Buy the news, sell the fact. The matter is that investors are too nervous and could start sell-offs before the expected event happens. I call this a rehearsal of the performance.

It is what happened ahead of the release of the FOMC meeting outcomes. US stock indexes were up, and EURUSD featured great volatility, jumping up to 1.058 and going down to initial positions.

Based on the CME derivatives signals, the Fed will raise rates by 50 basis points, which has not happened since 2000. The rate is expected to rise by half a point not only in May, but also in June, and then in July. Moreover, traders are speculating about the possibility of a 75-basis-point rate hike, which last happened in 1994.

Simultaneously with the increase in the rate, the Fed intends to reduce the balance sheet, which is almost $9 trillion. It will be shrinking by $95 billion a month. In the previous monetary policy tightening cycle, even at the peak, it was almost half as much.

Market trends explain why the Fed got inflation so wrong in the last year. Some analysts criticise the Fed for wishful thinking slow and having to catch up with the reality now. For a long time, the Fed insisted higher inflation was “transitory” even as evidence accumulated that it was not. After the US central bankers had admitted the problem, they did not act as though they meant it. It took another four months to end its monthly injection of $40bn into the markets that were already booming. Even after proclaiming a turn in the cycle of interest rate hikes, Jerome Powell signalled the shift would be modest.

I suppose that the Fed was in no hurry to tighten its policy, being afraid of a taper tantrum, like in 2013.

As the hawkish stance has been expressed more and more often, investors are coming to expect three half-point rate hikes. Now, the odds for the Fed are that the American economy will either run too hot, in case the rate hikes fall short of the expectations, or too cold if the monetary tightening turns out too aggressive.

Facts:

• If a country’s inflation rate is low, its currency is strong.

• Countries with higher interest rates have stronger currencies because lenders benefit more and foreign currency is attracted.

• Nations with a stable political and economic environment attract investors, who impact the currency exchange rate of the country.

• Foreign nations buying a country’s products create high demand for its currency, i.e., if a country’s goods are relatively inexpensive, foreign states will tend to purchase them. In order to purchase those items, they will need to buy the country’s money. The currencies of the nations with the lowest prices are usually the most powerful.

• Countries with strict monetary policies reduce the supply of their currency, increasing its value.

According to a Reuters Poll of 31 analysts and traders, the median price of gold will rise to $1,920 an ounce during the April-June quarter. Despite the strongest $ in 20 years, which usually pressures the price of the yellow metal as the currency accelerates, it seems gold demand has been holding steady. The result most likely of rising geopolitical risks such as the war in Ukraine and spiking global inflation which spotlights both the safe haven nature of the precious metal and its role as an inflation hedge.

Still, among those surveyed, there was a strong consensus that the price of gold will slump later this year as interest rates accelerate. However, there’s another camp that believes that if the Fed’s pace of hiking is aggressive, it could undermine economic growth which would be good for the yellow metal. With gold fundamentals currently contradictory, it’s difficult to forecast whether the price will rise on its haven or hedge status or fall amid a flurry of rate hikes.

“A 50bp interest rate hike…with quantitative tightening also announced.”

Knowing how broader markets may react to Fed’s steps to lower inflation and tighten credit is not easy. There are different views about the outlook for the rest of 2022 and even 2023.

Morgan Stanley suggests it will likely be a “battle between positives and negatives.” On the other hand, Goldman Sachs strikes a more cautious tone on how S&P could fare in the coming months. So, it is more or less a wait-and-see kind of period to see what will actually happen.

Debates over worst- and best-case market scenarios are likely to dominate the headlines in May. Yet, retail investors have access to an extensive range of exchange-traded funds (ETFs) that could help them protect their capital and generate returns even in that environment.

A rate hike of 50 basis points is generally expected and is fully priced in according to the Fed Fund Futures. It will therefore be almost more interesting to hear what Fed Chair Powell has to say about the bank’s FMP. If he sounds very hawkish and indicates that other major rate hikes will be made at the following Fed meetings, this could push $ and bond yields further up, which would presumably depress XAUUSD. The ADP labour market report will be published in the US this afternoon ahead of the Fed interest rate decision. The Bloomberg consensus anticipates another sharp increase in the number of jobs created. This could weigh on the gold price this afternoon. XAUUSD is trading in the red while within Tuesday’s wide trading range, as bears move away on the sidelines ahead of the all-important Fed showdown.

With a 50 bps rate hike and the commencement of the Fed’s balance sheet reduction almost a done deal on Wednesday, gold bears need an aggressively hawkish forward guidance to extend the ongoing downtrend. $ stabilizes at higher levels alongside the Treasury yields, awaiting the Fed’s hawkish confirmation for the next push higher. Meanwhile, the market’s cautious optimism, China’s covid resurgence-led lockdowns and its impact on the demand for gold keep the sentiment around the bright metal undermined. No other catalyst seems relevant so far this Wednesday, as pre-Fed anxiety leads the way and the outcome is likely to have a huge impact on the USD valuations, eventually impacting the gold price action in the coming days.

On an aggressive Fed policy outlook, hinting at a more than 50 bps hike in June, XAU/USD could accelerate the downside momentum to hit the 200-DMA EXT at $1,836/1818

If the Fed disappoints the hawks, then gold bulls will likely challenge the 100-DMA again. Acceptance above the latter is needed on a daily closing basis to affirm a bullish reversal from over three-month lows.

The next upside target for buyers is envisioned $1,907/1926

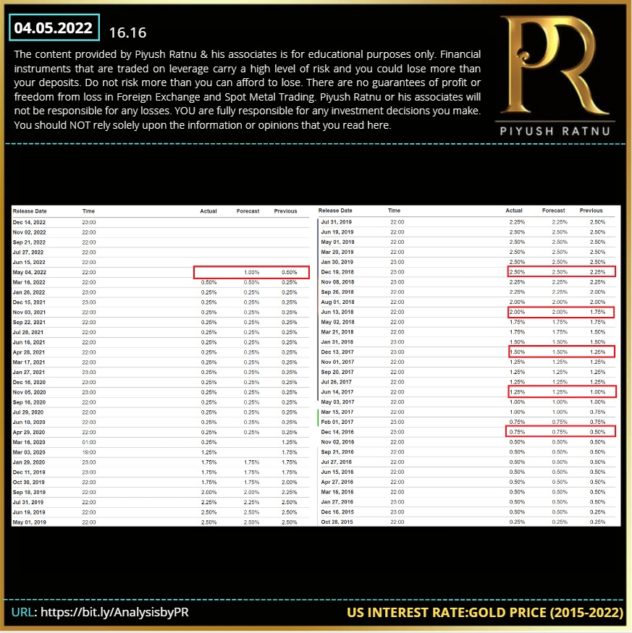

Analytical explanation of the above: based on the price movement in GOLD on and after the rate hikes:

Date of Hike: 14 Dec. 2016

XAUUSD on 01 Dec 2016: $1170

XAUUSD on 14 Dec. 2016: $ 1125

XAUUSD on 14 Jan. 2017: $1190

XAUUSD on 14 March 2017: $1188

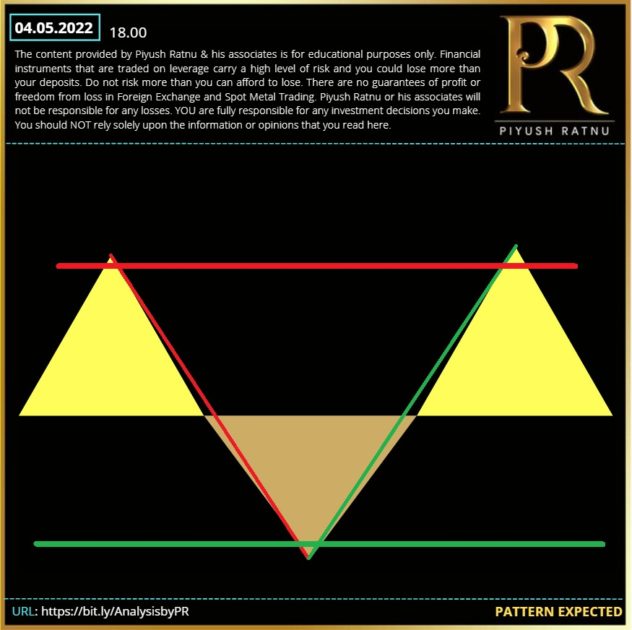

Pattern traced: V extension in 90 days

2017

Date of Hike: 14 June 2017

XAUUSD on 01 June 2017: $1290

XAUUSD on 14 June 2017: $1240

XAUUSD on 14 July 2017: $1258

XAUUSD on 14 Sept. 2017: $1346

Pattern traced: V extension in 90 days

Date of Hike: 13 December 2017

XAUUSD on 01 December 2017: $1280

XAUUSD on 14 December 2017: $1236

XAUUSD on 14 January 2018: $1330

XAUUSD on 14 March. 2018: $1303

Pattern traced: V extension, A 30RT in 90 days

Date of Hike: 13 June 2018

XAUUSD on 01 June 2018: $1290

XAUUSD on 14 June 2018: $1279

XAUUSD on 14 July 2018: $1247

XAUUSD on 14 Aug. 2018: $1160 (year low)

XAUUSD on 130 Nov. 2018: $1260

Pattern traced: V pattern in 150+ days

Date of Hike: 19 December 2018

XAUUSD on 01 December 2018: $1230

XAUUSD on 19 December 2018: $1273

XAUUSD on 19 January 2018: $1300

XAUUSD on 14 March. 2018: $1330

Pattern traced: V extension in 90 days $100

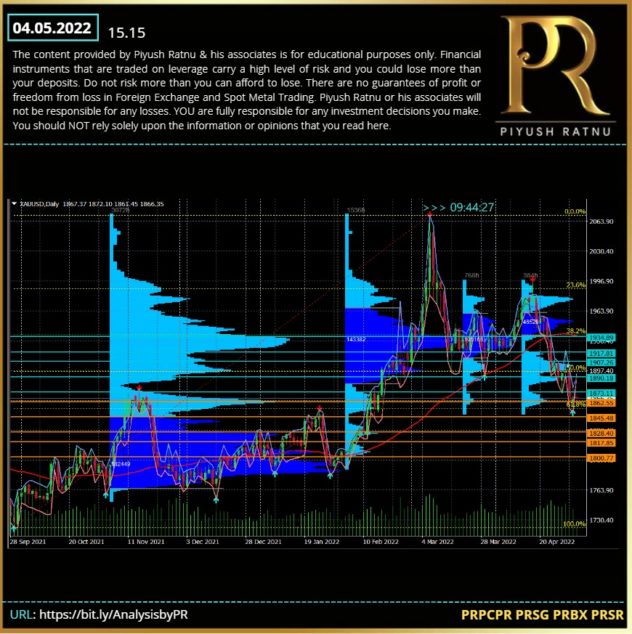

Based on the above data V pattern looks obvious, BUYING lows looks a wise idea.

Target NAP

V after completion of A

C RT NAP

1866/1836/1818

R RT NAP

1907/1926/1948

TAT

18 days/ 27 May, 2022

Kindly refer following software:

GRTS PRSR PRZZ PTTPL

for BUY and SELL entries.

Settings

3/1000/0.06/0.09/0.12 QP

Chart M30 and H4 in Q3

FRT 236 PRZ 38.2

IN MY OPINION:

Gold is all set to repeat the history.

V pattern confirmed after the completion of A pattern.

M5 M15 RT236 On radar.

GOLD near D1618 D1E2 M30S5 H1S5

Targets: RT

D1E1 M30E2 H1 E2 H4S5 E1 in sequence

Focus

S3/S4 (-6.9)

RR3/R4 (+6/9)

It is always wise to first PLAN THE TRADE, and then TRADE THE PLAN!

Hence, it is suggested to first observe the crash or rise with specific zones and levels in mind on the basis of various fundamental and technical parameters mentioned above, before entering a trade in a specific direction with a target of net average profit in a specific set of trades.

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at: https://bit.ly/PRForexGlossary

Instagram: https://www.instagram.com/prgoldanalysis

You Tube Channel: https://bit.ly/PRGOLDYT

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

Telegram LIVE Trade FEED:

https://t.me/PiyushRatnuGoldAnalysis 10 days complimentary.

Annual Package: contact for charges (Indicators + EAs + Analysis)

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

WARNING: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The author will not be held responsible for information that is found at the end of links posted on this page. The author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. The author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author is not a registered investment advisor and nothing in this article is intended to be investment advice. All performance information reflects past performance and is presented on a total return basis. Past performance is no guarantee of future results. Current performance may differ from the performance shown.

RISK WARNING | DISCLAIMER

Information on this Channel/Page contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Information or opinions provided by us should not be used for investment advice and do not constitute an offer to sell or solicitation of an offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. When making a decision about your investments, you should seek the advice of a professional financial adviser.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu. The analysis and trading suggestions published by Piyush Ratnu does not warrant or guarantee the accuracy, timeliness or completeness to its service or information contained therein. Piyush Ratnu does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading on their own risk and Piyush Ratnu shall not be responsible under any circumstances for the consequences of such activities. Piyush Ratnu and its affiliates, in no event, be liable to users or any third parties for any consequential damages or losses in any direct or indirect manner, however arising, including but not limited to damages caused by negligence or Force Majeure whether such damages were foreseen or unforeseen. The capital value of units in the fund can fluctuate and the price of units can go down as well as up and is not guaranteed. You should not buy a warrant unless you are prepared to sustain a total loss of the money you have invested plus any commission or other transaction charges. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals. The high degree of leverage can work against you as well as for you hence implement risk management and money management strictly to safeguard your investment. Do not risk more than .10% of your principle amount in a single trade set. Before deciding to invest in foreign exchange or other markets you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some, or all, of your initial investment. Therefore, you should not invest money that you cannot afford to lose. In some cases, it is possible to lose more than your initial investment as it is not always possible to exit a market at the price you intend upon doing so. There are also risks associated with utilizing an Internet-based trade execution software application including, but not limited to, the failure of hardware and software. You should be aware of all the risks associated with investing in foreign exchange, indices and commodities and seek advice from an independent financial advisor if you have any doubts. The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions. Piyush Ratnu or his associates will not accept any liability for any loss or damage, including but without limitation to, any financial, emotional loss, which may arise directly or indirectly due to your decision. If you do not agree to the above terms, conditions and disclaimer YOU MUST leave this group with immediate effect and YOU MUST not act as per the information provided in this document.