Gold (XAU/USD) surged higher in the second half of the week and reached a new record high above $2,585, boosted by growing expectations for a large Federal Reserve (Fed) rate cut at the upcoming policy meeting. The Fed will also release the revised Summary of Economic Projections (SEP), which could offer important clues on the US central bank’s rate outlook and drive the precious metal’s valuation next week.

Following the sharp decline seen at the end of the previous week, Gold recovered back above $2,500 on Monday. In the absence of high-tier macroeconomic data releases, falling US Treasury bond yields weighed on the US Dollar (USD), allowing XAU/USD to continue to edge higher on Tuesday.

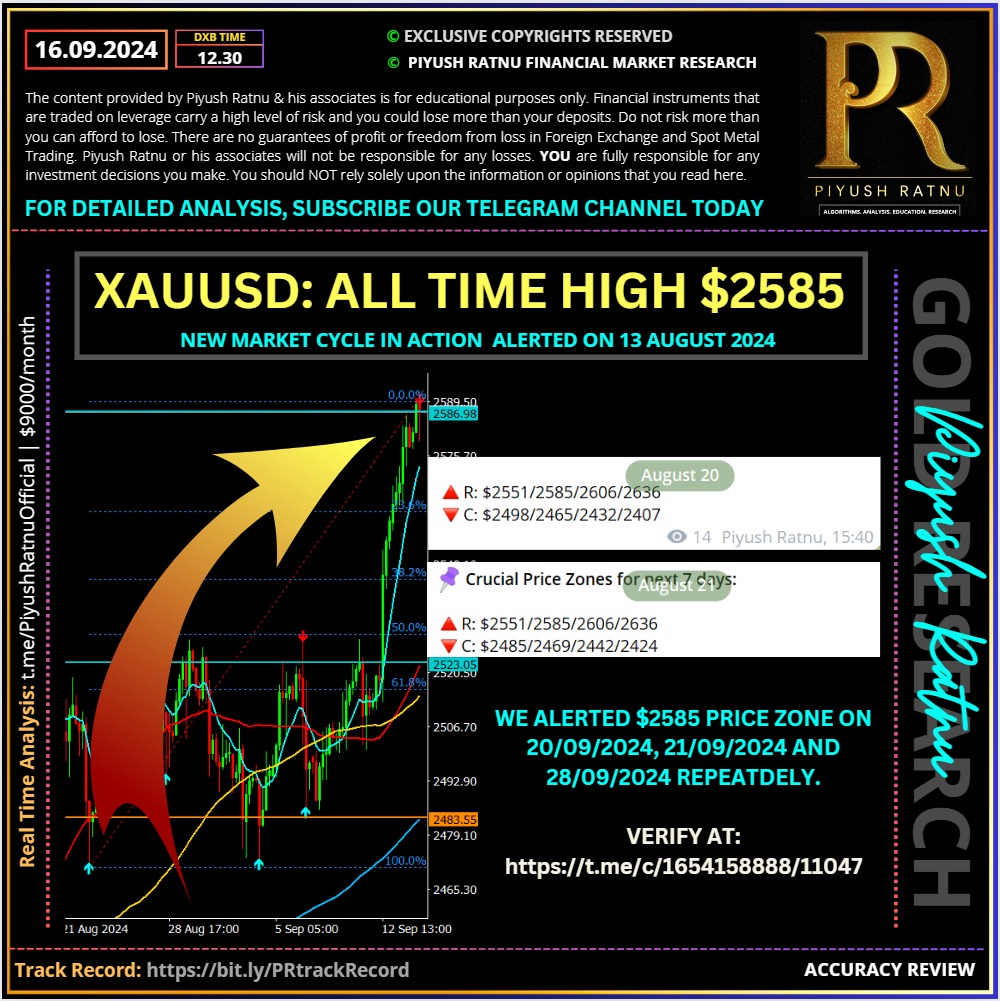

XAUUSD breached the mark of $2585 on 13 September 2024. We had projected $2525, $2552, $2585 zones on

20 August, 21 August and 28 August 2024 as a target price to be achieved before 25 September 2024.

Read the analysis here: //www.reddit.com/r/prgoldanalysis/comments/1eeujyq/how_to_trade_xauusd_spot_gold_this_week_fed/

Verify at: https://t.me/c/1654158888/11047

Current Status: XAUUSD: $2585 USDJPY $139.800

Current Status: XAUUSD: $2585 USDJPY $139.800

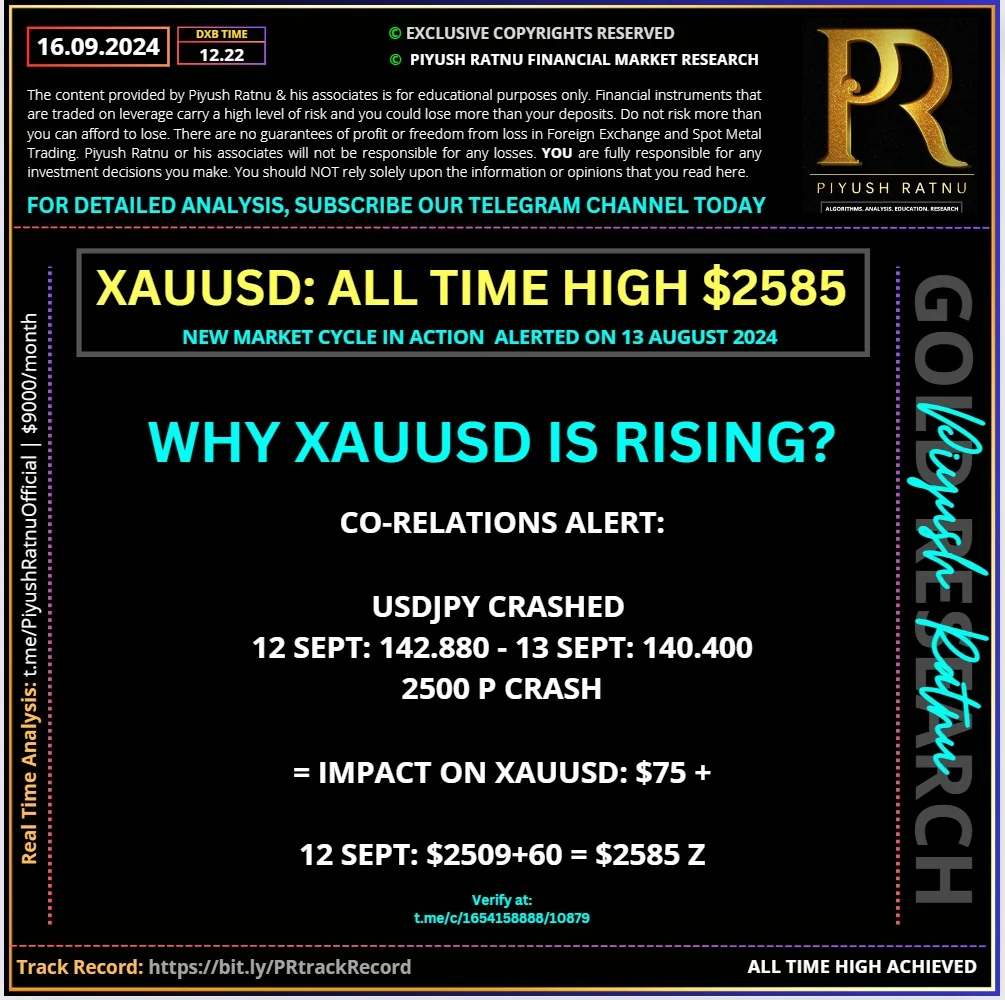

The yen hit its highest levels in more than a year on Monday in trading thinned by a holiday in Japan, as market participants increasingly expected an oversized rate cut by the Federal Reserve later this week.

Trading in Asia was slow, with markets in Japan, China and South Korea closed for holidays. The dollar was down 0.47% at 140.15 yen , falling further from the 140.285 end-December low it struck on Friday to levels last seen in July 2023. It fell 1.3% on the yen last week.

The Fed’s Sept. 17-18 meeting is the highlight of a busy week that also has the Bank of England and Bank of Japan announcing policy decisions on Thursday and Friday. Treasury yields have been falling in the run-up to the highly anticipated meeting, particularly as odds stack up for the Fed to get aggressive with a half-point rate cut.

Benchmark 10-year yields are down 30 basis points in about two weeks. Cash Treasuries were not traded in Asia due to the Japan holiday. Two-year yields , more closely linked to monetary policy expectations were around 3.57% and down from roughly 3.94% two weeks ago.

Selling the dollar for yen has been the cleanest trade for investors looking to play the drop in Treasury yields, said Chris Weston, head of research at Australian online broker Pepperstone.

“While speculators are short and riding this lower, this trend is clearly one to align with,” and the 🆘 December lows for the dollar-yen pair is one to watch, he said.

Fed speakers and data releases over the past month have had markets shifting the odds around the size of this week’s rate cut, debating whether the Fed will head off weakness in the labor market with aggressive cuts or take a slower wait-and-see approach.

Fed fund futures showed traders are pricing in a 59% chance of a 50-basis point cut at the September meeting, according to CME Fed Watch, opens new tab. Futures priced a total of 125 basis points in rate cuts in 2024.

Investors are also looking to the 🔺 Bank of Japan’s interest rate decision on Friday, when it is expected to keep its short-term policy rate target steady at 0.25%.

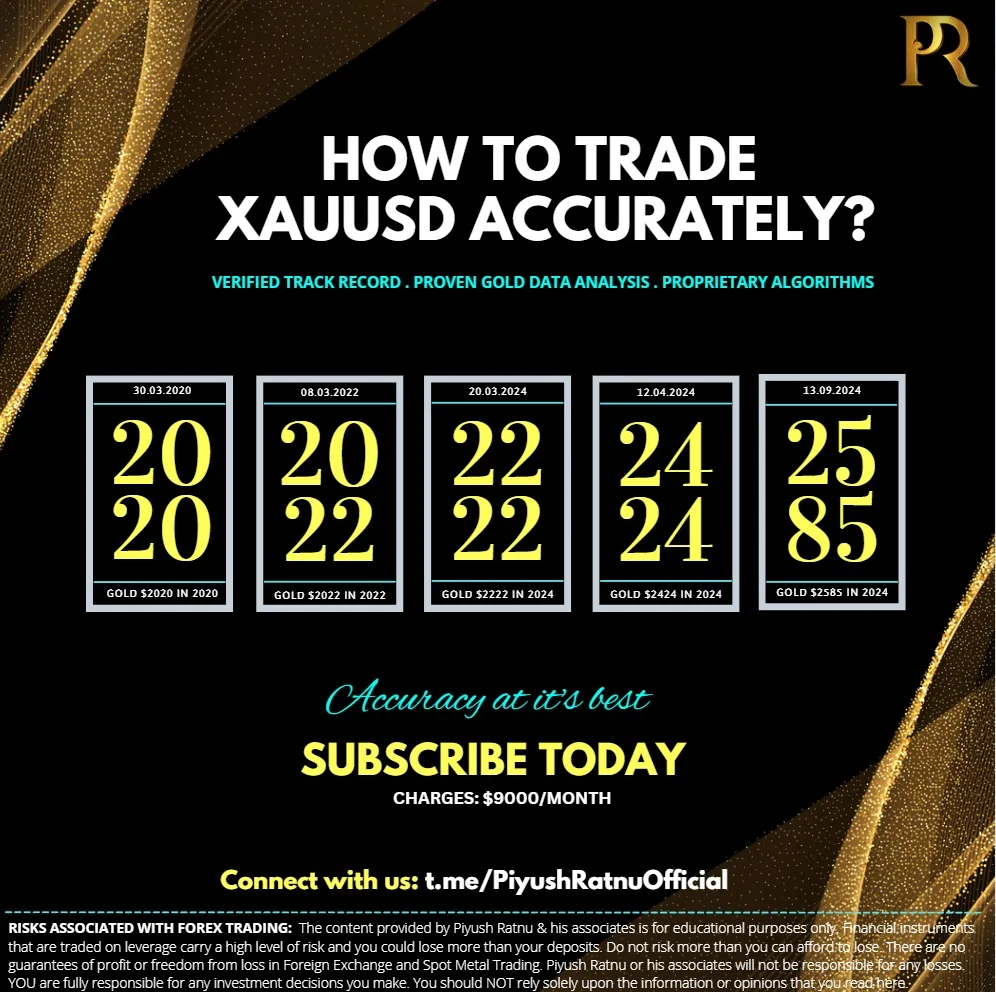

Trade with Confidence with Piyush Ratnu Gold Market Research

Subscribe one of the most accurate analysis in the industry: Spot Gold Analysis by Piyush Ratnu powered by 90+ technical and fundamental parameters with a verified and audited track record.

Current Trading Profit Status: 109%

Highest Drawdown Faced YTD: 8%

Highest profit/month booked: 42%

Highest loss/month booked: 5%

Core Focus: #XAUUSD | Spot #Gold

Platform: MT4 MT5

Trading Mode: Manual + Algorithm | Automated: both available

Auto-Copy Trading: Available | Plug and Play Solution

Live Trading Feed Available | Real Time Analysis Available

Verify Trading Performance at: https://bit.ly/PRinvestizo

#PiyushRatnu #prdxb #prgoldanalysis #gold #XAUUSD #forex

Connect for an appointment at T.ME/PIYUSHRATNUOFFICIAL