FACTORY ORDERS: The dollar level of new orders for both durable and nondurable goods. This report is more in depth than the durable goods report which is released earlier in the month.

FED: The Federal Reserve Bank, the central bank of the United States, or the FOMC (Federal Open Market Committee), the policy-setting committee of the Federal Reserve.

FED OFFICIALS: Refers to members of the Board of Governors of the Federal Reserve or regional Federal Reserve Bank Presidents.

FIGURE/THE FIGURE: Refers to the price quotation of ’00’ in a price such as 00-03 (1.2600-03) and would be read as ‘figure-three.’ If someone sells at 1.2600, traders would say ‘the figure was given’ or ‘the figure was hit.

FILL: When an order has been fully executed.

FILL OR KILL: An order that, if it cannot be filled in its entirety, will be cancelled.

FIRST IN FIRST OUT (FIFO): All positions opened within a particular currency pair are liquidated in the order in which they were originally opened.

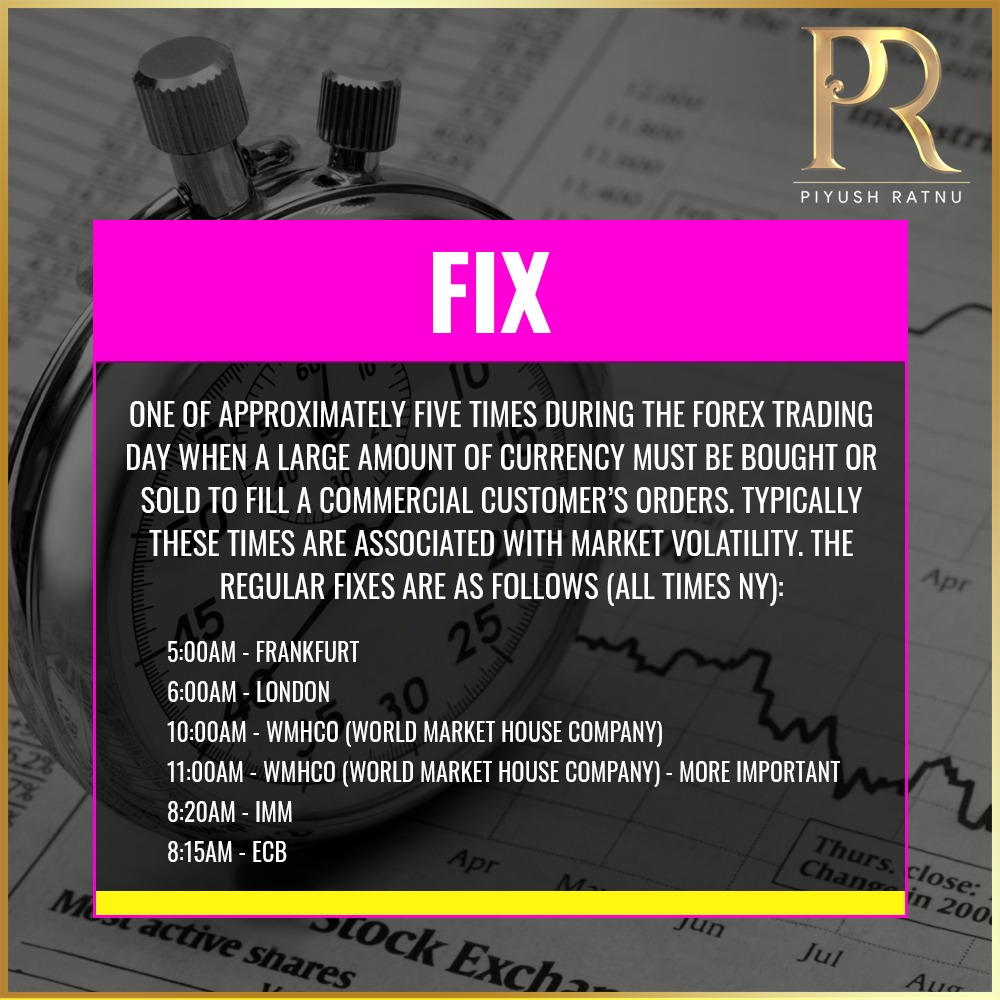

FIX:

One of approximately five times during the forex trading day when a large amount of currency must be bought or sold to fill a commercial customer’s orders. Typically these times are associated with market volatility. The regular fixes are as follows (all times NY):

5:00am – Frankfurt

6:00am – London

10:00am – WMHCO (World Market House Company)

11:00am – WMHCO (World Market House Company) – more important

8:20am – IMM

8:15am – ECB

FLAT OR FLAT READING: Economic data readings matching the previous period’s levels that are unchanged.

FLAT/SQUARE: Dealer jargon used to describe a position that has been completely reversed, e.g. you bought $500,000 and then sold $500,000, thereby creating a neutral (flat) position.

FOLLOW-THROUGH: Fresh buying or selling interest after a directional break of a particular price level. The lack of follow-through usually indicates a directional move will not be sustained and may reverse.

FOMC: Federal Open Market Committee, the policy-setting committee of the US Federal Reserve.

FOMC MINUTES: Written record of FOMC policy-setting meetings are released three weeks following a meeting. The minutes provide more insight into the FOMC’s deliberations and can generate significant market reactions.

FOREIGN EXCHANGE/FOREX/FX: The simultaneous buying of one currency and selling of another. The global market for such transactions is referred to as the forex or FX market.

FORWARD: The pre-specified exchange rate for a foreign exchange contract settling at some agreed future date, based on the interest rate differential between the two currencies involved.

FORWARD POINTS: The pips added to or subtracted from the current exchange rate in order to calculate a forward price.

FRA40: A name for the index of the top 40 companies (by market capitalization) listed on the French stock exchange. FRA40 is also known as CAC40.

FTSE 100: The name of the UK 100 index.

FUNDAMENTAL ANALYSIS: The assessment of all information available on a tradable product to determine its future outlook and therefore predict where the price is heading. Often non-measurable and subjective assessments, as well as quantifiable measurements, are made in fundamental analysis.

FUNDS: Refers to hedge fund types active in the market. Also used as another term for the USD/CAD (U.S. Dollar/Canadian Dollar) pair.

FUTURE: An agreement between two parties to execute a transaction at a specified time in the future when the price is agreed in the present.

FUTURES CONTRACT: An obligation to exchange a good or instrument at a set price and specified quantity grade at a future date. The primary difference between a Future and a Forward is that Futures are typically traded over an exchange (Exchange- Traded Contacts – ETC), versus Forwards, which are considered Over The Counter (OTC) contracts. An OTC is any contract NOT traded on an exchange.

G7: Group of 7 Nations – United States, Japan, Germany, United Kingdom, France, Italy and Canada.

G8: Group of 8 – G7 nations plus Russia.

GAP/GAPPING: A quick market move in which prices skip several levels without any trades occurring. Gaps usually follow economic data or news announcements.

GEARING (ALSO KNOWN AS LEVERAGE): Gearing refers to trading a notional value that is greater than the amount of capital a trader is required to hold in his or her trading account. It is expressed as a percentage or a fraction.

GER40: An index of the top 40 companies (by market capitalization) listed on the German stock exchange – another name for the DAX.

GIVEN: Refers to a bid being hit or selling interest.

GIVING IT UP: A technical level succumbs to a hard-fought battle.

GMT (GREENWICH MEAN TIME): Greenwich Mean Time – The most commonly referred time zone in the forex market. GMT does not change during the year, as opposed to daylight savings/summer time.

GOING LONG: The purchase of a stock, commodity or currency for investment or speculation – with the expectation of the price increasing.

GOING SHORT: The selling of a currency or product not owned by the seller – with the expectation of the price decreasing.

GOLD (GOLD’S RELATIONSHIP): It is commonly accepted that gold moves in the opposite direction of the US dollar. The long-term correlation coefficient is largely negative, but shorter-term correlations are less reliable.

GOLD CERTIFICATE: A certificate of ownership that gold investors use to purchase and sell the commodity instead of dealing with transfer and storage of the physical gold itself.

GOLD CONTRACT: The standard unit of trading gold is one contract which is equal to 10 troy ounces.

GOOD FOR DAY: An order that will expire at the end of the day if it is not filled.

GOOD ‘TIL CANCELLED ORDER (GTC): An order to buy or sell at a specified price that remains open until filled or until the client cancels.

GOOD ‘TIL DATE: An order type that will expire on the date you choose, should it not be filled beforehand.

GREENBACK: Nickname for the US dollar.

GROSS DOMESTIC PRODUCT (GDP): Total value of a country’s output, income or expenditure produced within its physical borders.

GROSS NATIONAL PRODUCT: Gross domestic product plus income earned from investment or work abroad.

GUARANTEED ORDER: An order type that protects a trader against the market gapping. It guarantees to fill your order at the price asked.

GUARANTEED STOP: A stop-loss order guaranteed to close your position at a level you dictate, should the market move to or beyond that point. It is guaranteed even if there’s gapping in the market.

GUNNING/GUNNED: Refers to traders pushing to trigger known stops or technical levels in the market.