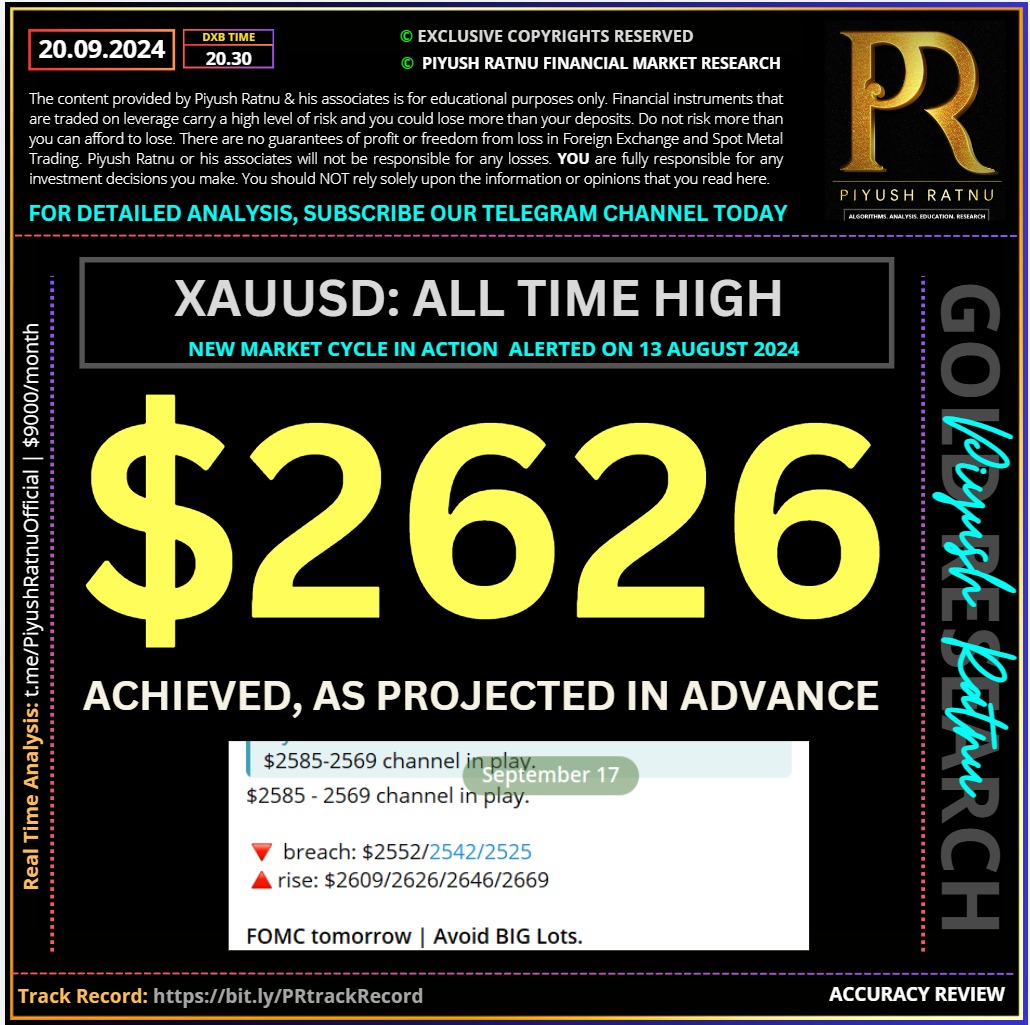

Who projected/predicted XAUUSD Spot Gold $2626 in September 2024 before Fed Interest Rate Cut Decision/FOMC Day 18 September 2024?

Check the accuracy of our analysis on FOMC Day here.

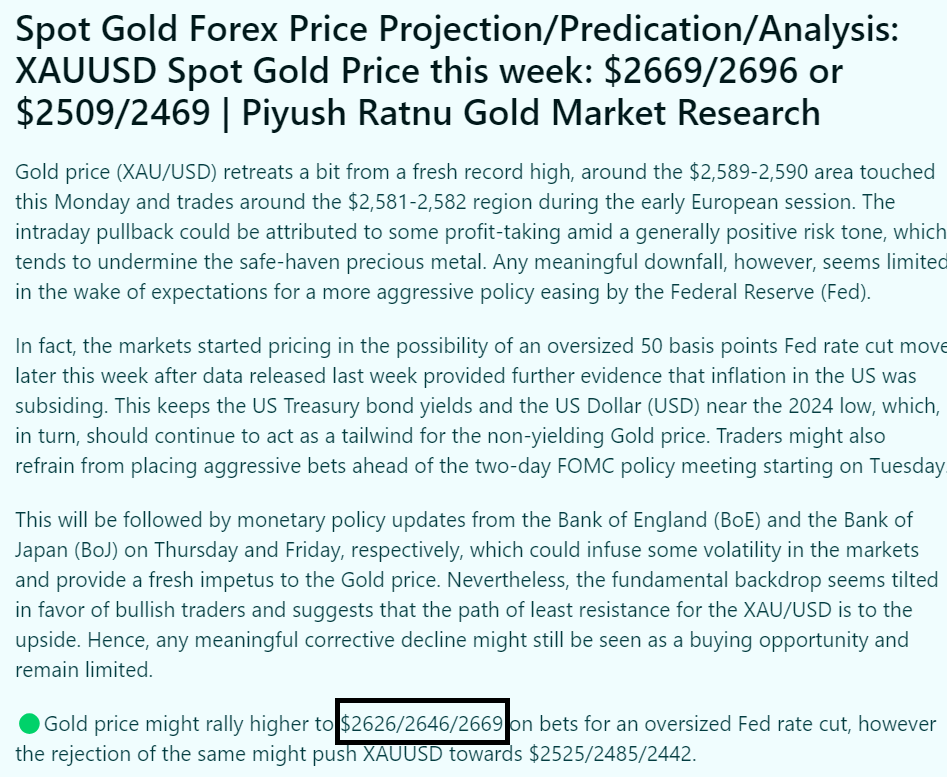

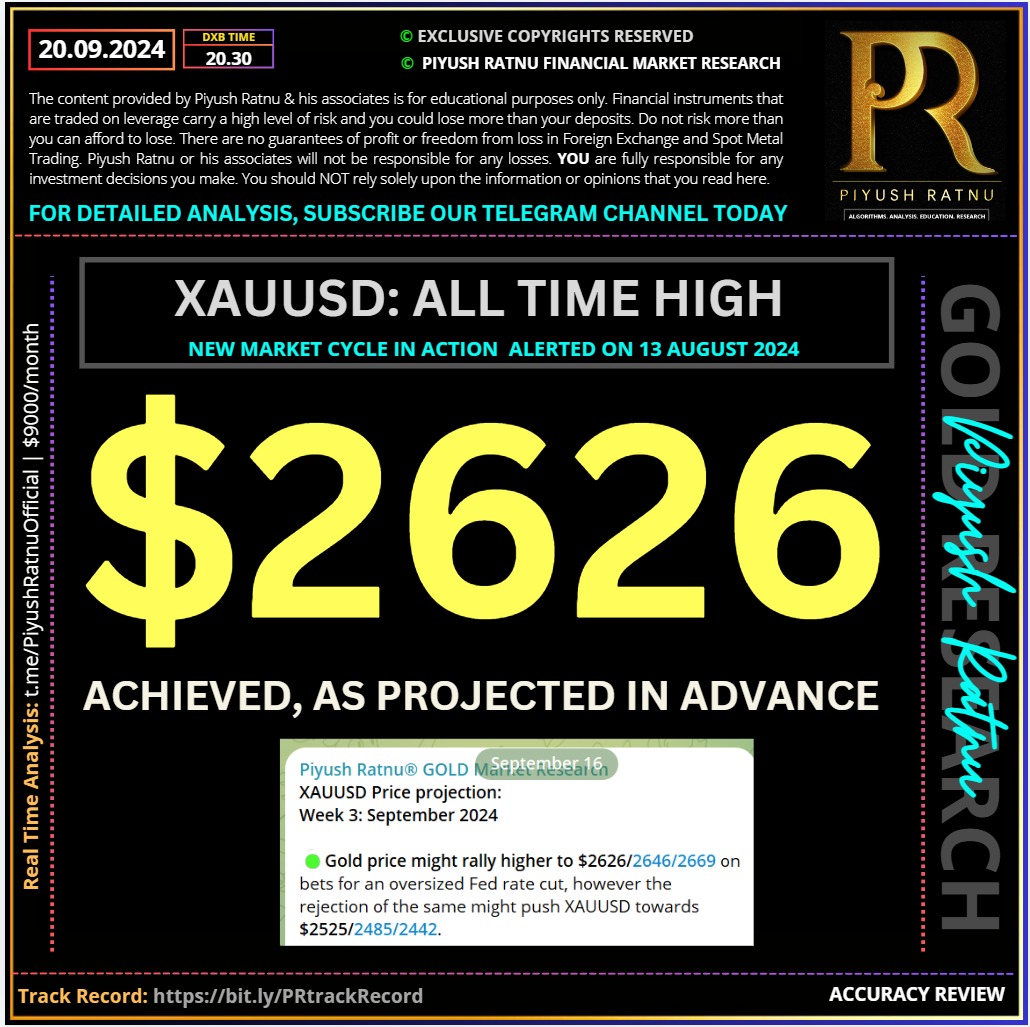

As projected by us on 16 September 2024: before Fed rate Cute Decision and FOMC:

Gold price (XAU/USD) retreats a bit from a fresh record high, around the $2,589-2,590 area touched this Monday and trades around the $2,581-2,582 region during the early European session. The intraday pullback could be attributed to some profit-taking amid a generally positive risk tone, which tends to undermine the safe-haven precious metal. Any meaningful downfall, however, seems limited in the wake of expectations for a more aggressive policy easing by the Federal Reserve (Fed).

In fact, the markets started pricing in the possibility of an oversized 50 basis points Fed rate cut move later this week after data released last week provided further evidence that inflation in the US was subsiding. This keeps the US Treasury bond yields and the US Dollar (USD) near the 2024 low, which, in turn, should continue to act as a tailwind for the non-yielding Gold price. Traders might also refrain from placing aggressive bets ahead of the two-day FOMC policy meeting starting on Tuesday.

This will be followed by monetary policy updates from the Bank of England (BoE) and the Bank of Japan (BoJ) on Thursday and Friday, respectively, which could infuse some volatility in the markets and provide a fresh impetus to the Gold price. Nevertheless, the fundamental backdrop seems tilted in favor of bullish traders and suggests that the path of least resistance for the XAU/USD is to the upside. Hence, any meaningful corrective decline might still be seen as a buying opportunity and remain limited.

🟢Gold price might rally higher to $2626/2646/2669 on bets for an oversized Fed rate cut, however the rejection of the same might push XAUUSD towards $2525/2485/2442.

🆘Key Factors Impacting XAUUSD/Spot Gold Forex price:

• Traders lifted bets for an oversized interest rate cut by the Federal Reserve amid signs that inflation in the US is subsiding, which continues to act as a tailwind for the non-yielding yellow metal.

• According to the CME Group’s FedWatch Tool, the current market pricing indicates over a 50% chance that the US central bank will lower borrowing costs by 50 basis points later this week.

• The expectations were fueled by the softer US Consumer Price Index (CPI) and the Producer Price Index (PPI) reports last week, which provided further evidence of easing inflationary pressures.

• The yield on the benchmark 10-year US government bond languishes near its lowest level since May 2023, while the US Dollar remains within striking distance of the YTD low touched last month.

• Reports of a second attempted assassination attempt on Republican presidential candidate Donald Trump at his Florida golf club on Sunday further underpin demand for the safe-haven bullion.

• The protracted Russia-Ukraine war, along with rising instability and the risk of a further escalation of tensions in the Middle East, turns out to be another factor lending support to the XAU/USD.

• Bullish traders, however, seem reluctant to place fresh bets and prefer to wait for the outcome of the highly-anticipated FOMC monetary policy meeting on Wednesday before placing fresh bets.

• Investors this week will further take cues from the Bank of England and the Bank of Japan policy meetings, which might infuse volatility in the markets and provide some impetus to the metal.

The above analysis can be verified on Reddit / Website / Twitter and our Official Telegram Channel.

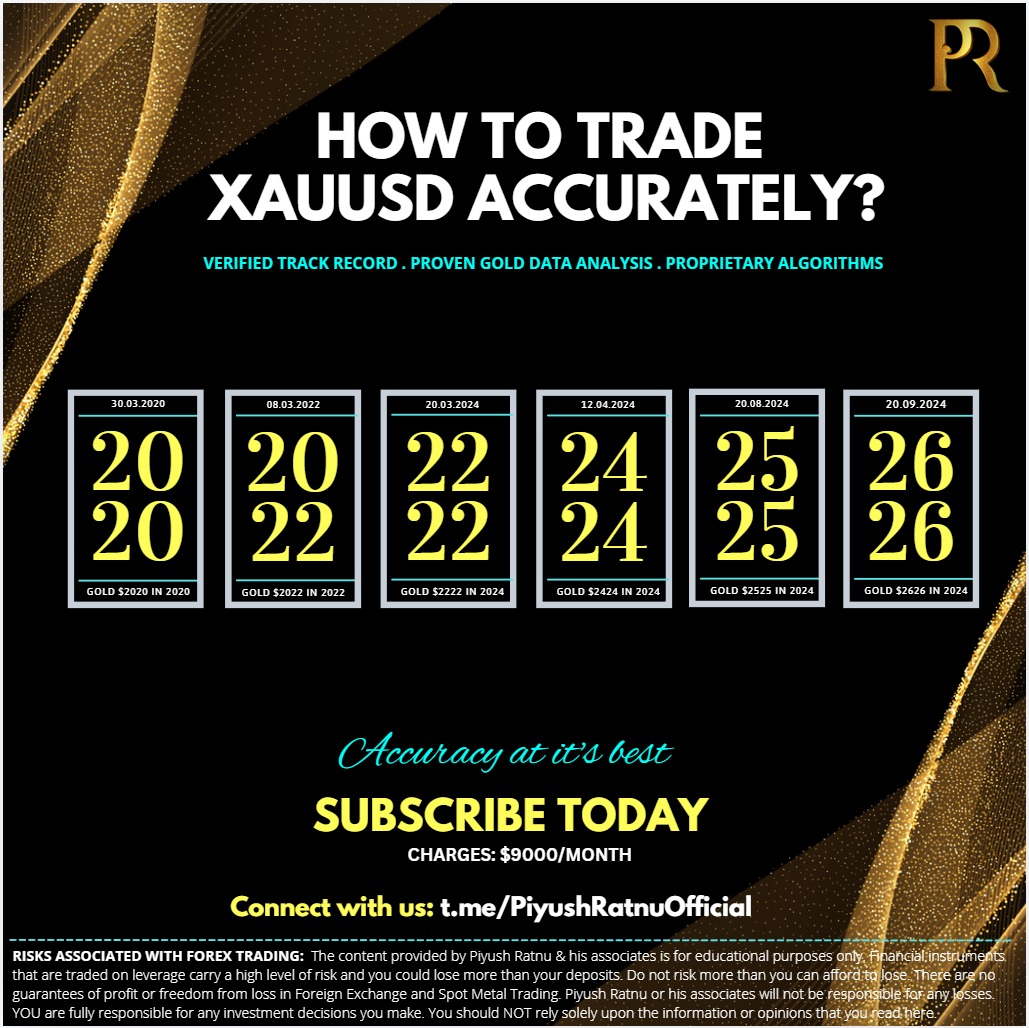

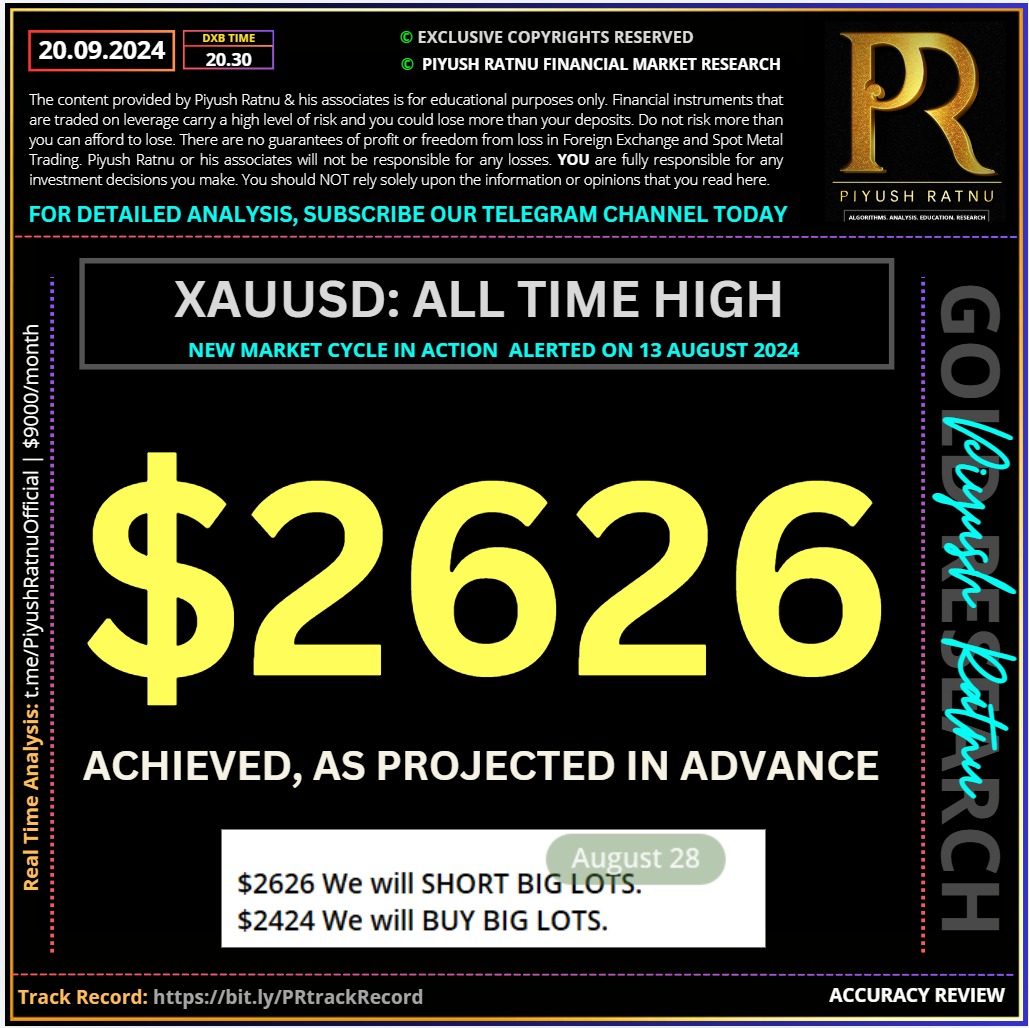

Who projected/predicted XAUUSD Spot Gold $2424 $2525 $2626 in 2024?

Who projected $2626 before Fed Interest Rate Cut Decision/FOMC Day 18 September 2024?

Trade with Confidence with Piyush Ratnu Gold Market Research

Subscribe one of the most accurate analysis in the industry: Spot Gold Analysis by Piyush Ratnu powered by 90+ technical and fundamental parameters with a verified and audited track record.

Current Trading Profit Status: 109%

Highest Drawdown Faced YTD: 8%

Highest profit/month booked: 42%

Highest loss/month booked: 5%

Core Focus: #XAUUSD | Spot #Gold

Platform: MT4 MT5

Trading Mode: Manual + Algorithm | Automated: both available

Auto-Copy Trading: Available | Plug and Play Solution

Live Trading Feed Available | Real Time Analysis Available

Verify Trading Performance at: https://bit.ly/PRinvestizo

#PiyushRatnu #prdxb #prgoldanalysis #gold #XAUUSD #forex

Connect for an appointment at T.ME/PIYUSHRATNUOFFICIAL

Who projected/predicted Forex XAUUSD Spot Gold $2424 $2525 $2626 in 2024 | Will GOLD rise in 2024 2025 WHY | Piyush Ratnu Gold Market Research