength of a nation’s currency. For instance, if a central bank lowers interest rates or engages in expansive monetary policy, the local currency may weaken. Since gold is priced in U.S. dollars, a weaker dollar makes gold cheaper for holders of other currencies, potentially increasing demand and driving up prices.

- Market Sentiment: Central bank communications and policy decisions can affect market sentiment. Clear signals of expansionary policies may lead to increased buying of gold as traders and investors prepare for potential economic instability or currency devaluation.

- Central Bank Purchases: Central banks themselves hold significant amounts of gold as part of their foreign reserves. If a central bank decides to increase its gold holdings, this can create upward pressure on prices due to increased demand. Conversely, if it sells its gold reserves, this may lead to lower prices.

Overall, the interplay between central bank policies, interest rates, inflation expectations, currency value, and market sentiment creates a complex environment that can significantly impact gold prices.

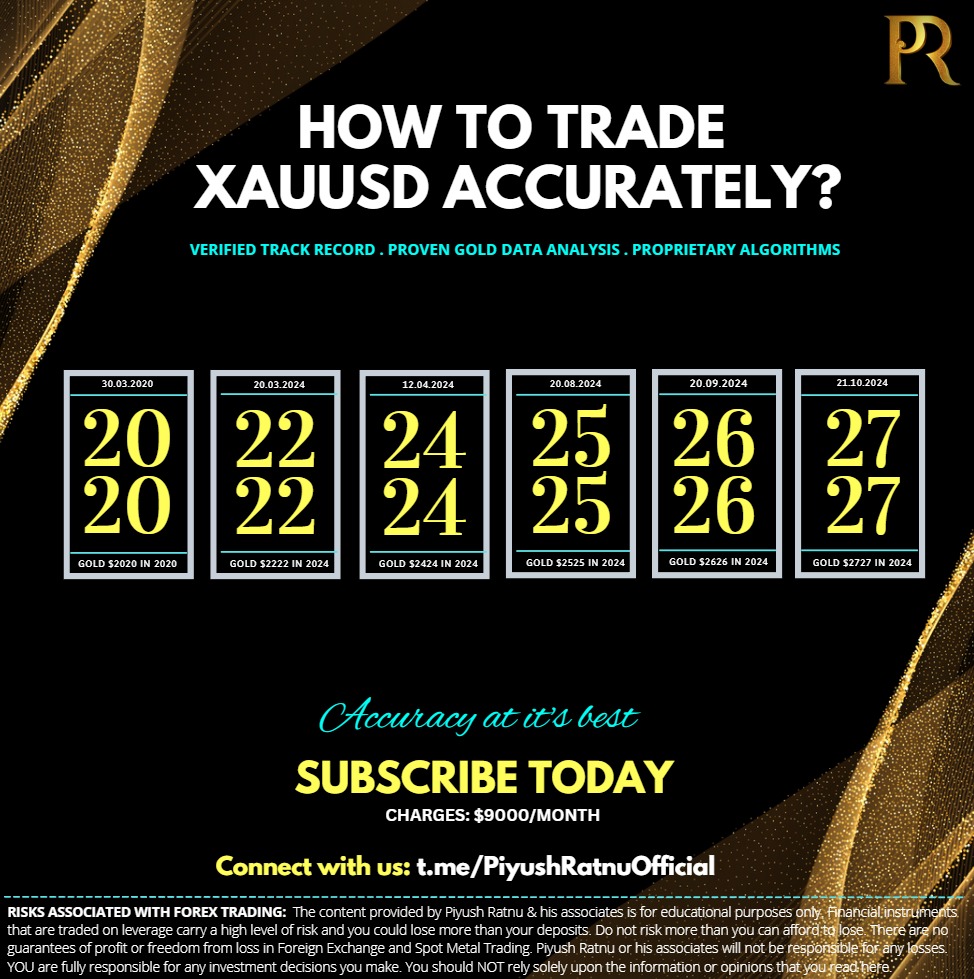

Trade with Confidence with Piyush Ratnu Gold Market Research

Subscribe one of the most accurate analysis in the industry: Spot Gold Analysis by Piyush Ratnu powered by 90+ technical and fundamental parameters with a verified and audited track record.

Current Trading Profit Status: 112%

Highest Drawdown Faced YTD: 8%

Highest profit/month booked: 42%

Highest loss/month booked: 5%

Check Trading Performance at:

https://www.myfxbook.com/members/PiyushRatnu

Core Focus: #XAUUSD | Spot #Gold

Platform: MT4 MT5

Trading Mode: Manual + Algorithm | Automated: both available

Auto-Copy Trading: Available | Plug and Play Solution

Live Trading Feed Available | Real Time Analysis Available

How to Analyse and Trade Spot Gold XAUUSD safely with accuracy

Connect for an appointment at T.ME/PIYUSHRATNUOFFICIAL