Non Farm Payrolls Day: SPOT GOLD Price projection & analysis: XAUUSD: $1888/1866 or $1966/1988 in next 10 days?

Key Fundamentals & EVENTS IMPACTING SPOT GOLD in July 2023:

- FOMC: Federal Open Market Committee unanimously holds benchmark rate in target range of 5%- 5.25%, as expected, in first pause since starting cycle of increases in early 2022, to “assess additional information and its implications for monetary policy”. New projections show policymakers favor a half-point of additional increases this year, which would push borrowing costs to about 5.6% — higher than most economists and investors have been expecting. FOMC statement gives clear signal that policymakers will resume tightening by referring to the “extent of additional policy firming that may be appropriate”; prior statement, in May, gave more leeway on whether to hike. Forecasts for economic growth and core inflation rose for 2023, while unemployment projections fell.

Nearly all FOMC participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year. With another hike in interest rates anticipated by the Federal Reserve and the European Central Bank for July, and some peers on a similar track, an aggregate gauge of borrowing costs calculated by Bloomberg Economics now shows a peak of 6.25% during the current quarter. That’s up from 6% foreseen three months ago.

Whatever the case, policymakers still minded to keep rate hiking, such as those at the Fed, are entering a more hesitant phase as they increasingly watch for an impact on economic growth. Federal Reserve officials look on track to keep raising rates despite a recent pause after 10 straight hikes as they try to slow a resilient US economy and hot labor market to cool inflation. Policymakers forecast rates reaching 5.6% this year, implying two more 25 basis-point increases from the current range of 5% to 5.25%. Policymakers have stressed there’s a lot of uncertainty about the rate outlook as they evaluate how recent banking failures are affecting credit conditions, putting extra weight on incoming data.

In conjunction with the Federal Open Market Committee (FOMC) meeting held on June 13–14, 2023, meeting participants submitted their projections of the most likely outcomes for real gross domestic product (GDP) growth, the unemployment rate, and inflation for each year from 2023 to 2025 and over the longer run. Each participant’s projections were based on information available at the time of the meeting, together with her or his assessment of appropriate monetary policy—including a path for the federal funds rate and its longer-run value—and assumptions about other factors likely to affect economic outcomes. The longer-run projections represent each participant’s assessment of the value to which each variable would be expected to converge, over time, under appropriate monetary policy and in the absence of further shocks to the economy. “Appropriate monetary policy” is defined as the future path of policy that each participant deems most likely to foster outcomes for economic activity and inflation that best satisfy his or her individual interpretation of the statutory mandate to promote maximum employment and price stability.

Bank Stress Test Results by FED: All 23 banks tested remained above their minimum capital requirements during the hypothetical recession, despite total projected losses of $541 billion. Under stress, the aggregate common equity risk-based capital ratio—which provides a cushion against losses—is projected to decline by 2.3 percentage points to a minimum of 10.1 percent.

For the first time, the Board conducted an exploratory market shock on the trading books of the largest banks, testing them against greater inflationary pressures and rising interest rates. This exploratory market shock will not contribute to banks’ capital requirements but was used to further understand the risks with their trading activities and to assess the potential for testing banks against multiple scenarios in the future. The results showed that the largest banks’ trading books were resilient to the rising rate environment tested.

- Job Data: US ADP Employment Change marked the largest one-month increase since February 2022, to 497K for June versus 228K expected and 267K prior (revised). That said, the ISM Services PMI also improved to 53.9 for the said month from 50.3 in May, versus the market expectation of 51.0. Further, the Challenges Job Cuts also slumps to 40.709K from 80.089K previous readings. However, the JOLTS Job Openings drops to 9.8M from 10.103M, compared to analysts’ estimation of 9.93M. It should be noted that the Initial Jobless Claims also rises to 248K for the week ended on June 30, versus 245K expected and 236K previous readings (revised).

- YEN: The BOJ on 16.06.2023 maintained its -0.1% short-term rate target and a 0% cap on the 10-year bond yield set under its yield curve control (YCC) policy, pushing the yen broadly lower. On 19.06.2023, the yen touched a near seven-month low of 141.98 per dollar, having slid 1% on Friday. The yen also touched a fresh 15-year low against the euro of 155.32. While inflation remains above the BOJ’s 2% target, public pressure has declined as fuel and global commodity prices have fallen from last year’s peaks. – Japanese authorities are facing renewed pressure to combat a continued yen fall driven by market expectations that the Bank of Japan will keep interest rates ultra-low, even as other central banks tighten monetary policy to curb inflation. Aside from verbal intervention, Japan’s government has several options to stem what it considers excessive yen falls. Among them is to intervene directly in the currency market, buying large amounts of yen, usually selling dollars for the Japanese currency.If the pace of yen declines accelerates and draws the ire of media and public, the chance of intervention would rise again. The decision would not be easy. Intervention is costly and could easily fail, given that even a large burst of yen buying would pale next to the $7.5 trillion that change hands daily in the foreign exchange market.

- China: China cut its key lending benchmarks on 20.06.2023, the first such reductions in 10 months as authorities seek to shore up a slowing economic recovery, although concerns about the property market meant the easing was not as large as expected. The Chinese central bank cut the one-year loan prime rate by 10 basis points from 3.65% to 3.55%, and trimmed the five-year loan prime rate by 10 basis points from 4.3% to 4.2% — for the first time since August.

The latest monetary loosening comes as a post-pandemic recovery in the world’s second-largest economy shows signs of losing the initial momentum seen in the first quarter. China’s cabinet announced a package of 33 measures covering fiscal, financial, investment and industrial policies on Tuesday to revive its pandemic-ravaged economy, adding it will inspect how provincial governments implement them.

The stimulus package, which was flagged by China’s State Council in a routine meeting last week, underscores Beijing’s shift toward growth, after COVID-19 control measures pounded the economy and threaten Beijing’s 5.5% growth target for the year. To revive investment and consumption, the government ordered localities not to expand curbs on auto purchases and said those which already have curbs in place should gradually increase their quotas on car ownership.

In terms of monetary and financial policies, China will boost financing efficiency via capital markets, by supporting domestic firms to list in Hong Kong, and promote offshore listings by qualified platform companies. The State Council also vowed to further reduce real borrowing costs, and strengthen financial support for infrastructure and major projects.

In an apparent answer to the calls, the Shanghai and Shenzhen stock exchanges published rules on Tuesday to allow listed real estate investment trusts (REITs) to raise fresh money to fund acquisition of infrastructure projects.

- EURO: The European Central Bank raised euro zone borrowing costs to their highest level in 22 years on Thursday and said stubbornly high inflation all but guaranteed another move next month and likely beyond that too. The quarter-percentage-point move was the ECB’s eighth consecutive interest rate hike since it badly misjudged the tenaciousness of price rises early last year, and took its policy rate to 3.5%, a level not seen since 2001. Euro zone government bond yields and the euro rose as traders priced in a near-certain hike next month and higher rates generally. While signs that economic growth is slowing would normally augur a pause, the ECB has been taking its own projections with a pinch of salt after years in which they missed the mark. Despite an unprecedented 400 basis points of rate hikes in the space of a year, the clear message from the ECB is that it isn’t done yet. Another increase in July has essentially been pre-announced and voices calling for a pause after that are being drowned out by hawks keen on further tightening in the fall.

- Gold ETF: Global physically-backed gold ETFs experienced net outflows in June, calling a halt to their three-month inflow streak. Collective holdings of global gold ETFs fell by 56t to 3,422 t while total assets under management (AUM) reached US$211bn (-4% m/m). The early June strong equity market performance in key markets likely shifted focus away from risk-off assets such as gold. And the majority of outflows occurred when the gold price dropped during the second half of the month amid hawkishness from major central banks in the face of obstinate inflationary pressure.

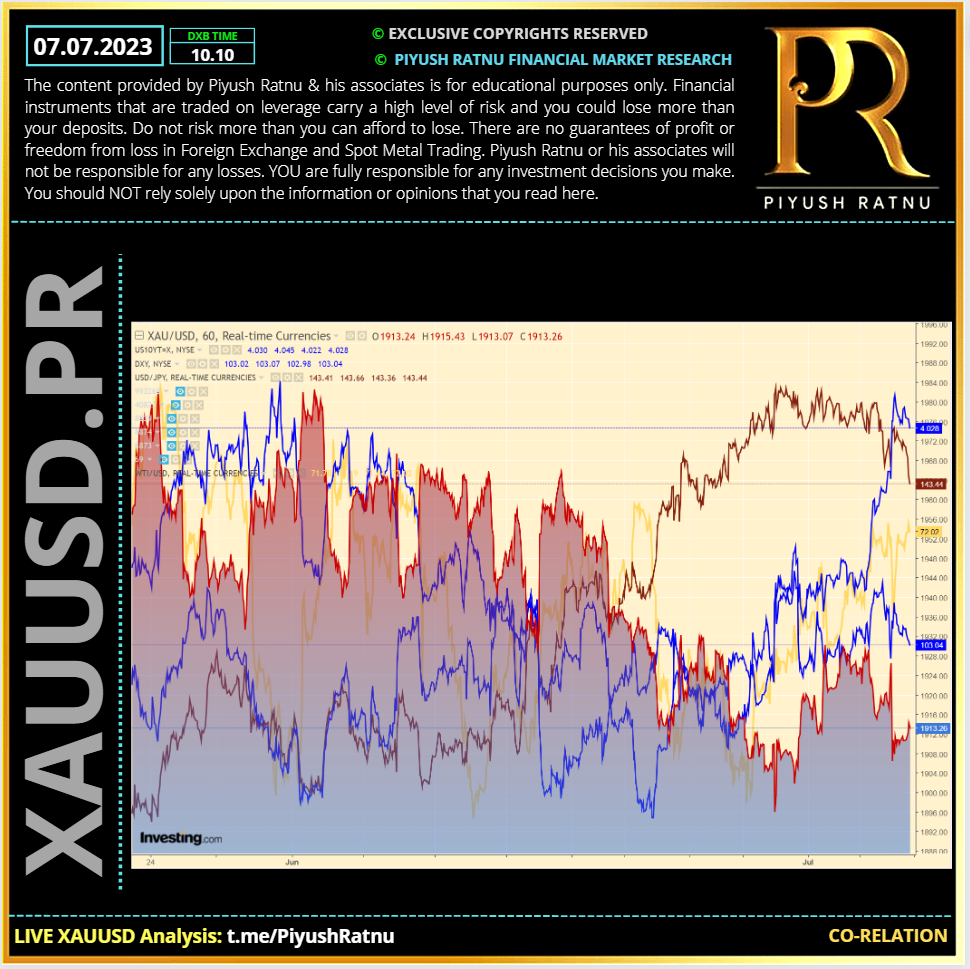

The US Dollar Index (DXY) continued crashing till 22 June 2023 from 104.300 zone towards 101.600 zone (22 June low), CMP 102.700 rising since last 6 days from 101.500 towards 103.000 zone. This impacted XAUUSD less and a crash in Gold price was observed from $1966-$1892 RT $1935 high 05.07.2023 in the month of June 2023.

How to trade Spot Gold XAUUSD on NFP data today?

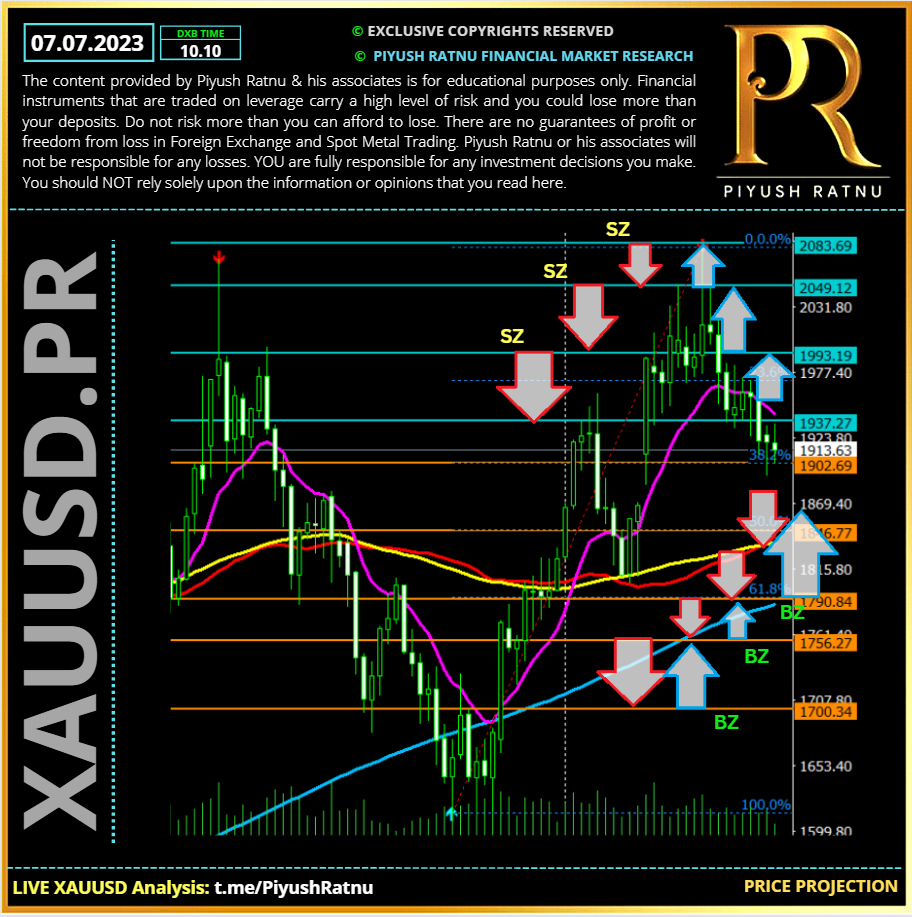

XAUUSD Bearish Scenario: $1907/1888/1866/1836/1818?

If the bearish momentum extends, gold price may fall further towards $1907/1888/1866/1818 price trap zone with 1818/1777 as next stops, if Gold crash halts at 1866 or 1836/1818 zones a reversal can be expected with a RT V 23.6 M15 M30 RT before/in next 9 trading days.

XAUUSD Bullish Scenario: $1947/1966/1985/2020/2048?

If the Bullish momentum pushes Gold price across $1970 barrier, $1985. $2020 followed by $2048 & $2069 zone can be the next target for Gold, opening way to $2096 zone as an ideal sell entry.

Heading into the NFP show today, Spot Gold price is under a price trap of $1907-1926 zone, as investors/traders are observing market closely.

BUY/SELL STOPS | B/S LIMITS: TARGET RT 23.6 TF M15/30/H1 or NAP $5 each set:

S2 ZONE 1888 | DOWN TREND (Below $1870) : 1866/1836/1818/1777 | BUY LIMITS

R2 ZONE 1931| UP TREND (Above $1950) : 1966/1985/2020/2069| SELL LIMITS

Technical Analysis | XAUUSD CMP $1915 | Gold Price – SR (D1) (MN) Levels to watch:

| SR ZONES D1 | |

| R1 | 1915 |

| R2 | 1930 |

| R3 | 1946 |

| R4 | 1955 |

| R5 | 1971 |

| S1 | 1906 |

| S2 | 1890 |

| S3 | 1875 |

| S4 | 1865 |

| S5 | 1850 |

| SR ZONES MN | |

| R1 | 1930 |

| R2 | 1965 |

| R3 | 1999 |

| R4 | 2021 |

| R5 | 2055 |

| S1 | 1909 |

| S2 | 1874 |

| S3 | 1840 |

| S4 | 1818 |

| S5 | 1784 |

07.07.2023 | XAUUSD: Spot Gold Price Projection and Trading Scenario by Piyush Ratnu

PROJECTED TRADING SCENARIO:

- Observe price at US OPENING D1 SS1 and then US SS2

- Observe SR: S3($1875)-3/6/9 & D1.SR R3 ($1946)+3/6/9 for M5/15.236RT

- Do not enter between the pivot zone D1: S/R zones

- ObserveD1SR: FIB 23.6% on M5 and M5/M15 TF for NAP target price based exit in buy or sell entry after 30/60/90/120 minutes of NFP and $15/30 price movement sets

- Movement of $50/75 dollars on Gold price is not something unexpected nowadays, and a surprise on Monday during early trading hours cannot be ruled out too, so closing all positions today in net average profit is always the best trading strategy for every trader who wants to safeguard his principal.

I expect V pattern on M15, M30, H1 and H4 TF chart in sequence in next 6 days (short term target) and 18 trading days (long term target). XAUUSD CMP $1915. I will prefer to BUY lows near SR zone mentioned in the above analysis.

Point to be noted: let us not forget ongoing geo-political tensions which can trigger an upward price rally of more than $150/200 in Spot Gold price. Another catalyst of low volumes might step in too during Monday early morning opening.

Terms: TF: Time Frame | RT: Retracement | SR: Support Resistance | NAP: Net Average Profit

It is always wise to first PLAN THE TRADE, and then TRADE THE PLAN!

Hence, it is suggested to first observe the crash or rise with specific zones and levels in mind on the basis of various fundamental and technical parameters mentioned above, before entering a trade in a specific direction with a target of net average profit in a specific set of trades.

WARNING: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The author will not be held responsible for information that is found at the end of links posted on this page. The author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. The author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author is not a registered investment advisor and nothing in this article is intended to be investment advice. All performance information reflects past performance and is presented on a total return basis. Past performance is no guarantee of future results. Current performance may differ from the performance shown.

RISK WARNING | DISCLAIMER

Information on this Channel/Page contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Information or opinions provided by us should not be used for investment advice and do not constitute an offer to sell or solicitation of an offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. When making a decision about your investments, you should seek the advice of a professional financial adviser.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

The analysis and trading suggestions published by Piyush Ratnu does not warrant or guarantee the accuracy, timeliness or completeness to its service or information contained therein. Piyush Ratnu does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading on their own risk and Piyush Ratnu shall not be responsible under any circumstances for the consequences of such activities. Piyush Ratnu and its affiliates, in no event, be liable to users or any third parties for any consequential damages or losses in any direct or indirect manner, however arising, including but not limited to damages caused by negligence or Force Majeure whether such damages were foreseen or unforeseen.

The capital value of units in the fund can fluctuate and the price of units can go down as well as up and is not guaranteed. You should not buy a warrant unless you are prepared to sustain a total loss of the money you have invested plus any commission or other transaction charges. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals. The high degree of leverage can work against you as well as for you hence implement risk management and money management strictly to safeguard your investment. Do not risk more than .10% of your principle amount in a single trade set.

Before deciding to invest in foreign exchange or other markets you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some, or all, of your initial investment. Therefore, you should not invest money that you cannot afford to lose. In some cases, it is possible to lose more than your initial investment as it is not always possible to exit a market at the price you intend upon doing so. There are also risks associated with utilizing an Internet-based trade execution software application including, but not limited to, the failure of hardware and software. You should be aware of all the risks associated with investing in foreign exchange, indices and commodities and seek advice from an independent financial advisor if you have any doubts.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

FAKE SOCIAL MEDIA ACCOUNTS BY SCAMMERS IMPERSONATING AS PIYUSH RATNU OR HIS ASSOCIATES | DISCLAIMER

Piyush Ratnu or his associates will never ask for credit card/debit card/account passwords/payments in crypto/digital currency for multiplication/duplication through or for trading or any format of investments. Kindly do not engage with any person(s) impersonating as Piyush Ratnu or his team member on social media platforms/email/WhatsApp/SMS. Kindly check our verified social media /group handles on Telegram (T.me/PiyushRatnu) and Twitter (www.twitter.com/piyushratnu) to contact us or email us at info@piyushratnu.com only. Kindly always verify the facts/claims/analysis track record face to face only with Piyush Ratnu or his associate(s) personally. In case you engage/pay/transact with any third party who is not associated with Piyush Ratnu or his associates in such case you and solely you will be responsible for any losses faced due to such engagement/transaction/communication done by you solely at your own risk.

Piyush Ratnu or his associates will not accept any liability for any loss or damage, including but without limitation to, any financial, emotional loss, which may arise directly or indirectly due to your decision. If you do not agree to the above terms, conditions and disclaimer YOU MUST close this page and YOU MUST not act as per the information provided.