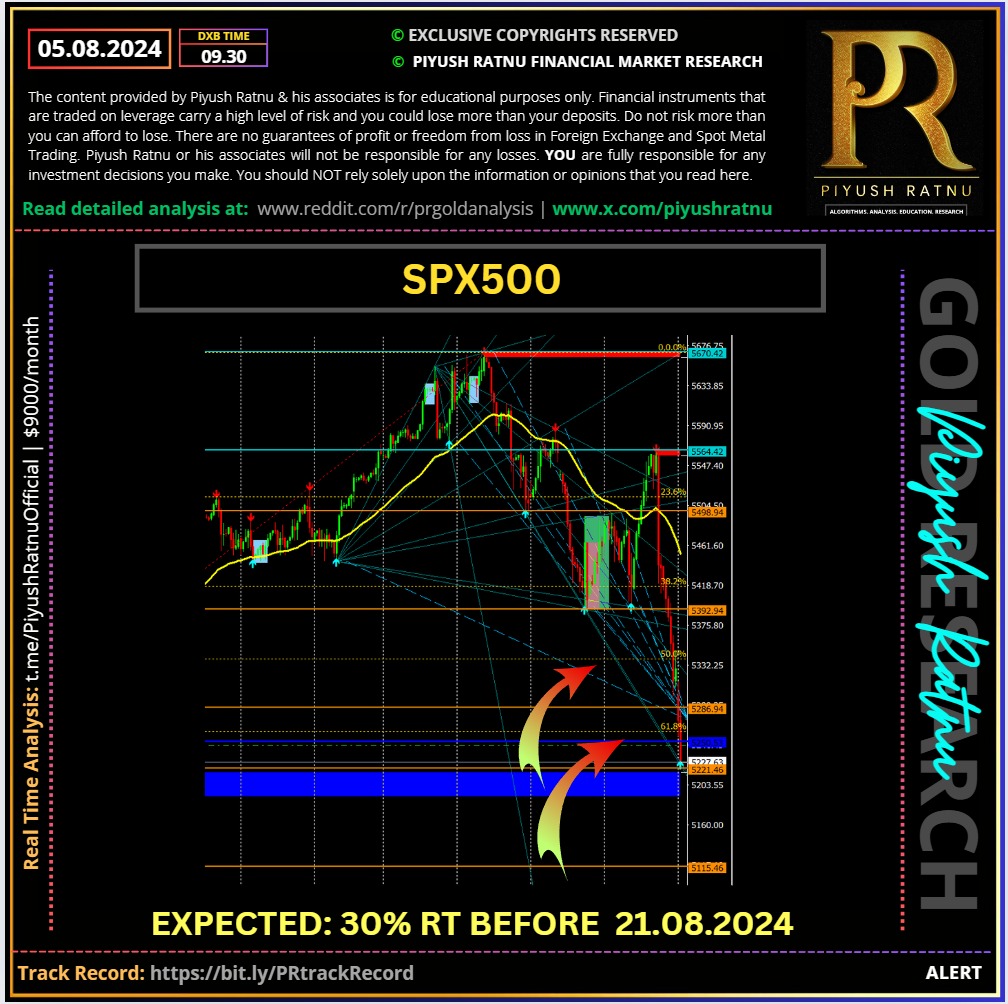

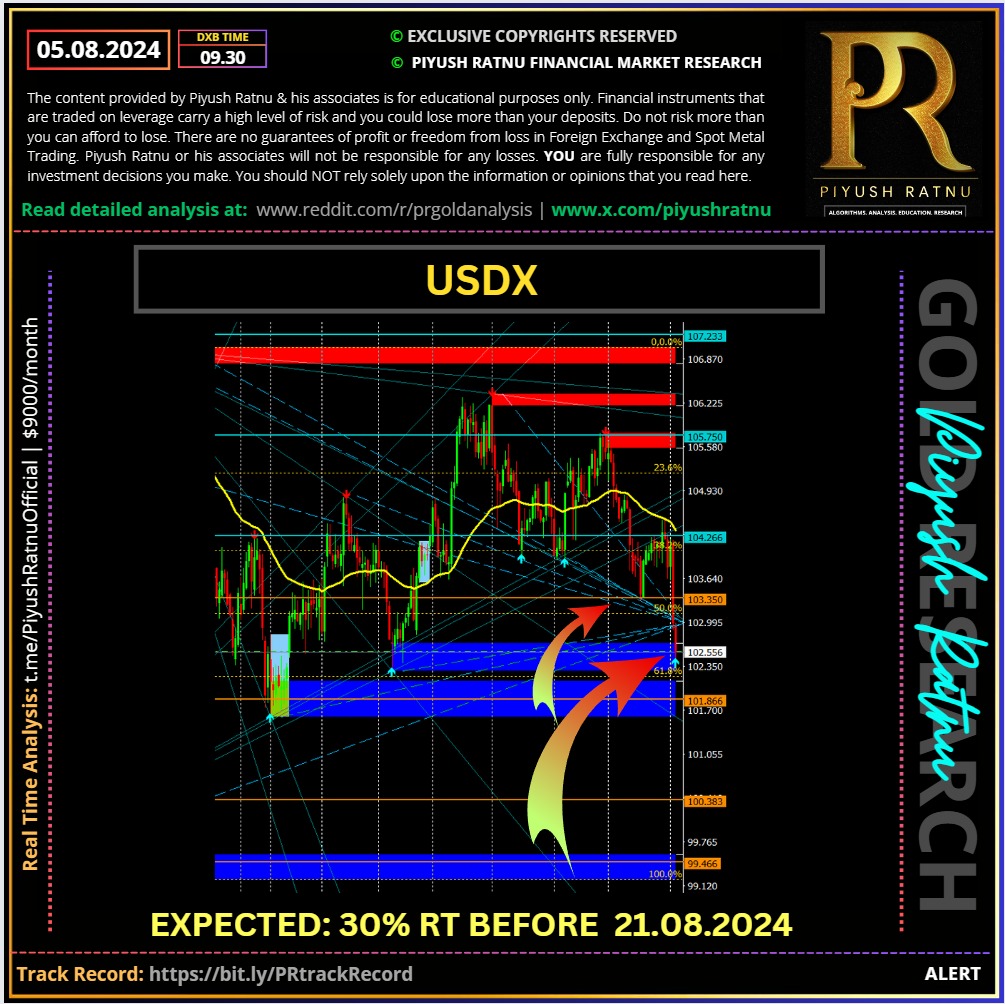

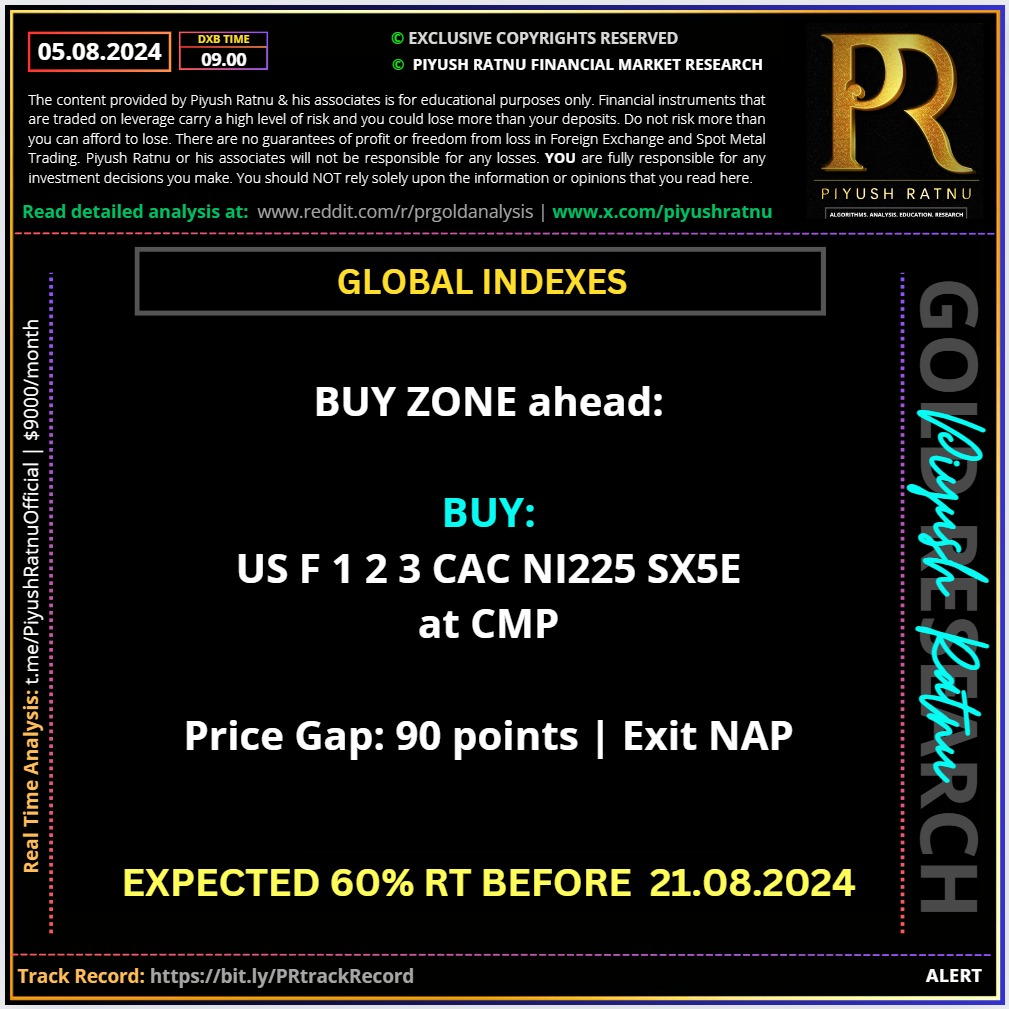

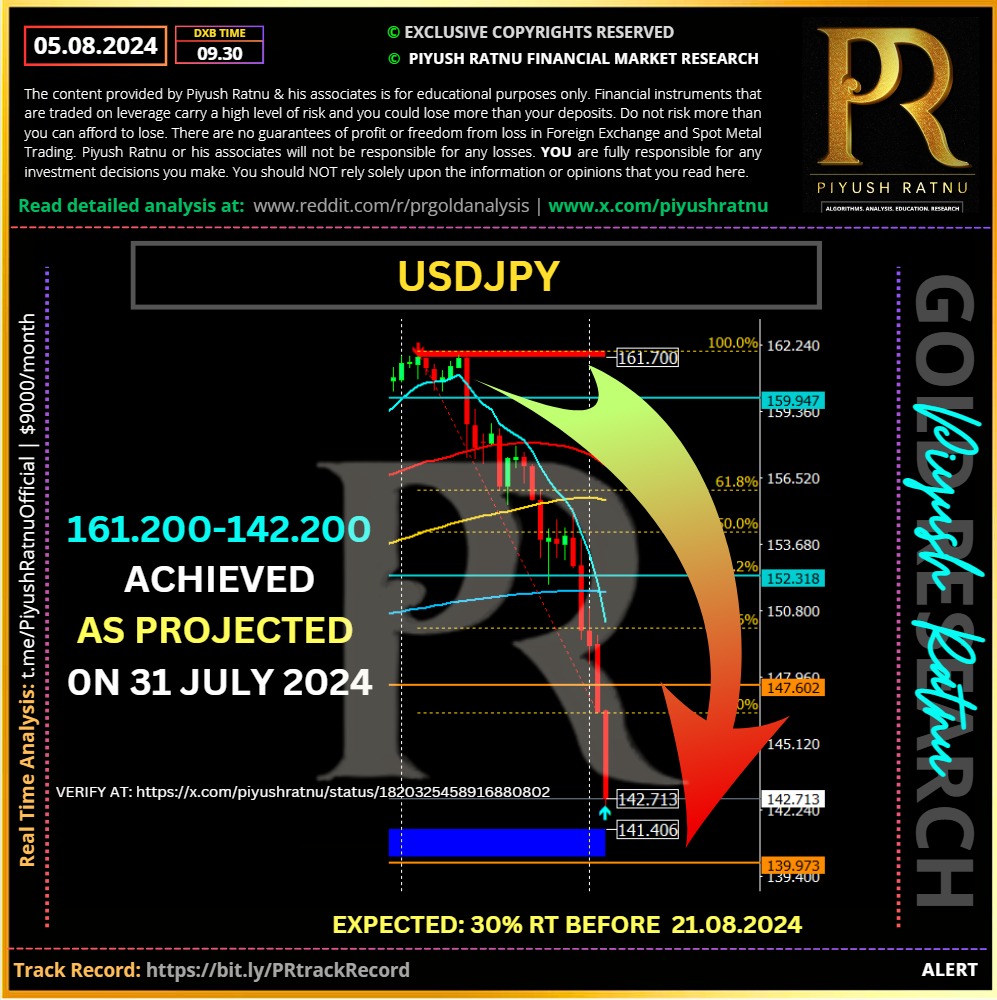

Most Accurate Black Monday 05 August 2024 Trading Performance and Analysis NASDAQ SPX500 USA30 USDJPY GBPJPY EURJPY CHFJPY CADJPY AUDJPY NZDJPY JP225 | Piyush Ratnu

Read LIVE Black Monday Analysis here. Check Accuracy.

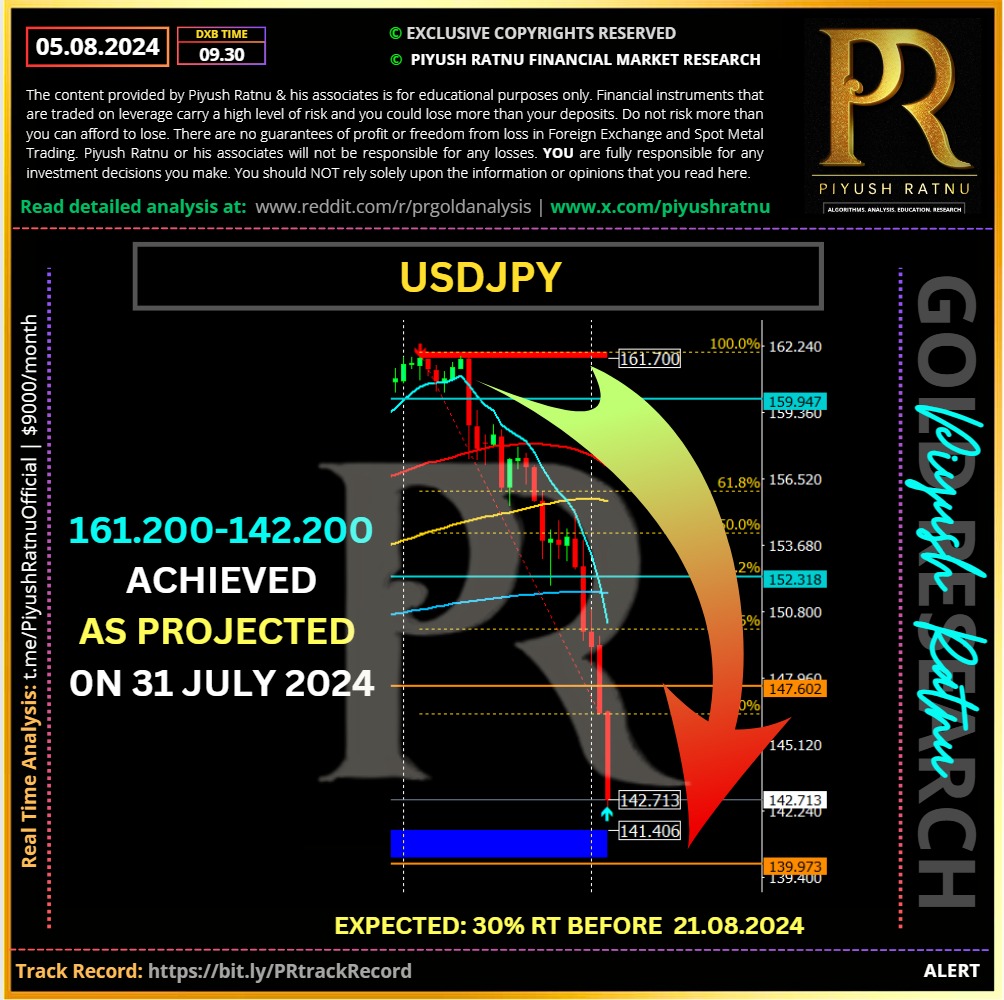

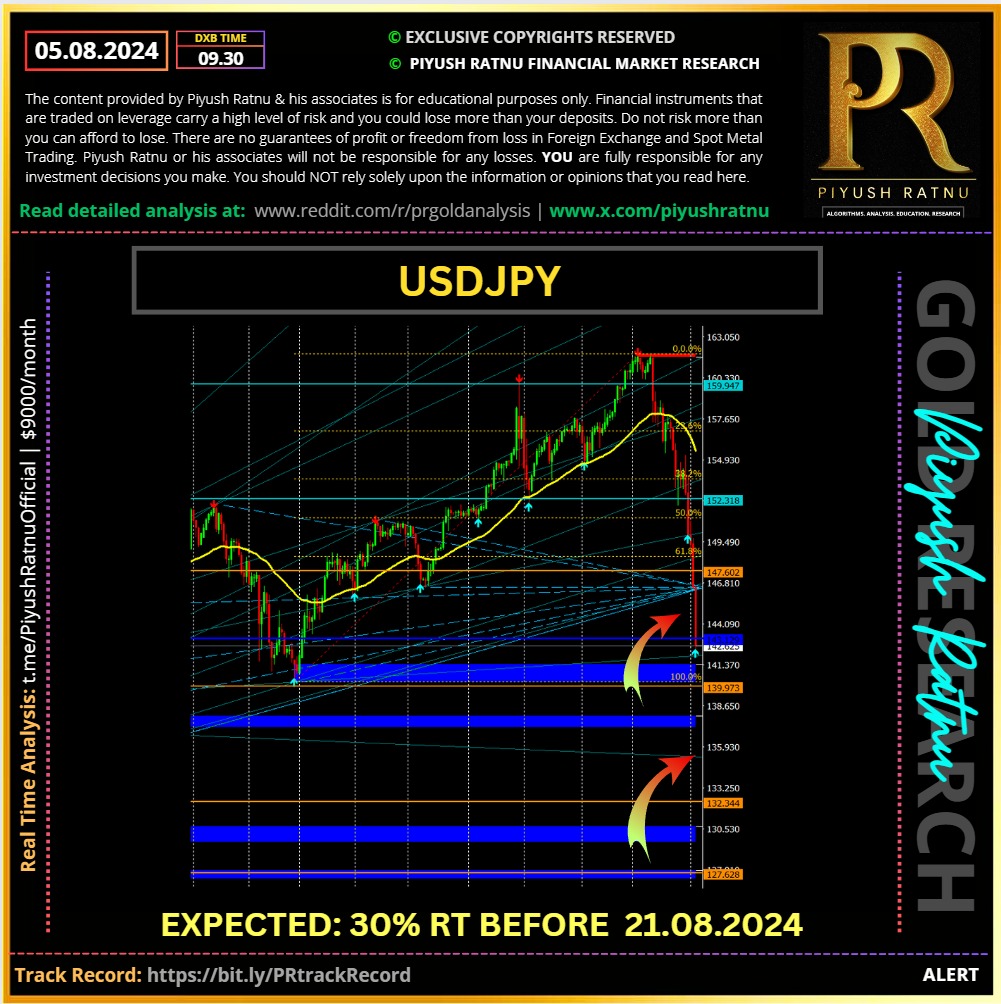

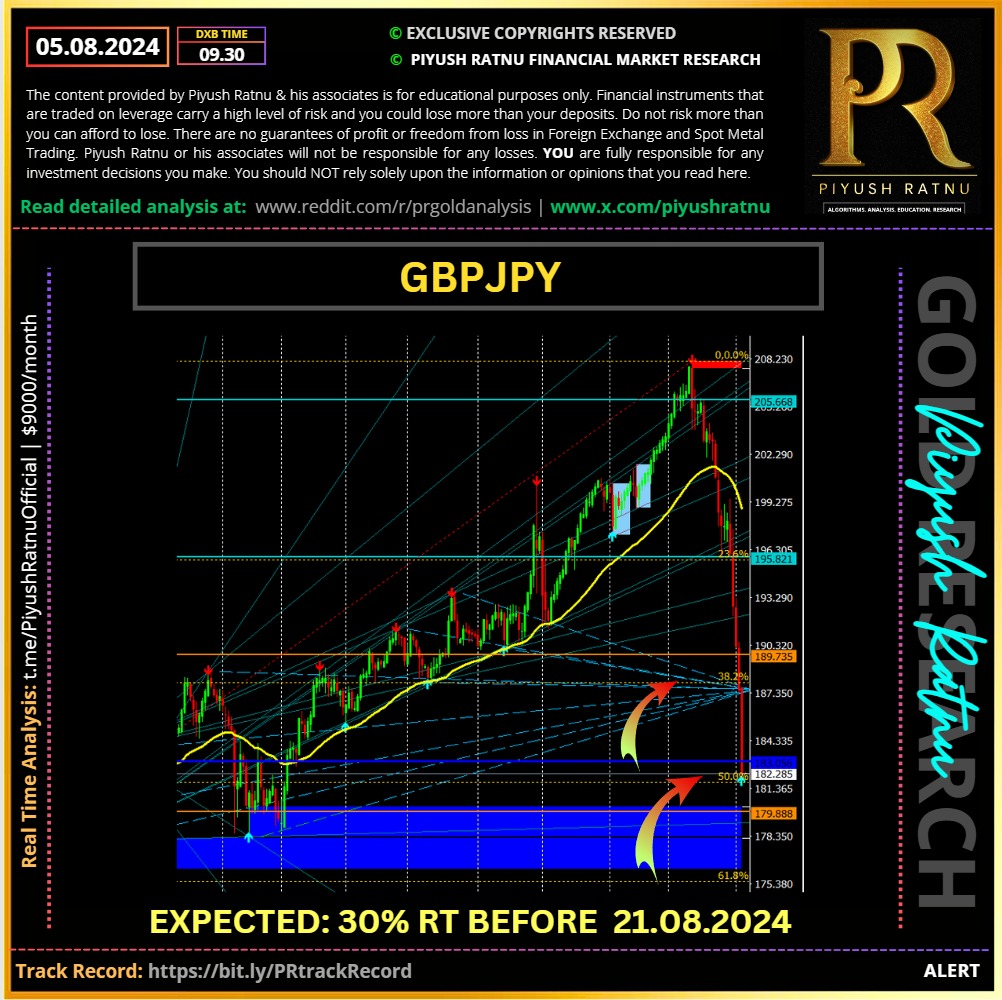

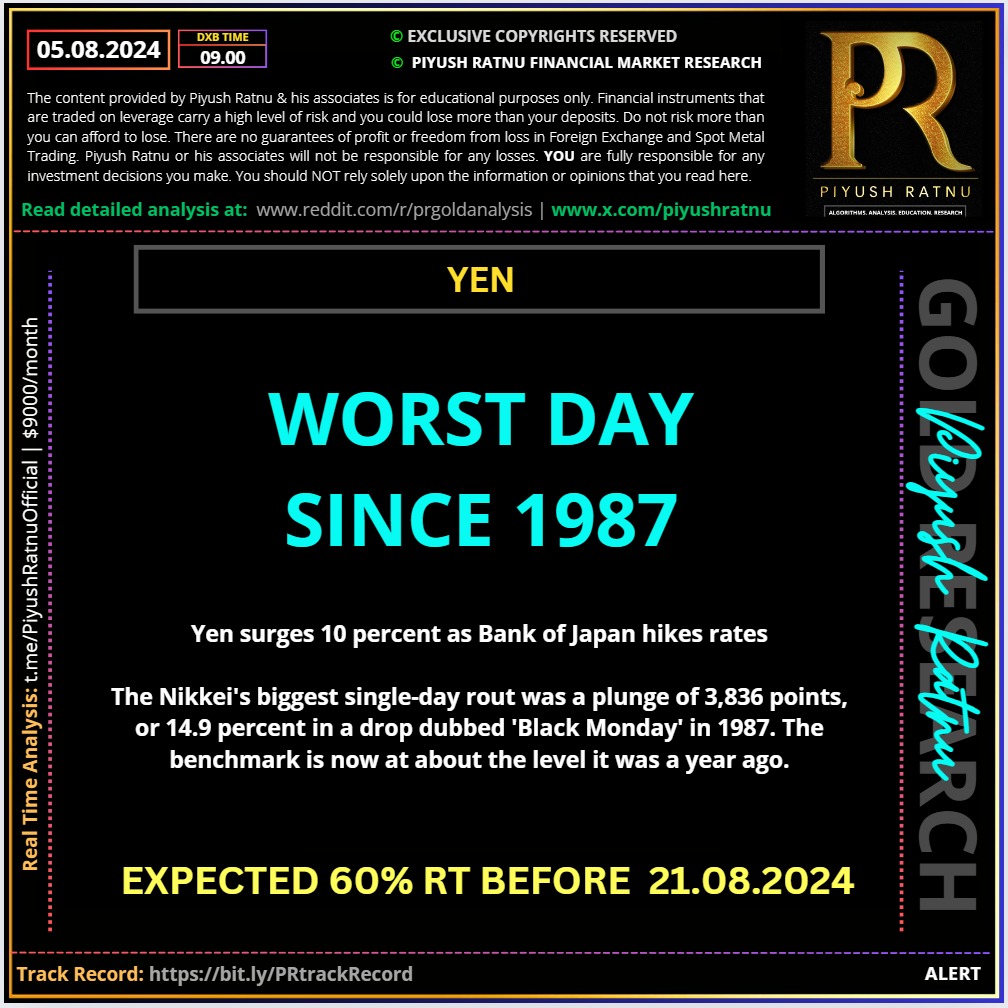

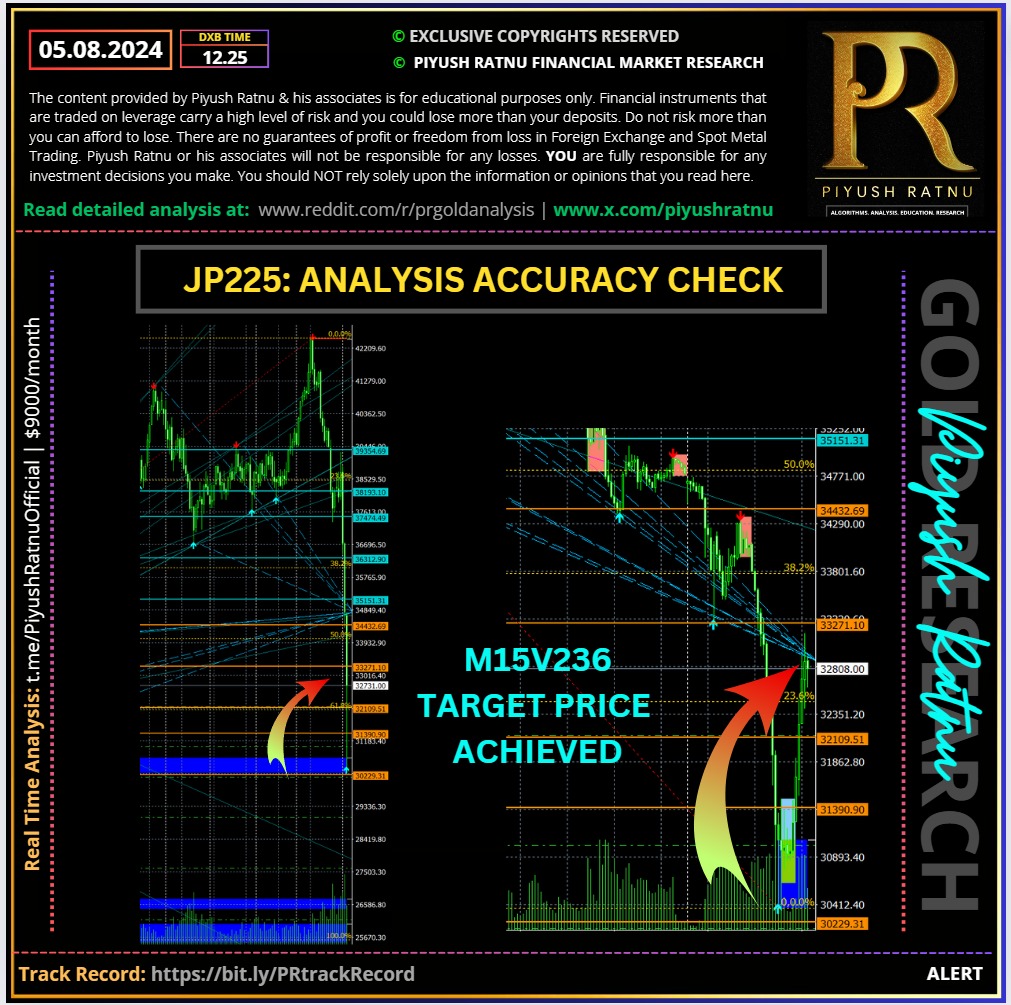

05 August 2024: Worst Day since 1987: Price Projections by Piyush Ratnu

Repetition expected on 07 August 2028

A global stocks selloff intensified on Monday as concerns grew that the Federal Reserve is behind the curve with policy support for a slowing US economy, sending investors into the safety of bonds.

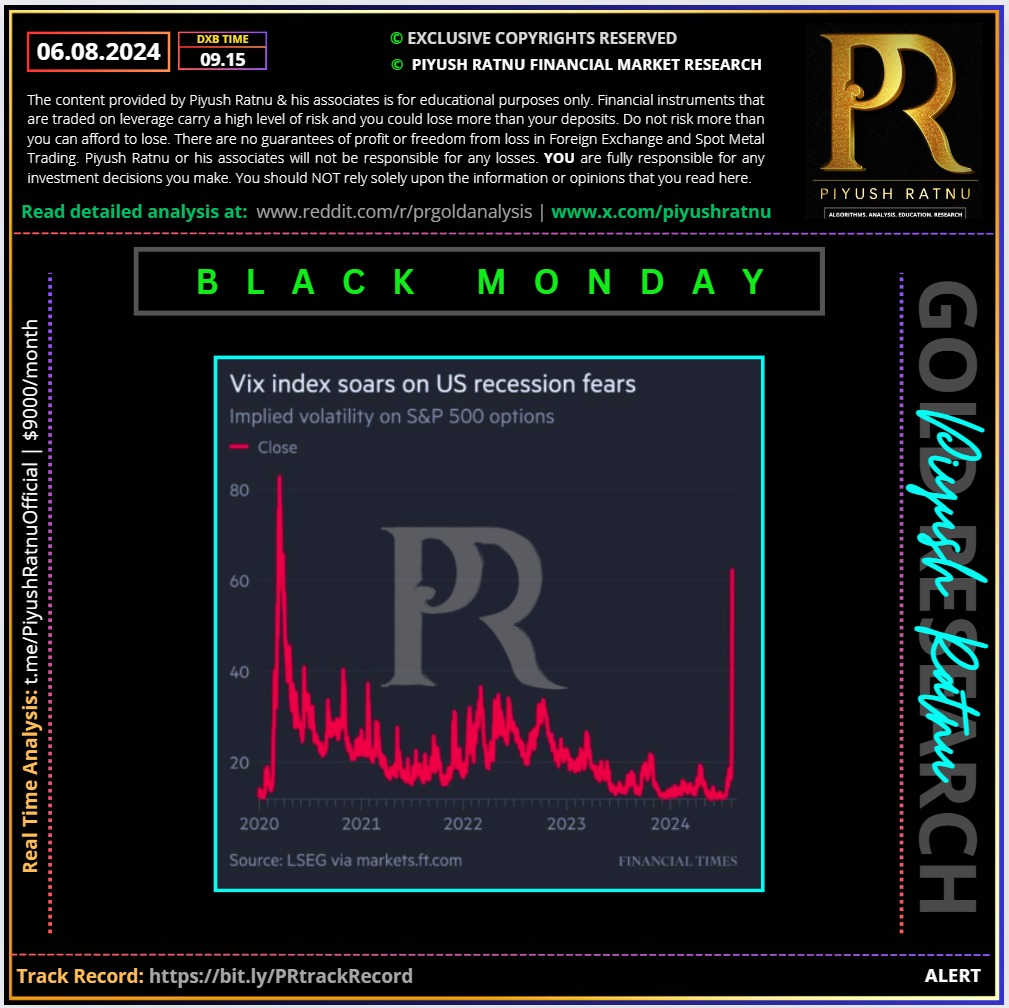

Nasdaq 100 futures tumbled more than 6% and S&P 500 contracts were down more than 3%. In Japan, both the Topix and Nikkei indexes fell over 13%. Taiwan’s benchmark had its worst day on record while a gauge of Asian shares slipped the most in over four years. The yen rallied over 2.5% against the dollar.

The selloff was fueled by data Friday that showed the US jobs market weakening, which triggered a closely watched recession indicator. The Nasdaq entered a technical correction as investors fretted about elevated valuations from the artificial intelligence rally.

The 10-year Treasury yield fell 10 basis points to 3.7%, the lowest on a closing basis on more than a year. Bond traders have repeatedly misjudged where interest rates have been headed since the end of the pandemic, at times overshooting in both directions. Global bonds erased their losses for the year, as signs of US economic deterioration fueled demand for fixed-income.

The global equity declines reflected worries on the economic outlook, geopolitical risks and questions over whether heavy investment into artificial intelligence will live up to the hype surrounding the technology. Economists at Goldman Sachs Group Inc. increased the probability of a US recession in the next year to 25% from 15%, although it added there are reasons not to fear a slump.

Sentiment was also weighed upon by news that Berkshire Hathaway Inc. had slashed its stake in Apple Inc. by almost 50% as part of a massive second-quarter selling spree.

Meanwhile, the MSCI emerging-market stock index slumped more than 3%, on track for the biggest one-day drop since March 2022.

Developing-nation currencies pushed higher – led by Malaysia’s ringgit – while the Mexican peso’s slump extended as traders continued to unwind emerging-market carry trades. The sudden appreciation in funding currencies, such as the yen and China’s yuan, have damaged the carry trade, which typically involves traders borrowing at lower rates to invest in higher-yielding assets.

Elsewhere, oil fluctuated near a seven-month low as a selloff in wider financial markets countered rising tensions in the Middle East. Israel is bracing itself for a possible attack from Iran and regional militias in retaliation for assassinations of Hezbollah and Hamas officials. Cryptocurrencies also reeled from risk aversion in global markets on Monday.

Source: Blomberg

Price projection by Piyush Ratnu Market Research | Copyrights Reserved

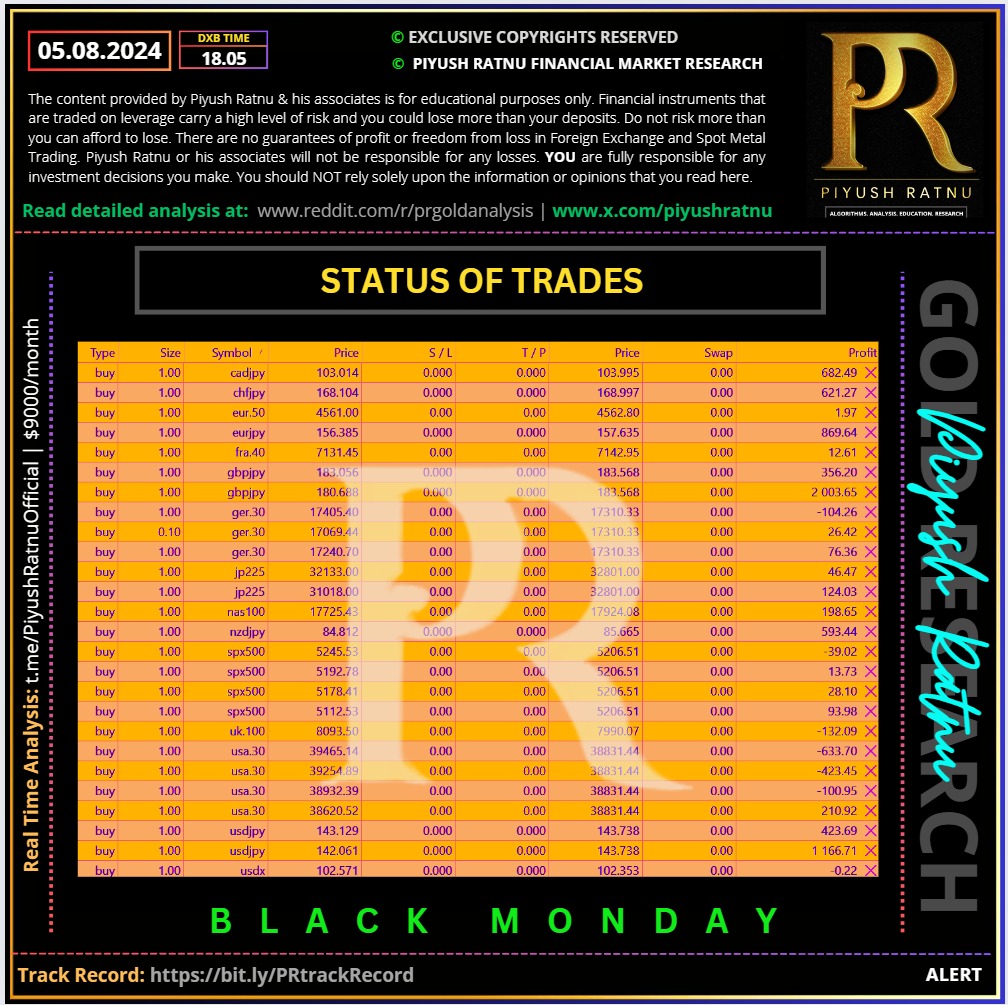

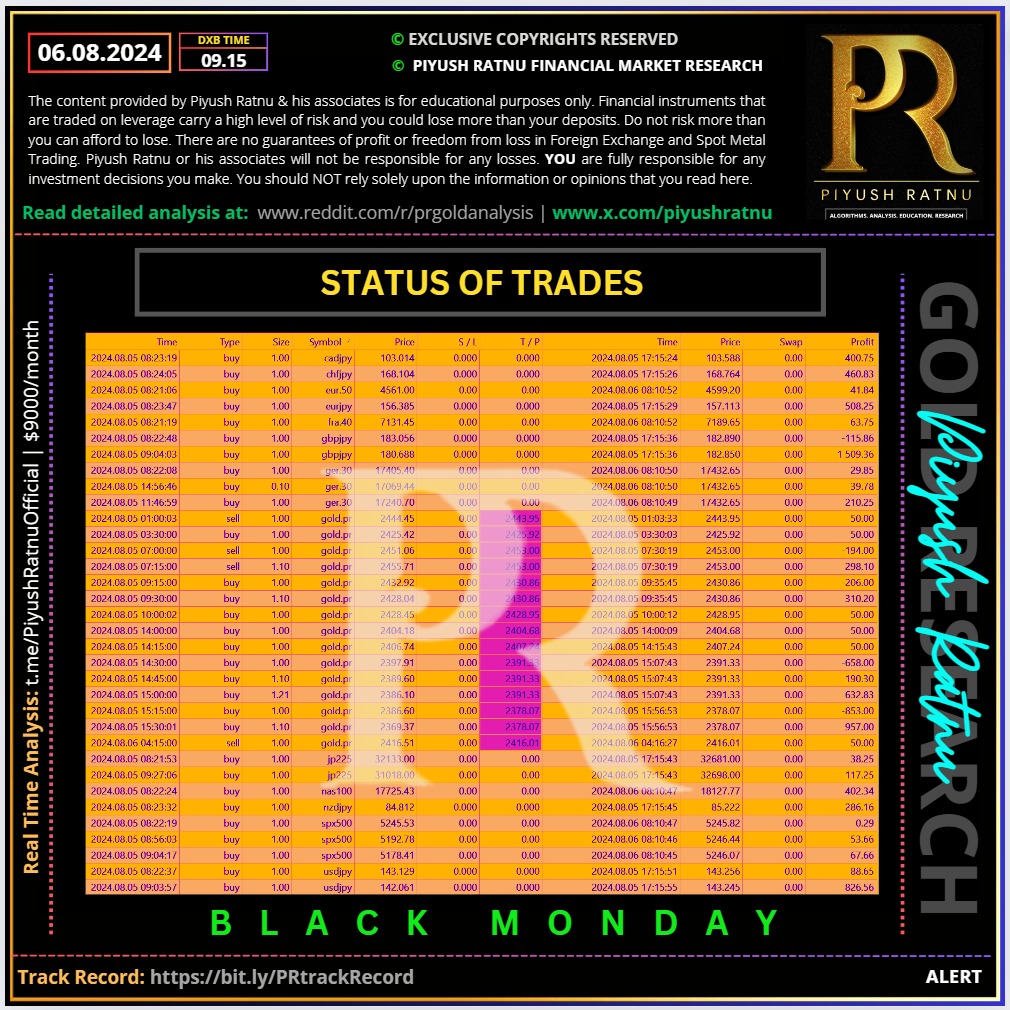

Status of trades on 06 August 2024:

Gold price is consolidating the previous swift rebound to near the $2,410 region early Tuesday, as traders absorb Monday’s volatile trading. Gold price struggles to build on the recovery mode amid a solid comeback staged by the US Dollar, alongside the US Treasury bond yields.

Following the assurances by the US and Japanese authorities to calm nerves, markets are witnessing a massive positive shift in risk sentiment. The Asian stocks attempt a turnaround, with the Japanese benchmark index – the Nikkei 225, jumping nearly 10% so far, reversing the 12% historic sell-off seen Monday.

With the return of risk flows, the haven demand for the US government bonds fades, putting a fresh bid under the US Treasury bond yields and helping lift the US Dollar across the board at the expense of the non-interest-bearing Gold price.

The diplomats from the US and Arab nations attempt to de-escalate the tensions between Iran and Israel that flared up since Wednesday, when Hamas leader Ismail Haniyeh was killed in Tehran in an attack. Iran blamed Israel, vowing to retaliate, with US intelligence noting that the attack could be panned over multiple days.

The diplomatic efforts to diffuse the situation seem to provide some support to the recovery in risk sentiment. However, traders remain wary of Iran striking back against Israel, as the former said “it didn’t care if the response triggered a war.”

Iran’s foreign ministry spokesperson, Nasser Kanaani, stated on Monday that while Iran does not intend to heighten regional tensions, it believes it must punish Israel to deter further instability.

As the Middle East geopolitical situation remains in a delicate spot, traders are glued to the upcoming developments, refraining from placing any fresh position in the Gold price. However, the downside in Gold price could remain limited, as markets continue pricing in a nearly 90% chance that the US Federal Reserve (Fed) will cut interest rates by 50 basis points (bps) in September, according to the CME Group’s FedWatch Tool.

Additionally, the market has around 115 basis points of easing priced in for this year, and a similar amount for 2025, per Reuters. Monday’s sell-off in Gold price, despite broad risk-aversion, could be attributed to investors locking in gains in their Gold longs to cover losses elsewhere. Global stock markets were in turmoil amid escalating Middle East tensions and US economic slowdown fears, following the weak US jobs report on Friday.

XAUUSD Crucial Price Zones:

🔺SZ $2442/2469/2485

🔻BZ $2385/2369/2342

Most Accurate Black Monday 05 August 2024 Trading Performance and Analysis NASDAQ SPX500 USA30 USDJPY GBPJPY EURJPY CHFJPY CADJPY AUDJPY NZDJPY JP225 | Piyush Ratnu

Most Accurate Black Monday 05 August 2024 Trading Performance and Analysis NASDAQ SPX500 USA30 USDJPY GBPJPY EURJPY CHFJPY CADJPY AUDJPY NZDJPY JP225 | Piyush Ratnu

All the above analysis, trading track record can be verified on our Telegram Channel, Twitter X.com account and Reddit.

All the above analysis, trading track record can be verified on our Telegram Channel, Twitter X.com account and Reddit.