How to trade XAUUSD Spot Gold this week | Fed Interest Rate Rate Decision | Non Farm Payrolls Data Week | Analysis by Piyush Ratnu

Investors begin the week desperate for answers to questions about the near-term path of global monetary policy after conflicting signals from key economies upended markets.

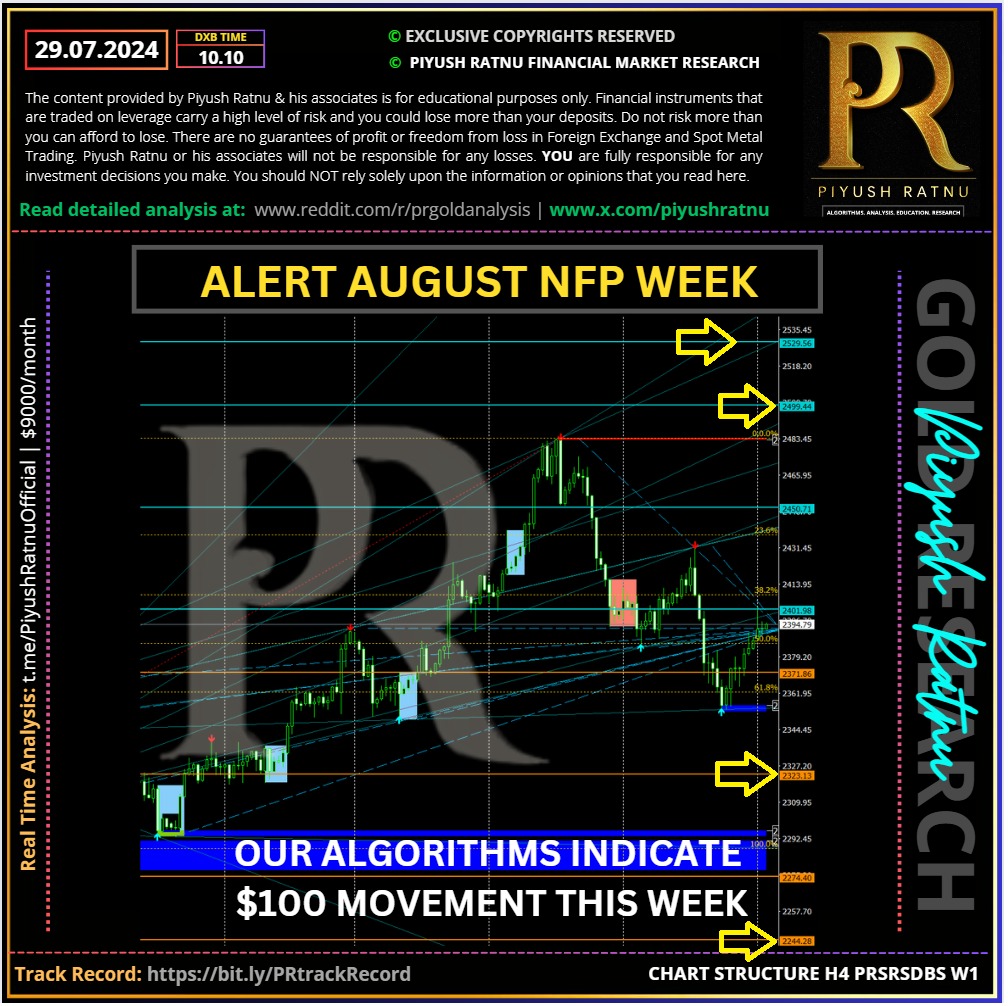

XAUUSD $2509/2525 or $2266/2244 before 25 09 2024?

Gold price is building on its previous recovery early Monday, having defended the key support at $2,350 zone on a weekly closing basis. Gold buyers fight back control heading into the critical central banks’ bonanza week, with the US Federal Reserve (Fed) – the main event risk for the bright metal.

🔘 Economics/Fundamentals:

Macro trader positioning remains larger than warranted by rates markets’ expectations for Fed cuts alone, with signs the Trump trade had contributed to some froth. Signs of a buyer’s strike in Asia also emerged, as highlighted by the significant deterioration in the SGE premium and by nascent signs of liquidations from Shanghai’s top precious metals traders. Demand from Asian central banks, hoarding Gold to hedge against currency depreciation against the US Dollar (USD), has fallen due the recent weakening of USD and the appreciation of their own domestic currencies. Significant liquidations from SHFE (Shanghai Futures Exchange) Gold and Silver traders are now reinforcing the downside in price action, with more than 5t and 6.6m toz of notional sold over the last session alone. After all, if precious metal holdings were a hedge against Asian currency pressures, than the recent strength in Asian currencies is now playing in favor of continued downside.

Following the sharp decline seen on Friday, Gold continued to edge lower at the beginning of the week. The People’s Bank of China (PBoC) announced early Monday that it cut the one-year Loan Prime Rate (LPR) by 10 basis points (bps) from 3.45% to 3.35% and lowered the five-year LPR from 3.95% to 3.85%. Additionally, the PBoC lowered the interest rate for the 7-day reverse report to 1.7% from 1.8%. These unexpected policy-easing measures from China, the world’s biggest consumer of Gold, made it difficult for XAU/USD to gain traction.

After ending the previous week marginally lower, Gold (XAU/USD) extended its slide and touched a two-week low near $2,350, pressured by growing signs of a worsening demand outlook for the precious metal. The Federal Reserve (Fed) will announce monetary policy decisions next week and the US economic docket will feature high-tier data releases, which could trigger the next directional move in XAU/USD. Risk-flows diminish the appeal of the safe-haven US Dollar while the US Treasury bond yields bear the brunt of increased expectations of a dovish Fed hold this week. Markets are fully pricing in a Fed rate cut in September, according to the CME Group’s FedWatch Tool.

Gold markets remain expectant of the potential dovish policy outlook from the Fed and the Bank of England (BoE) later in the week while the developments surrounding the Middle-East geopolitical tensions will remain in focus.

**🔘 Another cut remains on the table for December. Check CME tool here: **www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

🔘 Check Interest Rate Calendar here:

https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

US Elections: Trumponomics 2.0

According to data from RealClear Politics, the average betting odds for Trump have slipped from a high of 66% on 15 July to 55% at this time of the writing.

In contrast, the odds of the unofficial Democrat presidential nominee Harris have risen to 36% from 7% over the same period; indicating that the betting market thinks Harris is likely to be a tougher challenger for Trump, in turn, reduces the odds of Trumponomics 2.0 in November.

This direct correlation of gold with Trump winning the US Presidential Election has been driven by his preferred fiscal policies of steep corporate tax cuts (a part of Trumponomics) which in turn is likely to widen the US budget deficit that faces the risk of another round of credit downgrade on US Treasuries by rating agencies.

Hence, that’s a positive for gold, acting as a hedge in times of fiscal dominance that may lead market participants to question the credit standing and solvency of the US government.

🔘 Geo – political tensions

Over the weekend, fresh tensions in the Middle East spark a flight to safety in the traditional safety net, Gold price, reinforcing the buying interest in the yellow metal.

On Saturday, 12 children and young adults were killed in a rocket strike while playing football in the Israeli-occupied Golan Heights. The Israel Defense Forces (IDF) blamed the Iran-backed militant group, Hezbollah for the attack, saying that it conducted air strikes against seven Hezbollah targets “deep inside Lebanese territory”. The rising tensions have the potential to trigger an all-out war between Israel and Hezbollah, which has prompted investors to scurry for safety in Gold price.

What’s NEXT?

🔘 Wednesday, 31 July 2024

🔘 BoJ Interest Rate Decision +BoJ Press Conference

| 07:00 | JPY | BoJ Interest Rate Decision | 0.10% | 0.10% | |||

| 08:00 | JPY | BoJ Outlook Report (YoY) | |||||

| 10:30 | JPY | BoJ Press Conference |

Major central banks are set to meet in Tokyo and Washington on Wednesday and London on Thursday, with traders struggling to decide if the Bank of Japan will hike interest rates and then when and by how much the Federal Reserve and Bank of England will cut them.

In the Asian session on Wednesday, the July NBS Manufacturing PMI and the NBS Non-Manufacturing PMI data from China will be watched closely by market participants, especially following this week’s developments. In case both PMIs come in below 50, Gold could come under renewed selling pressure with the immediate reaction.

| 16:15 | USD | ADP Nonfarm Employment Change (Jul) | 166K | 150K | |||

| 16:30 | USD | Employment Cost Index (QoQ) (Q2) | 1.0% | 1.2% | |||

| 17:45 | USD | Chicago PMI (Jul) | 44.1 | 47.4 | |||

| 18:00 | USD | Pending Home Sales (MoM) (Jun) | 1.6% | -2.1% | |||

| 18:30 | USD | Crude Oil Inventories | -3.741M | ||||

| 18:30 | USD | Cushing Crude Oil Inventories | -1.708M | ||||

| 22:00 | USD | FOMC Statement | |||||

| 22:00 | USD | Fed Interest Rate Decision | 5.50% | 5.50% | |||

| 22:30 | USD | FOMC Press Conference | |||||

The ADP Employment Change data will be featured in the US economic docket on Wednesday. Investors, however, are likely to ignore this data and wait for the Federal Reserve to announce its monetary policy decisions later in the day.

The Fed is widely expected to leave its policy rate unchanged following the July 30-31 meeting. According to the CME FedWatch Tool, a 25 basis points (bps) Fed rate cut is fully priced in at the September meeting, suggesting that the USD doesn’t have a lot of room on the downside even if the Fed policy statement, or Fed Chairman Jerome Powell, confirms a rate reduction in September.

In the post-meeting press conference, Powell’s remarks on the policy outlook could influence the USD’s valuation and impact Gold’s movements. The CME FedWatch Tool shows that there is nearly a 70% chance that the Fed will lower the policy rate by a total of 75 bps by the end of this year. In case Powell draws attention to robust growth readings and argues that they can take their time when the policy easing starts, markets could reassess the number of Fed rate cuts in 2024. In this scenario, the USD is likely to gather strength and weigh on XAU/USD. On the other hand, markets could remain optimistic about several Fed rate reductions this year and pave the way for a leg higher in Gold if Powell voices confidence over further progress in disinflation while acknowledging loosening conditions in the labor market.

🔘 Thursday, 01 July, 2024: BoE Interest Rate Day + Jobless Claims + ISM PMI

| 15:00 | GBP | BoE MPC vote cut (Aug) | 6 | 2 | |||

| 15:00 | GBP | BoE MPC vote hike (Aug) | 0 | 0 | |||

| 15:00 | GBP | BoE MPC vote unchanged (Aug) | 3 | 7 | |||

| 15:00 | GBP | BoE Interest Rate Decision (Aug) | 5.00% | 5.25% | |||

| 15:00 | GBP | BoE MPC Meeting Minutes | |||||

| 15:30 | GBP | BoE Gov Bailey Speaks | |||||

| 16:30 | USD | Continuing Jobless Claims | 1,851K | ||||

| 16:30 | USD | Initial Jobless Claims | 239K | 235K | |||

| 16:30 | USD | Nonfarm Productivity (QoQ) (Q2) | 1.5% | 0.2% | |||

| 16:30 | USD | Unit Labor Costs (QoQ) (Q2) | 1.6% | 4.0% | |||

| 17:15 | GBP | BoE Gov Bailey Speaks | |||||

| 17:45 | USD | S&P Global US Manufacturing PMI (Jul) | 49.5 | 51.6 | |||

| 18:00 | USD | Construction Spending (MoM) (Jun) | 0.2% | -0.1% | |||

| 18:00 | USD | ISM Manufacturing Employment (Jul) | 49.3 | ||||

| 18:00 | USD | ISM Manufacturing PMI (Jul) | 49.0 | 48.5 | |||

| 18:00 | USD | ISM Manufacturing Prices (Jul) | 52.5 | 52.1 |

On Thursday, the ISM Manufacturing PMI report for July will be released. The headline PMI is expected to edge slightly higher to 48.8 from 48.5 in June. In case the data arrives above 50 and shows that business activity expanded unexpectedly in July, the USD could find demand. Ahead of Friday’s jobs report, however, the market reaction is likely to remain short-lived.

🔘 Friday, 02 July, 2024: NFP Data + Unemployment Rate

| 16:30 | USD | Average Hourly Earnings (YoY) (YoY) (Jul) | 3.9% | ||||

| 16:30 | USD | Average Hourly Earnings (MoM) (Jul) | 0.3% | 0.3% | |||

| 16:30 | USD | Nonfarm Payrolls (Jul) | 177K | 206K | |||

| 16:30 | USD | Participation Rate (Jul) | 62.6% | ||||

| 16:30 | USD | Private Nonfarm Payrolls (Jul) | 155K | 136K | |||

| 16:30 | USD | U6 Unemployment Rate (Jul) | 7.4% | ||||

| 16:30 | USD | Unemployment Rate (Jul) | 4.1% | 4.1% | |||

🔘Nonfarm Payrolls (NFP) rose by 206,000 in June. This reading came in above analysts’ estimate of 190,000. The USD, however, failed to benefit from this data as the jobs report also showed that May’s increase of 272,000 was revised lower to 218,000. Unless there is a significant revision to June’s print, a disappointing NFP growth in July could adversely impact the USD’s valuation.

If the NFP arrives near market consensus, the wage inflation component of the report could drive the USD’s action. On a yearly basis, Average Hourly Earnings increased 3.9% in June. A noticeable increase in this data could support the USD heading into the weekend. Point to be noted, just like last month I would suggest to consider Unemployment Rate data too, rather than focusing only on NFP Data.

BUY LOWS, SELL HIGHS | Plan your TRADE, then Trade your PLAN! | #PiyushRatnu

BUY LOWS, SELL HIGHS | Plan your TRADE, then Trade your PLAN! | #PiyushRatnu

🔘 Crucial Price Zones this week:

🔺SZ $2442/2469/2485/2505/2525

🔻BZ $2323/2300/2288/2266/2244

PG $10 | Exit in NAP/set | RM: GR 11 22 33 33 55 55 88 88 88

Refer Algo: PRSRSDBS Set W1

Piyush Ratnu Gold Market Research