Who projected $2929 XAUUSD Spot Gold Price Target in February 2025?

XAUUSD Price Action observed on 11 February 2025 between 05.00 AM – 06.00 AM DXB

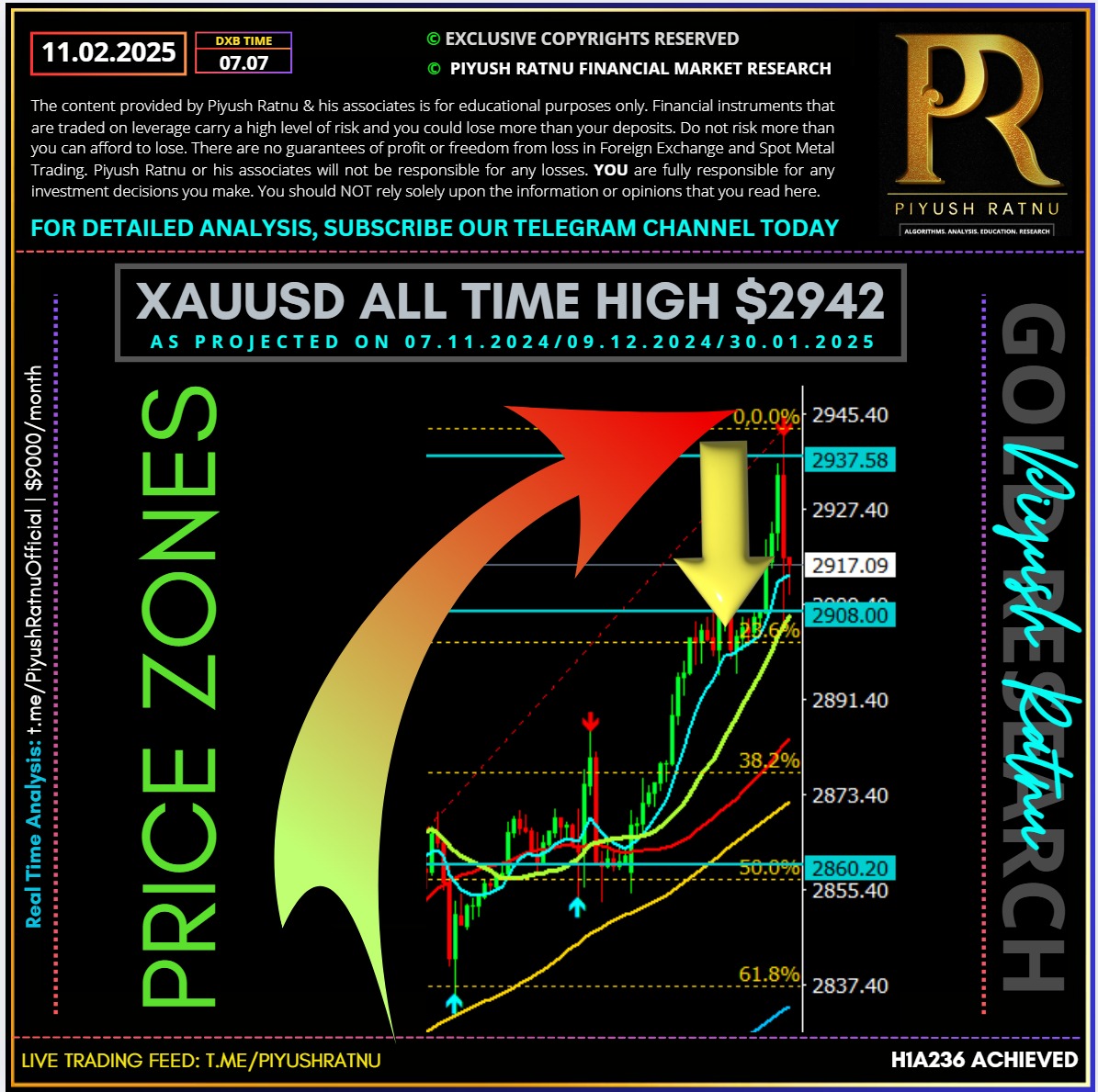

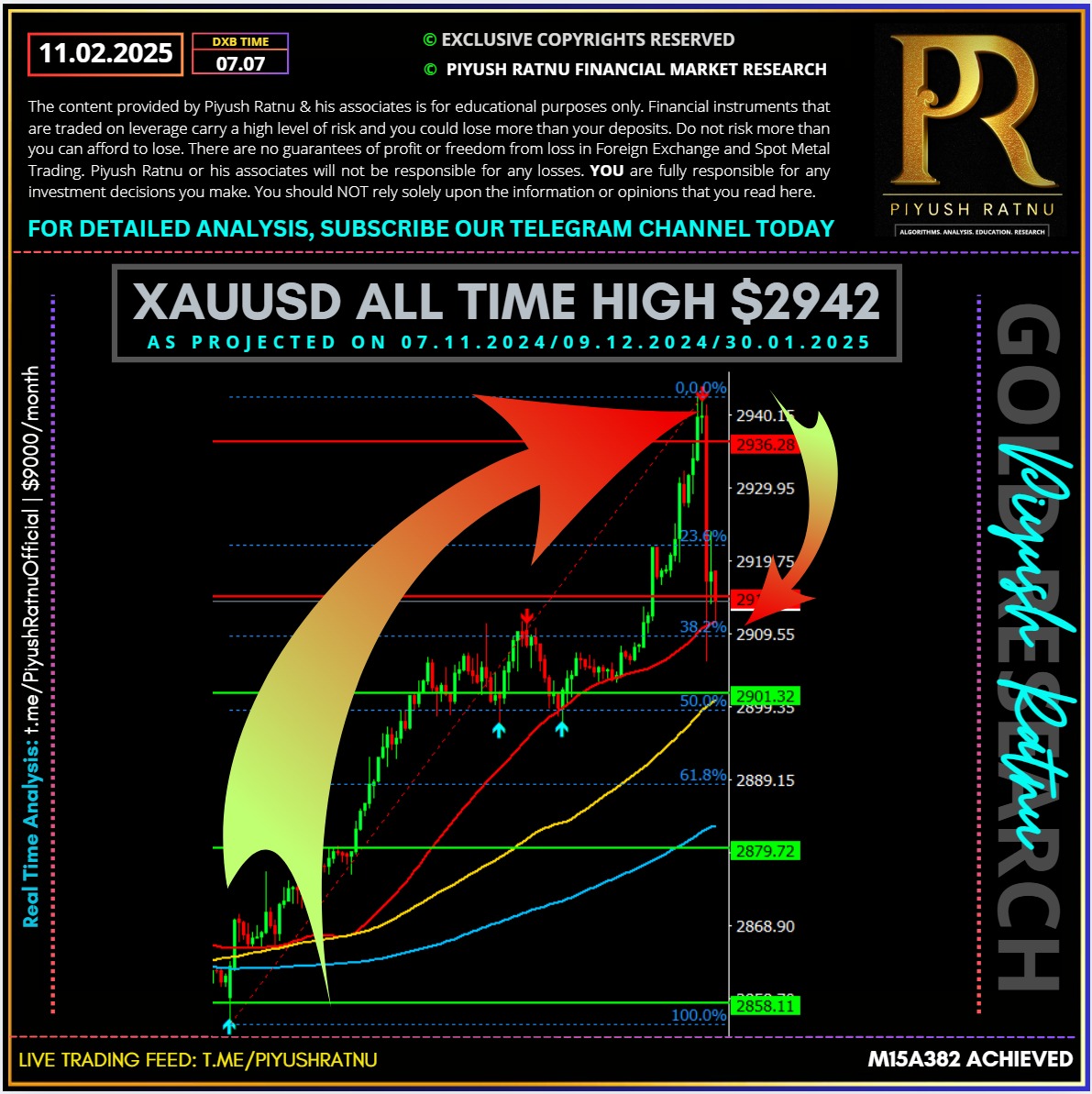

XAUUSD price shot up to all time high $2942 today morning at 06.15 hours, I had projected price target of $2929 on 05 February 2025, and Selling zone entry at $2919/2929 on 10 February 2025. Selling at and above $2909/2919/2929 gave us neat exit as XAUUSD price retraced from $2942 to $2905 today morning at 6.30 hours.

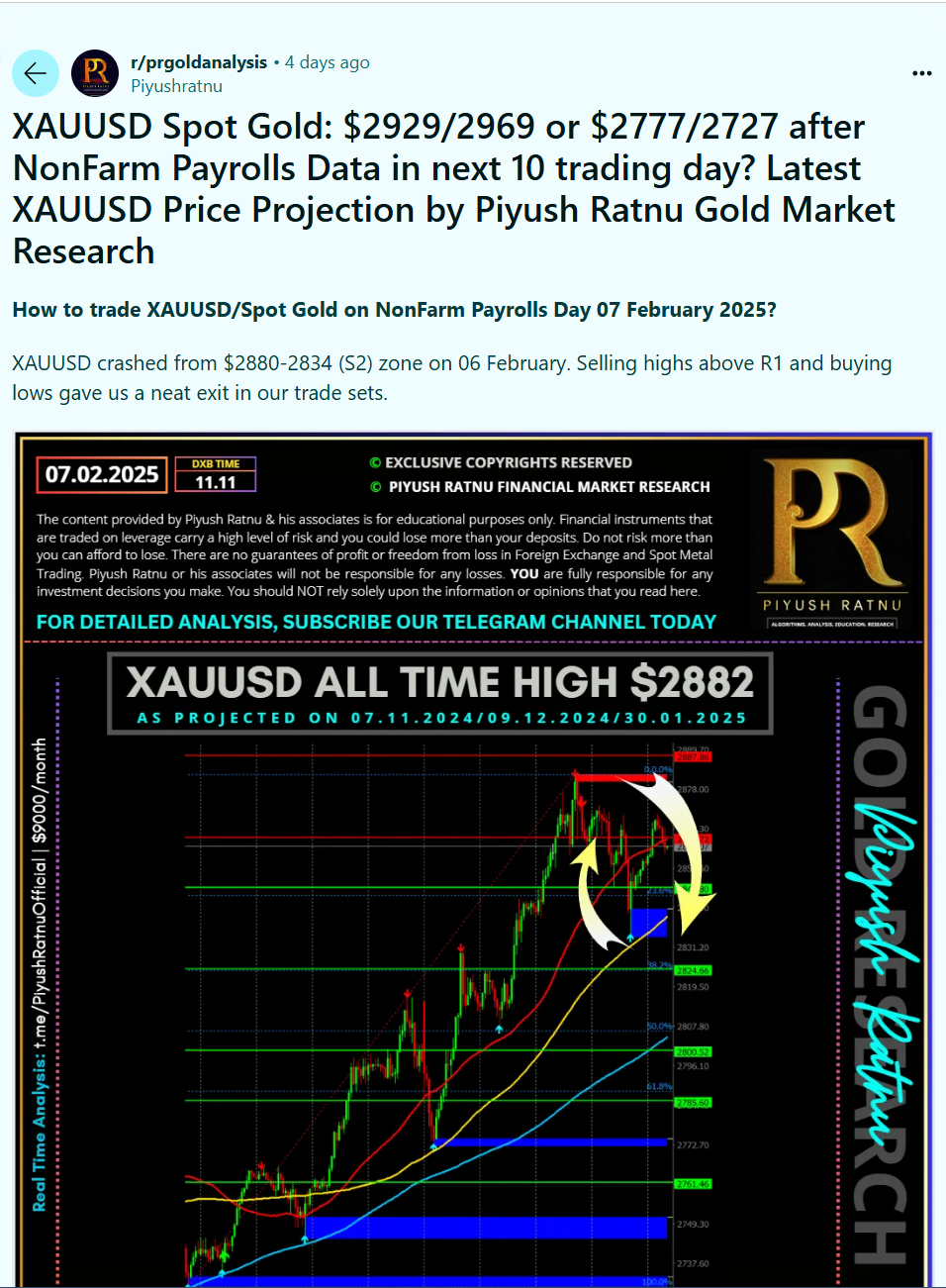

Price target $2929 projected before NFP Data. Verify here.

Selling Zone Entry $2909/2929 Verify here.

I had projected price zones: $2909/2929/2949 in my analysys published on Telegram on 10 February 2025.

🔺Gold prices seem to have picked up fresh bids above $2,850 at the start of the US inflation week. However, as trade war fears mount, the further upside in Gold price could remain limited by renewed haven demand for the US Dollar (USD).

🔺XAUUSD: 🔺The NFP report showed that the US economy added 143,000 jobs in January after creating 307,000 jobs in December while missing the estimates of a 170,000 increase.

🔺The Unemployment Rate declined to 4% from 4.1%, while the Labor Force Participation Rate ticked a tad higher to 62.6% from 62.5%.

🔻XAUUSD: 🔺Escalating tensions over a potential global trade war, the 47th US President announced on Sunday that he would impose new 25% tariffs on all steel and aluminium imports, exacerbating the pain in the Euro and the commodity-linked Australian Dollar (AUD) and New Zealand Dollar (NZD), in turn infusing fresh buying interest in the go-to safety net – the US Dollar.

🔺XAUUSD:🔺 Gold price also capitalizes on the People’s Bank of China’s (PBOC) expansion of its Gold reserves for a third month in January.

🔺XAUUSD:🔺 Hopes of more stimulus coming through from China could also keep Gold buyers hopeful, especially after China’s Producer Price Index (PPI) deflation extended into a 28th month in January, with a 2.3% decline. The uptick in China’s Consumer Price Index (CPI) failed to impress markets.

In the day ahead, the USD could extend its recovery momentum if risk-off flows intensify or markets resort to profit-taking on their USD short positions heading into Wednesday’s US CPI inflation data release. In both cases, Gold price upside appears limited.

Crucial Price Zones:

🔻BZ: $2848/2828/2808/2777

🔺SZ: $2909/2929/2949/2969

Why XAUUSD Price is rising in February 2025?

Risk aversion continued at the start of another week following Donald Trump’s pledge of blanket tariffs of 25% on steel and aluminum imports to the US. The markets opened with gaps as a result while safe haven flows continued to gain traction in the face of uncertainty.

🟢Latest Tariff Pledges

President Donald Trump is expected to sign an order on tariffs later on Monday or Tuesday, a source said. This move could raise the chances of a trade war involving multiple countries.

Trump announced on Sunday that he will add a 25% tariff on all steel and aluminum imports to the U.S., in addition to existing duties.

He also plans to introduce more tariffs later this week to match the tariffs other countries place on U.S. goods. Trade partners have warned they might retaliate. Details of the order Trump will sign are not yet available.

🟢Gold Council Report and ETF Flows

Gold delivered a stellar start to 2025 with January seeing the precious metal return gains of around 6.6%. This has continued in the early part of February with safe haven flows remaining strong and keeping Gold prices supported.

The World Gold Council report for January provided some interesting insights into the rise of Gold prices. A lot of which we have discussed but I thought it was worth a look.

The World Gold Councils Gold Return Attribution Model (GRAM) shows that most factors had a positive effect, including a big increase in the Geopolitical Risk Index (GPR). However, the strong US dollar in December held back returns slightly due to its delayed impact.

On the ETF front, 2025 kicked off with positive flows, led by Europe, while North America saw outflows. Following the second consecutive monthly inflow and supported by a higher gold price, global gold ETFs’ total AUM rose to US$294bn and holdings bounced to 3,523t.

European ETF flows reached their highest level in years with inflows of +US$3.4bn, 39t which was likely supported by the European Central Bank (ECB) rate cut, causing bund yields to drop sharply throughout the month.

These developments look set to continue and thus why many are now pricing and upgrading their Gold forecasts for 2025.

🟢$3030/oz as projected by me in advance now seems within reach.

🟢🆘🆘🆘US CPI Data This Week

On the data front, US inflation is the biggest data event this week which could have an impact on Gold prices.

However, despite last week’s uptick in inflation expectations as revealed by the Michigan Sentiment Index, I think it may be too soon for a significant change in inflation.

I do not expect a significant uptick or shot yet, as it will require more time before the impacts of tariffs are fully felt and absorbed by the US economy.

If there is a significant uptick in inflation this could send Gold prices lower.

Market participants will be concerned about an uptick in inflation before the impact of tariffs has been felt and this could spook markets.

This could work both ways though as a rise in inflation could spook markets and also lead to increased demand for safe havens. This could then net-off and keep Gold prices elevated.

Trade with Confidence with Piyush Ratnu Gold Market Research

Subscribe one of the most accurate analysis in the industry: Spot Gold Analysis by Piyush Ratnu powered by 90+ technical and fundamental parameters with a verified and audited track record.

Current Trading Profit Status: 142%

Highest Drawdown Faced YTD: 16%

Highest profit/month booked: 42%

Highest loss/month booked: 24%

Check Trading Performance at:

https://www.myfxbook.com/members/PiyushRatnu

Core Focus: #XAUUSD | Spot #Gold

Platform: MT4 MT5

Trading Mode: Manual + Algorithm | Automated: both available

Auto-Copy Trading: Available | Plug and Play Solution

Live Trading Feed Available | Real Time Analysis Available

Connect for an appointment at T.ME/PIYUSHRATNUOFFICIAL

Watch LIVE TRADING FEED

Real Time Trades by our proprietary trading algorithms at https://t.me/PiyushRatnu