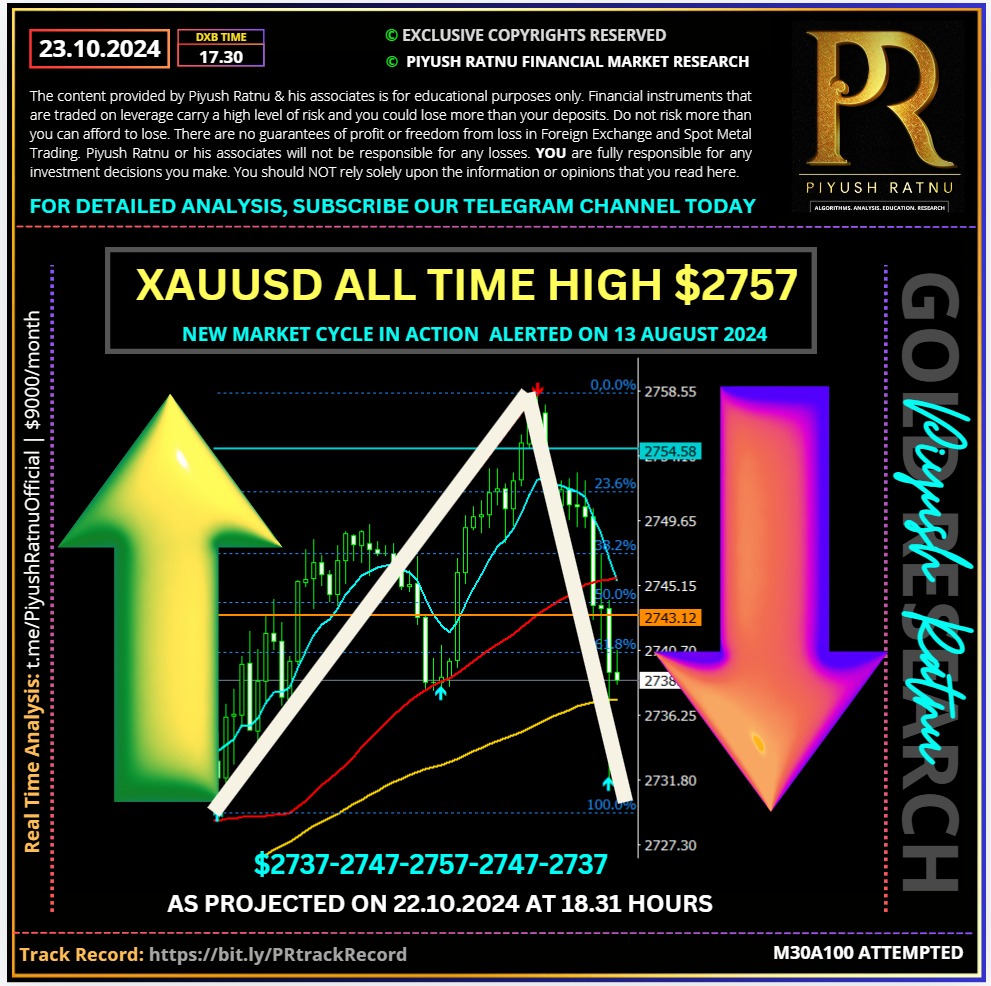

Who projected XAUUSD $2727 $2737 2747 2757 Gold Price in October 2024 | Most Accurate Gold XAUUSD Price Forecast

Why XAUUSD Gold Price is rising in October 2024 | Most accurate GOLD Price Forecast

How to trade XAUUSD during US Elections and Israel Iran War Geo political tensions?

Key factors Impacting XAUUSD Spot Gold Price during end of October 2024

- A combination of supporting factors assists the Gold price to prolong its recent well-established uptrend and touch a fresh all-time peak during the Asian session on Monday.

- Tensions and conflicts in the Middle East show no signs of abating despite the killing of Hamas leader Yahya Sinwar as Israel prepares to respond to Iran’s early-October strike.

- Israel’s Prime Minister Benjamin Netanyahu said that the attack on his private residence by Iran’s Lebanese proxy Hezbollah would not deter him from continuing the war.

- The Israeli army launched a series of air strikes across Lebanon and also intensified attacks across Gaza, raising the risk of a full-blown regional war in the Middle East.

- Recent polls indicate a close contest between Donald Trump and Vice President Kamala Harris, adding a layer of uncertainty and benefiting the safe-haven XAU/USD.

- The European Central Bank last week decided to lower interest rates for the third time this year – marking the first back-to-back rate cut in 13 years – and eyes more cuts.

- The Federal Reserve is also anticipated to lower borrowing costs further, while weak inflation data from the UK solidified bets for a more aggressive easing by the Bank of England.

- Investors have fully priced out the possibility of another jumbo interest rate cut by the Fed in November as the incoming macro data continue to point to a resilient US economy.

- Atlanta Fed President Raphael Bostic said that he is not in a rush to cut rates and see the case for a reduction in the policy rate to somewhere between 3% and 3.5% by the end of next year.

- The yield on the benchmark 10-year US government bond holds above 4% and acts as a tailwind for the USD, albeit does little to hinder the commodity’s positive move.

- Investors continue to cheer the launch of two funding schemes on Friday by the People’s Bank of China aimed at supporting the development of capital markets.

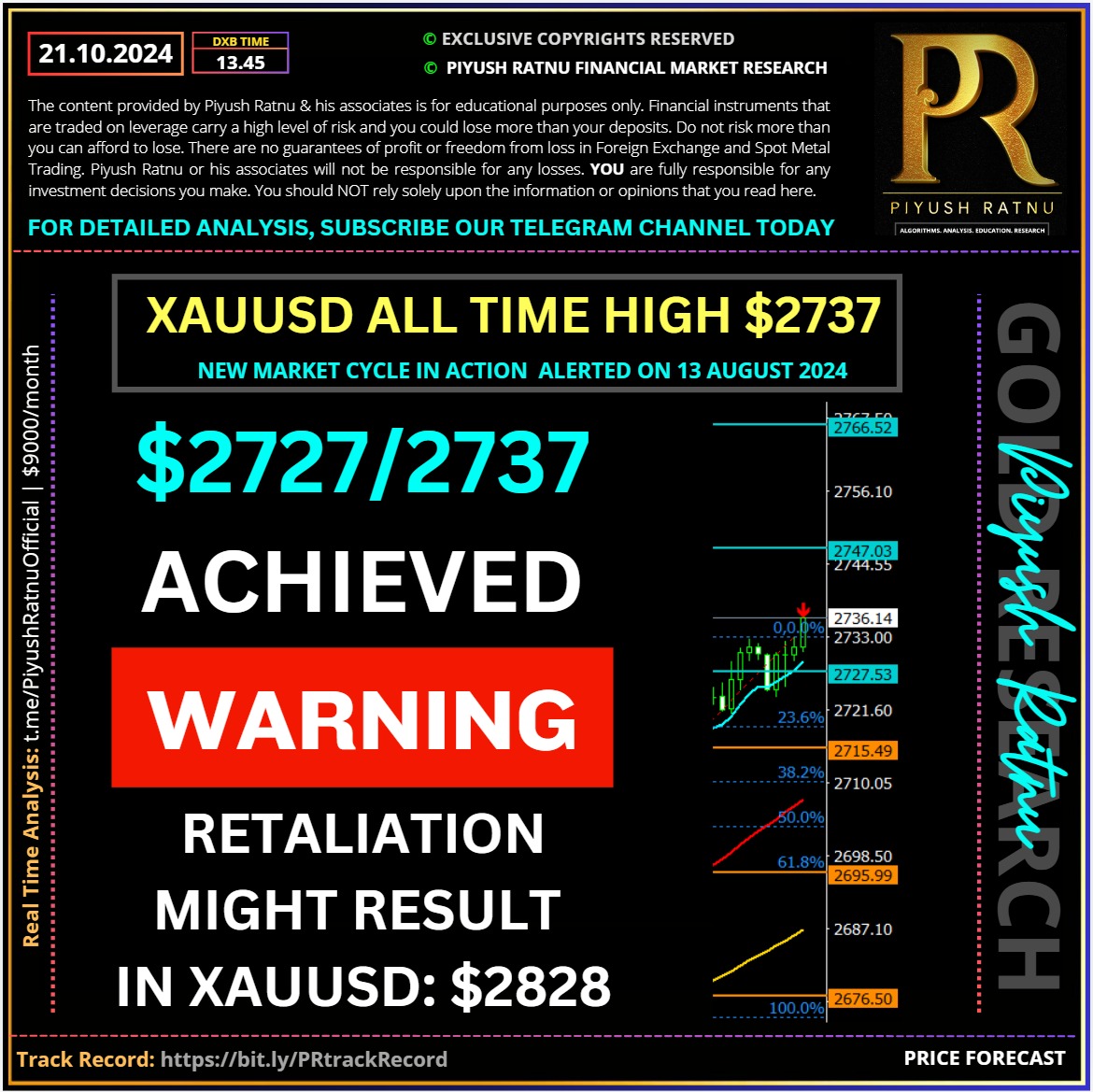

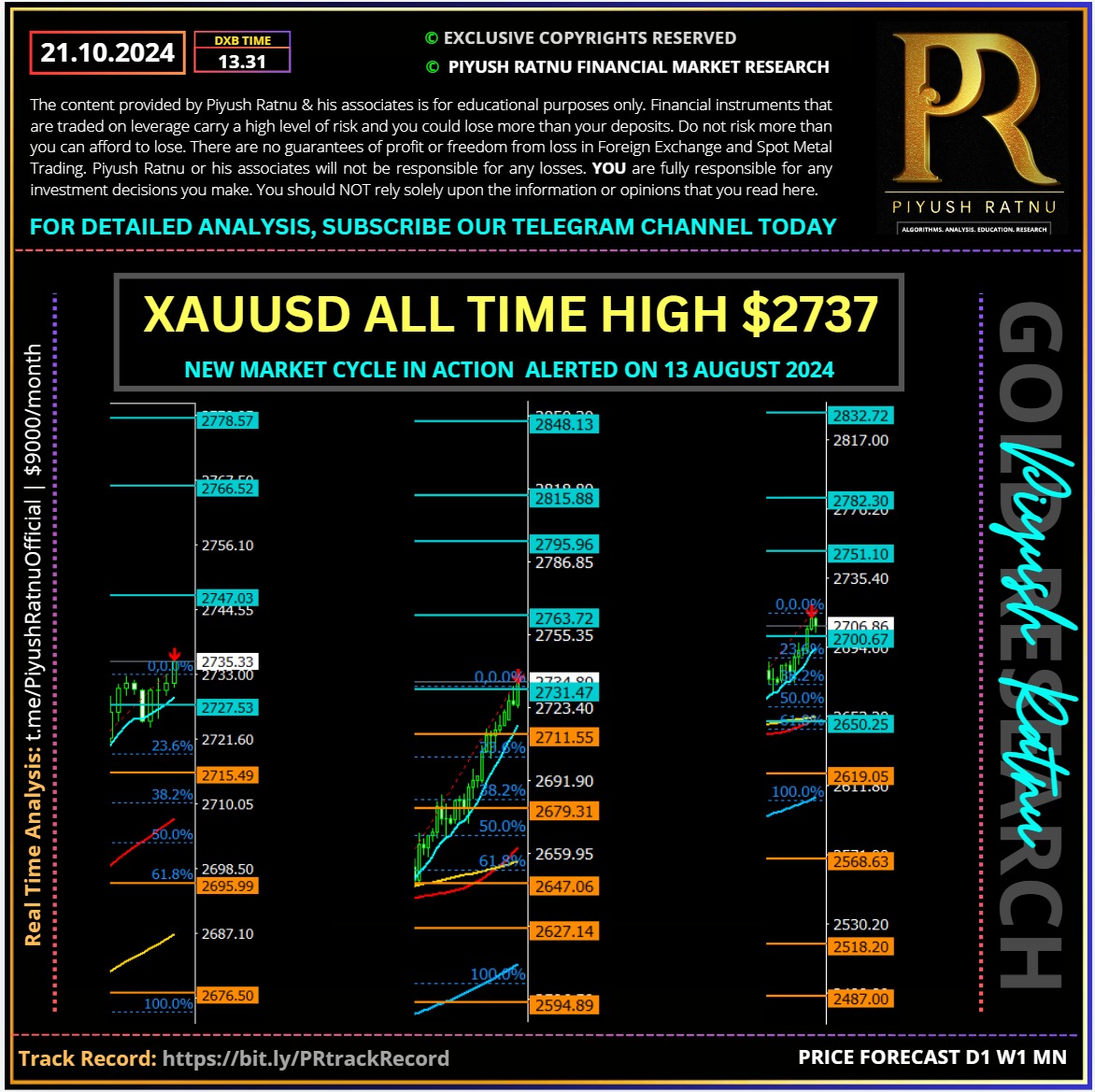

Gold price (XAU/USD) sticks to its intraday gains through the early part of the European session and is currently placed near the all-time peak, around the $2,727/2737 CMP $2736 region as projected in our daily analysis on 18 October 2024. The easing monetary policy environment, along with persistent geopolitical risks stemming from the ongoing conflicts in the Middle East, continues to benefit the non-yielding yellow metal. Apart from this, the US political uncertainty is seen as another factor that contributes to the recent upswing witnessed over the past two weeks or so.

Gold price (XAU/USD) sticks to its intraday gains through the early part of the European session and is currently placed near the all-time peak, around the $2,727/2737 CMP $2736 region as projected in our daily analysis on 18 October 2024. The easing monetary policy environment, along with persistent geopolitical risks stemming from the ongoing conflicts in the Middle East, continues to benefit the non-yielding yellow metal. Apart from this, the US political uncertainty is seen as another factor that contributes to the recent upswing witnessed over the past two weeks or so.

ALERT: Middle East tensions and the uncertainty around the US presidential election, I expect a fresh trading impetus from the upcoming speeches from US Federal Reserve (Fed) policymakers.

USD corrective mode

The US Dollar (USD) maintains its corrective mode intact, tracking the renewed weakness in the US Treasury bond yields, as Chinese stocks recover ground after the People’s Bank of China (PBOC) delivered a bigger-than-expected cut to the one-year Loan Prime Rate (LPR) from 3.35% to 3.10%.

China’s stimulus optimism alongside the persistent tensions between Israel and Iran kept the Gold price underpinned.

Israel carried out a new wave of air strikes on southern Beirut after it announced the targeting of Hezbollah’s al-Qard al-Hassan financial institution’s offices.

Israel’s government said a drone targeted Prime Minister Benjamin Netanyahu’s house Saturday, with no casualties, as fighting with Lebanon-based Hezbollah and Gaza-based Hamas showed no pause after the killing of the Hamas mastermind of last year’s October 7 attack.

Israel’s military said dozens of projectiles were launched from Lebanon a day after Hezbollah announced a new phase in fighting. Netanyahu’s office said the drone targeted his house in the Mediterranean coastal town of Caesarea. Neither he nor his wife was there. It wasn’t clear if the house was hit.

“The proxies of Iran who today tried to assassinate me and my wife made a bitter mistake,” Netanyahu said.

Hezbollah didn’t claim responsibility but said it carried out several rocket attacks on Israel. The barrage came as Israel is expected to respond to an attack earlier this month by Iran, which backs both Hezbollah and Hamas.

Israel in turn carried out at least 10 airstrikes on Beirut’s southern suburbs known as Dahiyeh, a heavily populated area home to Hezbollah’s offices, Lebanese authorities said. Israel’s military said it struck Hezbollah targets.

Release of classified documents

The US government has launched an investigation into the unauthorized release of classified documents detailing Israel’s military preparations for a potential strike on Iran. Investors prefer to flock to safety in the traditional safe-haven Gold price, in times of geopolitical turmoil.

Trump Rally

US Dollar could see resurgent demand on the revival of the ‘Trump rally’. Markets seem optimistic that Republican nominee Donald Trump will win the 2024 US presidential elections. Trump’s fiscal and trade policies are seen as inflationary and positive for the Greenback.

21 October 2024 | 21.21 hours | XAUUSD crashed from $2740-2717, as projected as SZ: $2727 2737 2747 2757.

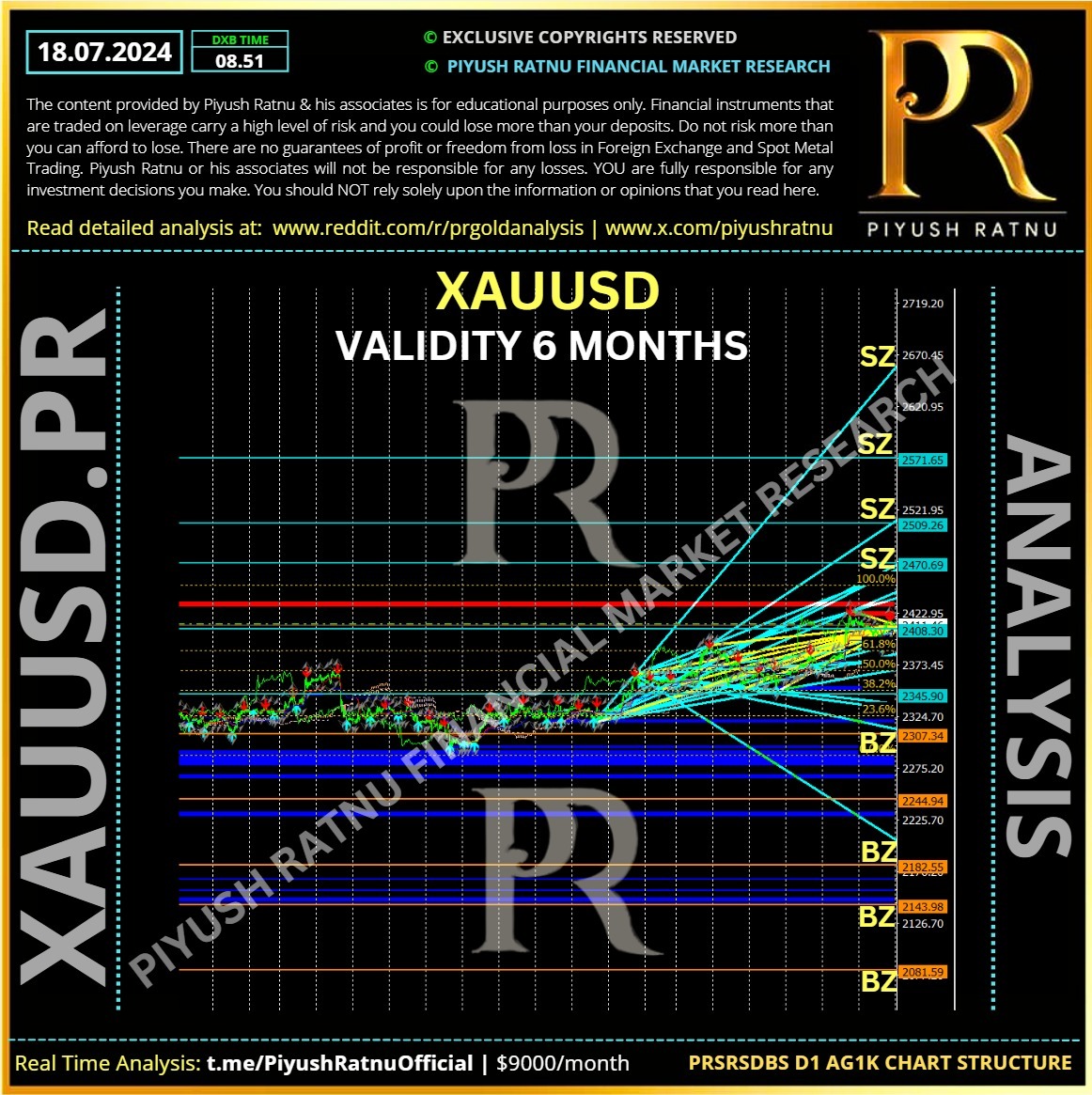

I had projected the same scenario recently on 18 October 2024, 13 July and 18 July 2024.

XAUUSD Spot Gold | $2740-2717 achieved today:

I had projected this trading scenario in advance on 13 July 2024, 18 July 2024:

You can cross verify this remarkable analysis here:

https://x.com/piyushratnu/status/1813560415332245606

Algorithm PRSRSDBS D1 AG1K Chart Structure by Piyush Ratnu Gold Market Research

Trade with Confidence with Piyush Ratnu Gold Market Research

Trade with Confidence with Piyush Ratnu Gold Market Research

Subscribe one of the most accurate analysis in the industry: Spot Gold Analysis by Piyush Ratnu powered by 90+ technical and fundamental parameters with a verified and audited track record.

Current Trading Profit Status: 112%

Highest Drawdown Faced YTD: 8%

Highest profit/month booked: 42%

Highest loss/month booked: 5%

Check Trading Performance at:

https://www.myfxbook.com/members/PiyushRatnu

Core Focus: #XAUUSD | Spot #Gold

Platform: MT4 MT5

Trading Mode: Manual + Algorithm | Automated: both available

Auto-Copy Trading: Available | Plug and Play Solution

Live Trading Feed Available | Real Time Analysis Available

Connect for an appointment at T.ME/PIYUSHRATNUOFFICIAL

Who projected XAUUSD $2727 $2737 Gold Price in October 2024 | Most Accurate Gold XAUUSD Price Forecast