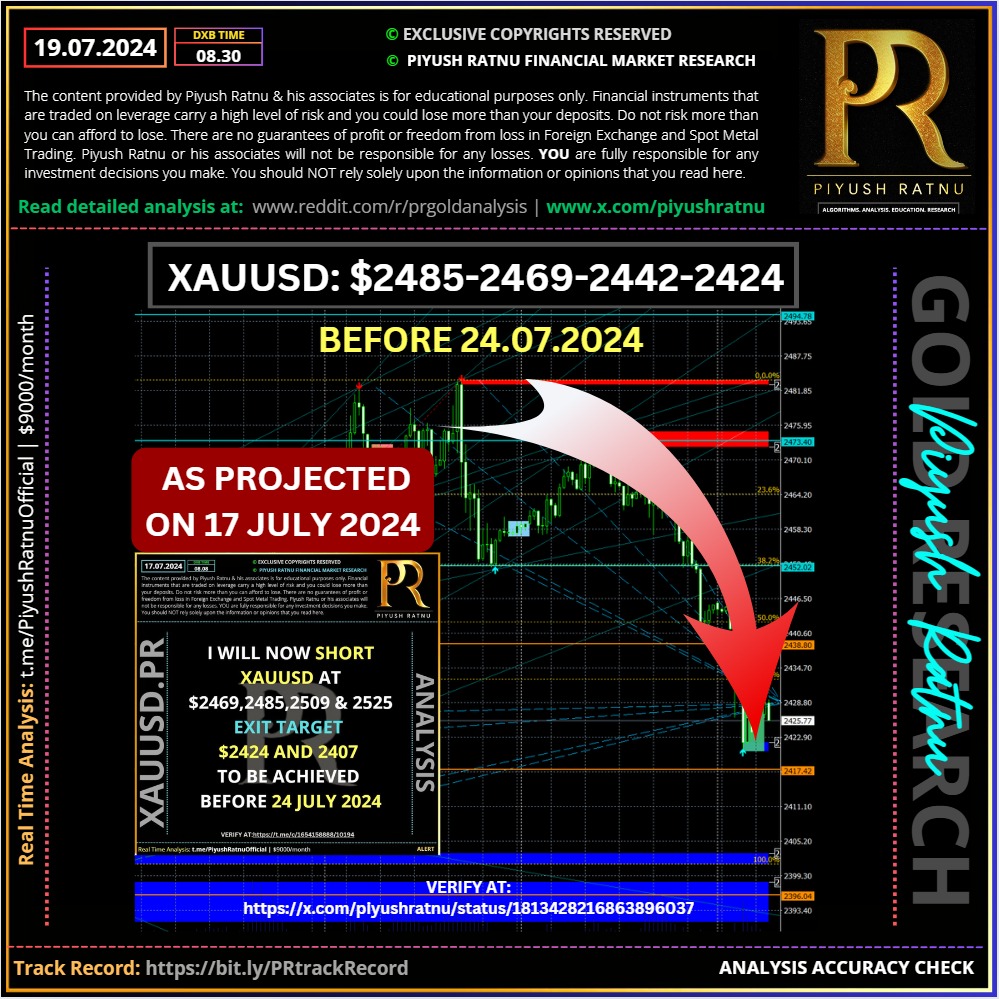

Why XAUUSD crashed from $2484-2469-2442-2424?

Analysis by Piyush Ratnu Gold Market Research

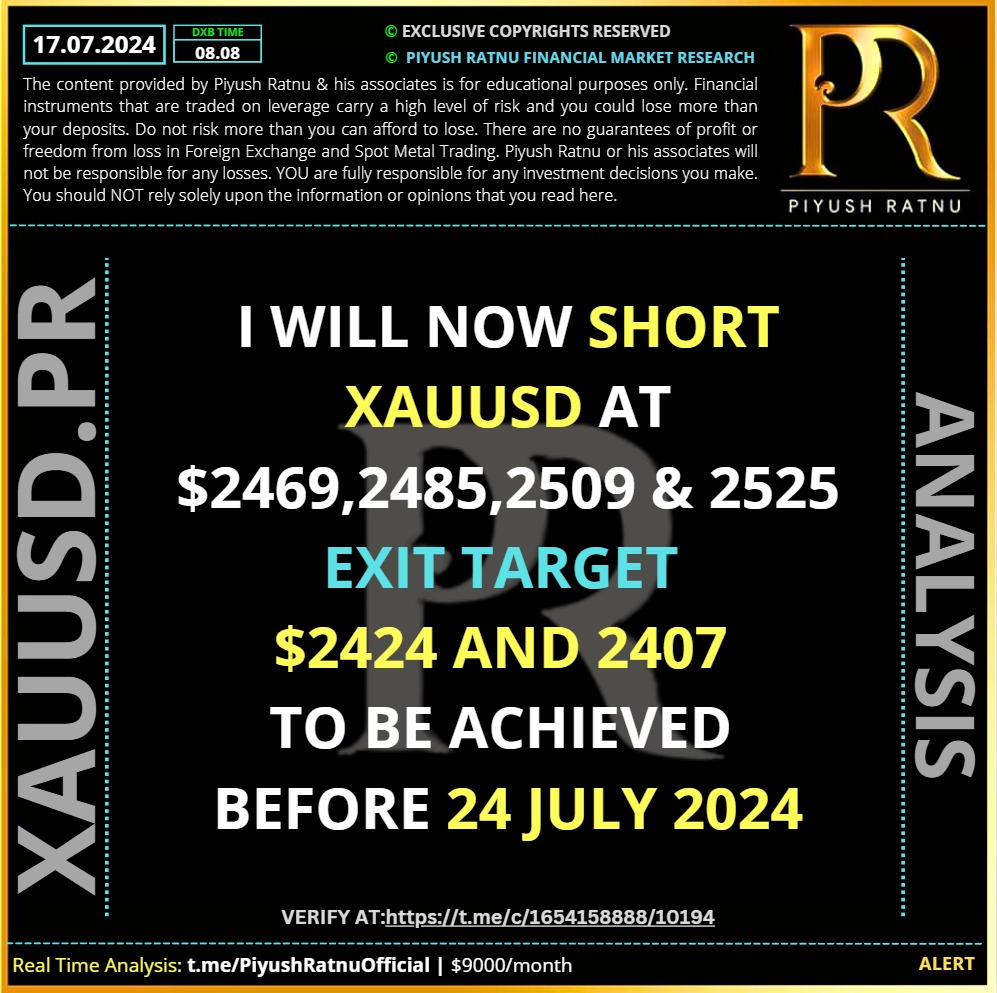

We projected a crash before 24 July 2024 till $2424/2407 in advance, verify at: https://x.com/piyushratnu/status/1813428216863896037/photo/1

Gold price is on a three-day corrective decline from record highs of $2,484 on Friday, paring back weekly gains amid a solid rebound staged by the US Dollar (USD) alongside the US Treasury bond yields.

Escalating trade tensions between the US and China combined with uncertainty on whether the US Federal Reserve (Fed) will go for another interest-rate cut after lowering rates in September weighed on the market sentiment, lifting the US Treasury bond yields across the curve. This, in turn, propelled the US Dollar from four-month troughs against its major currency rivals.

Alert:

Gold traders will stay cautious, as the end-of-the-week flows will remain in play and position readjustments ahead of next week’s advance US Gross Domestic Product (GDP) data for the second quarter.

🆘 Markets are fully pricing in the September Fed rate cut while another cut in December is also likely, according to the CME Group’s FedWAtch Tool.

Data on Thursday showed that US jobless claims rose to the highest level in nearly a year to a seasonally adjusted 243,000 for the week ended July 13. On the other hand, The Philly Fed Manufacturing Index jumped from 1.3 in June to an impressive 13.9 in July, reaching its highest point since April and smashing the 2.9 forecast. Mixed US economic data combined with prudent Fed commentary raised concerns on the scope of the Fed rate cuts this year.

Looking ahead, all eyes will remain on the speeches from the Fed officials, as the US central bank enters its ‘blackout period’ on Saturday before July 30-31 policy meeting. Fed policymakers John Williams and Raphael Bostic are due to speak later in the American session on Friday.

🍎 Summary:

Gold price (XAU/USD) maintains its offered tone through the Asian session on Friday and is currently placed near a multi-day low, around the $2,425 region. The US Dollar (USD) builds on the previous day’s solid recovery from a four-month low and turns out to be a key factor dragging the commodity lower for the third successive day. Apart from this, some profit-taking, especially after the recent rally of over 6.5% since the beginning of this month, further contributes to the decline, though the downside seems limited.

Investors now seem convinced that the Federal Reserve (Fed) will start lowering borrowing costs in September and have been pricing in the possibility of two more rate cuts by year end. This keeps the US Treasury bond yields on the defensive and should cap the USD. Apart from this, the risk-off mood could lend support to the safe-haven Gold price. Furthermore, geopolitical tensions and central bank demand should help limit any meaningful depreciating move for the non-yielding yellow metal.

Crucial Price Zones Ahead:

🔻BZ $2407/2385/2369/2332

🔺SZ $2469/2485/2500/2525

One of the major reasons XAUUSD crashed, which nobody is mentioning is:

- https://www.barrons.com/articles/stock-market-today-dow-nasdaq-0ad19ded

- https://www.reuters.com/technology/traders-london-singapore-struggle-cyber-outage-disrupts-business-2024-07-19/