How to trade XAUUSD Spot Gold on Non Farm Payrolls Day NFP in January 2025?

Factors responsible for rising GOLD XAUUSD Price in January 2025.

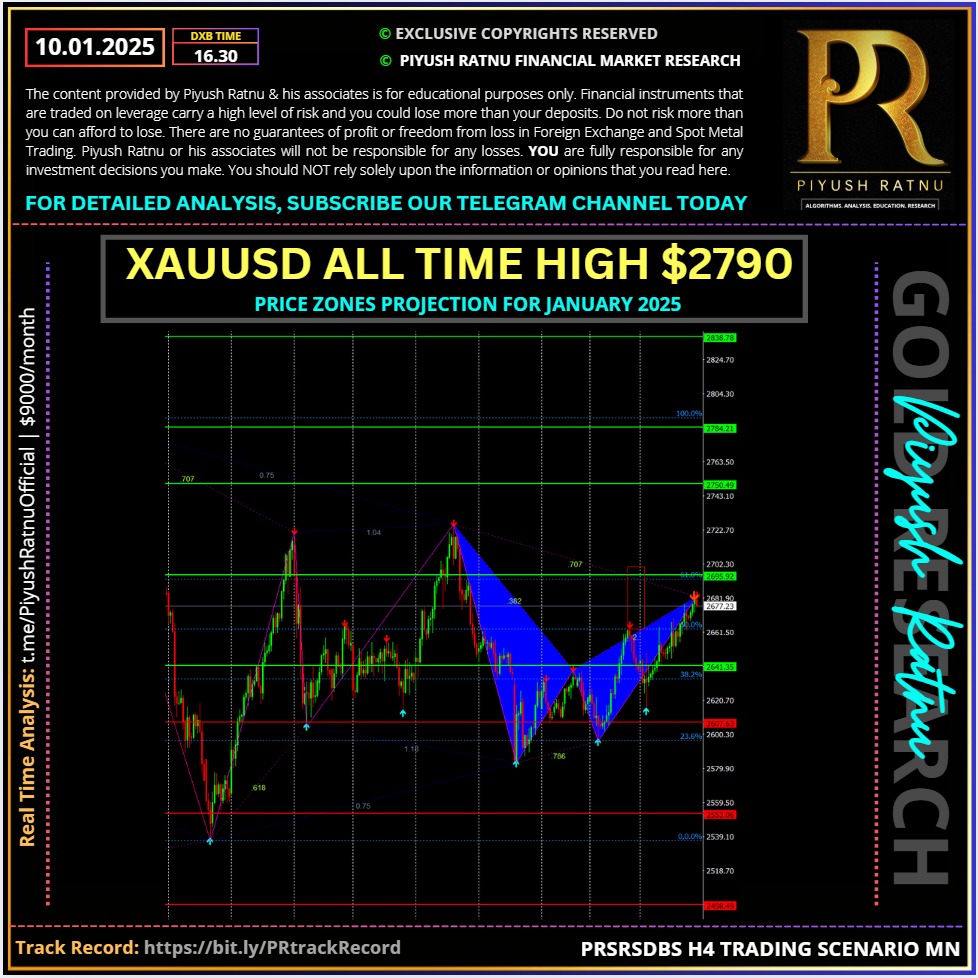

Spot Gold is up for a third consecutive day, hitting $2,682 a troy ounce during European trading hours, holding nearby in a thinned American session after a United States (US) holiday. Speculative interest maintained the cautious stance despite a lighter macroeconomic calendar, resulting in generally stronger safe-haven assets. XAU/USD trades comfortable above $2,669 zone, moving one step closer to record highs in the $2,707/2727 price zone.

Gold price continues to draw support from increased safe-haven demand, which overshadows the persistent strength in the US Dollar (USD) and the US Treasury bond yields. Inflation fears have been stoked due to the potential impact of the incoming immigration and trade policies by US President-elect Donald Trump, boosting the appeal of Gold price as an inflation hedge and a traditional safe-haven asset.

Markets also remain risk-averse and refrain from placing any directional bets on the bright metal amid a typical pre-NFP caution. The US economy is expected to create 160K jobs in December after adding 227K jobs in November. The Unemployment Rate and the Average Hourly Earnings will likely remain steady at 4.2% and 4%, respectively, in the reported period.

Markets also remain risk-averse and refrain from placing any directional bets on the bright metal amid a typical pre-NFP caution. The US economy is expected to create 160K jobs in December after adding 227K jobs in November. The Unemployment Rate and the Average Hourly Earnings will likely remain steady at 4.2% and 4%, respectively, in the reported period.

A weaker-than-expected headline NFP print is likely to bring back expectations of aggressive Fed rate cuts on the table, triggering a broad US Dollar correction while adding extra legs to the ongoing Gold price uptrend. Conversely, an upside surprise in the NFP and wage inflation data could ramp up hawkish Fed bets, spelling doom for Gold price.

Markets could also resort to profit-taking on Gold longs ahead of next week’s US Consumer Price Index (CPI) data. However, speculations surrounding Trump’s policies could continue to drive markets, acting as a major tailwind for Gold price heading into the weekend.

Gold is at a key juncture, testing a crucial resistance level just ahead of the NFP data release. It needs to close above the trendline zone of 2,678-2,680 to continue its recovery. While technical indicators like the RSI and stochastic suggest continued buying interest, they’re also nearing overbought territory, which could limit further gains in the short term.

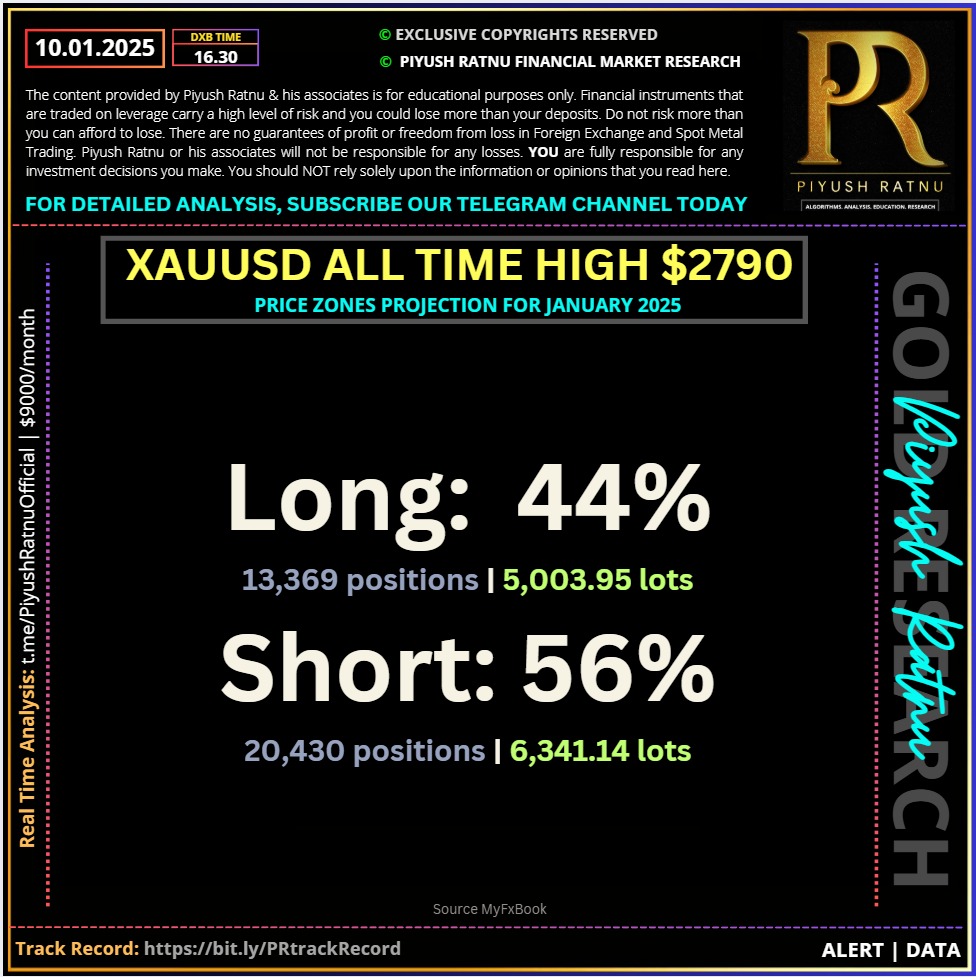

Traders should also monitor US Treasury yields and the US Dollar Index (DXY). The DXY has risen to 109.18, while real yields have increased slightly. Despite this, gold has maintained strength, showing strong investor demand.

The World Gold Council reported inflows into gold ETFs for the first time in four years. This indicates strong institutional demand. These factors suggest a positive outlook for gold, but caution is needed near resistance levels.

🟢Crucial Price Zones:

🔺SZ $2707/2727/2747/2757

🔻BZ $2646/2636/2626/2600

—————————————————————————

Trade with Confidence with Piyush Ratnu Gold Market Research

Subscribe one of the most accurate analysis in the industry: Spot Gold Analysis by Piyush Ratnu powered by 90+ technical and fundamental parameters with a verified and audited track record.

Current Trading Profit Status: 112%

Highest Drawdown Faced YTD: 8%

Highest profit/month booked: 42%

Highest loss/month booked: 24%

Check Trading Performance at:

https://www.myfxbook.com/members/PiyushRatnu

Core Focus: #XAUUSD | Spot #Gold

Platform: MT4 MT5

Trading Mode: Manual + Algorithm | Automated: both available

Auto-Copy Trading: Available | Plug and Play Solution

Live Trading Feed Available | Real Time Analysis Available

—————————————————————————-

Connect for an appointment at T.ME/PIYUSHRATNUOFFICIAL