KEY FUNDAMENTALS & EVENTS:

- The Journey of XAUUSD from $1826-$1960, the key contributors:

XAUUSD breached the $1836 zone and achieved the high of $1866 in New Year, first week. After struggling for three days between 09.01.2023 – 11.01.2023, XAUUSD achieved the critical Selling zone of $1926 on 16.01.2023, XAUUSD touched the mark of 1960 on 02.02.2023 (post FED).

On Wednesday, the US Federal Reserve slowed the pace of its own hikes and acknowledged that disinflation was underway, while reaffirming that borrowing costs still needed to rise further. Federal Reserve Chair Jerome Powell then held a news conference, in which he said that the economy’s disinflationary process had started. To be sure, Powell added that it’s premature to declare victorious against inflation. Don’t expect a rate cut in 2023, Mr. Powell said.

Powell also said he was “not concerned” about the bond market implying one more cut before a pause, because some market participants are expecting inflation to fall faster than the Fed does. “We can now say I think for the first time that the disinflationary process has started. We can see that and we see it really in goods prices so far,” Fed Chairman Jerome Powell said.

Bank earnings failed to impress investors as recession worries rise.

Hindenburg research’s accusations on Adani resulting in $100 bln market losses followed by suspension of trading of Adani shares due to price slump. Indian Parliament was adjourned for second day over Adani rout.

The European Central Bank raised interest rates again on Thursday and pencilled in at least one more hike of the same magnitude next month. The ECB has been increasing rates at a record pace to fight a sudden bout of high inflation in the euro zone – the by-product of factors such as the aftermath of the COVID-19 pandemic and an energy crisis that followed Russia’s war with Ukraine.

The persistent weakness in the US Treasury bond yields, is lending support to the Gold price. The focus now shifts toward Friday’s US labour market report and Fed Chair Jerome Powell’s speech scheduled next week for a fresh direction in the Gold price. Dovish Fed expectations, weak US Treasury bond yields could limit Gold’s downside.

- US-China Talks/Tensions: (might add + pressure resulting in higher XAUUSD price)

- US is tracking a suspected Chinese High Altitude surveillance balloon

- US secured deal on Philippines bases to complete arc around China

- China criticised the agreement, saying: “US actions escalate regional tension and undermine regional peace and stability”.

- A leaked memo from a US four-star general saying his “gut” told him the US would be at war with China in 2025 has prompted warnings about the danger of “undisciplined” predictions of a Taiwan strait conflict.

- Minihan’s memo was written off by many analysts as offering no evidence beyond his “gut” and crude assessments that 2024 elections in the US and Taiwan were good timing for an invasion.

- The Pentagon has distanced itself from Minihan’s memo, saying it was not representative of the department’s view.

- Stock Buybacks Race: Estimated buy backs of $132 billion, robust demand seen to New Year’s equity rally. In the first month of 2023, announced buybacks more than tripled to $132 billion from a year ago, reaching the highest total ever to start a year, according to data compiled by Birinyi Associates. The planned repurchases surpassed the previous January record, set two years ago, by more than 15%, as reported by Bloomberg.

- The US Dollar Index(DXY) dropped below the 100.900 support after 10-year US Treasury yields witnessed immense pressure and crashed down to near 3.35%. The US Dollar is holding onto its recovery momentum after reaching the lowest level in ten months on the dovish Federal Reserve outcome. Disappointing earnings reports from the American tech giants, Apple Inc., Amazon.com Inc. and Google parent Alphabet Inc., have unnerved markets and lifted the US Dollar demand across the board.

- YEN: USD/JPY was last seen trading at 128.57, down 0.07% on the day. The USD/JPY dropped further on Thursday and bottomed at 128.07, reaching the lowest level in two weeks. It remained above 128.00 and trimmed losses after US markets opened. The move-off lows took place amid a deterioration in market sentiment that offered support to the greenback across the board. The pair is back above 128.50, still down for the day, on its way to the third consecutive daily loss. Despite USD/JPY moving off lows, the Yen is trading at daily highs across the board. The US Dollar has risen sharply during the last hours, erasing most of the FOMC losses.

- US NFP: After two days of high volatility, Gold price is struggling at lower levels of $1907 zone, awaiting the next key United States event, in the Nonfarm Payrolls for further clarity on the US Federal Reserve (Fed) future policy course. The headline US Nonfarm Payrolls are expected to drop to 185K in January vs. 223K previous while the Unemployment Rate is expected to inch higher to 3.6% vs. 3.5% seen in December. A weaker-than-expected US NFP print is likely to support the dovish ‘Fed pivot’ expectations, triggering a risk rally at the expense of the US Dollar. In such a scenario, Gold price can jump to new highs of $1966/1996 per ounce. Aside from the US labour market report, it will be worth observing the United States S&P Global and ISM Services PMI data.

Figure 1: Reading Summary: XAUUSD co-relations | CMP $1916

Figure 1: Reading Summary: XAUUSD co-relations | CMP $1916

A CRASH in Dollar Index was observed from 102.500 zone till 100.870 zone in last 15 days, US10YT crashed from 3.710 zone till 3.300 zone. USDJPY crashed from 134.500 zone and marked a low of 127.400 in last 30 days.

In current scenario, and as per past data fundamentals-based co-relations have guided us in a more accurate manner than technical co-relations, however I prefer to compare and match both for a better accuracy.

How to trade Spot Gold XAUUSD on NFP data today?

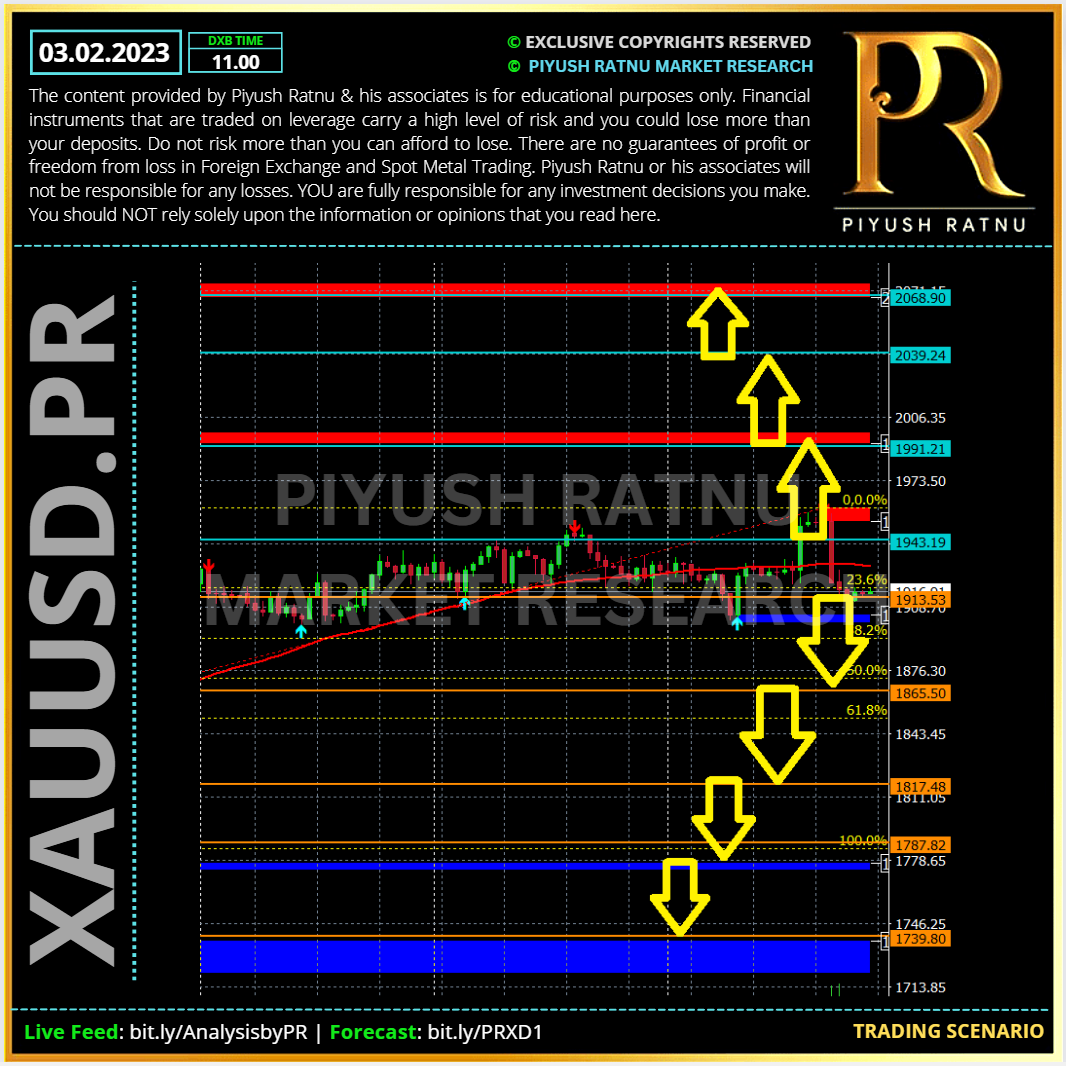

XAUUSD Bearish Scenario: $1888/1866/1836?

If the bearish momentum extends, gold price may fall further towards $1836/1818 zone (after 1872) with 1866/1836/1818 as next stops, if Gold crash halts at 1836 or 1818 zone a reversal can be expected with a RT 23.6 on M5 and M15 30% RT before/in next 7 trading days.

XAUUSD Bullish Scenario: $1966/1996/2023?

If the Bullish momentum pushes Gold price across $1955 barrier, $1966 followed by $1996 zone can be the next target for Gold, opening way to $2023 zone as an ideal sell entry.

Heading into the NFP show today, Spot Gold price is under a price trap of $1926 zone, as investors/traders are observing market closely after interest rate and monetary policy related statements by Mr. Powell on 01.02.2023.

The US NFP will emerge as one of the main market driver for Gold price. Point to be noted: let us not forget ongoing geo-political tensions between Russian – Ukraine and China – Taiwan which can trigger an upward price rally of more than $100/150 in Spot Gold price.

Technical Analysis | XAUUSD CMP $1916 | Gold Price – SR (D1) (MN) Levels to watch:

| SR ZONES MN | |

| R1 | 1943 |

| R2 | 1991 |

| R3 | 2039 |

| R4 | 2068 |

| R5 | 2116 |

| S1 | 1913 |

| S2 | 1865 |

| S3 | 1817 |

| S4 | 1787 |

| S5 | 1739 |

| SR ZONES D1 | |

| R1 | 1921 |

| R2 | 1951 |

| R3 | 1981 |

| R4 | 2000 |

| R5 | 2030 |

| S1 | 1903 |

| S2 | 1873 |

| S3 | 1843 |

| S4 | 1825 |

| S5 | 1795 |

XAUUSD: Spot Gold Price Projection and Trading Scenarios | XAUUSD CMP $1916

PROJECTED TRADING SCENARIO:

- Observe price at US OPENING D1 SS1 and then US SS2

- Observe D1.SR: S1 zone and R2/R3 zone for reversals/retracement, Target NAP $3

- Do not enter between the pivot zone

- Observe: FIB 23.6% on M5 and M15 TF for NAP target price based exit in buy or sell entry after 30/60/90/120 minutes of NFP and $15/25 price movement sets

Long term: 9 (Short term)/18 (Long term) days for an A or V pattern formation - Movement of $60/90 dollars on Gold price is not something unexpected nowadays, and a surprise on Monday during early trading hours cannot be ruled out too, so closing all positions today in net average profit is always the best trading strategy for every trader who wants to safeguard his principal.

I expect A pattern on H4 TF chart in next 7 days (short term target) and 12 trading days (long term target). XAUUSD CMP $1916.

BUY/SELL STOPS | B/S LIMITS: TARGET Net 23.6 RT M15/30/H1 or NAP $3:

S1/S2 ZONE 1888 | DOWN TREND (Below 1872) : 1866/1836/1818/1777 | BUY LIMITS

R1/R2 ZONE 1966| UP TREND (Above 1955) : 1966/1988/1996/2023 | SELL LIMITS

Terms: TF: Time Frame | RT: Retracement | SR: Support Resistance | NAP: Net Average Profit

It is always wise to first PLAN THE TRADE, and then TRADE THE PLAN!

Hence, it is suggested to first observe the crash or rise with specific zones and levels in mind on the basis of various fundamental and technical parameters mentioned above, before entering a trade in a specific direction with a target of net average profit in a specific set of trades.

WARNING: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The author will not be held responsible for information that is found at the end of links posted on this page. The author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. The author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author is not a registered investment advisor and nothing in this article is intended to be investment advice. All performance information reflects past performance and is presented on a total return basis. Past performance is no guarantee of future results. Current performance may differ from the performance shown.

RISK WARNING | DISCLAIMER

Information on this Channel/Page contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Information or opinions provided by us should not be used for investment advice and do not constitute an offer to sell or solicitation of an offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. When making a decision about your investments, you should seek the advice of a professional financial adviser.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

The analysis and trading suggestions published by Piyush Ratnu does not warrant or guarantee the accuracy, timeliness or completeness to its service or information contained therein. Piyush Ratnu does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading on their own risk and Piyush Ratnu shall not be responsible under any circumstances for the consequences of such activities. Piyush Ratnu and its affiliates, in no event, be liable to users or any third parties for any consequential damages or losses in any direct or indirect manner, however arising, including but not limited to damages caused by negligence or Force Majeure whether such damages were foreseen or unforeseen.

The capital value of units in the fund can fluctuate and the price of units can go down as well as up and is not guaranteed. You should not buy a warrant unless you are prepared to sustain a total loss of the money you have invested plus any commission or other transaction charges. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals. The high degree of leverage can work against you as well as for you hence implement risk management and money management strictly to safeguard your investment. Do not risk more than .10% of your principle amount in a single trade set.

Before deciding to invest in foreign exchange or other markets you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some, or all, of your initial investment. Therefore, you should not invest money that you cannot afford to lose. In some cases, it is possible to lose more than your initial investment as it is not always possible to exit a market at the price you intend upon doing so. There are also risks associated with utilizing an Internet-based trade execution software application including, but not limited to, the failure of hardware and software. You should be aware of all the risks associated with investing in foreign exchange, indices and commodities and seek advice from an independent financial advisor if you have any doubts.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu or his associates will not accept any liability for any loss or damage, including but without limitation to, any financial, emotional loss, which may arise directly or indirectly due to your decision. If you do not agree to the above terms, conditions and disclaimer YOU MUST close this page and YOU MUST not act as per the information provided.