As indicated repeatedly since 12 Aug 2020.Gold re created history by crashing on 09.08.2021, last year Gold crashed $150+ on 08.08.2020.Market cycles play a crucial role in price movements in addition to fundamentals and technicals. Fundamentals make technicals, technicals never make fundamentals, however by observing technicals you can trace the possibility of a planted fundamental to prove or justify the so called market correction or price consolidation. In such cases price range play a major role for a trader to enter in right direction at right price range and right time.

Fundamentals make technicals, technicals never make fundamentals, however by observing technicals you can trace the possibility of a planted fundamental to prove or justify the so called market correction or price consolidation. In such cases price range play a major role for a trader to enter in right direction at right price range and right time.

2020

1966

1947

1926

1907

1888

1866

1818

1777

1717

1666 (1685 year low)

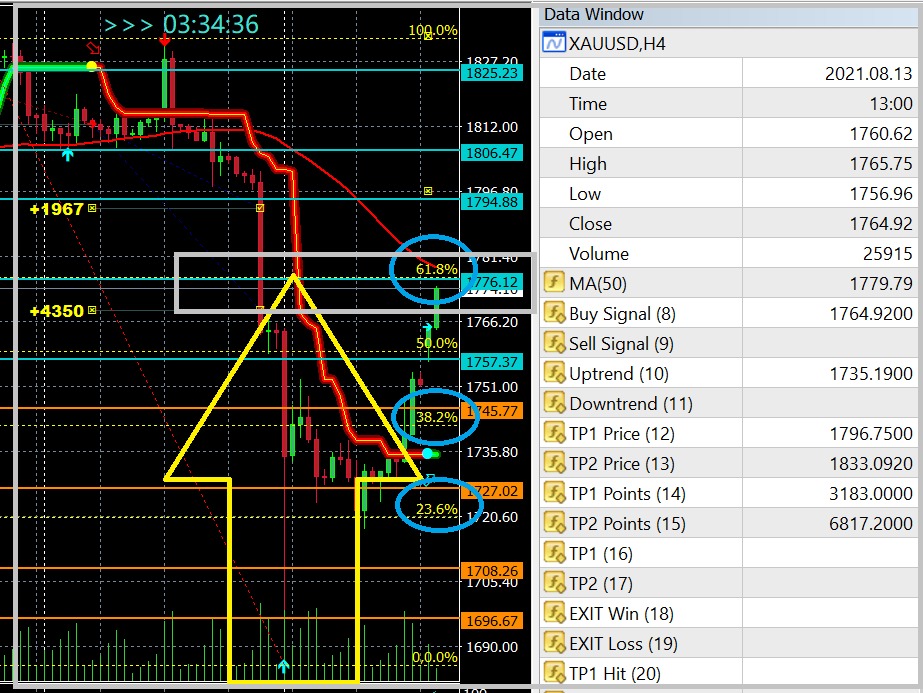

The above numbers were highlighted by me since 12 Aug 2020, these numbers are acting as tough resistance and support levels, and the same was proved once again on 09.08.2021 when Gold was in crash mode since ADP data published on 04.08.2021: 1832.

The price crash was observed from 1832 to 1684 (on some Platforms lowest price was observed as 1650/1630 price zone), some brokers tried to capitalise the crash to achieve higher revenue in B Booking and stop loss hunting.

I feel 70% of accounts were not ready to hold the losses at a price range of 1680, because general and generic sentiment on NFP is a price movement or $15/20, at 1810 traders expected a crash till 1790/1785 zone. However on NFP data Gold crashed till 1757 zone in four hours on Friday, and on Monday Gold crashed more 80 dollars and proved once again that Gold is the King of volatility by achieving this year’s low 1685 and recovering back 50% in next 12 hours.

Concluding the data:

Those who trade Gold, always be ready for a price movement of 5000/10000/25000 pips in a week, only then you can survive such market cycles based price movements and crashes.

Always believe in safeguarding your principle rather than risking the same to make some temporary profits.

We will resume trading from 18 Aug 2021 as announced earlier too.

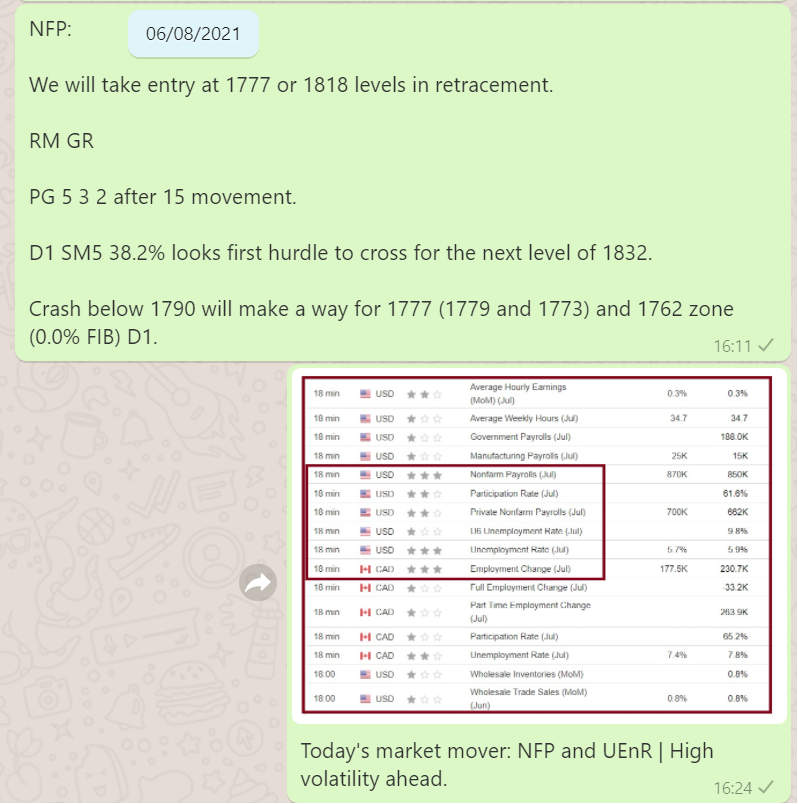

As alerted at 16.08 hours

Before NFP

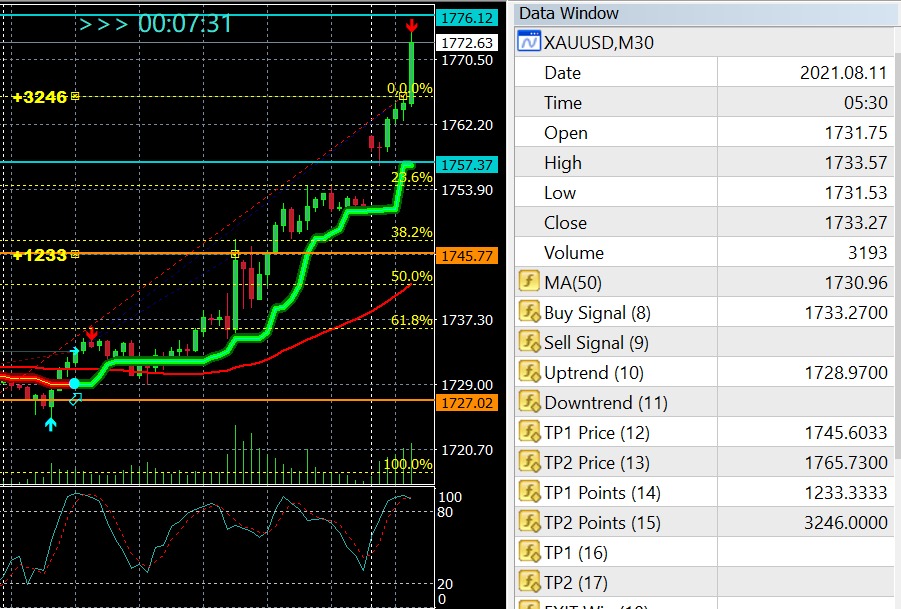

I suggested BUY entries from 1777, price gap of 15 and further gap of 5.3.2 dollars.

1762 was the ultimate target of Gold crossed 1790, and the low for Friday was 1757.

We entered from 1781 with price gaps in RM and GR and closed all trades in net average at 1763.90 after gold recovered from 1757 zone till 1766.

On NFP day

After NFP data

At 20.35 hours

I alerted in advance the next price target can be 1736/1717/1666

Reason:

Senate meeting

Infra Bill optimism

Stimulus spending

Monetary policy discussion

Tapering optimism

Dollar strength

COVID fears

Strong NFP data

Interest rate related discussion

Rising yields

Rising stocks and indices

On Monday 09.08.2021

Gold opened at 1757 and crashed till 1684 price in three hours, and recovered back till 1728 price zone.

Yes Gold crashed only till 1685, and a rally below 1666 would have opened the gates to 1600 and 1555 price levels.

06 August POST NFP DATA Analysis:

So, keeping safety first, we entered SR 1717 and made an exit at 1723/1726 SR zone.

Accuracy proven once again. As per analysis published on 06 August 2021, I had mentioned RT of 1777 before 18 August, 2021. However 1777 price range was achieved on 13 August 2021 at 18.30 hours.

Those who believe in my analysis, am sure made handsome profits.

And those who chose not to keep price gaps, am sure lost their entire principle.

Money Management

Risk Management

Is the key to success in Trading.

0.01 is my first step

Always!

Wish you luck,

See you all next week on the new set of trading.

Will be trading more from 18 Aug 2021 as I believe more market correction till 18 Aug, followed by Jackson Hole meeting.

Another movement of $45/80 is expected.