XAUUSD Spot Gold Price: Who projected $3333/3366/3399/3434 target price in April 2025? CMP $3396

Gold price (XAU/USD) CMP $3393 as projected here: https://t.me/c/1654158888/15708 | X.com: https://x.com/piyushratnu/status/1912407189781901579 sticks to its strong intraday gains heading into the European session on Monday and currently trades near the all-time peak, well within striking distance of the $3,400 round figure.

Trade-related uncertainties continue to weigh on investors’ sentiment, which is evident from the underlying bearish sentiment around the global financial markets and benefits the safe-haven precious metal.

I had projected XAUUSD Gold Price might hit highs at $3333/3366/3399 on 16 April 2025, which can be verified here: X.com: https://x.com/piyushratnu/status/1912407189781901579

US President Donald Trump’s back-and-forth tariff announcements have dented confidence in the US economy. This, along with bets that the Federal Reserve (Fed) will resume its rate-cutting cycle soon, drags the US Dollar (USD) to its lowest level since April 2022 and provides an additional boost to the non-yielding Gold price. The XAU/USD bulls, meanwhile, seem cautious with overbought conditions. I expect correct before Thursday 24 April 2025 H1A236 | $3366/3333 zone.

🔴KEY Factors impacting XAUUSD:

🔴KEY Factors impacting XAUUSD:

🟢Investors remain worried about the potential economic fallout from US President Donald Trump’s trade tariffs and the rapidly escalating US-China trade war, pushing the safe-haven Gold price to a fresh all-time peak on Monday. In fact, Trump recently imposed tariffs of up to 145% on certain Chinese goods, with some duties reportedly reaching 245%. In retaliation, China has levied tariffs of 125% on US products.

🟢Meanwhile, Trump’s aggressive trade policies could hurt the world trade order and trigger a recession in the US. This, in turn, drags the US Dollar to its lowest level since April 2022 and further benefits the precious metal. The USD bulls shrugged off Federal Reserve Chair Jerome Powell’s hawkish comments, saying that the central bank is well-positioned to wait for more clarity before making any changes to the policy stance.

🟢Furthermore, market participants are still pricing in the possibility that the Fed will resume its rate-cutting cycle in June and lower borrowing costs by a full percentage point by the end of this year. This turns out to be another factor that contributes to driving flows towards the non-yielding yellow metal, amid thin trading conditions on the back of the Easter Monday holiday and despite overbought conditions on the daily chart.

🟢Iran and the US agreed on Saturday to commence expert-level discussions to design a framework for a potential nuclear deal. Moreover, Russian President Vladimir Putin’s one-day ceasefire in Ukraine on Saturday sparked hopes that tensions could de-escalate. This, however, does little to boost investors’ confidence or dent demand for traditional safe-haven assets, supporting prospects for a further appreciation for the XAU/USD pair.

🟢There isn’t any relevant market-moving economic data due for release from the US on Monday, though a scheduled speech from Chicago Fed President Austan Goolsbee might influence the USD. Apart from this, trade-related developments should provide some impetus to the commodity. The market focus will then shift to the release of flash PMIs on Wednesday, which should offer a fresh insight into the global economic health.

🔴The US-China trade war witnessed a significant escalation over the weekend after a Boeing jet intended for use by a Chinese airline landed back at the plane maker’s US production hub due to China’s retaliatory move.

🔴Greenback remains vulnerable also as the US Federal Reserve’s (Fed) independence is threatened. “White House Economic Adviser Kevin Hassett said Friday that Trump and his team were studying if they could fire Federal Reserve Chair Jerome Powell, a sign that such a move, a matter of great consequence for the central bank’s independence and global markets, is still an option,” per Reuters.

🔴A broadly softer US Dollar and increased haven demand continue to bode well for the traditional safe-haven Gold price. In the day ahead, Gold price could be subject to intense volatility as trading conditions remain thin on account of Easter Monday.|

🔴It’s a relatively light week, in terms of US economic data, and hence, Gold price will remain at the mercy of Trump’s trade talks, risk sentiment and Fedspeak until the release of the S&P Global US flash PMI readings.

🔻Avoid BIG lots, maintain PG $50

GRID: $50 | Exit NAP

Crucial Price Zones:

Strategy: GR 11223355

🔺SZ $3400/3434/3464/3484

🔻BZ $3333/3303/3282/3262

Check Trading Performance at:https://www.myfxbook.com/members/PiyushRatnu

Core Focus: #XAUUSD | Spot #Gold

Platform: MT4 MT5

Trading Mode: Manual + Algorithm | Automated: both available

Auto-Copy Trading: Available | Plug and Play Solution

Live Trading Feed Available | Real Time Analysis Available

Connect for an appointment at T.ME/PIYUSHRATNUOFFICIAL

Watch LIVE TRADING FEED

Real Time Trades by our proprietary trading algorithm at https://t.me/PiyushRatnu

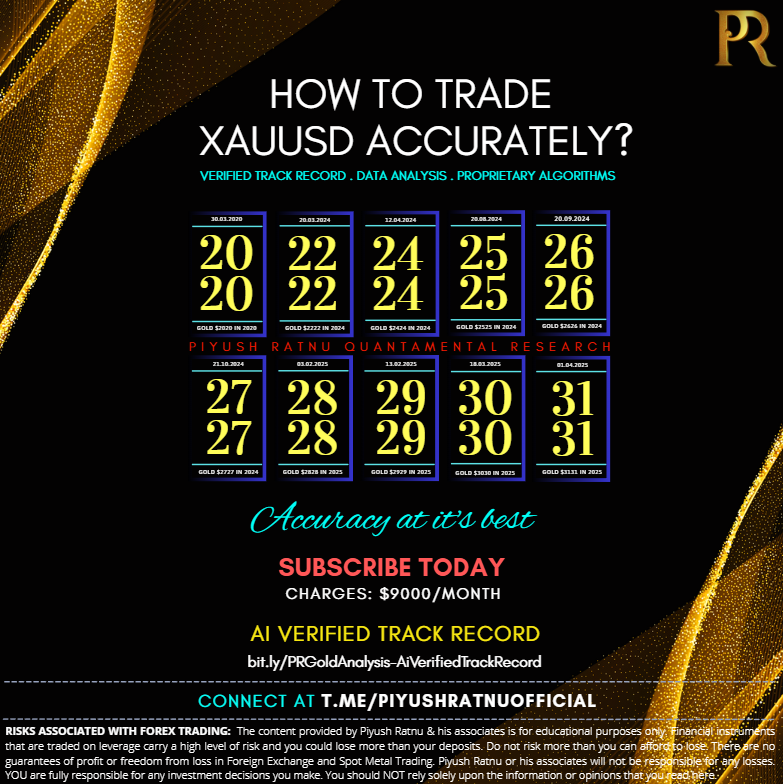

Who projected XAUUSD Spot Gold Price target $3131/3232/3333 in 2025/2026?

Click to Check Ai Verified Track Record of Piyush Ratnu Gold Market Research