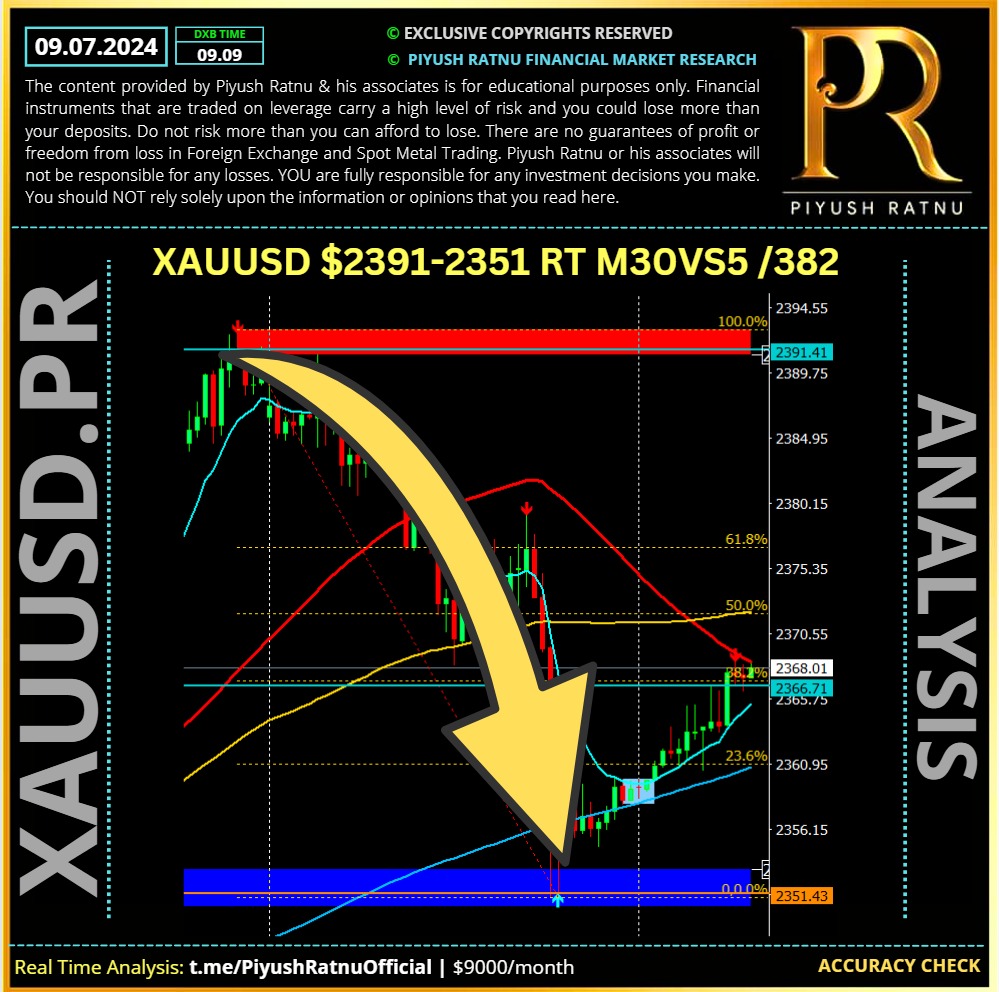

XAUUSD crashed from Friday high $2392 ($2385 zone – 2351.00 – today’s low)

A fear of increased inflation under a Trump presidency with the consequent higher interest rates is negatively impacting Gold. Gold weakened as fears Trump could win the next presidency weigh on bond markets.

Gold (XAU/USD) falls on Monday in line with most commodities, which are declining due to global growth fears after under-par US employment data last week.

Rising US Treasury bond yields, as a result of increased probabilities that former President Donald Trump could win the next presidential election in November, may also be weakening Gold. Trump is expected to cut taxes but maintain spending which will lead to higher inflation and interest rates – a negative for the non-interest-bearing asset Gold.

Given the question marks over President Joe Biden’s capacity to hold office and with no popular replacement on the radar, Trump is increasingly being viewed as the most likely candidate to win the presidential election. Known for cutting taxes and borrowing to cover the short-fall, his fiscal policies are likely to keep inflation high, leading to higher interest rates. This is having a negative impact on US Treasury bonds and pushing up yields, which are inversely correlated to Gold. The US Dollar is also benefiting from the outlook and further weighing on Gold price, which is primarily bought and sold in USD, according to Reuters.

China’s Central Bank has stopped buying for the second month in June.

The precious metal loses traction as the People’s Bank of China (PBoC), the Chinese central bank kept Gold buying on hold for the second month in June, according to official data released on Sunday. It’s worth noting that China is the world’s biggest bullion consumer, and the pause in gold buying could weigh on the Gold price.

Technical Correction/Profit Booking sliced down long volumes.

Additionally, short-term traders taking profit after the 1.45% gain witnessed on Friday, could also be weighing.

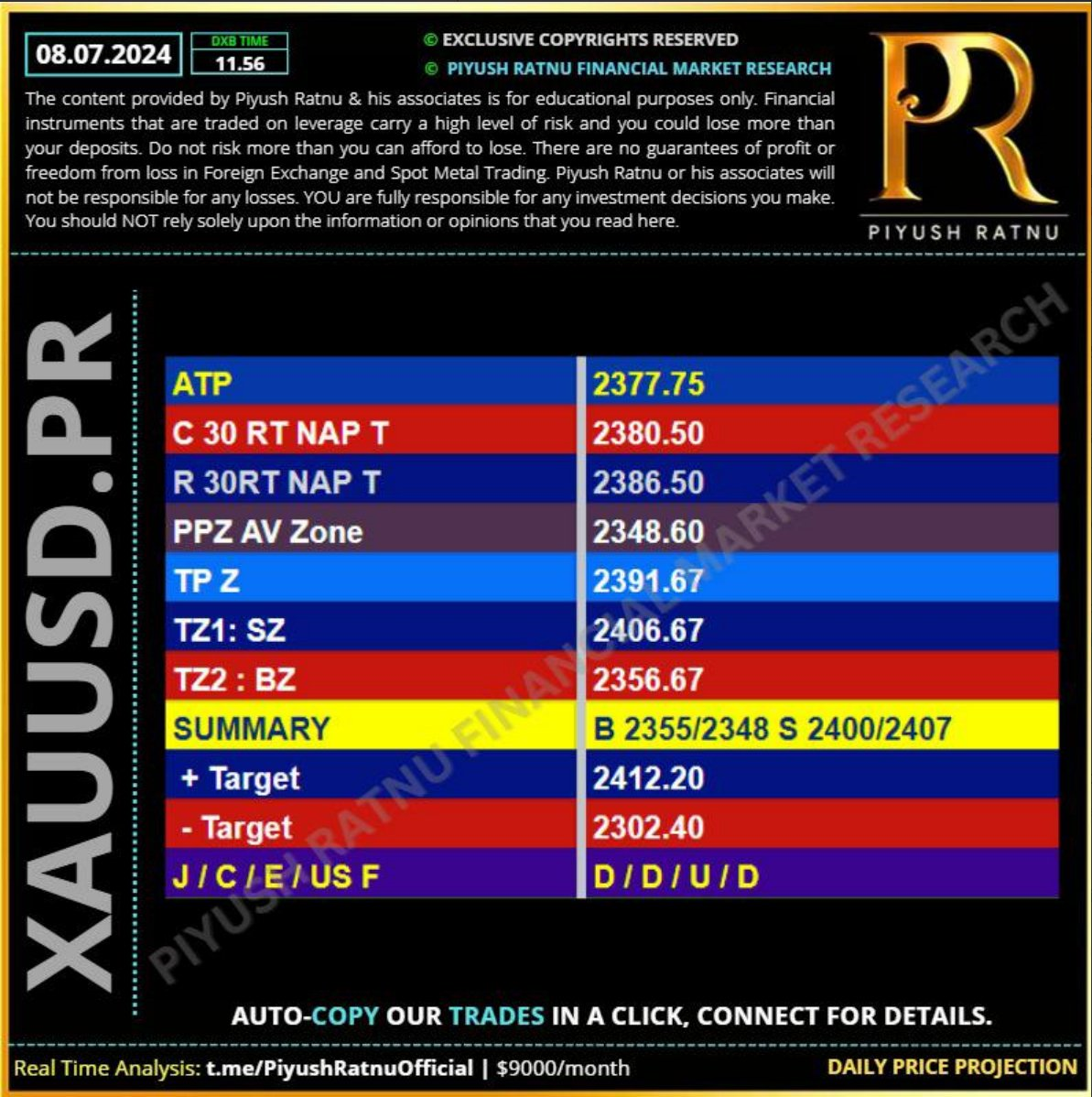

Crucial Zones ahead:

🔻2342/2323/2303

🔺$2369/2385/2407

🆘 ALERT:

Gold could target all-time-highs due to geo-political tension, avoid BIG SHORT POSITIONS.