Major Factors responsible for rising Gold Price:

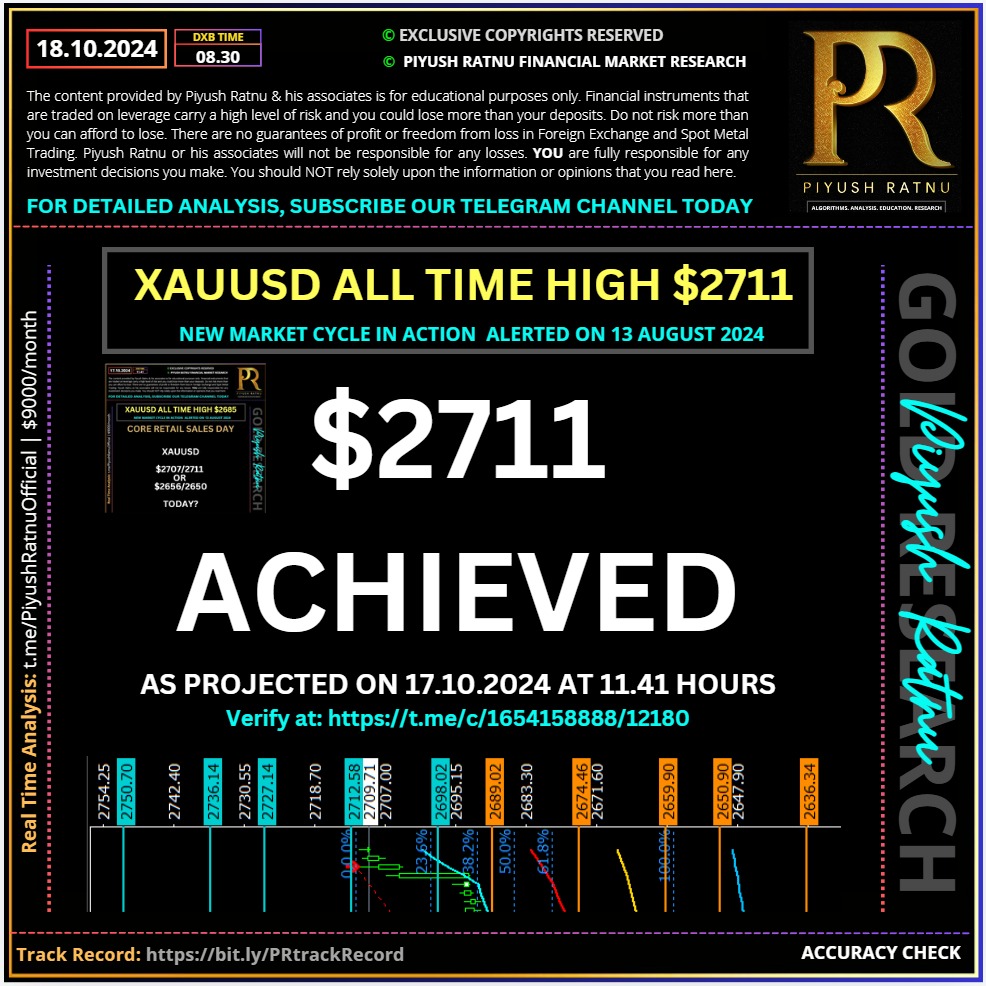

Gold price (XAU/USD)🔺 prolongs its multi-day-old uptrend and climbs further beyond the 🔺$2,700 mark, hitting a fresh record high during the Asian session on Friday. The momentum is sponsored by the expected interest rate cuts by major central banks, which tends to boost demand for the non-yielding yellow metal.

Apart from this, escalating tensions in the Middle East and the uncertainty surrounding the US Presidential election turn out to be another factor underpinning the precious metal.

The focus now shifts to the Middle East geopolitical updates and Fedspeak for further trading impetus.

Why XAUUSD breached the mark of $2700?

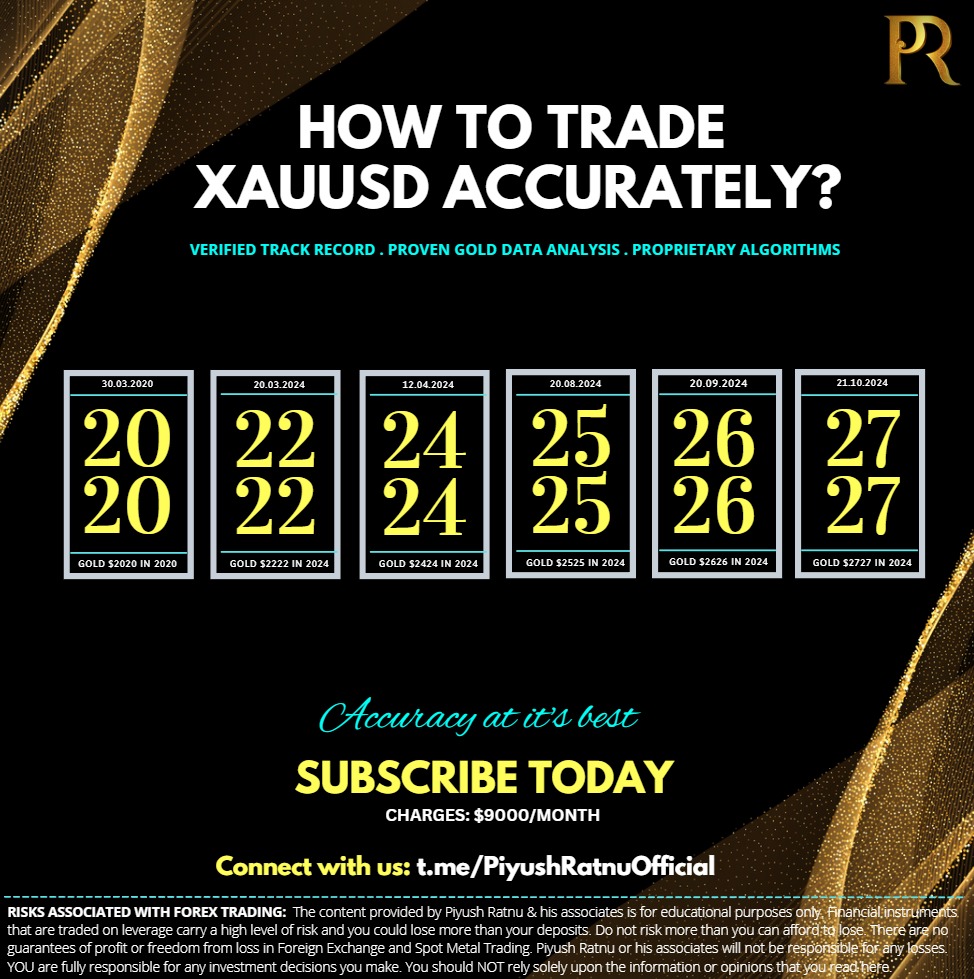

Who projected $ 2685 2700 2727 XAUUSD Spot Gold Price in 2024, WHY XAUUSD Gold Price is rising in 2024?

♦️Chinese Stimulus related optimism

🔺The mixed Chinese growth and activity data combined with the People’s Bank of China’s statement have rekindled stimulus hopes. The renewed market optimism also diminishes the Greenback’s appeal as a safe-haven currency.

♦️ TRUMPISM

🔻The USD retreats from over two-month highs against its six major rivals in Asian trades on Friday, as buyers take a breather after the recent rally back by the market’s optimism that Republican nominee Donald Trump is set to win the 2024 US presidential elections. Trump’s fiscal and trade policies are seen as inflationary and positive for the Greenback.

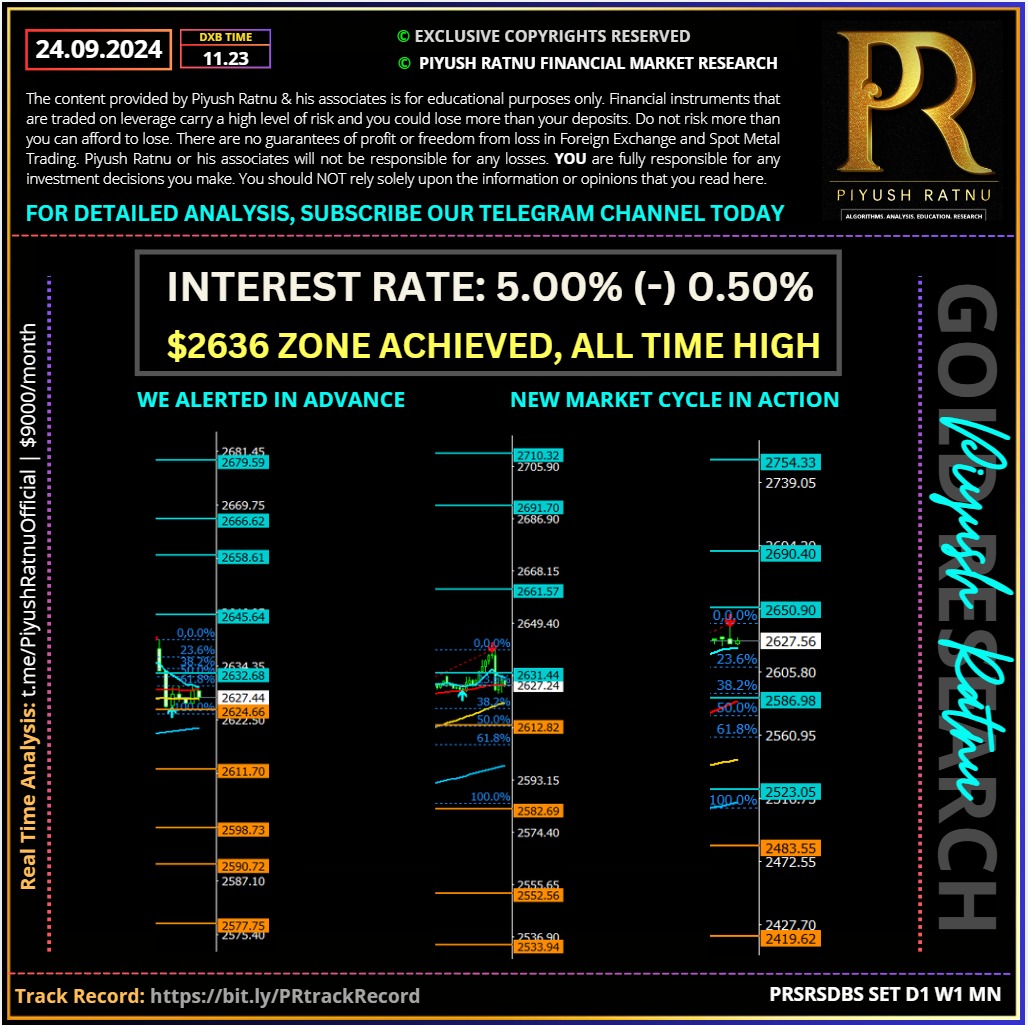

♦️ Interest Rate Cut

US Retail Sales rose 0.4% in September after an unrevised 0.1% gain in August, the Commerce Department’s Census Bureau said on Thursday. Strong US data indicated robust economic prospects but that failed to alter the odds of a 25 basis points (bps) rate cut by the US Federal Reserve (Fed) in November. Markets are currently pricing in a 93% probability of such a move by the Fed next month.

A period of low-interest-rate regime tends to benefit the non-interest-rate bearing Gold price.

♦️Geo-political tensions:

Gold price found fresh haven demand amidst escalating geopolitical tensions between Iran and Israel. Iran-backed militant group, Hezbollah, said it will escalate war with Israel after Israel’s Foreign Minister confirmed the killing of Hamas leader Yahya Sinwar on Thursday.

What’s NEXT?

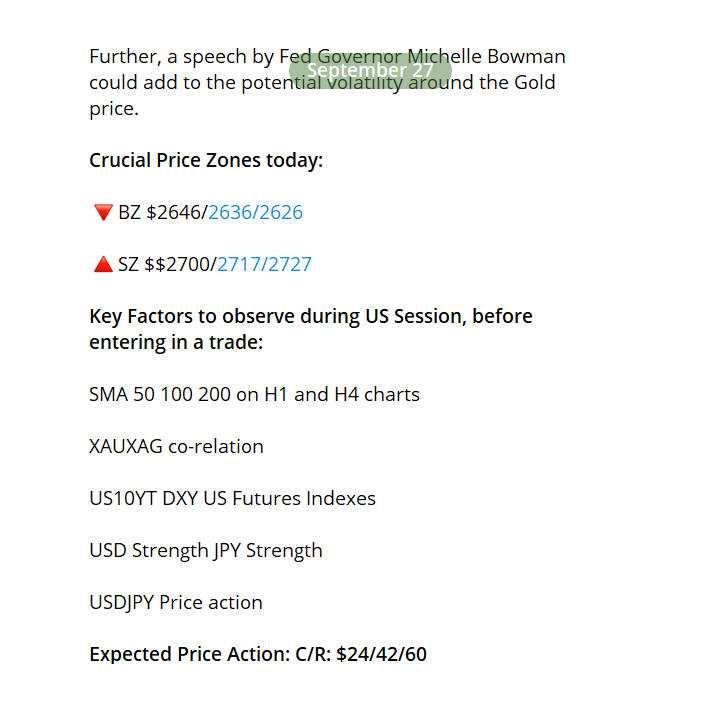

Looking ahead, all eyes remain on the speeches from several Fed policymakers and the rife tensions in the Middle East for further upside in Gold price. The end-of-the-week flows could also play its part in driving the volatility around Gold price.

Verify at: https://t.me/c/1654158888/11805

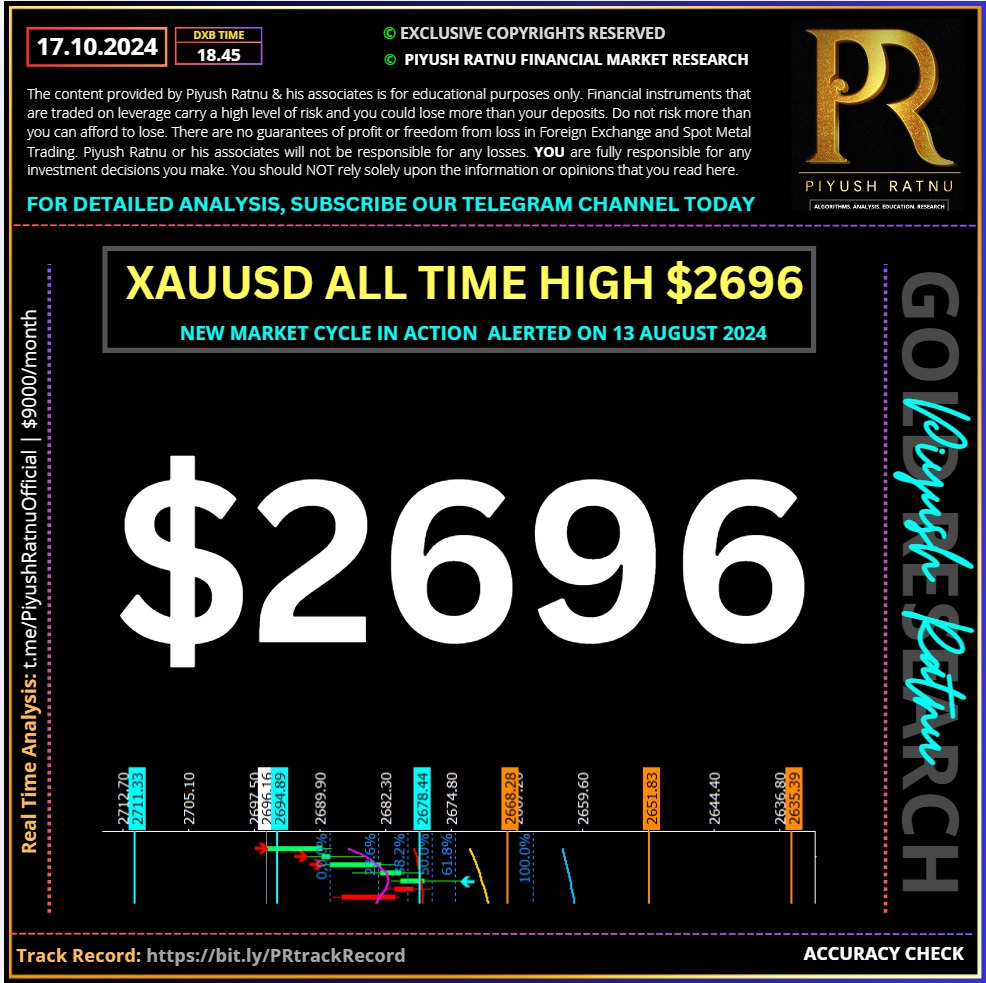

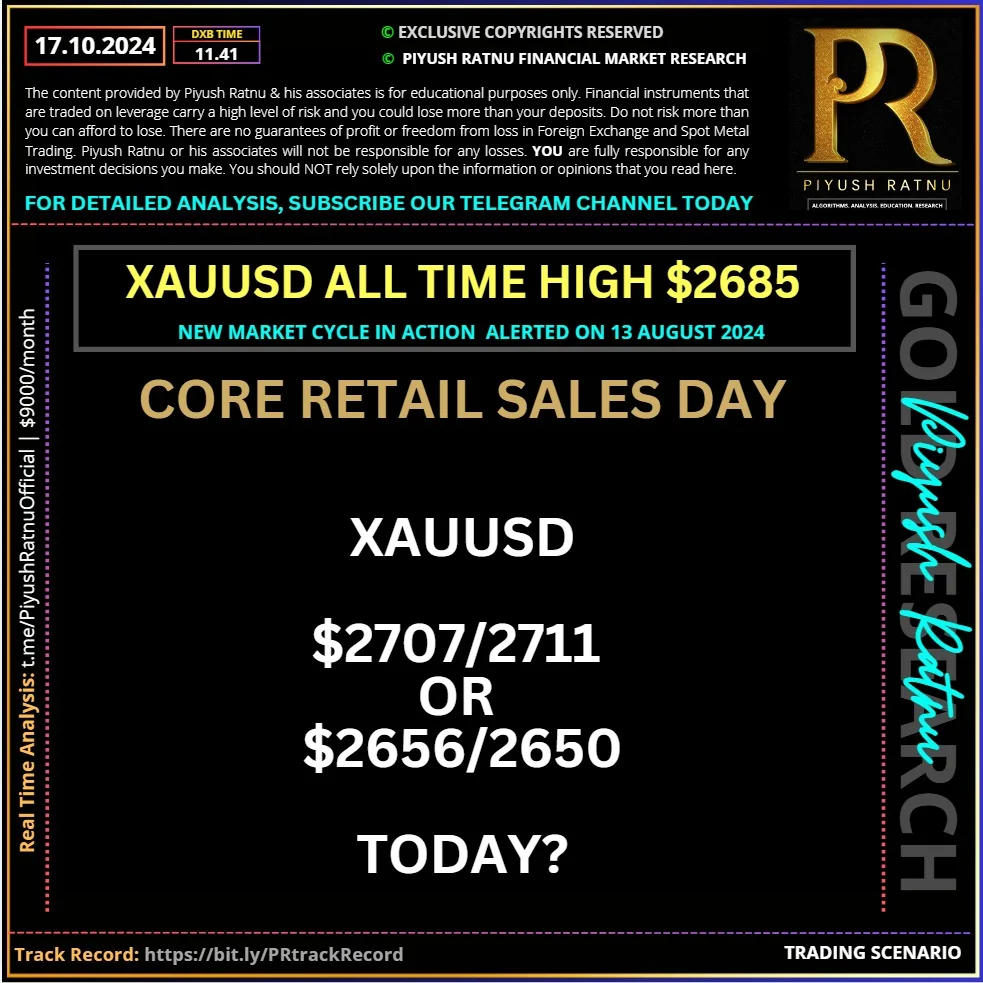

XAUUSD: All set to breach $2700/2727?

Gold price breached the all time high mark of $2685 today and marked $2688 as new high at 14.40 hours today. Gold buyers now look to the US Retail Sales data for the next push higher.

📌Why XAUUSD Gold Price is rising?

Gold price is capitalizing on a renewed pullback in the US Dollar (USD) across the board even as risk sentiment takes a hit on disappointing China’s property market support measures. China’s Housing Minister announced that Beijing will “increase the credit scale of white-list projects to four trillion” yuan by the end of the year and and help renovate a million homes.

A modest uptick in the US Treasury bond yields also check the Gold price upside. Meanwhile, markets are resorting to profit-taking on their USD longs heading into the high-impact economic data release of this week – the US Retail Sales report.

Meanwhile, a 25 basis points (bps) interest-rate cut by the US Federal Reserve (Fed) in November is a done deal. Therefore, the US Retail Sales data are unlikely to alter these expectations.

🟢Risk trends will continue to play their part in driving the Gold price action alongside US macro news, Fedspeak and Trump optimism.

As published in our official Telegram Channel on 17 October 2024: verify here.

Who projected $ 2685 2700 2727 XAUUSD Spot Gold Price in 2024, WHY XAUUSD Gold Price is rising in 2024?

Verify our articles on REDDIT.

Trade with Confidence with Piyush Ratnu Gold Market Research

Subscribe one of the most accurate analysis in the industry: Spot Gold Analysis by Piyush Ratnu powered by 90+ technical and fundamental parameters with a verified and audited track record.

Current Trading Profit Status: 116%

Highest Drawdown Faced YTD: 8%

Highest profit/month booked: 42%

Highest loss/month booked: 5%

Core Focus: #XAUUSD | Spot #Gold

Platform: MT4 MT5

Trading Mode: Manual + Algorithm | Automated: both available

Auto-Copy Trading: Available | Plug and Play Solution

Live Trading Feed Available | Real Time Analysis Available

Connect for an appointment at T.ME/PIYUSHRATNUOFFICIAL