As projected on 01.12.2023:

🆘 Gold Prices are trading sideways on Friday, with bulls capped below the $2,048 resistance area with the $2,032 level containing downside attempts so far.

Gold price is back in the green early Friday, snapping a corrective decline from six-month highs of $2,052 seen Thursday. The renewed weakness in the United States Dollar (USD) and the US Treasury bond yields is boding well for Gold price, as the focus shifts toward the US ISM Manufacturing PMI data and US Federal Reserve (Fed) Chair Jerome Powell’s dual appearances later in the day.

The US Dollar has come under fresh selling pressure in Asian trading on Friday, helped by a modest downtick in the US Treasury bond yields, as traders cheer increased expectations of a Fed interest rate cut as early as March 2024. Gold price is, therefore, firming up to take on the $2,050 level once again.

Gold traders will closely scrutinize his words to judge whether the speculation surrounding the Fed rate cuts has some ground. Powell is likely to maintain his rhetoric stance that further tightening remains on the cards if the progress on inflation stalls.

In the meantime, Gold price will continue to draw support from a surprise expansion in the Chinese Caixin Manufacturing PMI data for November. China is the world’s top Gold consumer.

On Thursday, and today noon Gold price extended its corrective downside, as markets resorted to profit-taking on their long positions after the recent upsurge and amid the monthly closing. The end-of-the-month flows offered a temporary reprieve to the US Dollar.

🆘 XAUUSD: Crucial Zones:

R: $2069/2075

C: $2023/2019

⏰Three Major reasons for the + rally in XAUUSD on 04.12.2023:

1. Israel war resumes

2. US fends of Red Sea attack

3. Fed statement

The precious metal jumped as much as 3.1% to $2,135.39 an ounce and Bitcoin climbed more than 2.5%. Asian shares were mixed, with a gain in Australian, Korean and Hong Kong stocks, while Japanese and mainland Chinese equities fell. US equity futures were steady.

♾Media is focusing on Fed related statements, however as per me: the real reason is:

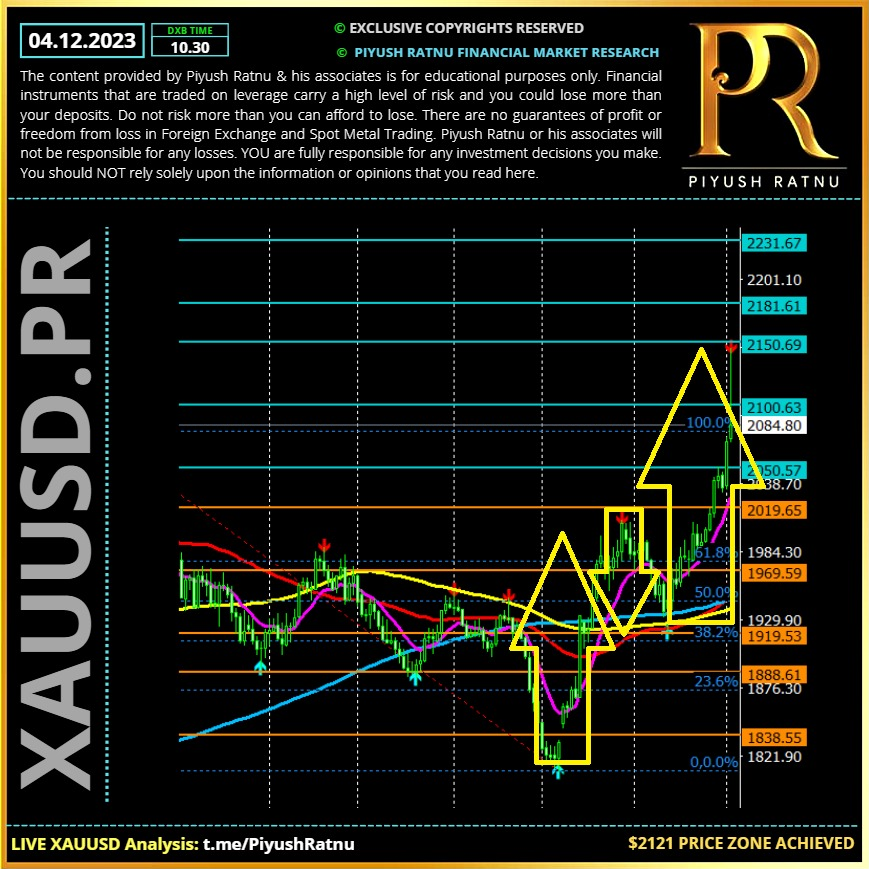

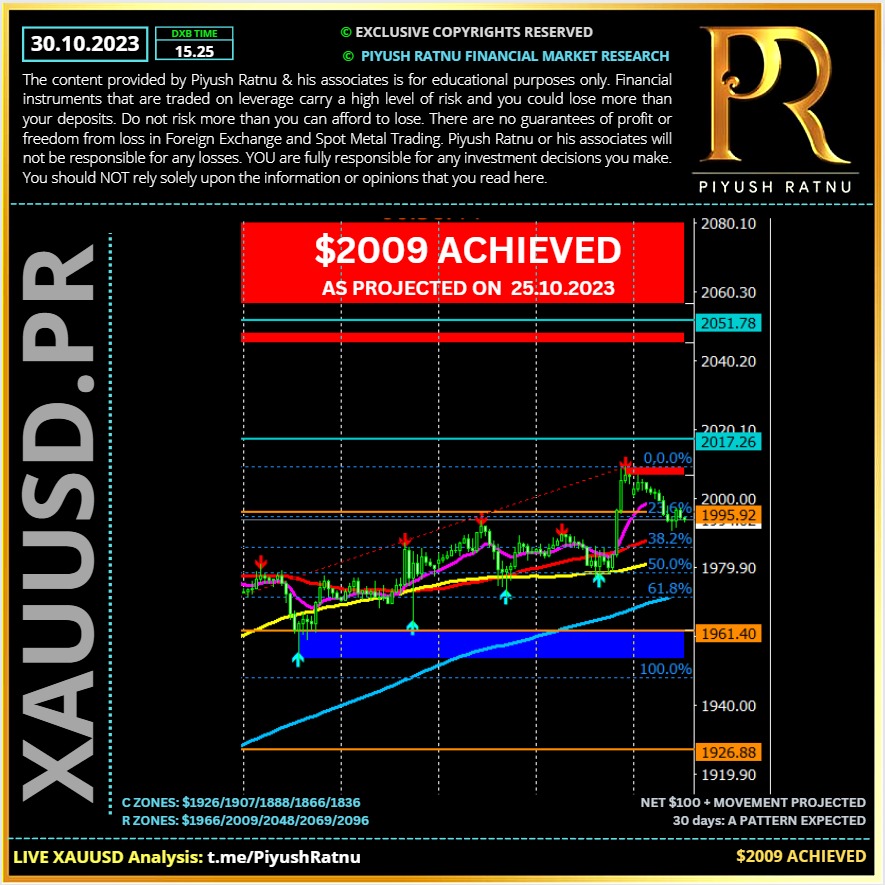

As alerted at $1926 price zone,

China had bought Gold, and as projected by me on the same day: $200 + rally was expected.

✔️$1926 + 200: $2026

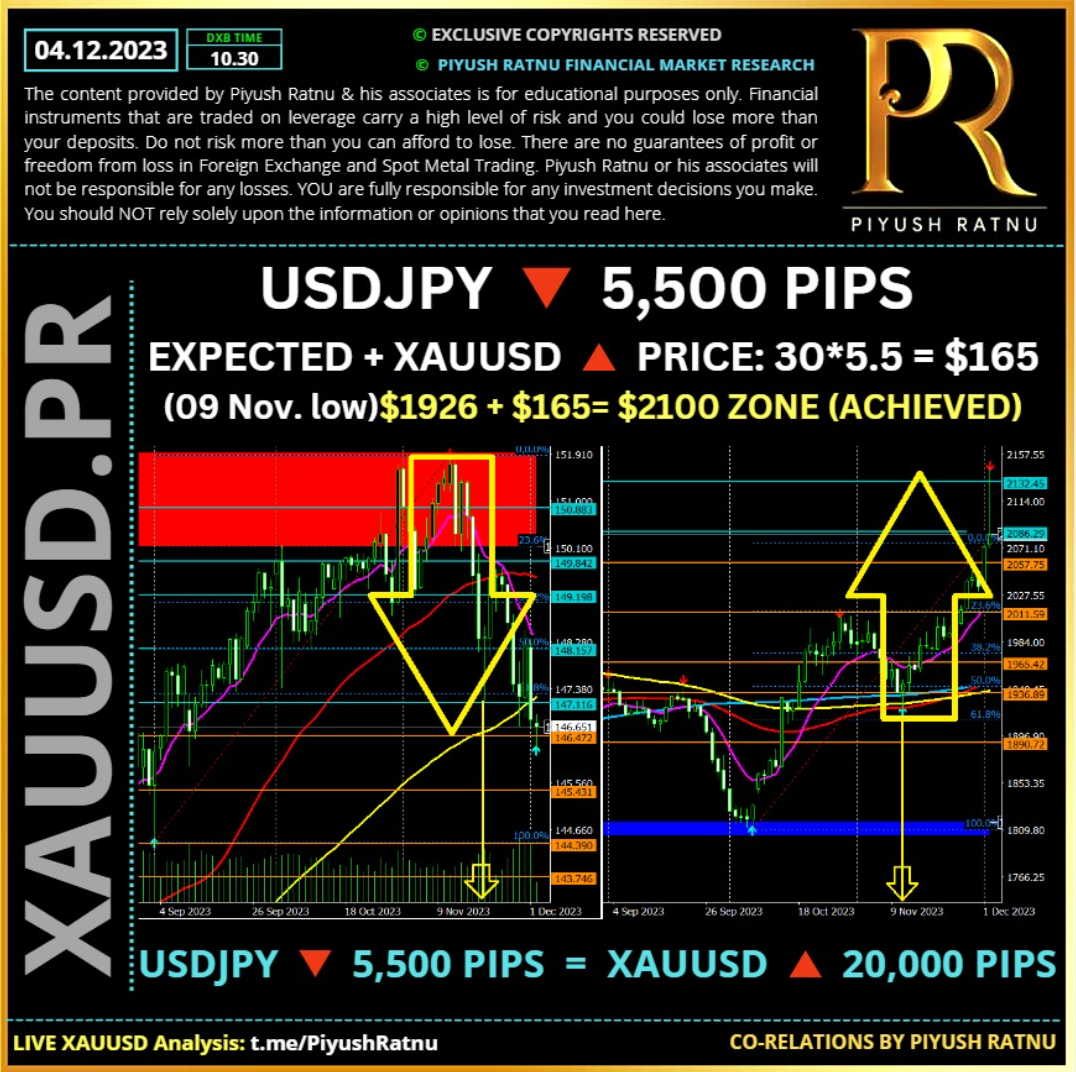

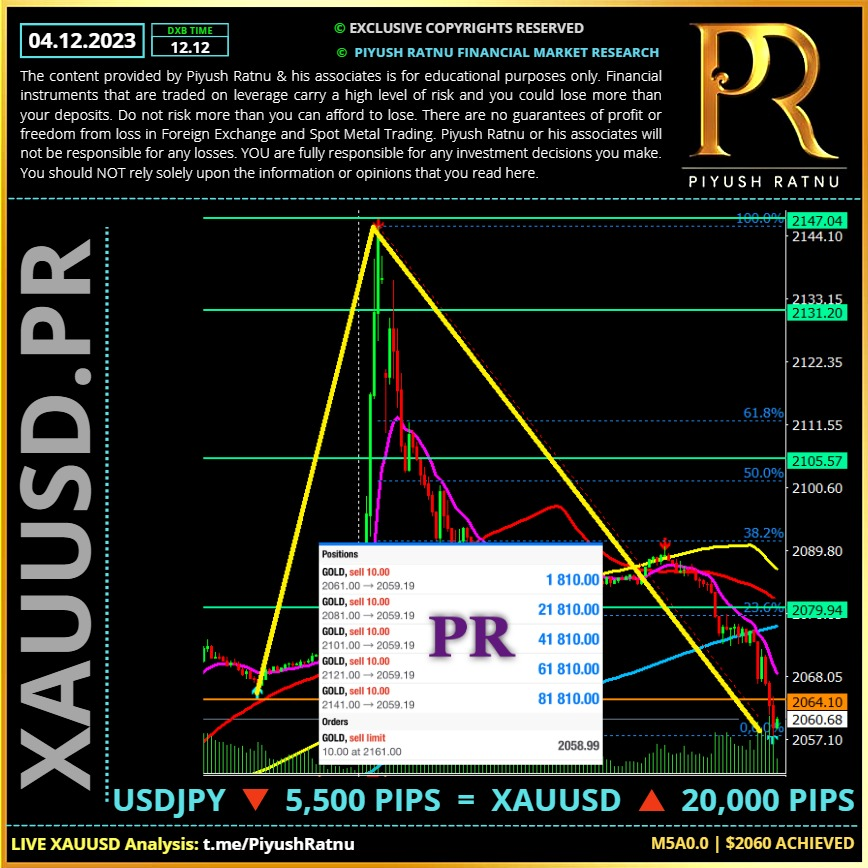

In addition, in last three trading days I had alerted + price movement of $30/45 in each set after USDJPY crashed more than $1/ set. Net movement of +$90 was awaited by me and hence I had projected selling above $2069 till $2121 zone and above with a price gap of $6 in each set. At CMP $2085, we are in Net profit in this set of trades.

*Target zone achieved.*

Same pattern was observed last year, when XAUUSD price was at $1616, after China bought Gold, XAUUSD crossed $200+ in 36 days, on 04 Dec 2022: XAUUSD traced price track of $1616-1818 zone.

Verify at: https://t.me/PiyushRatnu/6837

Projected SELLING zone on 01.12.2023: $2069/2075:

Reason: https://t.me/PiyushRatnu/7216