XAUUSD $2669 target price achieved as projected before US Elections 2024 | Accuracy Check, Price Forecast Review: Piyush Ratnu Gold Market Research

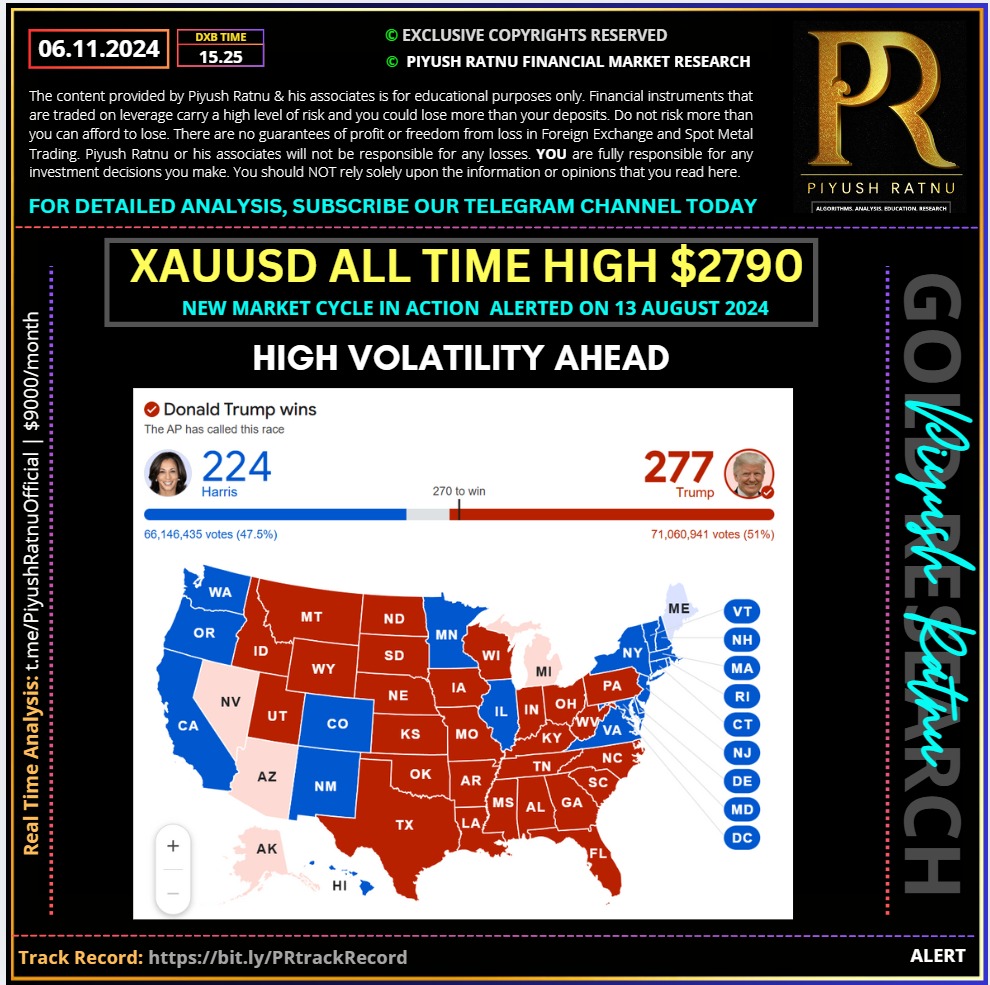

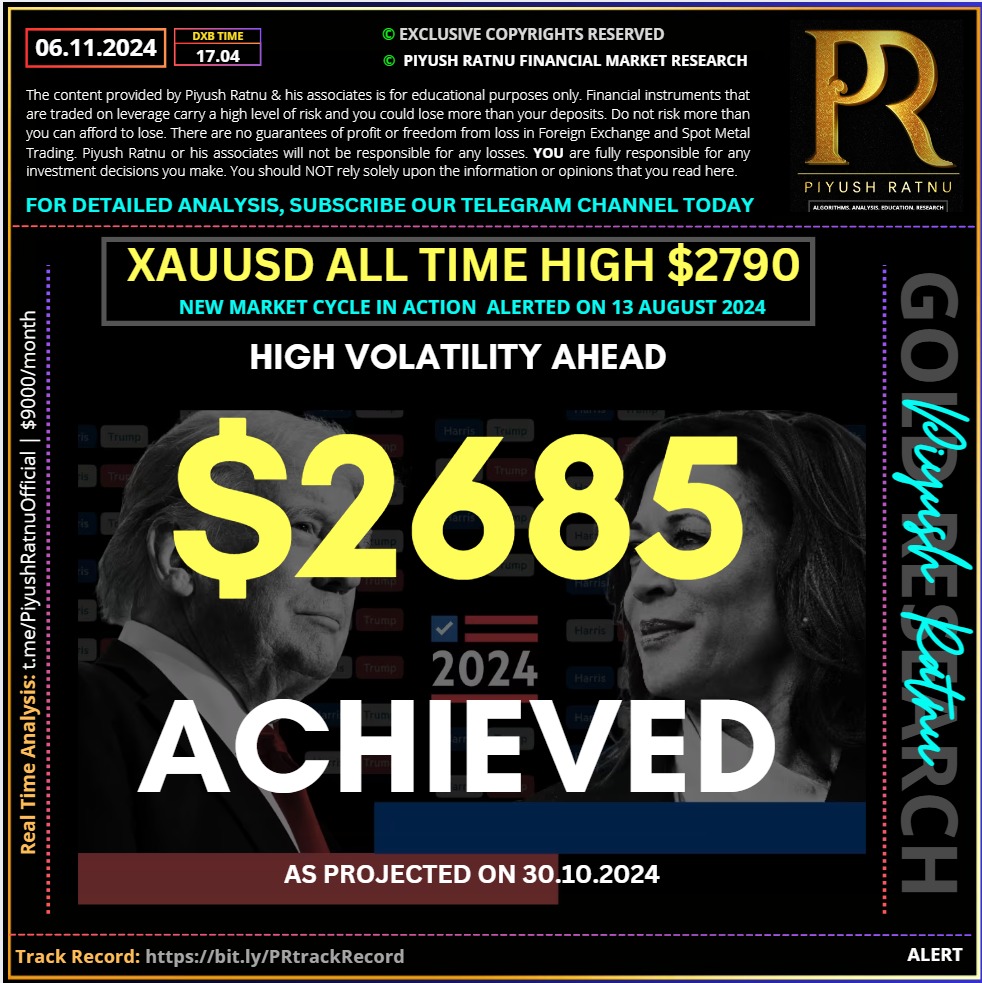

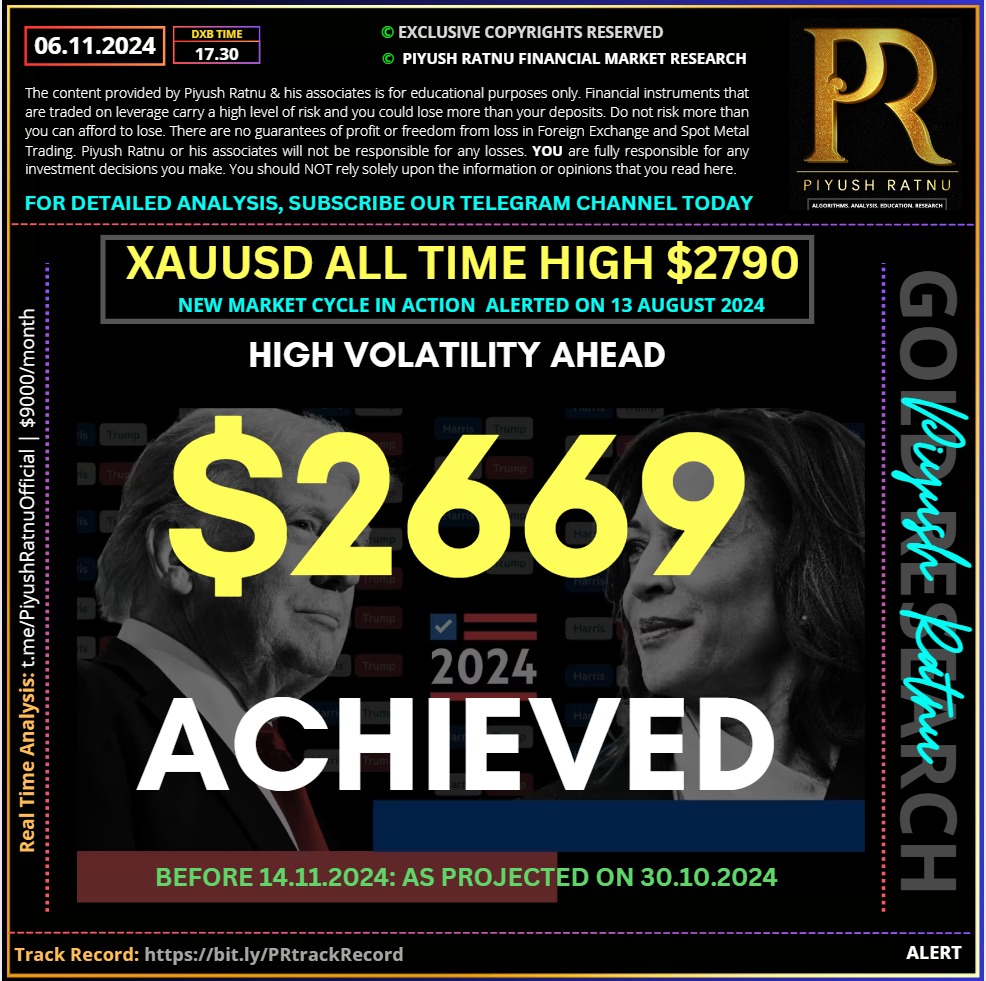

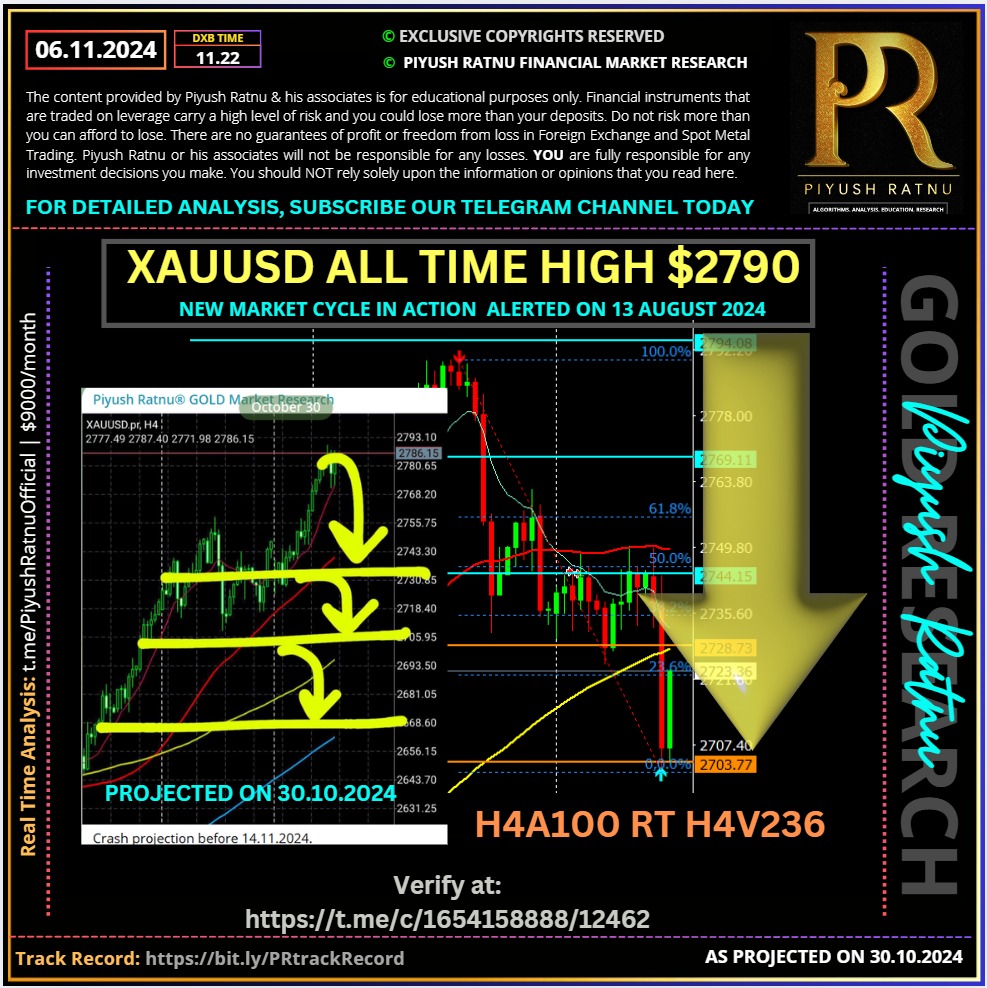

We projected XAUUSD Price crash: $2787-2669 before US elections, well achieved after US Elections 2024 on 06 November 2024. Most Accurate XAUUSD Spot Gold Forex price Forecast Projection US Elections 2024

What’s next: XAUUSD: $2525/2424 or $2828/2929 in 2025?

Gold price (XAU/USD) extends its losses for the second successive session on Thursday. The dollar-denominated precious metal faces downward pressure from a stronger US Dollar (USD) following the victory of former President Donald Trump in the US election.

Gold price is seeing a dead cat bounce from three-week lows of $2,655 in Asian trading session on Thursday. Gold prices are under pressure as safe-haven flows decline amid market optimism and “Trump trades.” This shift is driven by the clarity of a presidential victory, while the market had previously been anticipating a contested outcome.

🟢WHY XAUUSD crashed on 06.11.2024:

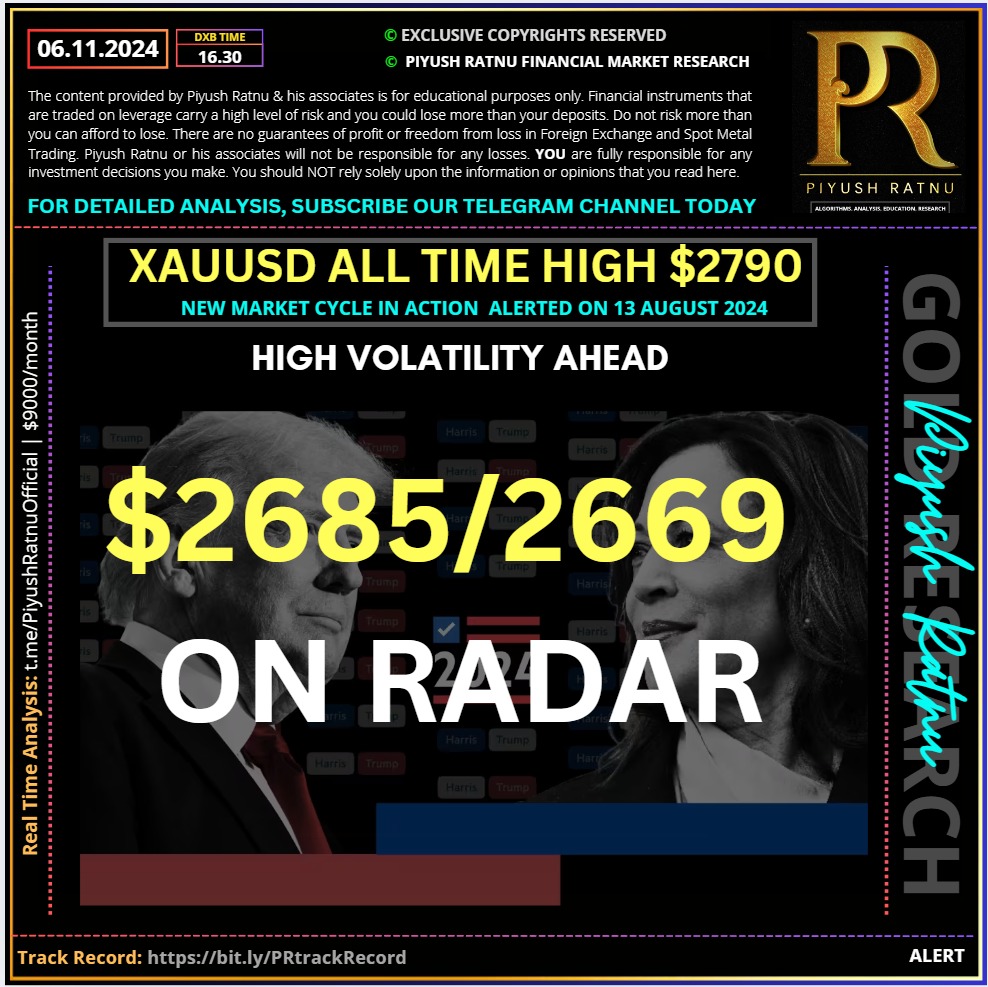

I had projected a crash till $2669 on 30 October 2024 from all time high $2790 which can be verified here on Reddit here and on Telegram. XAUUSD price crashed from $2745-2645: net crash of $100 was witnessed after the victory of Mr. Trump was declared officially.

Projected on 30.10.2024 and 06.11.2024 at 16.30 hours

The US Dollar (USD) has now entered a bullish consolidation phase after rallying to its highest level in four months against its major rivals, capitalizing on the return of Trump trades. Trump’s policies on immigration, tax cuts and tariffs are expected to put upward pressure on inflation, Wall Street stocks, US Treasury bond yields and the USD.

The expectations from the Trump administration and their likely implications on the economy spelt doom for the non-yielding Gold price, smashing it about $100 from the static resistance of $2,750.

Donald Trump’s return to the White House could prompt the Fed to slow down on its easy cycle, as his expansionary fiscal policies are seen as highly inflationary.

Fed Chair Jerome Powell is expected to affirm the US central bank’s independence and that they will act as the economic and inflation outlook unfolds. Powell is likely to acknowledge the recent slack in the labor market and the progress on disinflation, reiterating that the Fed will remain ‘data-dependent’ while determining the next policy move.

Fundamental Scenario:

If the Fed signals a slower pace of easing in the coming months, Gold price could see a sustained break below $2626 zone with $2585/2552/2525/2485 zones on radar.

🟢Note: Let us not ignore the fact that XAUUSD crashed from $1966-1777 zone in November-December 2020, before recovering back to 1966 in the first week of January 2020.

🔘Considering this year’s price movement, $360 crash doesn’t look like an impossible scenario, hence it will be wise to apply risk management accordingly to avoid high drawdown.

🔘XAUUSD $150 crash, as projected by me on 30 October 2024 has been already achieved: $2790-2646 zone.

Verify here: https://t.me/c/1654158888/12474 | X

Most Accurate XAUUSD Spot Gold Forex price Forecast Projection US Elections 2024

🔘XAUUSD: After $150, next target is $240 crash from $2790 = $2552 zone.

US Federal Reserve’s (Fed) policy decision will be eyed today. Markets expect a modest 25 basis point rate cut this week. This could provide support for Gold as lower interest rates reduce the opportunity cost of holding non-interest-bearing assets.

The CME FedWatch Tool shows a 98.1% probability of a quarter-point rate cut by the Fed in November.

🟢Crucial Price Zones for next 10 days:

RT zone targets:

H1VS5 $2707 H1VS1 $2727

🔻 BZ $2606/2585/2569/2552/2525

🔺 SZ $2727/2747/2757/2777/2787

🟢Why XAUUSD might rise in coming months to $2828/2848 making a new ALL TIME HIGH against ‘generic and media analysts opinion:

Gold price may receive support as Republican Donald Trump could lead to higher inflation, given his pledge to significantly raise trade tariffs. This may prompt investors to seek safe-haven assets as a hedge against long-term inflation risks.

Trump’s economic policy includes imposing tariffs, increasing the fiscal deficit, and reducing taxes. These proposals conflict with the Federal Reserve’s efforts to control inflation, likely prompting the US central bank to take a more gradual approach to easing monetary policy.

Geo-political tensions: Iran’s plans for a retaliatory strike against Israel’s attack on its territory will be witnessed soon, resulting in another series of attacks.

Trade with Confidence with Piyush Ratnu Gold Market Research

Trade with Confidence with Piyush Ratnu Gold Market Research

Subscribe one of the most accurate analysis in the industry: Spot Gold Analysis by Piyush Ratnu powered by 90+ technical and fundamental parameters with a verified and audited track record.

Current Trading Profit Status: 112%

Highest Drawdown Faced YTD: 8%

Highest profit/month booked: 42%

Highest loss/month booked: 5%

Check Trading Performance at:

https://www.myfxbook.com/members/PiyushRatnu

Core Focus: XAUUSD | Spot Gold

Platform: MT4 MT5

Trading Mode: Manual + Algorithm | Automated: both available

Auto-Copy Trading: Available | Plug and Play Solution

Live Trading Feed Available | Real Time Analysis Available

Connect for an appointment at T.ME/PIYUSHRATNUOFFICIAL