How to trade XAUUSD accurately in last two weeks of April 2025?

Will XAUUSD breach $3232 or $3030 before 14 April 2025? Piyush Ratnu Gold Market Research: Check XAUUSD price Projection by Piyush Ratnu Gold Market Research published on 01 April 2025 here.

Result and review:

XAUUSD reversed from $2969-3069-3169-3269-3369 | CMP $3408

Gold price (XAU/USD) sticks to its positive bias comfortably above the $3,200 mark through the Asian session on Tuesday and remains close to the all-time peak touched the previous day. The growing market concerns about the escalating US-China trade war and its impact on the global economy continue to underpin demand for the safe-haven bullion. Moreover, rising bets for more aggressive policy easing by the Federal Reserve (Fed) and the underlying bearish sentiment surrounding the US Dollar (USD) turn out to be other factors benefiting the non-yielding yellow metal.

- Concerns about the potential economic fallout from US President Donald Trump’s aggressive trade policies continue to underpin safe-haven assets. Meanwhile, China increased tariffs on US imports to 125% on Friday in retaliation to Trump’s decision to raise duties on Chinese goods to an unprecedented 145%. This keeps the Gold price close to the all-time peak touched on Monday.

- Traders now look to Tuesday’s US economic docket, featuring the release of the Empire State Manufacturing Index. This, along with trade-related developments, might influence the USD and provide some impetus to the commodity. The focus, however, remains on Fed Chair Jerome Powell’s speech on Wednesday, which might offer cues about the future rate-cut path and drive the non-yielding yellow metal.

Key factors responsible for impacting XAUUSD Price:

- The US bond market seems to have stabilized after a brutal last week as the benchmark 10-year US Treasury bond yields fell about 10 basis points (bps), reversing a part of the recent 50 bps relentless rally.

- Investors take a breather, pausing the rotation out of the US assets, digesting the ongoing back-and-forth on US President Donald Trump’s tariff headlines while bracing for the earnings results from top American banks and tech companies.

- The risk reset allows the US Dollar (USD) to find its feet following the massive sell-off to three-year troughs.

- US President Donald Trump said on Monday he was considering modifying the 25% tariffs imposed on foreign auto and auto parts imports from Mexico, Canada and other places, noting that car companies “need a little bit of time because they’re going to make ’em here.”

- This comes after the Trump administration announced exemptions on some technology imports, including smartphones, computers, laptops and disc drives, from reciprocal tariffs imposed on China.

- Markets continue to remain wary amid uncertainty over Trump’s trade policies, and his constant backpedalling on tariffs raises worries over the global economic outlook, keeping the sentiment around the traditional Gold price underpinned.

- Increased dovish bets surrounding the US Federal Reserve (Fed) interest rate cuts also continue to act as a tailwind for the non-yielding Gold price. Fed Governor Christopher Waller said Monday that “the Trump administration’s tariff policies are a major shock to the US economy that could lead the Fed to cut rates to head off recession even if inflation remains high,” per Reuters.

- Gold price also draws support from increased investment flows into China’s physically backed gold exchange-traded funds (ETFs) so far this month, according to the latest data published by the World Gold Council (WGC).

- Investors also remain unnerved ahead of China’s first-quarter Gross Domestic Product (GDP) data release on Wednesday, which could significantly impact the broader market sentiment and the Gold price action.

Connect for an appointment at T.ME/PIYUSHRATNUOFFICIAL

Watch LIVE TRADING FEED

Real Time Trades by our proprietary trading algorithm at https://t.me/PiyushRatnu

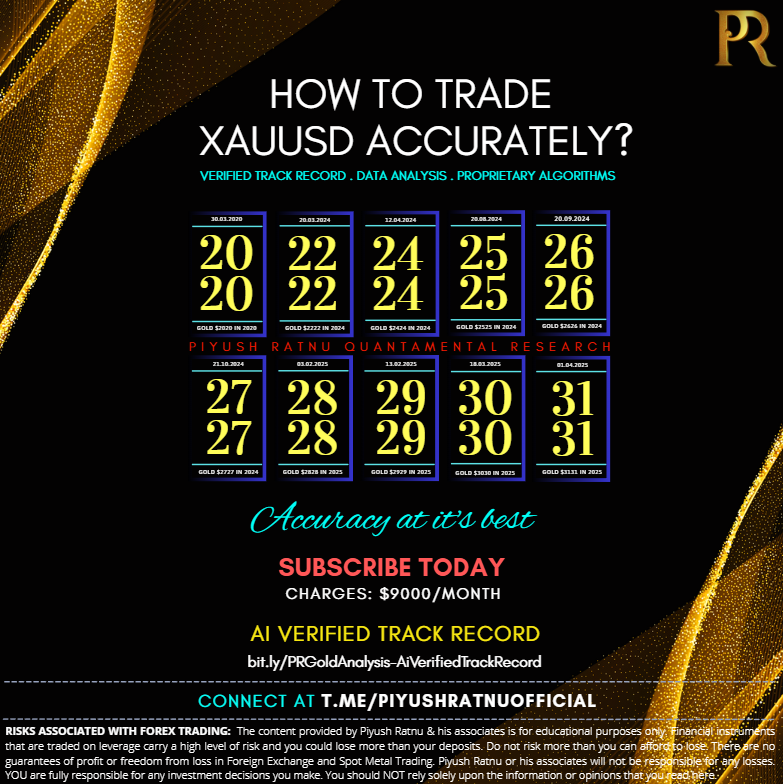

Who projected XAUUSD Spot Gold Price target $3131/3232/3333 in 2025/2026?

Click to Check Ai Verified Track Record of Piyush Ratnu Gold Market Research