How to Trade XAUUSD Spot Gold on Interest Rate Decision and FED FOMC Day?

Gold awaits US CPI and Fed, however I am waiting for CHINA to resume BUYING GOLD, which will push Gold price another $200+ in less than 45 days from the date of announcement/proof of buying.

🟢XAUUSD: H1V100 or D1AS1 ahead | PRSRBS Algorithm

After tomorrow:

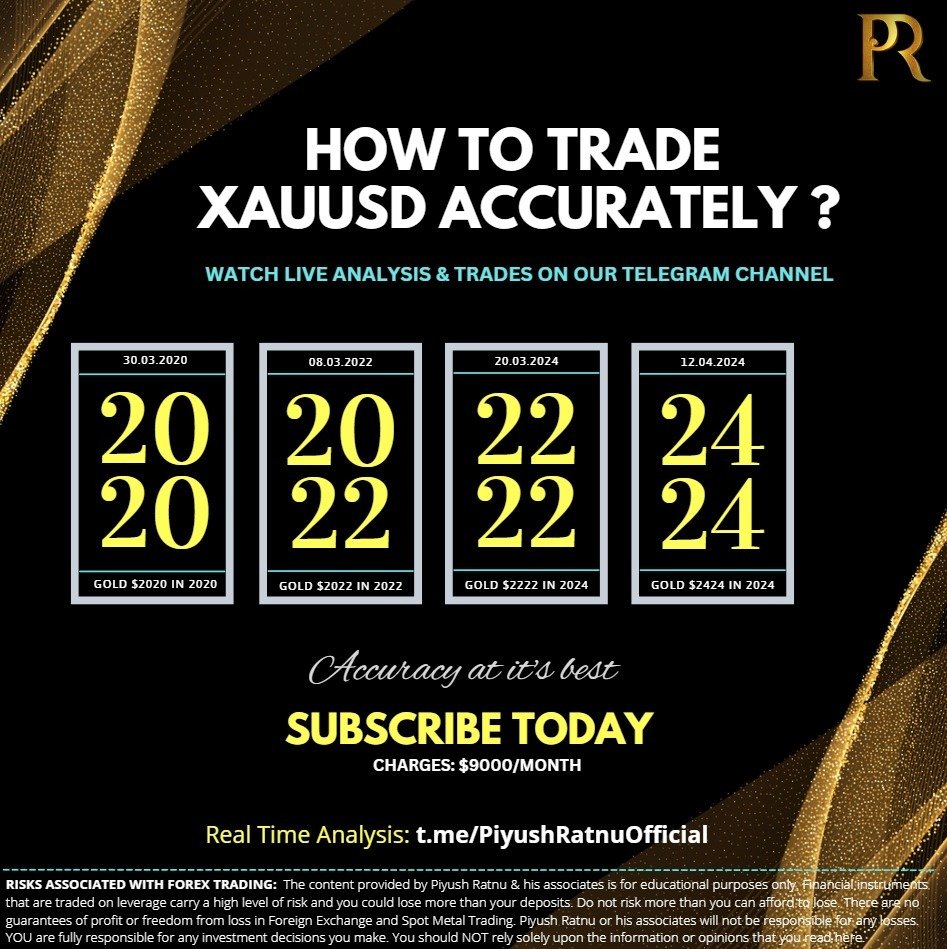

🔻 IRC (-) – statements and policy might push XAUUSD to: $2288/2266/2244/2222/2185(China might start buying below $2222)

🔺 IRC(-) + statements and policy might push XAUUSD to: $2369/2385/2407/2424/2442

🔻Gold price attempted a 🙀dead cat bounce on Monday, helped by a pullback in the US Dollar across its major rivals, as risk tone improved in the latter part of the day.

🔺US stocks witnessed a positive close after a day of despair in Europe due to renewed political tensions.

🔻 The Euro was sold off into mounting political tension in the Euro area, especially after French President Emmanuel Macron announced snap elections on Sunday, dissolving parliament after exit polls showed his alliance suffered a heavy defeat in European elections to Marine Le Pen’s far-right National Rally (RN) party.

Markets are now pricing in a 46% probability that the US Federal Reserve (Fed) will lower rates by 25 basis points in September, slightly up from 43% seen following the NFP data release, the CME Group’s FedWatch Tool showed Tuesday.

All eyes now turn toward Wednesday’s big events – the US Consumer Price Index (CPI) data and the Fed policy announcements, which will significantly impact the value of the US Dollar and determine the next directional move for Gold price.

Meanwhile, Gold price fails to take advantage of the persisting risk-on mood after China and 🔻 Hong Kong stock markets reopened on Tuesday deep in the red, catching up with the EU political uncertainty.

It remains to be seen how far Gold price can extend the weakness, induced by delayed Fed rate cut bets and China stalling its Gold reserves purchases after an 18-month long stretch.

David Tait, CEO of the World Gold Council (WGC), told Reuters on the sidelines of the Asia Pacific Precious Metals Conference in Singapore, “China’s data did show a pause. (But) they are just waiting and watching. If prices correct to the ⚠️ $2,200 per ounce level, they will resume again.”

How to trade XAUUSD on Interest Rate Decision and FED Day | Analysis by Piyush Ratnu

byu/Piyushratnu inprgoldanalysis