How to trade XAUUSD/Spot Gold accurately on NonFarm Payrolls Day 07 February 2025?

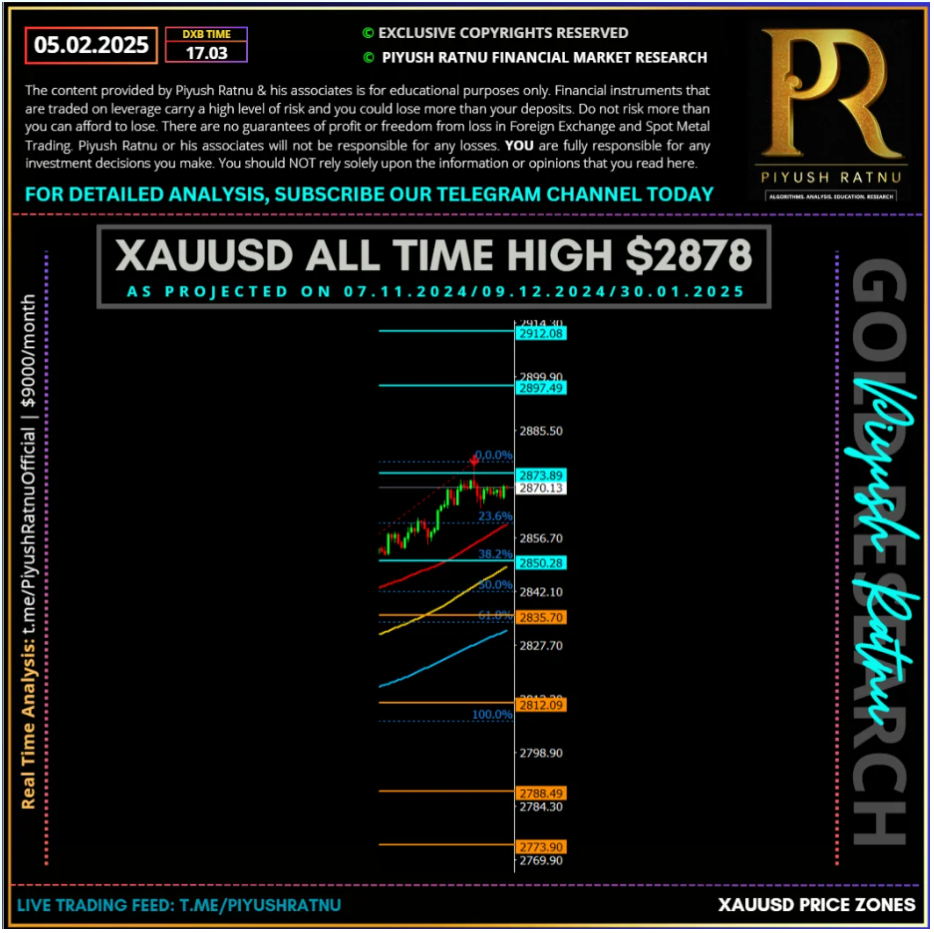

XAUUSD crashed from $2880-2834 (S2) zone on 06 February. Selling highs above R1 and buying lows gave us a neat exit in our trade sets. Yesterday morning I had projected:

XAUUSD under PPZ

Co-relations alert: USDJPY (+) 800

Possible Impact on Gold: (-) $20/25 from $2872.

Target price as per current co-relation: $2848/2838 zone. XAUUSD crashed till $2834 after economic data was published, inspite of a weaker USD Data. XAUUSD retraced from $2834-2870 today morning, making it an idea trade set at support zone projected by us yesterday and on 05 February 2025.

Today, Gold price (XAU/USD) sticks to its intraday gains through the Asian session on Friday and remains well within striking distance of the all-time peak touched earlier this week. Investors remain concerned about escalating US-China trade tensions and the potential economic fallout from US President Donald Trump’s aggressive trade policies, which continue to underpin the safe-haven bullion.

Today, Gold price (XAU/USD) sticks to its intraday gains through the Asian session on Friday and remains well within striking distance of the all-time peak touched earlier this week. Investors remain concerned about escalating US-China trade tensions and the potential economic fallout from US President Donald Trump’s aggressive trade policies, which continue to underpin the safe-haven bullion.

Sanctions on ICC

President Donald Trump authorized sanctions on International Criminal Court officials who investigate the US and its allies, reviving a policy from his first term against an organization that he’s cast as a threat to American sovereignty.

Trump signed the executive order on Thursday, according to a White House official. He was also expected to sign other directives creating a White House faith office and targeting what he said was anti-Christian bias in the federal government — all moves designed to please his conservative base.

The order would deny visas and block access to the funds of ICC employees and their family members who assist in probes related to US citizens and American allies. It comes in response to the court’s issuance of arrest warrants against Israeli Prime Minister Benjamin Netanyahu and the nation’s former defense minister over the military campaign in Gaza.

The White House said in a statement the court drew “a shameful moral equivalency” between Israel’s leaders and Hamas, designated a terrorist group by the US, which launched the deadly attack on Oct. 7, 2023 that sparked the fighting. It also said the ICC has “broad, unaccountable powers that pose a significant threat to United States sovereignty and our constitutional protections.”

Iran Sanctions

President Donald Trump’s maiden sanctions package targeting a handful of vessels carrying Iranian oil stopped short of the “maximum pressure” campaign his administration had pledged, according to shippers and analysts.

The move, announced Thursday, affected one very-large crude carrier and two Aframaxes that the Treasury Department said helped move Iranian oil to China. It also targeted several entities and individuals across different countries that were involved in the trade, which was on behalf of Tehran’s Armed Forces General Staff and its sanctioned front company, Sepehr Energy Jahan Nama Pars.

Gaza Takeover

President Donald Trump reasserted his vision for a “spectacular” development in the Gaza Strip, led by the US and without Palestinians, in a social media post early Thursday.

Trump wrote on his Truth Social platform that Israel would hand over control of Gaza to the US “at the conclusion of fighting,” and that no US soldiers would be needed to execute his plan. The president first floated the idea after a Tuesday meeting with Israeli Prime Minister Benjamin Netanyahu, surprising almost everyone and drawing rebukes from many Middle Eastern countries. Aides soon began to downplay his plan, insisting Trump was not committing US troops to the region or promising American money for Gaza’s reconstruction. The Palestinian Authority, which controls parts of the West Bank though not Gaza, said it would oppose “all calls for the displacement of the Palestinian people from their homeland.”

DOGE by Trump, Run by Musk | Department of Government Efficiency

Read more at https://www.bbc.com/news/articles/c23vkd57471o

Created by President Donald Trump and run by tech-billionaire Elon Musk, the Department of Government Efficiency, or DOGE, has consistently been in the headlines for the major changes it is making to the federal government.

Musk has promised that he would cut trillions off of the federal budget. During a Trump rally at Madison Square Garden in New York City on Oct. 27, Musk said he could slash the federal budget by trillions.

Earlier this year, Musk told political strategist Mark Penn that the figure of $2 trillion was a “best-case outcome,” instead suggesting there is a “good shot” at cutting close to $1 trillion instead. As DOGE continues to make cuts, several Democrats have criticized the actions of Musk and the agency.

XAUUSD to hit $2929/2949 or $2777/2747 in next 10 trading days? NFP Data to be released today.

All eyes now remain on the US labor market data, which will likely provide fresh insights on the scope and timing of the US Federal Reserve (Fed) interest rate cuts this year. The data is also likely to have a significant impact on the US Dollar (USD) and the US Treasury bond yields, eventually influencing the near-term direction in Gold price.

The US economy is seen creating 170,000 jobs in January after recording a stellar job gain of 256,000 in December. The Unemployment Rate is likely to remain at 4.1% in the same period. Meanwhile, Average Hourly Earnings are set to rise by 3.8% in January, compared to a 3.9% increase previously.

What is NonFarm payrolls Data?

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months’ reviews and the Unemployment Rate are as relevant as the headline figure. The market’s reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Key Highlights in last 7 days impacting XAUUSD/Spot Gold Prices:

- China announced tariffs on some US goods in retaliation to US President Donald Trump’s 10% levy on Chinese imports. This marks a new trade war between the world’s top two economies and continues to underpin the safe-haven Gold price.

- On the economic data front, the US Department of Labor (DoL) reported on Thursday that the number of US citizens filing new applications for unemployment insurance rose to 219K for the week ending February 1, from the previous week’s revised tally of 208K.

- US Treasury Secretary Scott Bessent said on Thursday that the Trump administration was not particularly concerned about the Federal Reserve’s trajectory on interest rates and that the focus is on bringing down 10-year Treasury yields.

- The yield on the benchmark 10-year US government bond fell to its lowest level since December 12 earlier this week amid bets that the Federal Reserve will cut rates twice by the end of 2025, further benefitting the non-yielding yellow metal.

- Chicago Fed President Austan Goolsbee noted that the appearance that inflation has stalled is largely due to base effects and that the central bank needs to be mindful of overheating and deterioration, but things are largely going well.

- Dallas Fed President Lorie Logan said that inflation progress has been significant, but the US labor market remains far too firm to push the central bank into rate cuts any time soon. This, however, does little to impress the US Dollar bulls.

- Market participants now look forward to the US Nonfarm Payrolls report, which is expected to show that the economy added 170K jobs in January compared to 256K in the previous month and the Unemployment rate held steady at 4.1%.

- The crucial data will influence market expectations about the Fed’s interest rate outlook, which, in turn, should play a key role in driving the USD demand in the near term and determining the next leg of a directional move for the XAU/USD.

How can NFP Data impact XAUUSD Price:

A smaller-than-expected increase in the headline NFP figure and slowing wage growth could indicate loosening labor market conditions in the US, reviving dovish Fed expectations and driving Gold price to fresh all-time highs close to the $2,900 threshold.

In case of an upside surprise, markets will double down on the recent hawkish hold decision by the Fed, dialling down expectations of two Fed rate cuts this year. The US Dollar will likely receive the much-needed respite from a potentially strong US payrolls data, initiating a corrective decline in Gold price.

Crucial Price Zones: Kindly refer our Telegram Channel for Buying and Selling Zones.

Crucial Price Zones: Kindly refer our Telegram Channel for Buying and Selling Zones.

Trade with Confidence with Piyush Ratnu Gold Market Research

Subscribe one of the most accurate analysis in the industry: Spot Gold Analysis by Piyush Ratnu powered by 90+ technical and fundamental parameters with a verified and audited track record.

Current Trading Profit Status: 142%

Highest Drawdown Faced YTD: 16%

Highest profit/month booked: 42%

Highest loss/month booked: 24%

Check Trading Performance at:

https://www.myfxbook.com/members/PiyushRatnu

Core Focus: #XAUUSD | Spot #Gold

Platform: MT4 MT5

Trading Mode: Manual + Algorithm | Automated: both available

Auto-Copy Trading: Available | Plug and Play Solution

Live Trading Feed Available | Real Time Analysis Available

Connect for an appointment at T.ME/PIYUSHRATNUOFFICIAL

Watch LIVE TRADING FEED

Real Time Trades by our proprietary trading algorithms at https://t.me/PiyushRatnu

How to trade XAUUSD/Spot Gold on and after NonFarm Payrolls Data Day?