03.11.2021

The analysis as published here at 13.30 hours DXB |

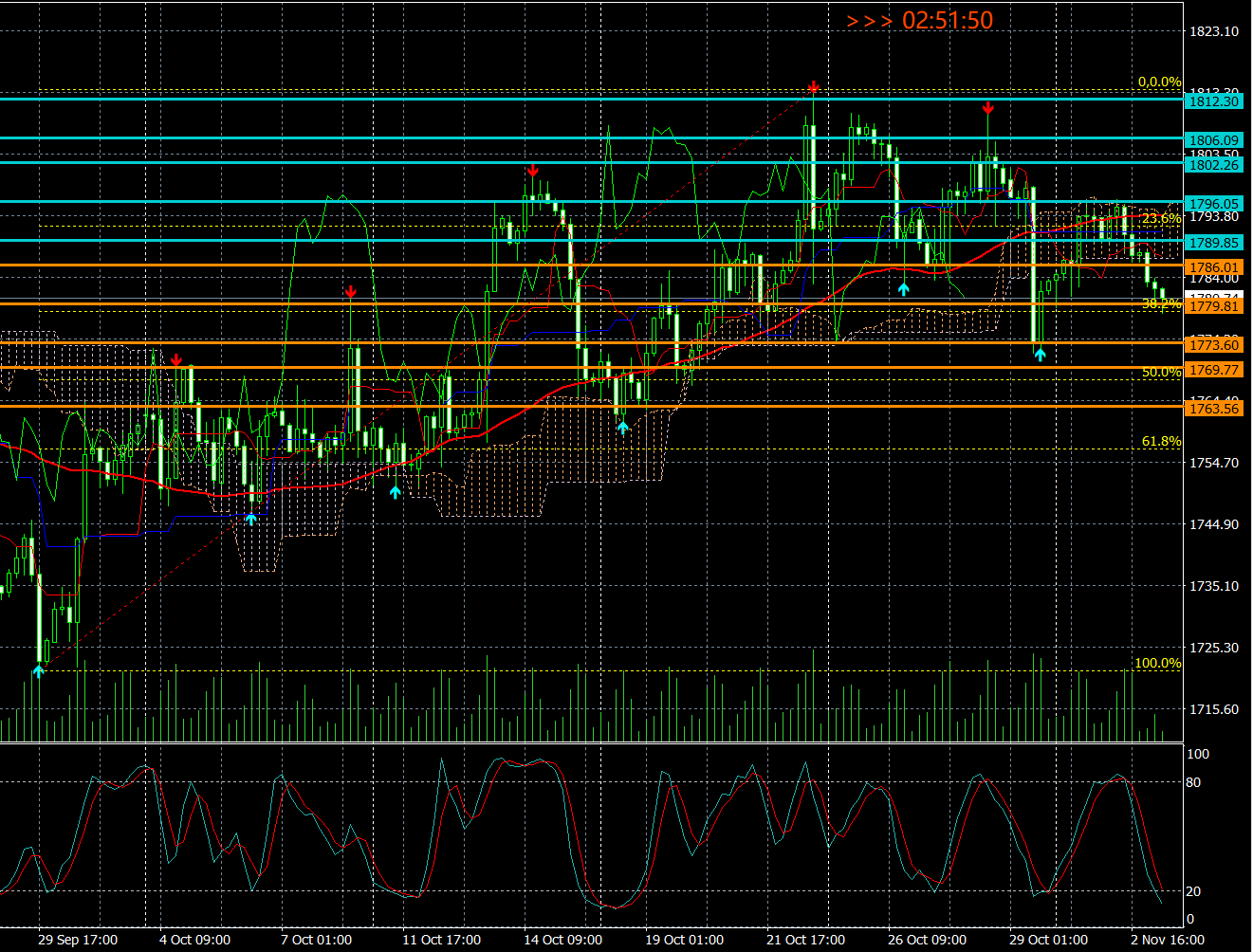

Today Gold price achieved D1 SMA 50 (1778) after crashing from H4 SMA 50. 1756/1721 and 1808-1818/1832 levels are the next major Support and Resistance zone. Tapering related statements can push gold up or down $45-90. All three major equity indexes in the US hit new record highs on Tuesday, and GOLD once again made a failed attempt to achieve $1800 mark and crashed back from $1796 Resistance zone to $1778 Support zone today morning.

The FOMC meeting for November began yesterday and will conclude today. Most importantly, it will be the statement and following press conference by Chairman Powell that will draw the most attention. The statement will contain information about when the Federal Reserve will begin tapering their $120 billion monthly asset purchases. The press conference will clarify any ambiguities found within the statement itself.

It is highly believed that the Fed will announce the onset of tapering tomorrow. They have already defined that tapering will reduce asset purchases by $15 billion each month. The reduction will be composed of $10 billion of U.S. bonds and $5 billion of MBS. Since the Federal Reserve has been buying $80 billion each month of U.S. debt instruments, it will take a total of eight months to complete the tapering process.

That means that if they begin tapering in November, they will not complete the tapering process until June 2022. It is also important to note that they will not begin lift-off until they have completed tapering.

Worried foreign central banks boost gold reserves

After sitting on the side-lines for much of last year, central bank appetite for gold has resumed, in part due to inflationary pressures globally along with disruptions in the energy market.

Russia recently reached a milestone record for its gold reserves, now ranking fifth in the world for the size of its holdings. Russia now holds well over 20% of its reserves in gold! This represents nearly 2,300 tons of gold now held by the totalitarian nation, and that figure is likely to increase substantially in the years ahead.

Meanwhile, the central banks of Serbia, Hungary, Thailand, France, and Germany have added gold to their reserves in recent months. Brazil even bought 41.8 tons recently.

The heavy gold accumulation by central banks points to an ongoing shift away from the Federal Reserve Note “dollar” as the global reserve currency of choice and points to the ongoing shift in global economic dynamics.

The decline and fall of the U.S. dollar as a world reserve currency could mark a key turning point in financial history. Fiat currencies and the debt instruments denominated in them may fall in tandem. Investments in precious metals stand to rise.

Today is FED interest rate announcement and FOMC. In addition, this Friday NFP and Unemployment rate will be published, which brings another huge volatility in Gold price. This week is crucial and retail traders might lose their principle amount if they are stuck in wrong direction.

Analysing Relevant Data plays a crucial role in decision making during such highly volatile economic events:

Observe Resistance & Support zones

Observe Fibonacci Retracement zones

Observe Session shifts

Observe Dollar Index

Observe US10YT – US 10 Year Yield

Observe XAUXAG Ratio

Observe USDJPY price

Observe Yen strength

Observe US Dollar strength

Observe COT on Spot GOLD

Gold council report regarding Supply and Demand stats of Gold

Observe Chairman Powell’s statement

Observe US Monetary Policy

The next big day for the high volatility action in GOLD will be NFP Day:

NFP on 05 November, 2021

Participation rate on 05 November, 2021

Unemployment rate on 05 November, 2021

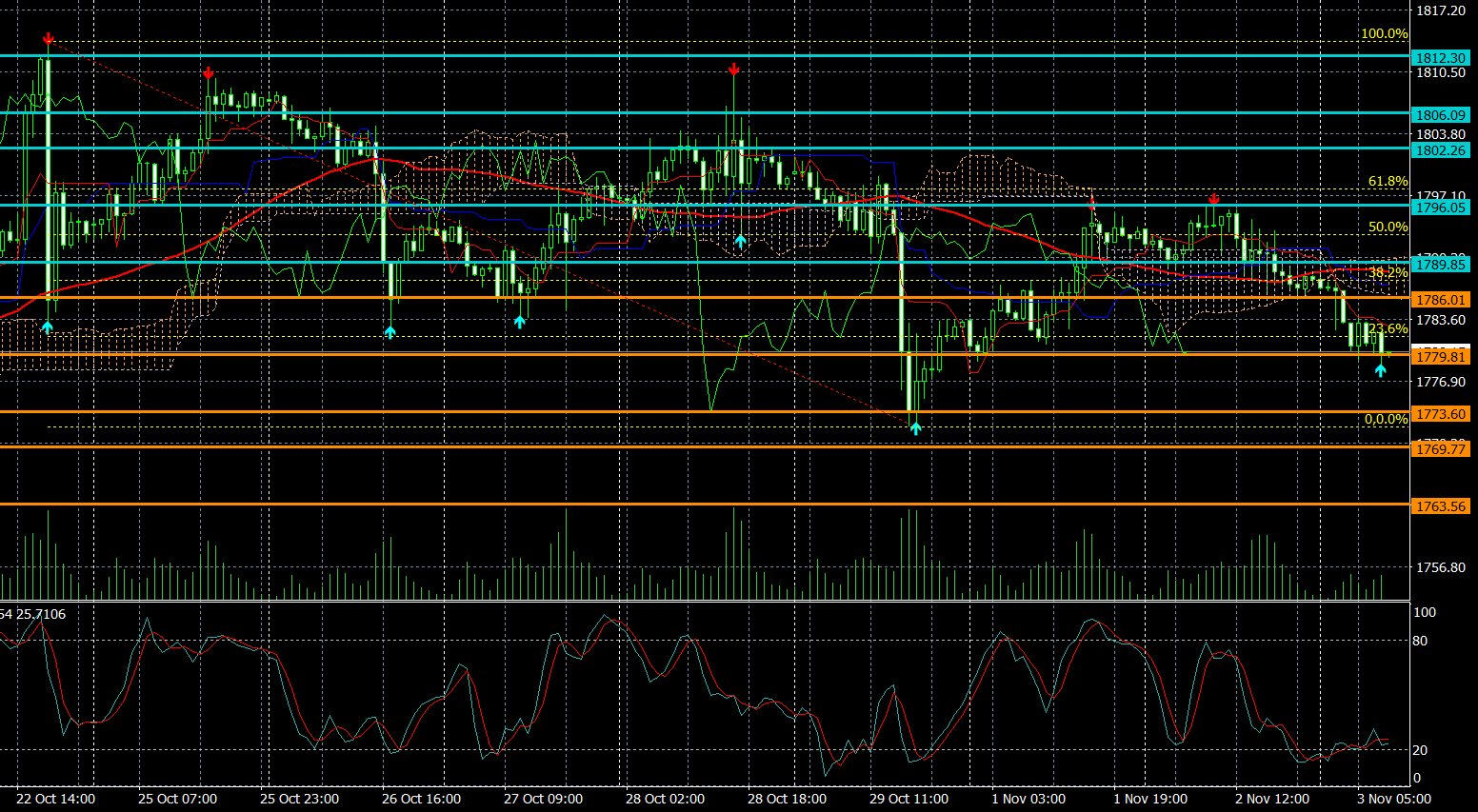

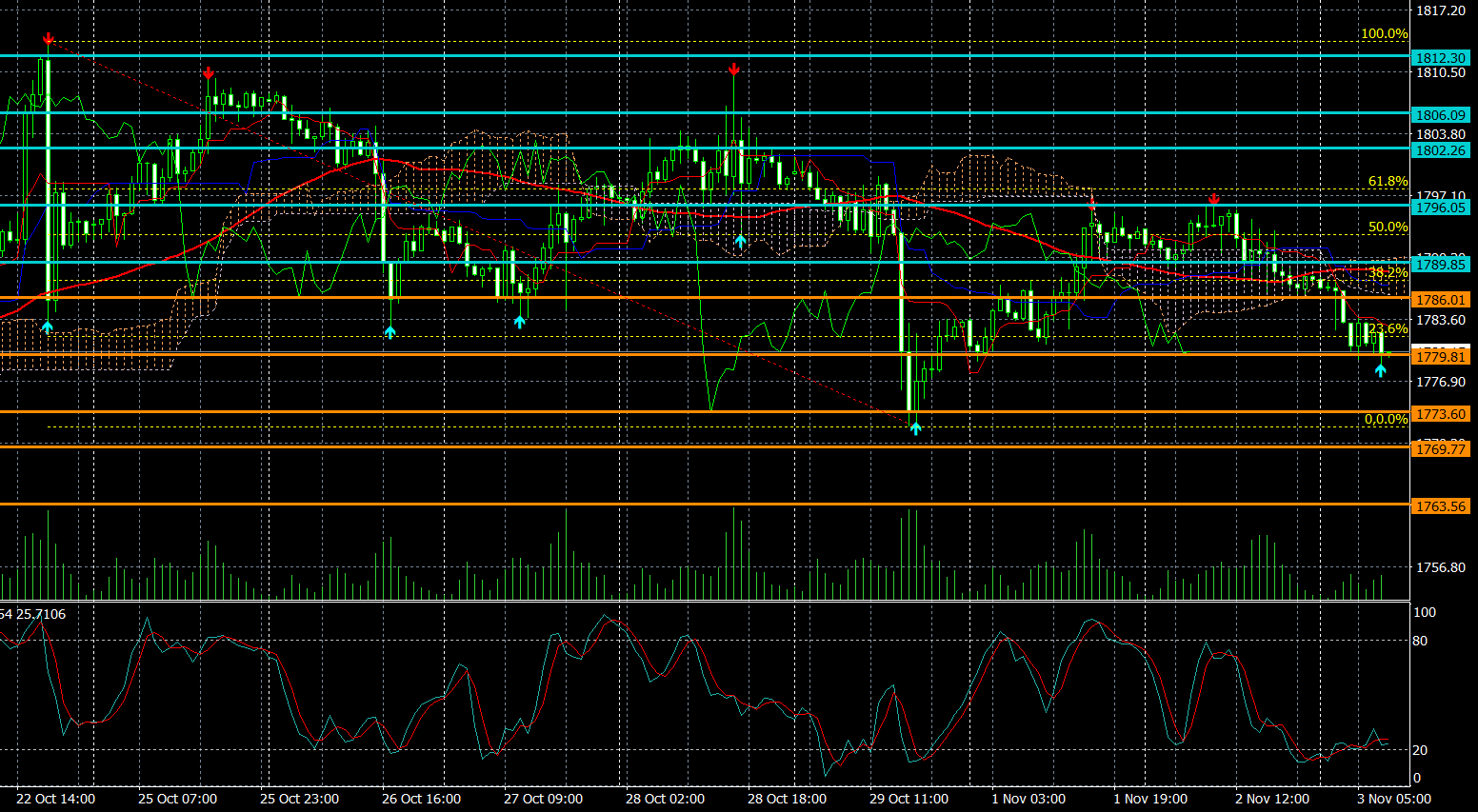

1789 | 1796 (1796 zone) | 1802 – 1806 (1808 zone) | 1812 (1818 zone)

Support zone:

1786 – 1779 – 1773 (1777 zone) | 1769 – 1763

As per past data:

Resistance zone:

1808/1818/1832/1866/1888

Support zone:

1777/1735/1717/1685

SOC Parameters:

H1 Over Sold

H4 Over Sold

D1 at 45.0

RISE above 1796: 23.6% FIB level + H4 SMA zone + Resistance 2: a strong zone of retracement before the further rise to 1808-1818 price levels.

CRASH till 1750: 1763 Last support level + 61.8% at 1756: a strong zone of retracement before the further crash to 1721 – 1717 price levels.

SMA 50 Levels:

M30: $ 1787.00

H1: $ 1788.78

H4: $1793.65

D1: $ 1780.45

All the above data needs to be observed carefully to derive co-relation and trace the further movement of Gold in this and next week. The first and second week in November has always proved itself as a choppy week. Last year too due to elections, Gold crashed in first and second week more than $100.

This week is unique in it’s own way since FED interest rate day, FOMC and NFP – all three economic events of utmost importance are scheduled this week. The only certainty about today’s FOMC conclusion is that we will see increased volatility as market participants attempt to read between the lines of the Federal Reserve statement and chairman Powell’s press conference.

I wish you ALL THE BEST for today!

WARNING: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The author will not be held responsible for information that is found at the end of links posted on this page. The author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. The author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author is not a registered investment advisor and nothing in this article is intended to be investment advice.