SPOT GOLD – XAUUSD Price forecast: $2121/2145 or $1966/1945?

Key Fundamentals & EVENTS IMPACTING SPOT GOLD in may 2023:

- FED: The U.S. Federal Reserve on Wednesday raised interest rates by a widely expected 25 basis points and dropped from its policy statement language saying that it “anticipates” further rate increases would be needed. Even as worries remain about the unfolding U.S. banking crisis, Powell said he still expects the economy to avoid a recession this year. The US Federal Reserve voted to increase interest rates to a 16-year high on Wednesday, even as a banking crisis has left the economy wobbling. The quarter-point rise in the Fed’s benchmark interest rate was the 10th hike since March 2022, when interest rates were zero and the Fed started its rapid inflation-fighting campaign. The interest rate now stands at 5% to 5.25%.

The Fed chair, Jerome Powell, has consistently argued that the central bank must prioritize bringing down inflation, which hit a 40-year high in the wake of the Covid-19 pandemic. In a statement, the Fed said the banking system was “sound and resilient”. “Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The committee remains highly attentive to inflation risks,” said the Fed. The statement hinted that the Fed’s rate rises – the fastest in 40 years – could be nearing an end. The statement cut a phrase suggesting additional increases might be appropriate that was included in its last rate rise announcement. The next monetary policy decision from the Fed is due on June 14.

2. ECB: The Governing Council decided to raise the three key ECB interest rates by 25 basis points. Accordingly, the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will be increased to 3.75%, 4.00% and 3.25% respectively, with effect from 10 May 2023. Christine Lagarde has signalled that interest rates in the eurozone will have to rise towards record highs to stop the economy from overheating as she warned that the fight against inflation was far from over. The president of the European Central Bank (ECB) warned policymakers had “more ground to cover” to keep a lid on price rises, which rose at an annual pace of 7pc in the year to April. “We are not pausing, that is very clear,” she told reporters after the ECB lifted all three of its key interest rates by 0.25 percentage points, taking the deposit rate to a 15-year high of 3.25pc.

3. Treasuries Hit: In a letter to House and Senate leaders, Yellen urged congressional leaders “to protect the full faith and credit of the United States by acting as soon as possible” to address the $31.4 trillion limit on its legal borrowing authority. She added that it is impossible to predict with certainty the exact date of when the U.S. will run out of cash. Treasury Secretary Janet Yellen notified Congress on Monday that the U.S. could default on its debt as early as June 1, if legislators do not raise or suspend the nation’s borrowing authority before then and avert what could potentially become a global financial crisis.

4. YEN: USD/JPY Yen bulls are bracing for a period of weakness in the currency until speculation returns for a Bank of Japan policy tweak at its June or July meetings. The Japanese currency has fallen to a two-month low against the greenback in the aftermath of the BOJ’s decision to keep its main stimulus measures unchanged and options signal about a 50-50 chance it will touch 140 per dollar by the end of July. USDJPY achieved a high of 137.700 on 02 May, 2023 (impact on XAUUSD: negligible), before crashing back to CMP $134.000 zone: impact of USDJPY crash: XAUUSD $2045+

5. Collapsing Banks: The news is full of emergency meetings, central banks offering credit lifelines and tumbling bank shares. No wonder people are asking: is this the start of another financial crisis? Politicians, including the UK prime minister, and central banks, say the situation is now stable. But banking shares have continued to fluctuate. In the US, regulators have shut down and sold three mid-size US banks since the beginning of March – Silicon Valley Bank, Signature Bank and First Republic. The failures are the biggest to hit the US since the 2008 financial crisis. In Europe, troubled Swiss giant Credit Suisse, a major global player, is being taken over by rival UBS in a forced rescue deal. Central banks responded to the crisis with measures to make extra cash available to make sure financial transactions continued as normal. The nervousness around the health of banks is often contagious. And if people start to worry about their deposits they can move them at the click of a mouse. Even if we don’t see the total breakdown in trust that characterised the financial crisis, we could still see regulators toughening up the rules further and banks pulling back on their willingness to lend. One term is certain: UNCERTAINITY, and this might impact XAUUSD price.

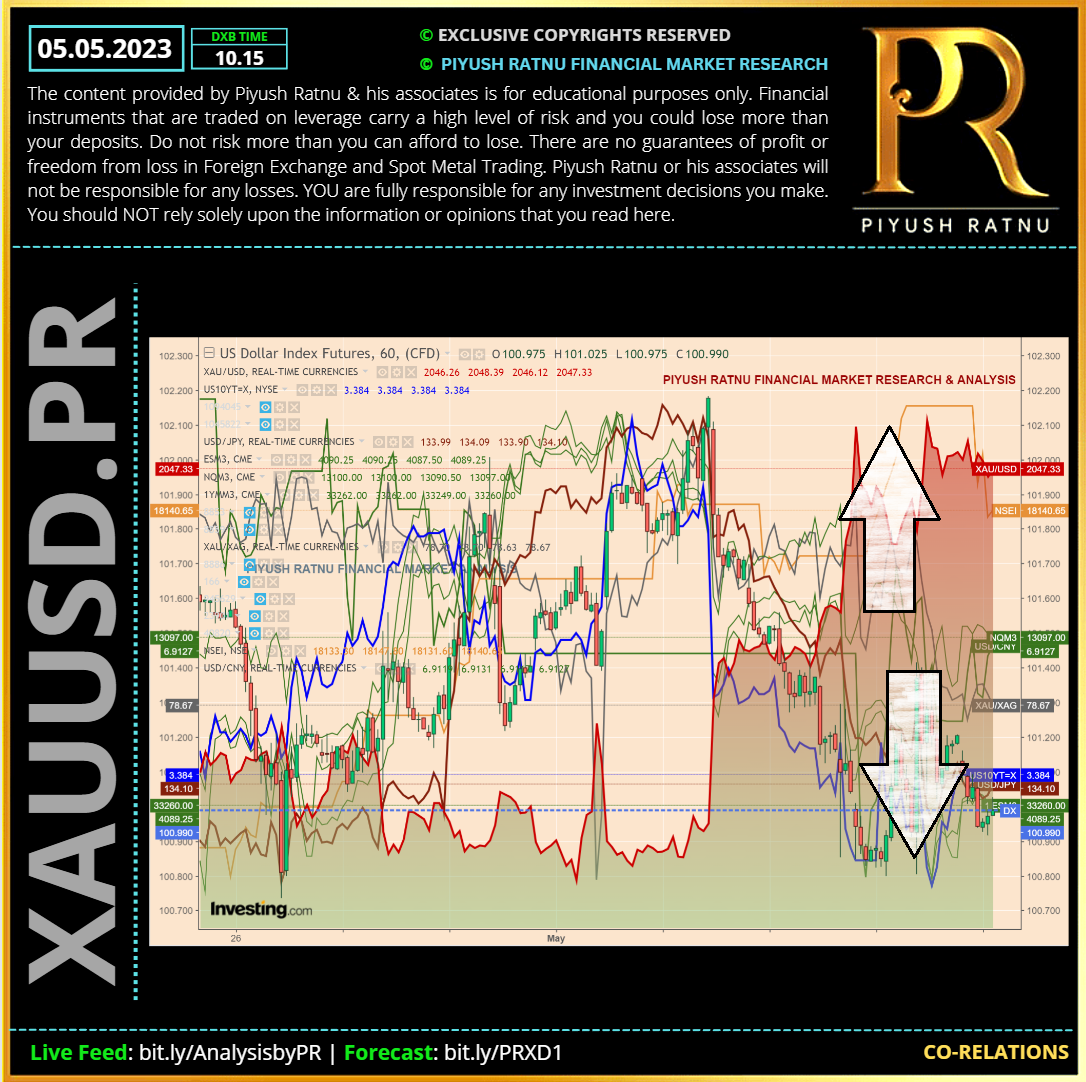

6. The US Dollar Index(DXY) continues crashing below 101.000 (CMP 100.970) from strong resistance zone: 104.500 after 10-year US Treasury yields witnessed immense pressure and crashed down to near 3.35%.

7. US NFP: Attention now shifts to US employment figures. Earlier on Thursday, the United States released Initial Jobless Claims for the week ended April 28, which rose by 242K, worse than anticipated. Also, Q1 Nonfarm Productivity declined by 2.7%, while Unit Labor Cost in the same period was up by 6.3%. Market players gear up for the April Nonfarm Payrolls (NFP) report on Friday. The US is anticipated to have added 179K new jobs in the month, while the Unemployment rate is foreseen at 3.5%, unchanged from March.

As per the consensus, the US labor market witnessed a fresh addition of 179K payrolls in April, which was lower than former additions of 236K. The catalyst that will hijack the attention of investors would be the Average Hourly Earnings data.

In current scenario, and as per past data fundamentals-based co-relations have guided us in a more accurate manner than technical co-relations, however I prefer to compare and match both for a better accuracy.

How to trade Spot Gold XAUUSD on NFP data today?

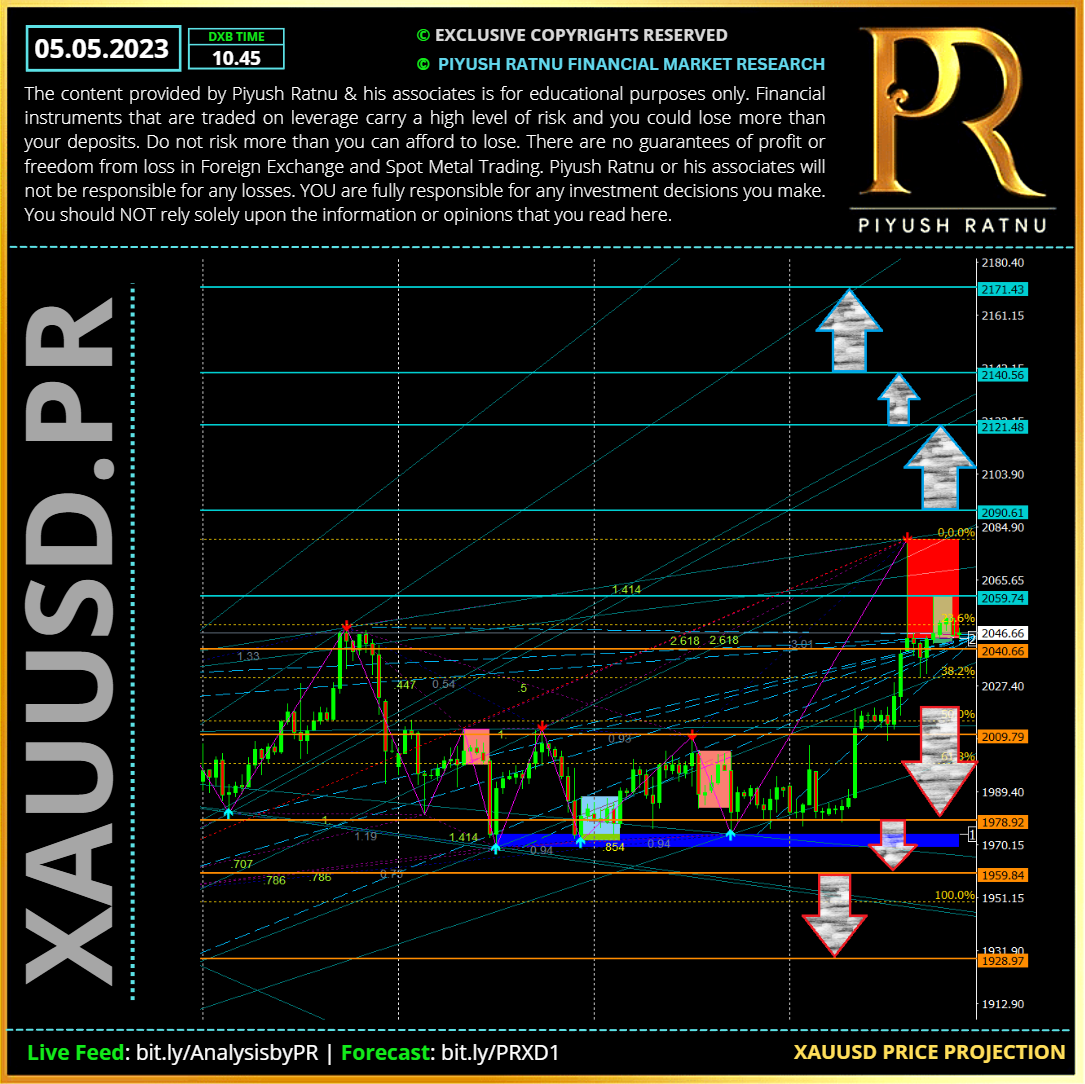

XAUUSD Bearish Scenario: $2009/1966/1947/1926?

If the bearish momentum extends, gold price may fall further towards $2009/1966 price trap zone with 1947, 1926 and 1907 as next stops, if Gold crash halts at 1966/1947 or 1926/1907 zones a reversal can be expected with a RT 23.6 on M5 and M15 30% RT before/in next 9 trading days.

XAUUSD Bullish Scenario: $2069/2096/2121/2145?

If the Bullish momentum pushes Gold price across $2090 barrier, $2096 followed by $2109, $2121 zone can be the next target for Gold, opening way to $2145 zone as an ideal sell entry.

Heading into the NFP show today, Spot Gold price is under a price trap of $2045 zone, as investors/traders are observing market closely after interest rate and monetary policy related statements by Mr. Powell on 03 May, 2023.

The US NFP will emerge as one of the main market driver for Gold price. Point to be noted: let us not forget ongoing geo-political tensions between Russian – Ukraine and China – Taiwan-US which can trigger an upward price rally of more than $100/150 in Spot Gold price. Another catalyst of low volumes might step in too during Monday early morning opening.

Technical Analysis | XAUUSD CMP $2050 | Gold Price – SR (D1) (MN) Levels to watch:

| SR ZONES MN | |

| R1 | 2008 |

| R2 | 2070 |

| R3 | 2131 |

| R4 | 2168 |

| R5 | 2230 |

| S1 | 1971 |

| S2 | 1910 |

| S3 | 1848 |

| S4 | 1811 |

| S5 | 1749 |

| SR ZONES D1 | |

| R1 | 2059 |

| R2 | 2090 |

| R3 | 2121 |

| R4 | 2140 |

| R5 | 2171 |

| S1 | 2040 |

| S2 | 2009 |

| S3 | 1978 |

| S4 | 1959 |

| S5 | 1928 |

XAUUSD: Spot Gold Price Projection and Trading Scenario | XAUUSD CMP $2050

PROJECTED TRADING SCENARIO:

- Observe price at US OPENING D1 SS1 and then US SS2

- Observe D1.SR: S2 zone and R2 zone for reversals/retracement, Exit NAP $5

- Do not enter between the pivot zone

- ObserveD1SR: FIB 23.6% on M5 and M5/M15 TF for NAP target price based exit in buy or sell entry after 30/60/90/120 minutes of NFP and $18/36 price movement sets

Long term: 9 (Short term)/18 (Long term) days for an A or V pattern formation - Movement of $90/120 dollars on Gold price is not something unexpected nowadays, and a surprise on Monday during early trading hours cannot be ruled out too, so closing all positions today in net average profit is always the best trading strategy for every trader who wants to safeguard his principal.

I expect A pattern on H1 and H4 TF chart in next 9 days (short term target) and 12 trading days (long term target). XAUUSD CMP $2050.BUY/SELL STOPS | B/S LIMITS: TARGET Net 23.6 RT M15/30/H1 or NAP $3:

S2 ZONE 2009 | DOWN TREND (Below 1990) : 1985/1966/1947/1926/1907| BUY LIMITS

R2 ZONE 2100| UP TREND (Above 2096) : 2107/2121/2145/2169/2188| SELL LIMITSTerms: TF: Time Frame | RT: Retracement | SR: Support Resistance | NAP: Net Average ProfitIt is always wise to first PLAN THE TRADE, and then TRADE THE PLAN!Hence, it is suggested to first observe the crash or rise with specific zones and levels in mind on the basis of various fundamental and technical parameters mentioned above, before entering a trade in a specific direction with a target of net average profit in a specific set of trades.

WARNING: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The author will not be held responsible for information that is found at the end of links posted on this page. The author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. The author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author is not a registered investment advisor and nothing in this article is intended to be investment advice. All performance information reflects past performance and is presented on a total return basis. Past performance is no guarantee of future results. Current performance may differ from the performance shown.RISK WARNING | DISCLAIMERInformation on this Channel/Page contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Information or opinions provided by us should not be used for investment advice and do not constitute an offer to sell or solicitation of an offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. When making a decision about your investments, you should seek the advice of a professional financial adviser.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

The analysis and trading suggestions published by Piyush Ratnu does not warrant or guarantee the accuracy, timeliness or completeness to its service or information contained therein. Piyush Ratnu does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading on their own risk and Piyush Ratnu shall not be responsible under any circumstances for the consequences of such activities. Piyush Ratnu and its affiliates, in no event, be liable to users or any third parties for any consequential damages or losses in any direct orindirect manner, however arising, including but not limited to damages caused by negligence or Force Majeure whether such damages were foreseen or unforeseen.

The capital value of units in the fund can fluctuate and the price of units can go down as well as up and is not guaranteed. You should not buy a warrant unless you are prepared to sustain a total loss of the money you have invested plus any commission or other transaction charges. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals. The high degree of leverage can work against you as well as for you hence implement risk management and money management strictly to safeguard your investment. Do not risk more than .10% of your principle amount in a single trade set.

Before deciding to invest in foreign exchange or other markets you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some, or all, of your initial investment. Therefore, you should not invest money that you cannot afford to lose. In some cases, it is possible to lose more than your initial investment as it is not always possible to exit a market at the price you intend upon doing so. There are also risks associated with utilizing an Internet-based trade execution software application including, but not limited to, the failure of hardware and software. You should be aware of all the risks associated with investing in foreign exchange, indices and commodities and seek advice from an independent financial advisor if you have any doubts.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu or his associates will not accept any liability for any loss or damage, including but without limitation to, any financial, emotional loss, which may arise directly or indirectly due to your decision. If you do not agree to the above terms, conditions and disclaimer YOU MUST close this page and YOU MUST not act as per the information provided.