Who projected XAUUSD Spot Gold $2828 in 2025?

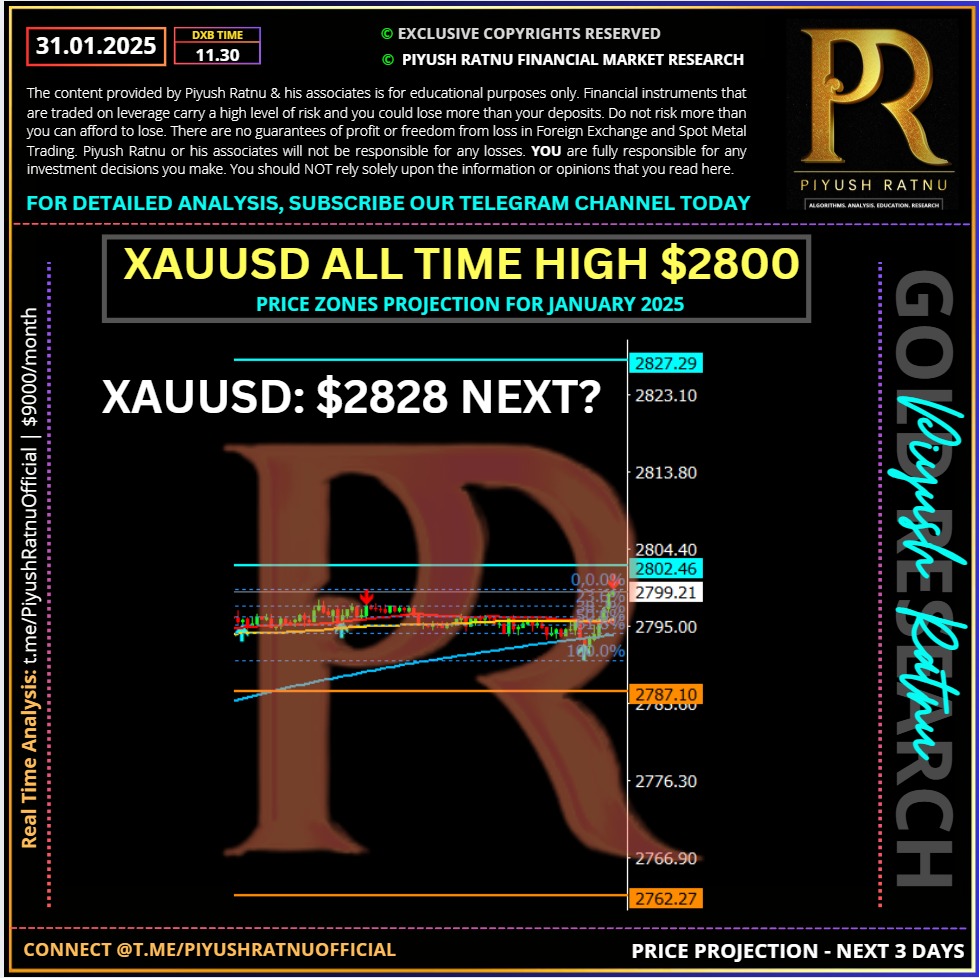

As published on our official analysis feed on 29 January 2025:

FOMC Day: I had projected $2808/2828 zone reversal $2727/2707

Verify here.

As published on 30 January 2025 at 16.47 hours:

The latest analysis of XAU/USD (Gold against the US Dollar) indicates a bullish trend as gold prices have recently surged past the $2,777 resistance level, reaching a weekly high around $2,780.

This upward movement is supported by a decline in US Treasury yields, which typically boosts demand for non-yielding assets like gold. Traders are closely monitoring upcoming economic data, particularly the US GDP figures, which could influence market sentiment. If gold maintains momentum and breaks above the $2,787 level, it may target the all-time high near $2,790 with next target as $2808/2828.

Key Factors responsible for the above analysis:

Key Factors responsible for the above analysis:

• US GDP for Q4 204 dipped from 3.1% in Q3 to 2.3%, missing the mark. According to the US Department of Labor, Initial Jobless Claims for the week ending January 24 fell to 207K, coming in lower than the expected 220K and the previous week’s 223K.

• Gold’s advance is also sponsored by the fall of US yields. The US 10-year T-note yield dropped two basis points down to 4.516%. US real yields, as measured by the 10-year Treasury Inflation-Protected Securities (TIPS), followed suit, tumbling two basis points to 2.138%.

• Bullion prices are also unfazed by a hawkish Fed, which unanimously voted to keep interest rates steady at 4.25% – 4.50% on Wednesday. The central bank cited a resilient US economy, limited progress in reducing inflation, and a recovering labor market as key factors behind the decision.

• While Trump’s plans are still unclear, he set a deadline of Saturday for tariffs of 25% on Mexico and Canada, and has also said he intends to impose across-the-board levies that are “much bigger” than the 2.5% figure previously suggested by Treasury Secretary Scott Bessent.

• The swaps market is pricing 50 bps of Fed rate cuts in 2025.

Gold price skyrocketed to a new all-time high (ATH) of $2,800 on Friday after a series of data of the United States (US) indicated the economy is slowing down, warranting the Federal Reserve (Fed) to lower interest rates despite holding them steady at Wednesday’s meeting. At the time of writing, the XAUUSD trades at $2,794, up 1.31%.

The yellow metal exploded on Thursday after being contained by the $2,770 figure for the last three days. US Treasury yields edged lower as traders grew disappointed following the last reading of 2024 of the fourth quarter Gross Domestic Product (GDP), which, although expanding, did so at a lower rate than expected.

Trump renewed his pledge to impose 25% tariffs on Canada and Mexico, sending the currencies of both countries lower against the US dollar. The USDCAD rallied to 1.46 and is now challenging the highest levels since 2016 and 2020. The risks are tilted to the downside for the Loonie, as heated trade war with the US could significantly hurt Canada’s economic growth, bring in stronger Bank of Canada (BoC) support and weigh on the Canadian dollar.

The European Central Bank (ECB) cut the interest rates yesterday for the fifth time, and pulled the facility deposit rate to 2.75%. The euro reacted by giving a positive reaction to the expected move. But enthusiasm didn’t last beyond ECB Chief Christine Lagarde’s presser, where she reminded investors that growth risks remain ‘tilted to the downside’.

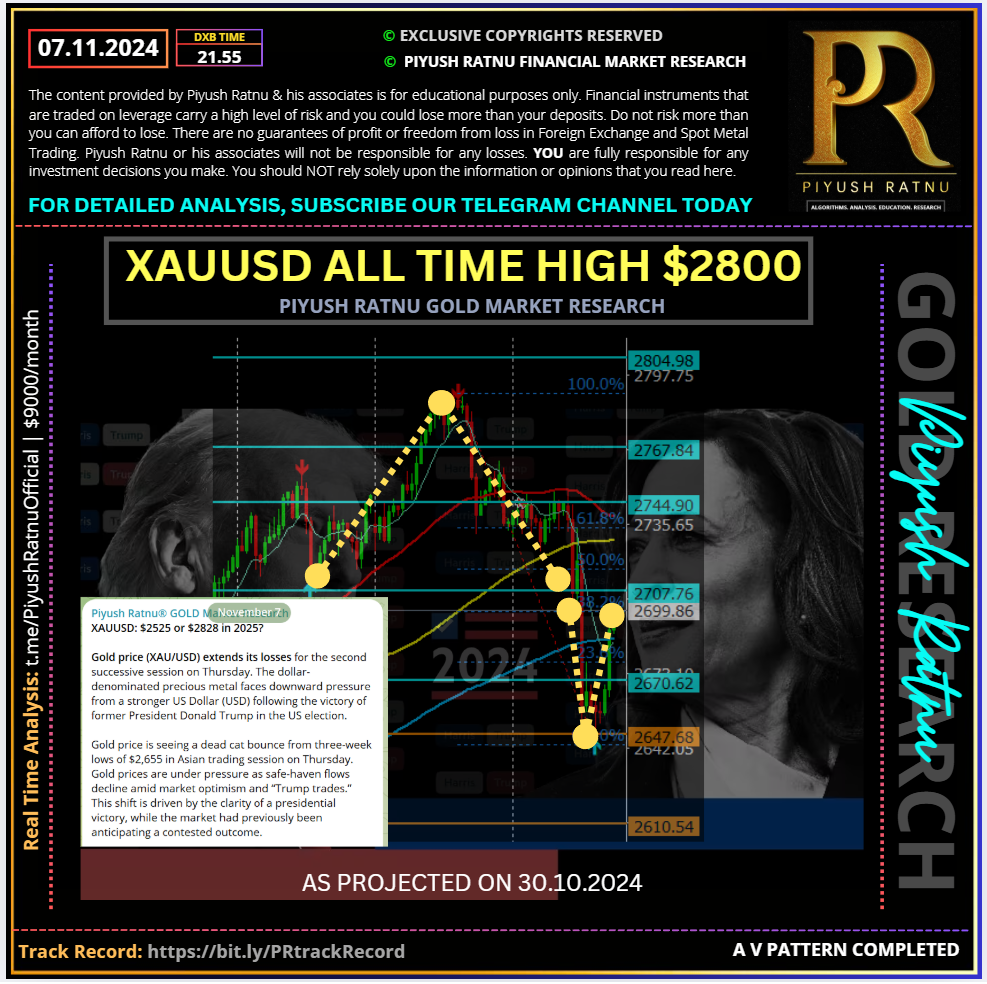

I had projected the target of $2828 on 07 Novemeber 2024: the same can be verified here.

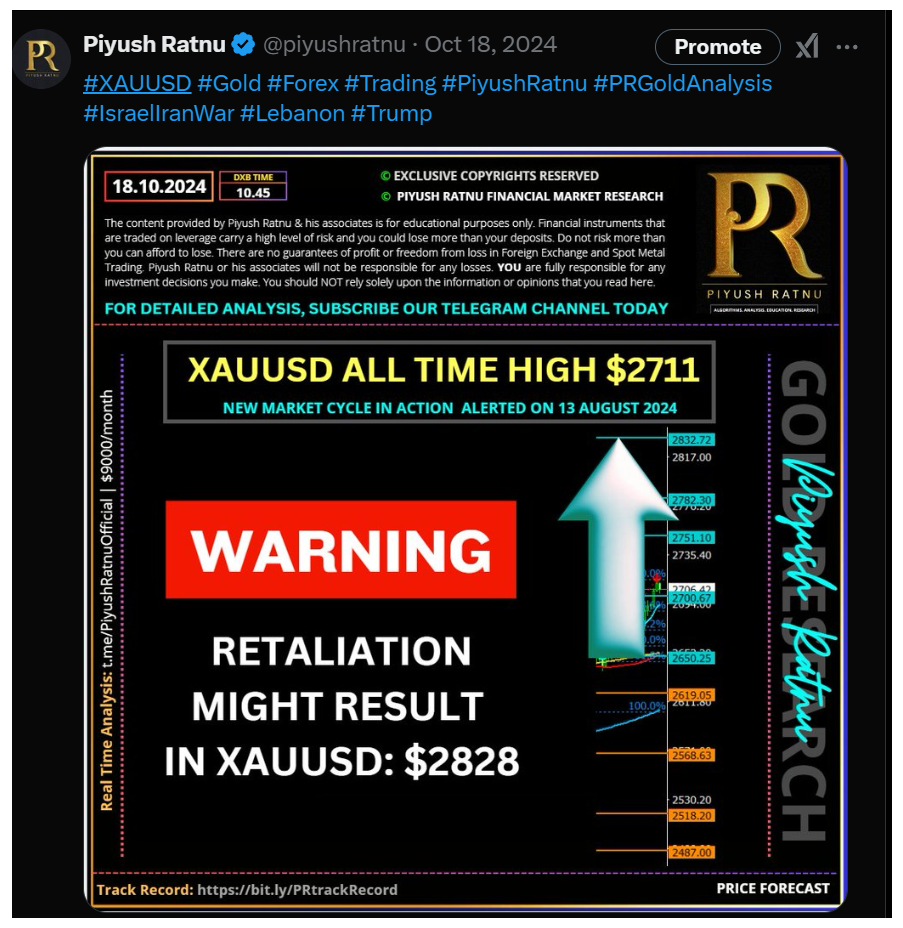

As mentioned on our live analysis feed on 22 October 2024: Verify here. Telegram Post.

Gold Price held at record levels on Tuesday, with XAU/USD trading as high as 🔺$2,747 during American trading hours.

XAUUSD maintains the positive tone amid the dismal market mood, given tensions in the Middle East and looming US elections.

Speculative interest began pricing in a slower pace of Federal Reserve (Fed) interest rate cuts amid concerns former President Donald Trump may win the presidential race.

🆘Trump’s policies on taxes and tariffs are seen as a potential booster for inflation and even increased odds for interest rate hikes.

Government bond yields extended their advance, with the 10-year Treasury note currently yielding 4.20%, its highest since late in July. The 2-year note currently offers 4.05%, also a fresh multi-week high.

Meanwhile, 🟢stock markets are in retreat mode, with most Asian and European indexes having closed in the red. Wall Street trades mixed, with the Dow Jones Industrial Average posting sharp losses and only the Nasdaq Composite trading in the green.

🟢The risk-averse environment suggests the bright metal will continue posting higher highs, with no signs of bullish exhaustion despite technical readings suggesting overbought conditions.

📌Crucial Price Zones:

SZ: 🔺 $2767/2787/2808/2828

BZ: 🔻 $2727/2707/2685/2669

Facts about GOLD

How is Gold correlated with other assets?

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

What does the price of Gold depend on?

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Who buys the most Gold?

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Which country is the largest source of gold?

China

China remains the largest producer of gold in 2024, with a mine production of 370 metric tons (MT). Despite a peak production of 455 MT in 2016, China’s consistent output exceeding 300 MT for over a decade solidifies its position as the world leader in gold production.

Which country owns the most gold privately?

Private holdings

| Rank | Name | Gold holdings (in tonnes) |

| 1 | China | 31,000 |

| 2 | India | 30,000 |

| 3 | SPDR Gold Shares | 1,167 |

| 4 | iShares Gold Trust | 523.0 |

Where is the purest gold found?

What makes Dahlonega gold so different from other gold found around the world is its purity. Dahlonega has the purest gold in the world, which is 98.7 percent pure.

Where is the richest gold mine in the world?

Nevada Gold Mines in the USA is the Largest Gold Mine in the World, producing 94.2 million tons of gold. Grasberg in Indonesia is the second largest, producing 55.9 million tons of gold and also a lot of copper. Olimpiada in Russia is third, with a production of 32.5 million tons of gold.

Where is the richest source of gold in the world?

Richest Gold Mines in The World

- Turquoise Ridge, USA. 10.9 g/t. …

- Bulyanhulu, Tanzania. 10.7 g/t. …

- Leeville, USA. 10.41 g/t. …

- Island Gold, Canada. 10.37 g/t. …

- Mponeng, South Africa. 9.54 g/t. …

- Goldstrike, USA. 9.44 g/t. …

- Obuasi, Ghana. 9.13 g/t. …

- Fruta del Norte, Ecuador. 8.74 g/t. Fruta del Norte gold mine, Ecuador.

Which country buys gold most?

China is not only the world’s top gold bullion buyer, but the Chinese are also avid buyers of gold jewellery. While the demand for gold jewellery fell in 2019 and during the Covid-19 pandemic, the slump is over now. In China, 65% of gold consumption is accounted for by jewellery.

List of Countries with Highest Gold Reserves

Here’s the list of the top 10 countries with the most gold reserves in the world. The data has been compiled from the latest reports by the World Gold Council.

These countries hold a significant amount of gold as part of their national reserves, which can impact global financial markets.

| Rank | Country | Gold Reserves (Tonnes) | Gold Reserves (Million USD) |

| 1 | United States of America | 8,133.46 | 687,729.10 |

| 2 | Germany | 3,351.53 | 283,390.26 |

| 3 | Italy | 2,451.84 | 207,316.33 |

| 4 | France | 2,436.94 | 206,056.58 |

| 5 | China | 2,264.32 | 191,460.36 |

| 6 | Switzerland | 1,039.94 | 87,932.38 |

| 7 | India | 853.63 | 72,179.49 |

| 8 | Japan | 845.97 | 71,531.70 |

| 9 | Taiwan, China | 422.69 | 35,741.02 |

| 10 | Poland | 419.70 | 35,488.16 |

| 11 | Saudi Arabia | 323.07 | 27,317.14 |

| 12 | United Kingdom | 310.29 | 26,236.49 |

| 13 | Spain | 281.58 | 23,808.94 |

| 14 | Thailand | 234.52 | 19,829.82 |

| 15 | Singapore | 227.61 | 19,245.97 |

| 16 | Turkey | 595.37 | 50,341.81 |

| 17 | Algeria | 173.56 | 14,675.12 |

| 18 | Libya | 146.65 | 12,400.21 |

| 19 | South Korea | 104.45 | 8,831.42 |

| 20 | Indonesia | 78.57 | 6,643.26 |

Trade with Confidence with Piyush Ratnu Gold Market Research

Subscribe one of the most accurate analysis in the industry: Spot Gold Analysis by Piyush Ratnu powered by 90+ technical and fundamental parameters with a verified and audited track record.

Current Trading Profit Status: 112%

Highest Drawdown Faced YTD: 8%

Highest profit/month booked: 42%

Highest loss/month booked: 24%

Check Trading Performance at:

https://www.myfxbook.com/members/PiyushRatnu

Core Focus: #XAUUSD | Spot #Gold

Platform: MT4 MT5

Trading Mode: Manual + Algorithm | Automated: both available

Auto-Copy Trading: Available | Plug and Play Solution

Live Trading Feed Available | Real Time Analysis Available

Connect for an appointment at T.ME/PIYUSHRATNUOFFICIAL

Watch LIVE TRADING FEED

Real Time Trades by our proprietary trading algorithms at https://t.me/PiyushRatnu

Follow us on Social Media:

Instagram

instagram.com/PiyushRatnuOfficial

Track Record: Spot Gold Analysis

bit.ly/PRxauusdAnalysis

Reddit

reddit.com/r/prgoldanalysis

Live Trading Feed

t.me/PiyushRatnu

Connect with us on Telegram

t.me/PiyushRatnuOfficial

Who projected XAUUSD Spot Gold $2828 in 2025? Why is Gold XAUUSD price rising in 2025 | Most Accurate XAUUSD Gold Analysis

Who projected XAUUSD Spot Gold $2828 in 2025? Why is Gold XAUUSD price rising in 2025 | Most Accurate XAUUSD Gold Analysis