🟢What is Non Farm Payrolls Data?

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile.

The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months’ reviews and the Unemployment Rate are as relevant as the headline figure. The market’s reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

🟢Next release: Fri Sep 06, 2024 16:30

Frequency: Monthly

Consensus: 160K

Previous: 114K

Source: US Bureau of Labor Statistics

🟢Why it matters to traders?

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers.

🟢Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

🟢What is the forecast for United States Nonfarm Payrolls?

The consensus for the next United States Nonfarm Payrolls is 160, and the last deviation was -0.97406.

🟢NFP Historical Data:

Date—————-Actual—— Dev——- Cons

08/02/2024 (Jul) 114 -0.97 175

07/05/2024 (Jun) 179 0.20 190

06/07/2024 (May) 216 1.10 185

05/03/2024 (Apr) 108 -1.28 243

04/05/2024 (Mar) 310 1.52 200

03/08/2024 (Feb) 236 0.92 200

02/02/2024 (Jan) 256 2.63 180

01/05/2024 (Dec) 290 0.66 170

🟢NFP Data today:

16:30 Payrolls (Aug)

Actual Forecast Previous

——— 164K 114K

#PiyushRatnu #Gold #XAUUSD #Forex #Trading #NFP

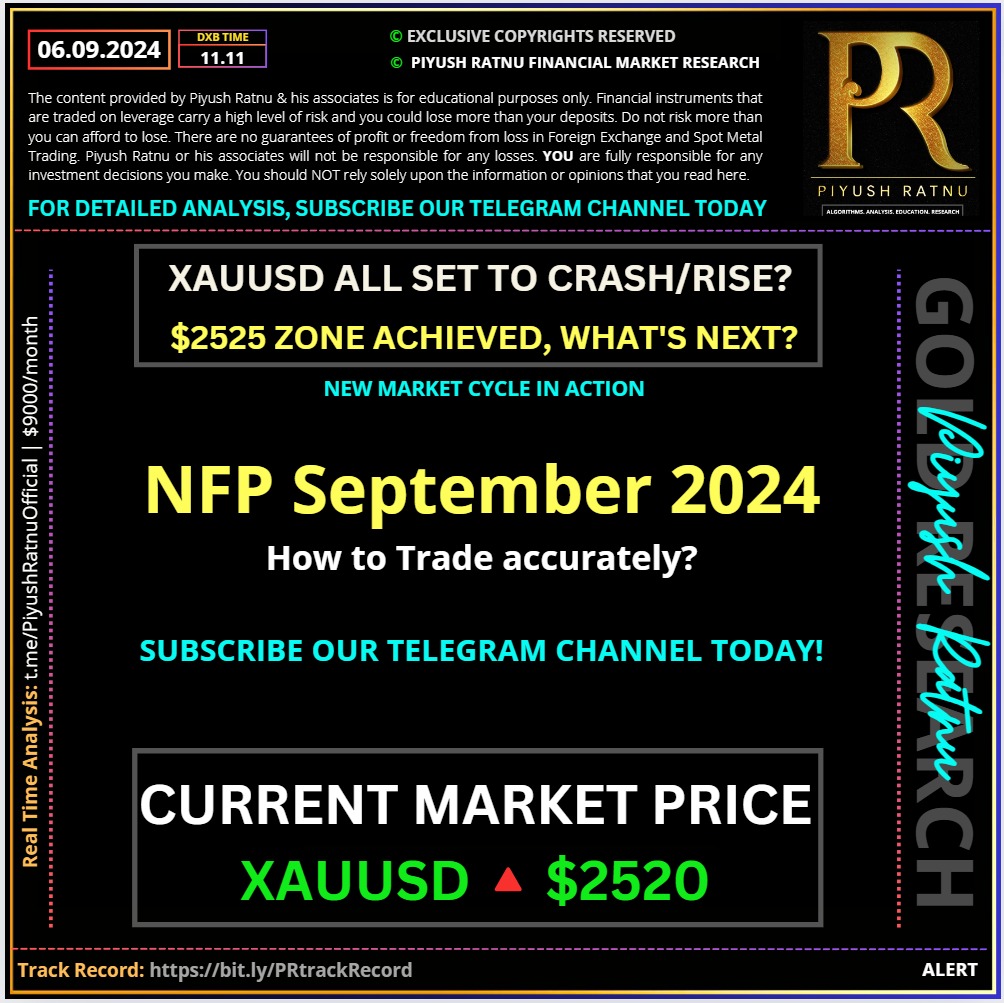

Gold price (XAU/USD) extends its sideways consolidative price move ($2485-2525) below the weekly top touched the previous day as traders opt to wait on the sidelines ahead of the crucial US Nonfarm Payrolls (NFP) report later during the North American session. In the meantime, rising bets for a larger interest rate cut by the Federal Reserve (Fed) in September exert downward pressure on the US Dollar (USD) for the third straight day and offer some support to the non-yielding yellow metal.

Gold price (XAU/USD) extends its sideways consolidative price move ($2485-2525) below the weekly top touched the previous day as traders opt to wait on the sidelines ahead of the crucial US Nonfarm Payrolls (NFP) report later during the North American session. In the meantime, rising bets for a larger interest rate cut by the Federal Reserve (Fed) in September exert downward pressure on the US Dollar (USD) for the third straight day and offer some support to the non-yielding yellow metal.

Meanwhile, a mixed bag of employment data released from the United States (US) this week suggested that the labor market was losing steam and fueled concerns about the health of the economy.

This, along with persistent geopolitical tensions, tempers investors’ appetite for riskier assets and further acts as a tailwind for the safe-haven Gold price. That said, it will be prudent to wait for some follow-through buying before positioning for an extension of a two-day-old uptrend.

🆘 Key Factors impacting/might impact XAUUSD Price:

• The ADP National Employment Report published on Thursday showed that US private-sector employment rose 99,000 in August, marking the smallest gain since January 2021.

• The reading was well below the market expectation of 145,000 and was accompanied by a downward revision of the previous month’s print to 111,000 from 122,000 originally estimated.

• This comes on top of a report on Wednesday showing that job openings fell to 7.673 million, or a three-and-a-half-year low in July and provided further evidence of a deteriorating labor market.

• The Institute for Supply Management’s (ISM) Services PMI inched up from 51.4 to 51.5 in August, while the Prices Paid Index rose to 57.3 from 57 and the Employment Index declined to 50.2 from 51.1.

• Separately, the US Department of Labor (DoL) reported that Initial Jobless Claims declined more than anticipated, to 227K in the week ending August 31 from the previous weekly figure of 232K.

• San Francisco Fed President Mary Daly said that the US central bank must calibrate policy to the evolving economy and cut policy rates because inflation is falling and the economy is slowing.

• Chicago Fed President Austan Goolsbee said on Friday that the longer-run trend of the labor market and inflation data justify easing interest-rate policy soon and then steadily over the next year.

• According to the CME Group’s FedWatch Tool, the markets are pricing in a 40% chance that the Fed will lower borrowing costs by 50 basis points at the September 17-18 monetary policy meeting.

• Dovish expectations, meanwhile, keep the US Treasury bond yields depressed and the US Dollar bulls on the defensive, which, in turn, should act as a tailwind for the non-yielding gold price.

• The market focus now shifts to the crucial US Nonfarm Payrolls (NFP) report, which is expected to show that the economy added 160K jobs in August and the Unemployment Rate ticked lower to 4.2%.

Investors should also consider that while the mainstream seems to think the Federal Reserve has managed to beat inflation back, in reality, the central bank has surrendered to inflation and is set to ramp up inflationary monetary policy.

In fact, government officials and central bankers don’t want to beat inflation. They want inflation. It is the stated policy.

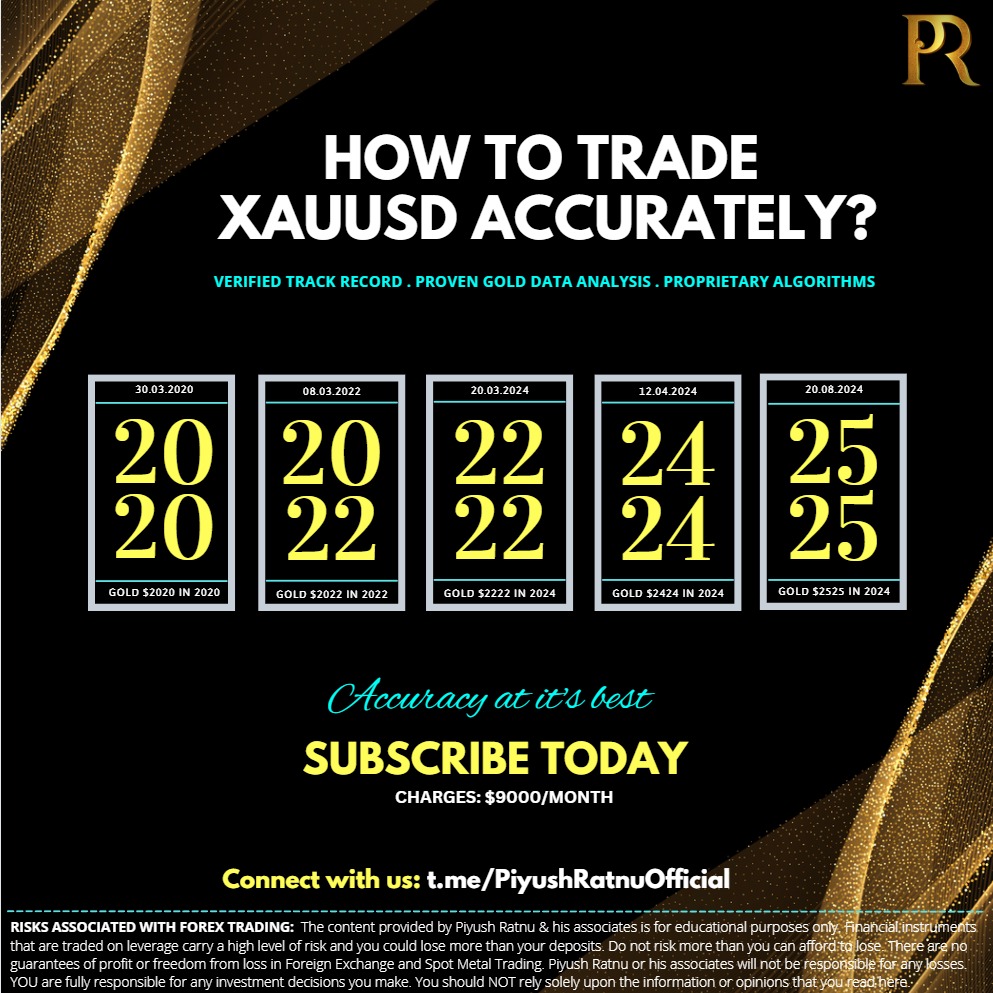

🟢It will be wise to note the past 5 years pattern indicated by us in our analysis dated 30 August 2024.🟢

As projected on 02 September 2024: Analysis for NFP September 2024: Check here.

🆘 NFP September 2024: XAUUSD: 🔺$2569/2585 or 🔻2385/2369?

Following a quiet start to the week, Gold (XAU/USD) briefly dipped below $2,500 on a broad US Dollar (USD) recovery. Although the precious metal struggled to gather bullish momentum, it managed to stabilize above $2,500 ahead of next week’s key macroeconomic data releases from the US.

After ending the previous week on a bullish note on Federal Reserve (Fed) Chairman Jerome Powell’s dovish remarks at the Jackson Hole Economic Symposium, Gold registered small gains on Monday and Tuesday. In the absence of fundamental drivers, however, the yellow metal’s upside remained limited.

🟢Financial markets in the US will remain closed in observance of the Labor Day holiday on Monday.

On Tuesday, the ISM Manufacturing Purchasing Managers Index (PMI) for August will be featured in the US economic docket. Investors expect the headline PMI to edge higher to 47.8 from 46.8 in July. A reading above 50, which would suggest that the business activity in the manufacturing sector recovered back into the expansion territory, could provide a boost to the USD with the immediate reaction and weigh on XAU/USD.

On Thursday, the ADP Employment Change and the ISM Services PMI data from the US will be looked upon for fresh impetus. The market reaction to these data is likely to be straightforward and short-lasting, with positive surprises supporting the USD and negative prints hurting the currency, ahead of Friday’s highly-anticipated August jobs report.

Nonfarm Payrolls (NFP) in the US are forecast to rise by 163,000 in August following July’s disappointing 114,000 increase. The Unemployment Rate is expected to tick down to 4.2% from 4.3% and the monthly wage inflation, as measured by the change in the Average Hourly Earnings, is seen rising 0.3%.

Fed policymakers made it clear following the July policy meeting that they are shifting their focus to the labor market on growing signs of worsening conditions. Hence, even a small divergence from the market consensus in the NFP reading could 🔻🔺trigger a big reaction in Gold.

🔻A better-than-forecast print could cause investors to refrain from pricing in an aggressive Fed policy loosening and fuel a strong rebound in the USD, weighing on Gold.

According to the CME FedWatch Tool, markets currently see a nearly 70% probability of the Fed lowering the policy rate by a total of at least 100 basis points by year-end.

🔺On the other hand, a second straight weak NFP print could open the door for another leg lower in the US Treasury bond yields and the USD, allowing XAU/USD to push higher heading into the weekend.

According to Bloomberg, Gold ETF holdings rose by 15 tonnes last week to the highest level in six months. Speculative interest is particularly strong. The net long position of speculative investors rose to around 193,000 contracts in the week to August 20th, at the same time as Gold hit an all-time high, its highest level in almost four and a half years.

Much of the positive news for Gold may therefore already have been priced in.

🟢It will be wise to note the past 5 years pattern indicated by us in our analysis dated 30 August 2024.🟢